The Ultimate Monese Review: Card, Fees, Exchange Rates, and Monito's Verdict

Laurent Oberholzer

Guide

Co-Founder of Monito, Laurent has been reviewing money transfer services for over six years, and loves to share his expertise in international payments to help others.

Cecilia Gibson

Reviewer

A journalist and expert in digital marketing, Cecilia strives to help Monito users navigate the world of money transfers and exchange rates, and offers tips on how to save money on remittances.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreMonese is a good current account option (8/10) recommended by Monito, especially for UK or EU residents who frequently spend in Brtish pounds, Euros, and Romanian leu because of its excellent account and spending functionalities (9/10). Monese is also much-loved by its customers across the board (8.7/10) for its high-quality product offering, despite not yet having a banking license of its own and being smaller than many of its competitors (7.9/10). However, on the downside, Monese can be quite pricey (6.6/10), especially for foreign currency spending in currencies other than GBP, EUR, SEK, and RON.

What Monito Likes About Monese

- Available even without a UK or EU proof of residence;

- Money transfers to over 30 other countries;

- Supports joint accounts and virtual cards in the UK.

What Monito Dislikes About Monese

- Does not offer overdraft, interest, or loans;

- Upgrading plans usually does not equal lower costs;

- High conversion fees for non-GBP, EUR, SEK, and RON spending;

- Weekend surcharges apply to currency exchange.

We recommend Monese if you'd like to use your card for spending (whether physically or online) and want to optimise your savings as much as possible in GBP, EUR, or RON.

Last updated: 17/3/2022

💳 Card | White debit Mastercard |

|---|---|

⬆ Top-up | Bank transfer, debit card, cash |

💱 Currencies | 3 |

👥 Users | 2000000 |

🔐 Trustpilot | 3.9/5 |

📝 Reviews | Approx. 25,000 |

🌍 Available | UK, EU/EEA |

💬 Languages | English, French, German, Spanish, Portuguese, Italian, Czech, Estonian, Lithuanian, Polish, Romanian, Turkish |

Last updated: 17/3/2022

📍 Headquarters | London (GB) |

|---|---|

📃 Established | 2015 |

🌏 Offices | London (GB), Tallinn (EE) |

👥 Employees | 247 |

📈 Private/Public | Private |

🏆 Award(s) | Best Banking App 2020 (British Bank Awards) |

✅ Fun Fact | After moving from Estonia to the UK and being barred from opening a bank account without credit history, Norris Koppel began working a new, inclusive digital bank which later turned into Monese. |

Last updated: 17/3/2022

Key Questions About Monese Answered

Who Is Monese For?

Monese is available to residents of the UK and most of the EU, specifically Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

Monito's reviews are trusted by 100,000+ readers every month.

We don't merely research. We probe and verify every statement.

Our recommendations are always unbiased and independent.

We only recommend what we'd recommend to our friends and families too.

How Monito Reviewed Monese's Services

As with all services reviewed by Monito, Monese underwent a rigorous evaluation to assess the quality of its service. To begin with, our experts analysed several key criteria, including customer reviews, the percentage cost of various transaction types, top-up options, access to customer service, as well as business and legal metrics such as revenue, appropriate authorisation, and company size. As with all Monito Scores, Monese's score was peer-reviewed by at least one Monito expert.

Reviews are written independently by Monito's editors and recommendations given are our own. Services you sign up with using our links may earn us a commission. Learn more.

Trust & Credibility

Background check

Duly authorised and regulated by the FCA in the United Kingdom, as well as by the relevant authorities in all the countries in which it operates.

Security & reliability

Accounts are fully secured using segregated user accounts and HTTPS and cards are 3-D Secure.

Company size

Around 2 million customers and 250 employees all over Europe.

Transparent pricing

A full overview of pricing is relatively accessible and provides every fee as per the regulator-standard fee schedule.

Is Monese Safe?

Yes, Monese is a safe and secure current account option — one in which you can deposit your money with peace of mind.

