- Languages English

- Country availability United Kingdom

- Services Full bank account

- Monthly fee Very low

- Card delivery time Mid

- Best for Everyday banking

- Bank details UK account no. & sort code

- Supported currencies Pound sterling

- Overdraft Yes

- Annual interest rate Low

- Supports cash deposits Yes

- International transfers Yes

Top Neobanks and Online Banks (Worldwide Lists)

Compare Top Neobanks

Filter your results

Languages

See allCountry availability

42See allServices

Monthly fee

Card delivery time

Best for

See allBank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Overall Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

Filter your results

Languages

See allCountry availability

42See allServices

Monthly fee

Card delivery time

Best for

See allBank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Starling Bank Monito Score 9.1

- Monzo Monito Score 9.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Everyday banking +1

- Everyday banking

- Saving money

- Bank details UK account no. & sort code

- UK account no. & sort code

- Supported currencies Pound sterling +2

- Pound sterling

- US dollar

- Euro

- Overdraft Yes

- Annual interest rate High

- High

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

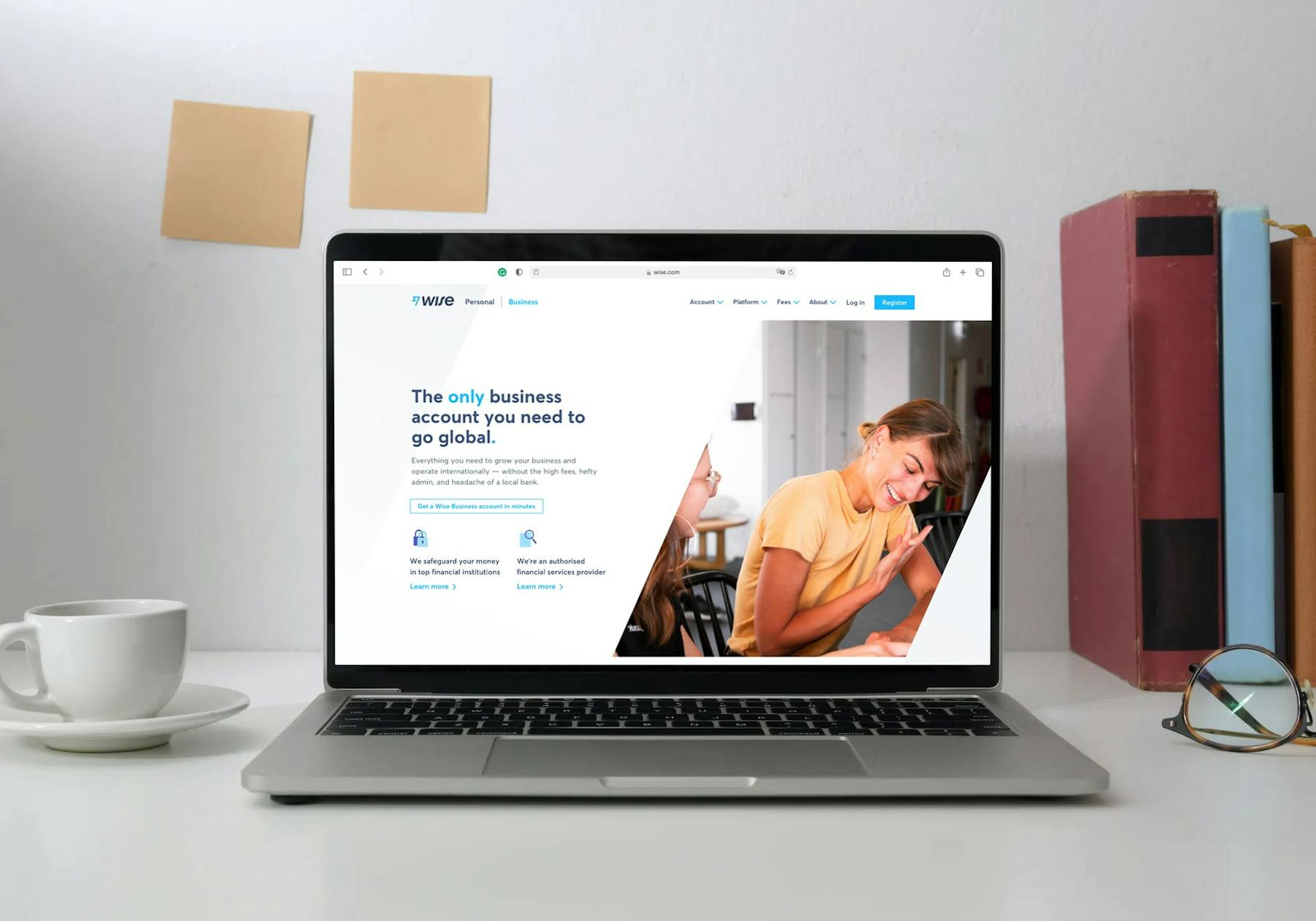

- Wise Multi-Currency Account Monito Score 8.9Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +21

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Polish

- Dutch

- Slovenian

- Polish

- Romanian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +37

