Compare international money transfers and save

Why Compare International Money Transfer Services?

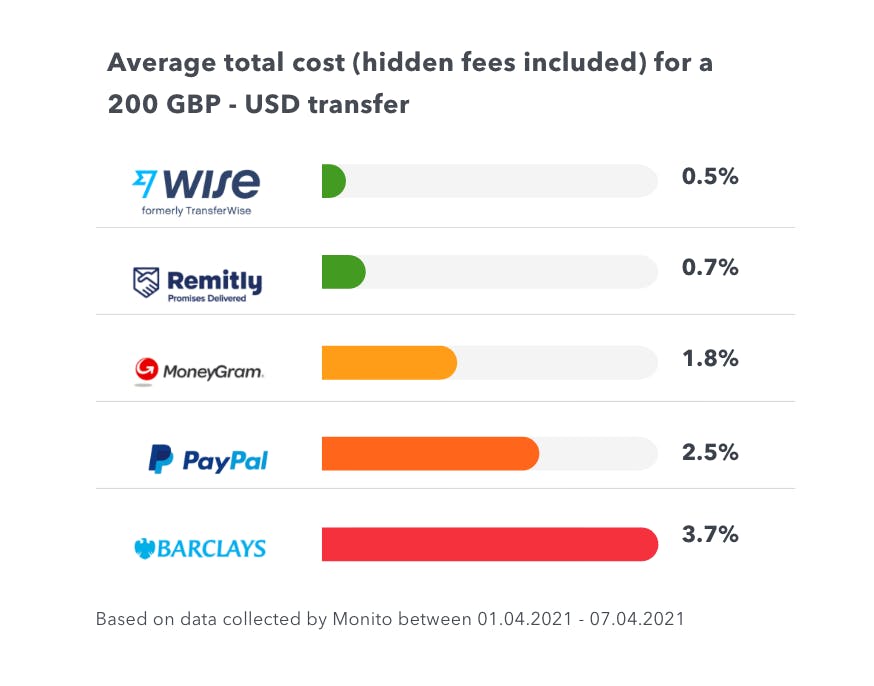

Sending money abroad can cost you a lot, especially if you aren’t aware of the hidden fees. Money transfer companies and banks earn money by not only charging you a transfer fee but often also by charging you a hidden markup on the exchange rate.

Comparing fees and exchange rates saves you money. With our real-time comparison engine, you’ll find the best way to send money internationally in just a few clicks.

25M+ comparisons made

$78M+ in transfer fees saved

200 providers compared

2,000+ in-depth guides

We Compare and Review Over 200 Money Transfer Services

See all services ❯Keep an Eye on the Exchange Rates and Set up Smart Alerts

What Users Are Saying About Monito

- “

Monito has given me a complete and reliable summary to pick the best choice in providers.

Rana, Norway

Monito user since 2018

- “

Before, I couldn’t trust half the sites out there. Monito has helped me because it takes the hard part out of an already hard situation.

Rena, United States

Monito user since 2021

- “

The great benefits of Monito is it gives a snapshot of the current money transfer offers and trends.

Knut, Norway

Monito user since 2019

Key Facts About Money Transfers on Monito

| 💸 Number of providers | 200+ |

|---|---|

| 💱 Best money transfer rates | 0% (some providers don't charge FX margins!) |

| 🌐 Best online money transfer | It depends. Compare now. |

| 💸 Avg. fee via Monito | 0.59% |

| 🏦 Avg. fee via your bank | 4.6% |

| ⚡ ️Fastest transfer time | In minutes |

| 🌎 Avg. cheapest to the Americas | |

| 🌍 Avg. cheapest to Europe | |

| 🌏 Avg. cheapest to Asia-Pacific | |

| 🌍 Avg. cheapest to Africa |

We spend hours researching, testing, reviewing and comparing money transfer services so you don't have to

Monito's Latest Youtube Videos

Monito's experts are unbiased and independent

Our articles are regularly fact-checked and updated

We go the extra mile in our research

Guiding you with clear recommendations

Find the best deal for your next transfer:

Questions You May Have

Travelling Abroad? Avoid Sneaky Exchange Rate Markups With Our In-Depth Guides

Living Abroad? Read Our Latest Guides