Monese is regulated by the Financial Conduct Authority (FCA) in the UK and uses best practices to protect your money and secure your personal information, including segregated user accounts (which it calls "safeguarding"), HTTPS, and a 3-D Secure card. Transfers made to Monese current accounts are stored in a network of stable European banks. Customer funds are also safeguarded if the company should go into financial distress and will never be reinvested by Monese.

Monese closely adheres to the latest standards in financial security, applying modern tools and techniques to protect its systems 24/7. It has developed breakthrough technologies and processes to protect accounts against unauthorised access. Monese is a member of CIFAS and works with major banking services to fight against fraud.

Accounts can only be accessed from a single mobile device — preventing the possibility of anyone else from gaining control of funds from another location. They use secure, multifactor authentication to verify identities, not only 3-D Secure but also Touch ID and Face ID biometric recognition.

Monese Ltd is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (900010) to issue electronic money and payment instruments, approved by the Financial Conduct Authority No: 900188.

Monese Purchase Protection

Another nifty safely feature that Monese offers to UK users on its 'Premium', 'Classic', and 'Essential' plans (more about these later) comes in the form of bill and purchase protection for purchases made through the Monese account. With this feature, Monese will give you a lumpsum each month to cover bills such as insurance premiums, rent, and utilities, and hospital bills for up to one month in the event that you end up in hospital, ill, or without a job.

The purchase protection scheme becomes more extensive the higher the plan you choose, starting out at a maximum of £600 for 'Essential' plan users and going up to £1,800 for 'Premium' plan users.

Find out more about Monese's bill and purchase protection here.

Service & Quality

Using the mobile app

Well-designed and smooth interface with many interesting features, including finance updates and 'Savings Pots'.

Managing the account

Multiple top-up methods and three foreign currencies are supported, but overdraft and interest on the standard account are not.

Contacting support

FAQ, live chat, and phone support are all available on the Simple plan, although not reachable at all times.

Making card payments

Contactless, online payments, Apple Pay, Google Pay, and social payments are all supported.

Monese's Service Quality

Monese is a digital financial services provider in the United Kingdom that provides instant current accounts in the UK and the Eurozone. Monese operates as an online-only institution, but it provides all of the services of a standard bank account.

Monese provides their current account and other services through a fully featured mobile app that lets people open a bank account in British pounds, Euros, and even in Romanian lei if you live in Romania. There are no credit checks, and proof of address is not required, so people can open accounts as long as they live in the European Economic Area (EEA). You can also open up a secondary Monese account at no extra charge. You will need a photo of yourself and a passport or national identity card to open an account.

You can add money to your Monese account by using a debit card or through a transfer from another bank. If you’re in the UK, you can add funds in cash to your account from 40 thousand locations, including Post Offices or any Paypoint location (Paypoint is available in the UK, Ireland, and Romania). In the EU, you can top up with cash through SOFORT or Paysafecash, depending on the country. Monese also integrates with your phone’s mobile wallet so that you can make payments directly from your Monese account through Apple Pay or Google Pay.

The Monese account is particularly interesting for digital nomads who want to open a UK or European bank account and other location-independent global citizens who, for one reason or another, need to open a bank account without a physical address. By offering three different plans, including a free tier, Monese makes it easy to tailor your account to your needs!

Monese provides customer service and support in English, Spanish, French, German, and others.

The Monese Current Account

The Monese Current Account provides all the services you would expect from a standard bank account, including:

- Online access through the Monese app or your browser;

- Payments;

- Budgeting;

- Account transfers;

- Direct debits;

- Recurring payments;

- Debit cards;

- Unlimited transactions;

- Receive £ or € bank transfers;

- Fast bank transfers;

- Get cash at ATMs globally.

Monese bank accounts come with sorting codes and account numbers, so you can quickly get paid directly into your Monese account or accept transfers from elsewhere. This will be a Belgian IBAN in most countries, but residents of France and the United Kingdom get a local IBAN! Additionally, Monese only allows you to spend as much as you have in the account, so you can never go overdrawn.