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- New Zealand

- Malaysia

- Services Multi-currency account

- Multi-currency account

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN +11

- Euro IBAN

- Hungarian account no.

- US account & routing no.

- UK account no. & sort code

- Australian account & BSB no.

- New Zealand account no.

- Canadian account

- transit

- institution no.

- Romanian account no.

- Singaporean account no. & bank code

- Turkish IBAN

- Supported currencies US dollar +50

- US dollar

- Euro

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Pound sterling

- Croatian kuna

- forint

- Japanese yen

- Malaysian ringgit

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Romanian leu

- Swedish krona

- Singapore dollar

- Turkish lira

- United Arab Emirates dirham

- Chilean peso

- lari

- Moroccan dirham

- Pakistani rupee

- Tanzanian shilling

- Uruguayan peso

- ZMK

- Argentine peso

- Botswana pula

- Chinese yuan

- Egyptian pound

- Ghanaian cedi

- Indian rupee

- Kenyan shilling

- Mexican peso

- Ukrainian hryvnia

- Vietnamese Dong

- Costa Rican colon

- Israeli new shekel

- South Korean won

- Malaysian ringgit

- Thai baht

- Ugandan shilling

- CFA franc

- Bangladeshi taka

- Sri Lankan rupee

- Nigerian naira

- Philippine peso

- Russian ruble

- rand

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Chime Monito Score 8.8Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United States

- United States

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Everyday banking

- Everyday banking

- Bank details US account & routing no.

- US account & routing no.

- Supported currencies US dollar

- US dollar

- Overdraft Yes

- Annual interest rate Low

- Low

- Supports cash deposits Yes

- International transfers No

- Trust & Credibility

- Yuh Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages German +3

- German

- French

- Italian

- English

- Country availability Switzerland +5

- Switzerland

- France

- Liechtenstein

- Austria

- Italy

- Germany

- Services All-in-one finance app +1

- All-in-one finance app

- Multi-currency account

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Trading stocks or cryptos

- Trading stocks or cryptos

- Bank details Swiss IBAN

- Swiss IBAN

- Supported currencies Swiss franc +12

- Swiss franc

- US dollar

- Euro

- Pound sterling

- Japanese yen

- Australian dollar

- Canadian dollar

- Swedish krona

- Hong Kong dollar

- Norwegian krone

- Danish krone

- United Arab Emirates dirham

- Singapore dollar

- Overdraft No

- Annual interest rate Low

- Low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

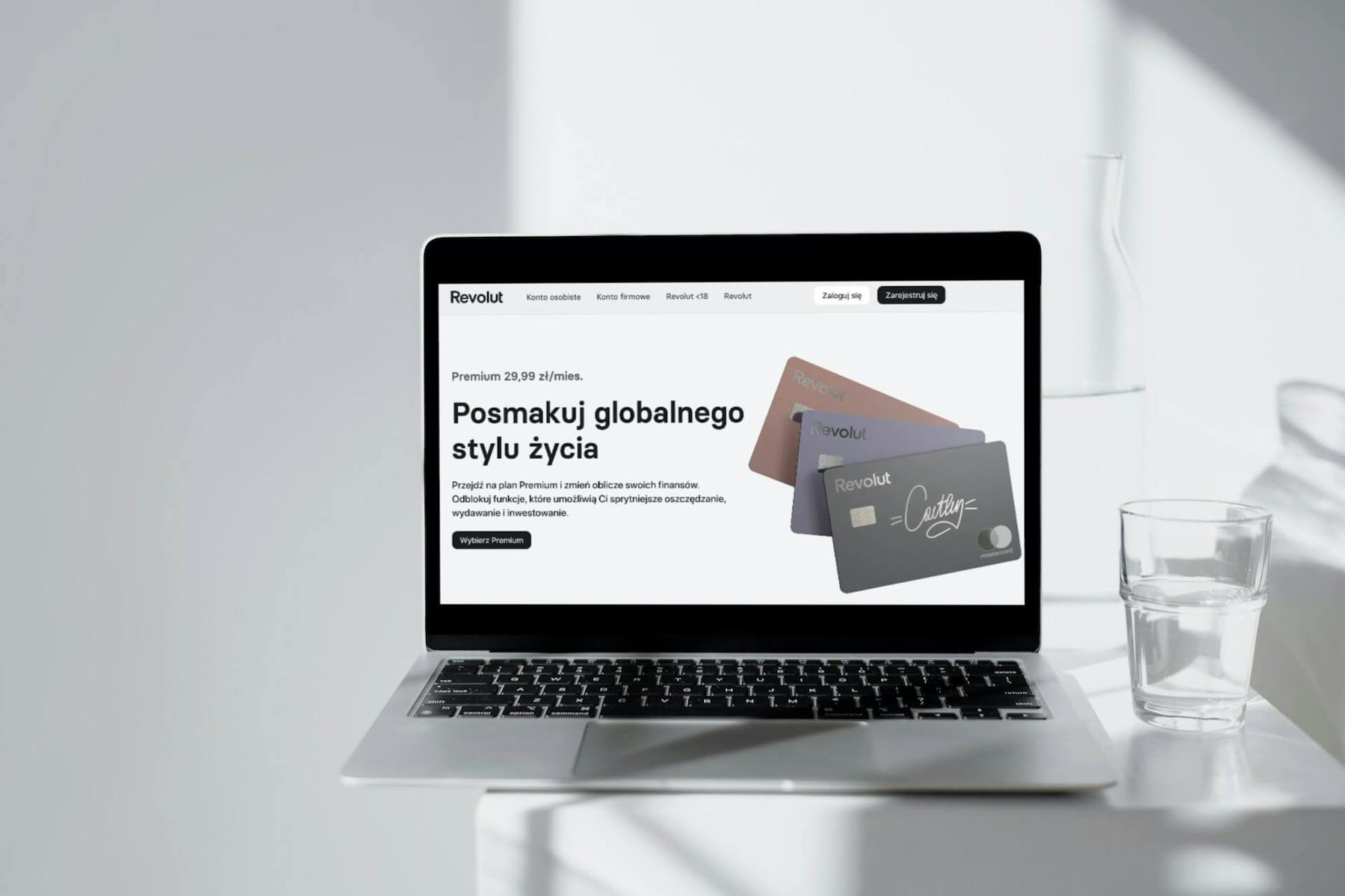

- Revolut Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +20

- English

- German

- French

- Portuguese

- Spanish

- Dutch

- Slovenian

- Polish

- Romanian

- Italian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +35

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending online +1

- Spending online

- Spending while abroad

- Bank details UK account no. & sort code +1

- UK account no. & sort code

- Euro IBAN

- Supported currencies United Arab Emirates dirham +26

- United Arab Emirates dirham

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Euro

- Pound sterling

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Russian ruble

- Qatari riyal

- Romanian leu

- Saudi riyal

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- US dollar

- rand

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Conotoxia Multi-Currency Card Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages Polish +1