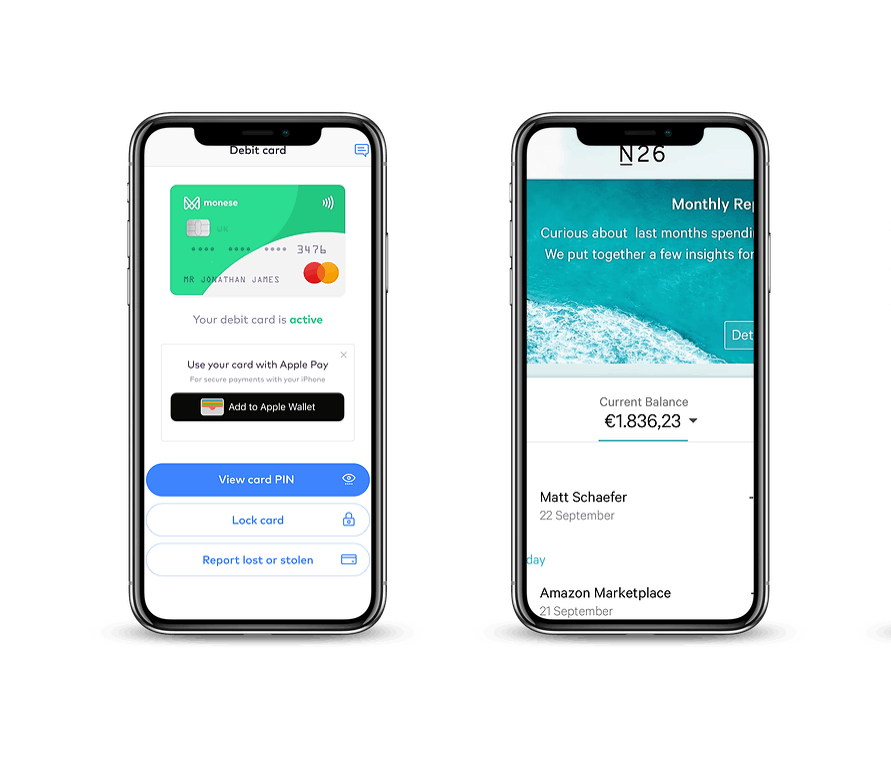

Monese Contactless Debit Card and Virtual Cards

Monese provides a dedicated, prepaid debit card that you can use worldwide to pay for goods and services. The debit card offers international payments at Mastercard's wholesale exchange rates and comes in a design that changes depending on your plan.

The card is accepted in over 200 countries worldwide by merchants that take Mastercard and is compatible with Apple Pay and Google Pay (only in the UK). There is no foreign transaction fee, providing you spend below certain limits based on your price plan. If you lose your debit card, you can instantly lock it from your Monese mobile app.

The card delivery costs £4.95 and will arrive at the registered address within 14 days.

Monese also allows you to create a virtual debit Mastercard, whether you already have a physical one or not. You can choose to use it online to add a layer of security to your payments, but you can also add it to Apple Pay or Google Pay to use it in stores!

Digital Wallets With Monese

Suppose you like paying with your iPhone, good news! You can add your Monese debit cards to Apple Pay in Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Lithuania, Liechtenstein, Latvia, Luxembourg, Malta, Norway, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the UK.

And if you favour Android smartphones, you can also use Monese cards through Google Pay in Austria, Belgium, Bulgaria, Croatia, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Norway, the Netherlands, Poland, Portugal, Slovakia, Spain, Sweden, and the UK.

Monese Cash Top-Ups with PaySafecash

Monese now allows users in France, Spain, Portugal, the Netherlands, Austria, Luxembourg, Poland, Bulgaria, Romania, and Belgium to deposit cash onto their Monese accounts with Paysafecash, a new, popular service in Europe. Thanks to a barcode, this allows you to top up your Monese account at any retailer that accepts Paysafecash deposits.