- Polish

- English

- Country availability Austria +28

- Austria

- Belgium

- Bulgaria

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- United States

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +19

- Euro

- US dollar

- Pound sterling

- Swiss franc

- Australian dollar

- Canadian dollar

- Czech koruna

- Danish krone

- denar

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Russian ruble

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- rand

- Polish zloty

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- comdirect Monito Score 8.4Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability Germany

- Germany

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Everyday banking

- Everyday banking

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro

- Euro

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Vivid Money Monito Score 8.3Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +4

- English

- German

- French

- Spanish

- Italian

- Country availability Austria +26

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Sweden

- Spain

- Services Travel card +2

- Travel card

- Multi-currency account

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Spending while abroad +1

- Spending while abroad

- Trading stocks or cryptos

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Albanian lek +40

- Albanian lek

- United Arab Emirates dirham

- Armenian dram

- Australian dollar

- Bosnia and Herzegovina mark

- Brazilian real

- Bulgarian lev

- Canadian dollar

- Chinese yuan

- Croatian kuna

- Czech koruna

- Danish krone

- Euro

- lari

- Pound sterling

- Hong Kong dollar

- forint

- Indian rupee

- Israeli new shekel

- Japanese yen

- South Korean won

- denar

- Malaysian ringgit

- Mexican peso

- Moldovan leu

- Moroccan dirham

- New Zealand dollar

- Norwegian krone

- Polish zloty

- Romanian leu

- Russian ruble

- Saudi riyal

- Serbian dinar

- Singapore dollar

- rand

- Swedish krona

- Swiss franc

- Thai baht

- Turkish lira

- Ukrainian hryvnia

- US dollar

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers No

- Trust & Credibility

- Koho Monito Score 8.3Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +1

- English

- French

- Country availability Canada

- Canada

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee No monthly costs

- No monthly costs

- Card delivery time Mid

- Mid

- Best for Everyday banking +2

- Everyday banking

- Spending online

- Saving money

- Bank details Canadian account +2

- Canadian account

- transit

- institution no.

- Supported currencies Canadian dollar

- Canadian dollar

- Overdraft Yes

- Annual interest rate Moderate

- Moderate

- Supports cash deposits No

- International transfers No

- neobank.metadata.label.new_value neobank.metadata.enum.new_value.value 1

- neobank.metadata.enum.new_value.value 1

- Trust & Credibility

- Commerzbank Girokonto Monito Score 8.3Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages German +1

- German

- English

- Country availability Germany

- Germany

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Everyday banking

- Everyday banking

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro

- Euro

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Billetera multimoneda Global66 Monito Score 8.3Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages Portuguese +1

- Portuguese

- Spanish

- Country availability United States +2

- United States

- Brazil

- TK

- Services Multi-currency account +2

- Multi-currency account

- All-in-one finance app

- Full bank account

- Monthly fee Very high

- Very high

- Card delivery time Mid

- Mid

- Best for Withdrawing or depositing cash

- Withdrawing or depositing cash

- Bank details US account & routing no.

- US account & routing no.

- Supported currencies afghani

- afghani

- Overdraft Yes

- Annual interest rate Very high

- Very high

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Tomorrow Monito Score 8.2Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages German +1

- German

- English

- Country availability Germany +17

- Germany

- Belgium

- Estonia

- Finland

- Ireland

- Georgia

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Austria

- Portugal

- Slovakia

- Slovenia

- Spain

- Cyprus

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Moderate

- Moderate

- Card delivery time Mid

- Mid

- Best for Spending online

- Spending online

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro

- Euro

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers No

- Trust & Credibility

- Tangerine Chequing Account Monito Score 8.2Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +1

- English

- French

- Country availability Canada

- Canada

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Slow

- Slow

- Best for Everyday banking

- Everyday banking

- Bank details Canadian account +2

- Canadian account

- transit

- institution no.