Monese International Money Transfer Service

On top of allowing you to transfer money within the UK and within the Eurozone with SEPA payments, Monese also provides a currency transfer service that lets you send money internationally to with no hidden fees. The platform the same rates as the mid-market exchange rate, although you will need to pay a service fee of between 0.50% and 2.00% if you do not have a premium account, which costs £14.95/€14.95 a month. You will need a Monese current account if you want to make international money transfers. Most transfers are completed by the end of the next working day.

- Transfer money to over 30 countries in 18 currencies;

- Currency exchange services at the mid-market rate.

Monese Joint Accounts

Unlike most neobanks, Monese also offers joint accounts! Whether you need to share an account with a partner, a flatmate, or even simply a friend, Monese lets you open an account instantly and for free, with all the same features as its 'Simple' plan. You even get a pair of exclusive matching rose gold debit Mastercards linked to the account, each adorned with half of the Monese logo.

Monese iOS and Android Mobile Applications

Monese provides all of its current account and money transfer services via its mobile app. This app offers several key features to users:

- Notifications whenever you spend or receive money;

- Send and request money from your contacts;

- Fast bank transfers to domestic or international accounts;

- Quickly pay rent, utility or other bills with transfers;

- Instabalance, for real-time account balance updates;

- Balance graph to track and manage spending habits;

- Overdraft protection to prevent overspending.

The Monese app is available in English, French, German, Portuguese, Brazilian Portuguese, Bulgarian, Italian, Spanish, Romanian, Polish, Czech, Turkish, Lithuanian and Estonian.

Monese and Avios

Monese integrates with Avios, a travel rewards system for Aer Lingus, British Airways, Iberia, Air Italy and Vueling. You can collect Avios when you shop at certain places and easily view your Avios balance within the Monese app.

Monese Integrates With PayPal

Monese also integrates with the popular payment provider, PayPal. This means that Monese users can:

- Link Monese and PayPal accounts and manage PayPal balances and transactions in the Monese app;

- Add a Monese card to the PayPal digital wallet to buy from and send money to PayPal’s consumers and merchants worldwide;

- Select Monese as a preferred way to pay within the PayPal wallet.

Get Started With Monese

Enter MONITO when signing up with Monese to get a £10/€10/30 lei bonus after the first card transaction. See the terms and conditions here.

Fees & Exchange Rates

Everyday use

No everyday costs such as monthly fees and transfer fees, although exceeding the free ATM withdrawal limit will cost.

ATM withdrawals

No free amount, with all cash withdrawals costing €1.5/£1.5 /L5 per transaction.

Online spending

Ordinary online spending comes at no cost, but a 2% applies on non-GBP, EUR, SEK, and RON transactions.

International spending

A 2% fee applies on all non-GBP, EUR, SEK, and RON foreign currency transactions, an additional €1.5/£1.5 /L5 per cash withdrawal, and an additional 1% currency conversion on weekends.

Monese's Fees and Exchange Rates

Monese offers a free plan and three paid plans in the UK, while in Europe it offers just two paid plans. Whichever plan you choose, you'll have access to the same features, which differ in their allowances and functionality depending on the plan. Monese's paid plans are also conveniently payable on an annual basis at a 30% price reduction.

'Simple' Plan

Monese's 'Simple' plan provides you with a basic, free current account for £/€0.00 per month. You get special allowances for spending abroad without incurring a fee, although you will pay more for currency transfers. The costs on the 'Simple' plan break down as follows:

- Free ATM withdrawals for first £100 per month;

- Cash top-ups come with a 3.50% fee;

- Foreign currency spending costs 2.00% per transaction;

- Free foreign currency transfers to other Monese accounts, with a 2.50% fee when sending to non-Monese accounts on weekdays and 3.50% on weekends.