- Supported currencies Canadian dollar

- Canadian dollar

- Overdraft Yes

- Annual interest rate Low

- Low

- Supports cash deposits Yes

- International transfers No

- Trust & Credibility

- Majority Monito Score 8.2Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +1

- English

- Spanish

- Country availability United States

- United States

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Moderate

- Moderate

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details US account & routing no.

- US account & routing no.

- Supported currencies US dollar

- US dollar

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Boursorama Banque Monito Score 8.1Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages Portuguese +1

- Portuguese

- Spanish

- Country availability United States +2

- United States

- Brazil

- TK

- Services Multi-currency account +2

- Multi-currency account

- All-in-one finance app

- Full bank account

- Monthly fee Very high

- Very high

- Card delivery time Mid

- Mid

- Best for Withdrawing or depositing cash

- Withdrawing or depositing cash

- Bank details US account & routing no.

- US account & routing no.

- Supported currencies afghani

- afghani

- Overdraft Yes

- Annual interest rate Very high

- Very high

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- neon Monito Score 8.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages German +3

- German

- French

- Italian

- English

- Country availability Switzerland

- Switzerland

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Everyday banking +1

- Everyday banking

- Spending online

- Bank details Swiss IBAN

- Swiss IBAN

- Supported currencies Swiss franc

- Swiss franc

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

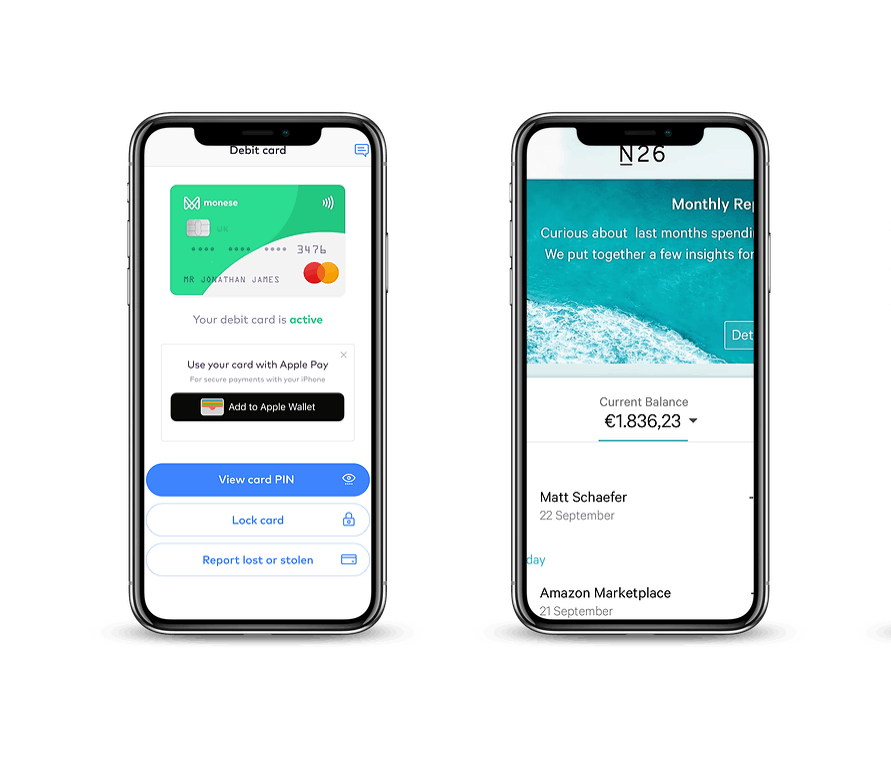

- N26 Monito Score 8.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +4

- English

- French

- Spanish

- German

- Portuguese

- Country availability Austria +20

- Austria

- Belgium

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Iceland

- Ireland

- Liechtenstein

- Luxembourg

- Netherlands

- Norway

- Poland

- Portugal

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Slow

- Slow

- Best for Everyday banking

- Everyday banking

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro

- Euro

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Monese Monito Score 8.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +11

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Czech

- Estonian

- Lithuanian

- Polish

- Romanian

- Turkish

- Country availability Austria +30

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details UK account no. & sort code +2

- UK account no. & sort code

- Euro IBAN

- Romanian account no.