'Essential' Plan*

The next step up, Monese's 'Essential' plan provides you with a basic, free current account for £/€1.95 per month. You get special allowances for spending abroad without incurring a fee, although you will pay more for currency transfers. The costs on the 'Essential' plan break down as follows:

- Free ATM withdrawals are free up to £200 per month, 2.00% after that;

- Cash top-ups come with a 3.50% fee;

- Foreign currency spending costs 0.50% per transaction;

- Free foreign currency transfers to other Monese accounts, with a 2.00% fee when sending to non-Monese accounts on weekdays and 3.00% on weekends.

'Classic' Plan

Monese 'Classic' increases your allowances and also reduces your fees for currency exchanges. Coming in at £/€5.95 per month (or £/€49.95 per year), the costs on the 'Classic' plan break down as follows:

- Free ATM withdrawals or cash top-ups of up to £/€500 a month, then a 2.00% fee after that;

- Free foreign currency spending on your card is free;

- Free foreign currency transfers to other Monese accounts, but a fee starts at 0.50% when sending to non-Monese accounts.

'Premium' Plan

For £/€14.95 per month (or £/€125.95 per year), Monese Premium gives you unlimited allowances without any fees for foreign currency spending, transfers, top-ups or cash machine withdrawals — making it a one of a kind offer from a neobank. You can read about Monese Premium in-depth in our dedicated review.

Travelling With Monese

If you have a paid Monese plan, you can benefit from its generous limits on how much you can spend before incurring fees. On the £/€5.95 Classic Plan, you can spend up to £/€9,000 internationally before attracting a 2.00% fee (£/€2,000 on the Free plan). On the £/€14.95 Premium Plan, you can spend as much as you want internationally without incurring a fee. Its currency exchange rates are also highly competitive, providing you can reduce the 2.00% transaction fee by being on a paid plan.

* The 'Essential' plan is only available in the UK

Best Multi-Currency Cards Compared

To get a better picture of how Monese's pricing compares to that of other multi-currency alternatives, take a look at the table below:

N26 | Monese | Revolut | Wise | |

|  |  |  | |

Currency Conversion Cost | 0 | 2.00% on weekdays (3.00% on weekends) | 0.00% (first €1,000.00, 2.00% after that) | 0.35% - 2.85% |

Foreign ATM Fee | 0.017 | £1.50/€1.50 + 2.00% on weekdays (3.00% on weekends) | 0.00% (first €200.00 per month, 2.00% after that) | 0.00% (first €200.00 per month, 2.00% thereafter) |

Card Delivery Fee | €10.00/£10.00 | €0.00/£0.00 | €5.50/£4.99 | €5.00/£5.00 |

Trustpilot Score | 3.9/5 | 3.5/5 | 4.4/5 | 4.6/5 |

Monito Promo | - | Enter MONITO21 when signing up to get £5 after the first card transaction (excl. ATM) and £15 after spending £500*. | Free card delivery with the link below | - |

| Go to N26 | Go to Monese | Go to Revolut | Go to Wise |

Last updated: 30/09/2021

* Available in the UK and EU (except Poland, France, and the Netherlands). Customers must order, pay for, and activate the physical card to qualify.

For more in-depth analysis, you may check our Monese comparison with N26 or compare Monese with wise.

Customer Satisfaction

Customer review score

Average Trustpilot rating of 3.9 out of 5 stars.

Number of positive reviews

Over 19,000 four- and five-star reviews.

Customer Satisfaction

Monese has excellent reviews on Trustpilot with a satisfaction score of 3.5 out of 5 stars. Around 21 thousand people have left reviews, and we summarise positive and negative comments below.

Positive Monese Reviews

- An excellent alternative to a traditional UK bank account;

- Opening an account was very fast, simple and effective;

- Effective customer service that answers questions and resolves issues in 12 languages.

Negative Monese Reviews

- A few customers reported issues with Monese blocking their accounts;

- Some customers said that Monese did not give them access to their funds;

- Some customers reported problems with payments going missing.

Other In-Depth Guides by Monito