- Supported currencies Euro +2

- Euro

- Pound sterling

- Romanian leu

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Buddybank Monito Score 8.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages Italian

- Italian

- Country availability Italy

- Italy

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Everyday banking

- Everyday banking

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro

- Euro

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

Everything You Need to Know About Neobanks + Neobank Comparisons

Traditional banking is all too often filled with nontransparent fees, long waits at your local branch, and overly complex finance talk. Even the most basic financial services, such as bank transfers and direct deposits, work on slow legacy systems.

However, the neobank industry has grown rapidly to disrupt and compete with traditional high-street bank services.

With Monito, you can take advantage of the best neobank comparisons and recommendations to find the best-rated, cheapest, most user-friendly, and most secure choice.

In this neobank guide, you'll learn exactly what they are, how they work, whether they are worth it, how they compare, and how you can transition away from big banks.

Everything You Should Know About the Best Neobanks

- 01. What is a neobank?

- 02. How safe are online banks?

- 03. Monito's full list of the best neobanks around the world

- 04. Neobanks versus traditional banks

- 05. Which neobank is better?

- 06. Can you set up a business bank account online?

- 07. Are neobank premium memberships worth the price?

- 08. What is the best foreign currency account?

- 09. How does Monito rate and review neobanks?

- 10. Frequently asked questions about online banks

![]()

Online Bank Account

How to open a foreign bank account online

![]()

Neobanks USA

See the best online banks in the US.

![]()

Neobanks UK

See the best online banks in the UK.

![]()

Neobanks Europe

See the best online banks in the EU.

![]()

Neobanks Nigeria

See the best online banks in Nigeria.

![]()

Travel Cards Compared

Spend money abroad without fees

What Is a Neobank?

In this guide, we do a dive into neobanks, their digital apps on your desktop or smartphone device, and how to take advantage over their services and low fees.

We cover our in-depth neobank comparisons, digital business banks, if premium membership is worth it, foreign currency accounts, as well as regional industries, such as neobanks in the United States. Read on to learn about this new cohort of bank and bank-like financial services that are competing with traditional high street banking: —

How Safe Are Online Banks?

All legit neobanks will be registered and regulated by the competent financial regulation authorities of their home country so be sure to check where it is headquartered and under which legal jurisdiction it operates.

For example, as a company founded in London, Starling Bank is regulated by the UK's FCA. Similarly, as an American company, Chime®'s checking accounts are insured by the FDIC.

It's also important to note that many neobanks are not licensed banks, and instead are fintech platforms that offer digital banking services. These kinds of neobanks partner with banks, so make certain that their partner banks are insured with government deposit protection (such as the FSCS in the UK and the FDIC in the US).

If a neobank company does not have evidence of registration with the competent finance authorities, then take serious caution.

Best Rated Global Neobanks and Fintech Apps

In this category, we list powerful neobanks that offer their financial services in several regions around the world. To learn more, click on the product's unique Monito score to read our in-depth review of each provider:

Top UK Digital Accounts List

Have a look at some of the best UK accounts eligible to UK residents and citizens:

Top Neobanks in the EU & EEA

The European Union and the wider European Economic Area arguably has the most advanced neobank industry in the world. Citizens and residents from these areas benefit from a variety of high-quality fintech choices:

Top Neobanks and Fintech Apps in the US

Along with Europe, the United States has a well-developed fintech industry. Innovative newcomers are always entering the scene at an impressive pace:

Best Online Banks in Canada

The neobank industry in Canada is still in its early stages, but it is growing:

Top Neobanks in Germany

- Fidor Bank

- Commerzbank

- Comdirect

- DKB

- N26

- Revolut

- Monese

- Bunq

- Curve

- Tomorrow

- Wise Multi-Currency Account

- Vivid Money

Best Neobanks in France

- Boursorama Banque

- Nickel

- Monabanq

- Ma French Bank

- Fortuneo

- N26

- Revolut

- Monese

- Bunq

- Curve

- Tomorrow

- Wise Multi-Currency Account

- Vivid Money

List of Neobanks in Italy

- Widaba

- Hype

- Buddy Bank

- Illimity Bank

- Mooney

- N26

- Revolut

- Monese

- Bunq

- Curve

- Tomorrow

- Wise Multi-Currency Account

- Vivid Money

List of Best Online Banks in Brazil

Pros and Cons of Neobanks & Online Banks Versus Traditional Banks

In recent years, digital neobanks have been fast on the rise in many countries across the globe. With traditional banks having little competitive incentive to reduce their fees, neobanks disrupted the industry by offering innovative financial solutions to customers at a reduced cost.

Thanks to this new competition and the post-pandemic digital transition, big banks have begun investing in financial technology and even partnering with neobank companies.

As a customer, this is great news. You have a plethora of choice ranging from tech-saavy big banks to fully-licensed digital banks to secondary finance apps. Here at Monito, we are committed to helping you find the best solution for you.

Pros of Neobanks

What makes them different from big high-street banks is their approach to their service, which includes the following:

- Cheap: A lower cost structure than high-street banks means that users benefit from lower fees all-round.

- Accessible: There's often less emphasis on being a resident of a particular country, and cross-border accounts are common.

- Savvy: Services are conveniently online, with online and mobile banking generally being well-designed and easy to navigate.

- Transparent: Communication and consumer-facing language tend to be more straightforward, conversational, and transparent.

- Global: Many (although not all) neobanks tend to emphasize cross-border payments, international money transfers, and favourable exchange rates as part of their service package.

Cons of Neobanks

On the other hand, the following drawbacks mean that neobanks may not be cut out for everybody:

- Branchless: Neobanks rarely, if ever, have any physical branches of their own, meaning that face-to-face consultation isn't an option for those customers who value it.

- Limited: High-street banks offer a wide range of financial services, while neobanks tend to be considerably more restricted in terms of their scope of service.

- Non-banks: Some (although not all) neobanks aren't, in fact, banks at all in the strict sense because they're organised as different legal entities entirely.

Comparing the Best Neobanks

In each dedicated guide, we compare relevant competitors one-on-one according to their level of security, fees, service quality, and customer satisfaction. Whether you a British citizen debating between Starling Bank and Wise or an EU resident deciding between N26 and Revolut, we have the comparison guide for you.

Our Monito experts dive into the legal background of each provider and read the fine print of each neobank's fee schedule to bring you the best and most in-depth analysis out there.

Visit our official YouTube channel for even more guidance on the neobank industry and how to choose the best neobank for you.

Neobank Comparisons

How to Set Up a Business Bank Account Online

Neobanks are not only making it easier for retail bank customers to open accounts virtually. Small business owners around the world are also benefitting from tech savvy and user friendly platforms to manage their business finances.

The process for opening a business bank account with a neobank will vary by country because each country will have its own tax reporting procedures and other corporate laws.

Have a look at our guides below to learn more about the options available to small business owners and international business alike:

Digital Banks for Businesses

Is Neobank Premium Membership Worth It?

One of the greatest draws to neobanks is their access to basic banking services for zero monthly fees. However, most neobanks offer advanced services to customers who pay a premium.

Companies like Majority in the United States have opted for a monthly fee model. Most others, such as Revolut, N26, and Monzo, tier their services. They may set monthly allowances for free ATM withdrawals or free international money transfers. Others send beautifully engraved custom cards to paying members.

To lift these allowances and access more services, you may have to pay into higher tiers. In the following guides, we walk through what premium products you get and if they are worth the price tag:

Premium Neobank Service: Is It Worth It?

What Neobank Is Best For Foreign Currency Accounts?

There are many reasons why you might need a bank account that holds foreign currency.

Perhaps you are an EU citizen preparing to move to the UK and want to begin holding pound sterling. If you are a non-US business who has American customers and makes frequent business trips to the US, then doing business in US dollars will save you a lot of money. Or perhaps you simply want to hold safe haven currencies like the US dollar, Swiss franc, and British pound.

Whatever your reason, you will want a bank account that allows you to hold foreign-denominated currency. In the following guides, we walk through neobanks that offer foreign currency solutions and show you how to open an account:

Best Foreign Currency Accounts

Our List of the Best Neobanks and Online Accounts in 2022 by Monito Score

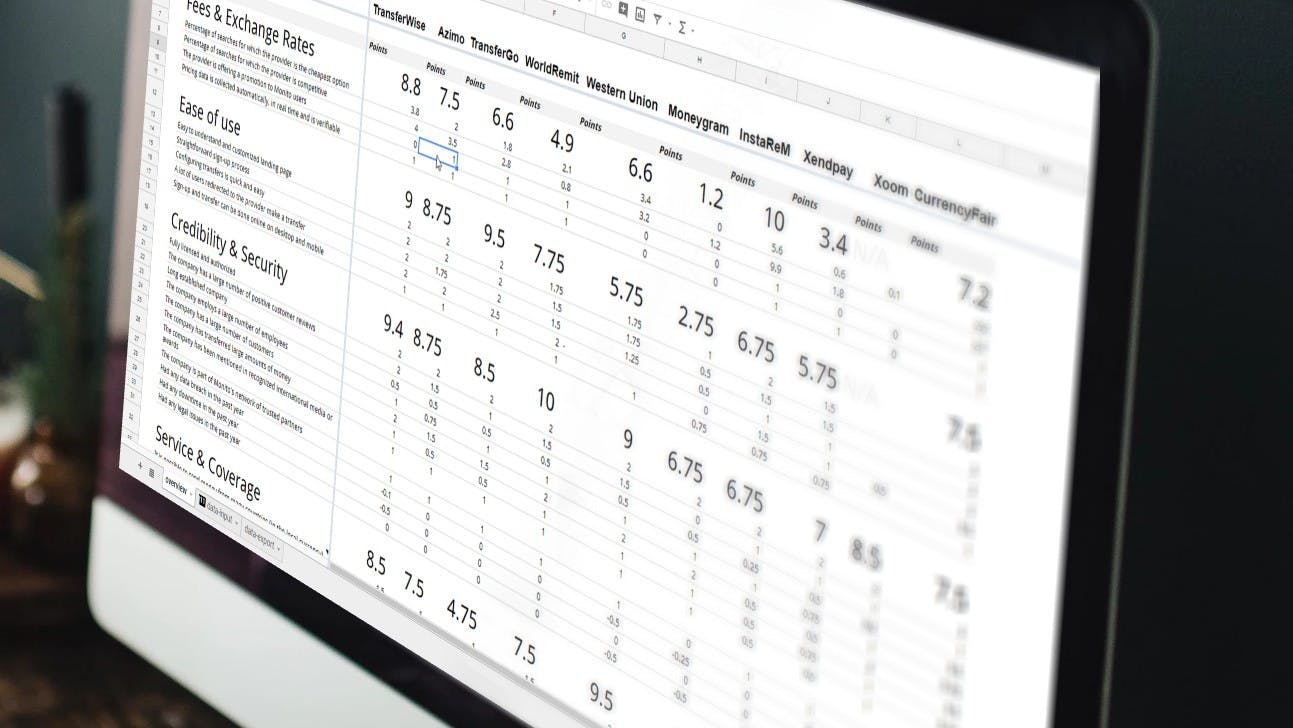

How We Rate Neobanks

In addition to comparing the fees and safety of neobanks, we try to review as many providers as possible in detail, to help you make the best decision when picking a new digital bank.

We developed the Monito Score, an evaluation based on 50+ criteria from how easy to how secure & transparent a neobank is.

Frequently Asked Questions About the Best Online Banks and Neobanks

What is a neobank?

A neobank is a digital bank that does not operate brick-and-mortar branches. Instead, neobanking is done entirely online through a desktop or mobile app. The neobank umbrella is broad, encompassing fully licensed banks to fintech apps to fintech platforms that partner with regulated banks.

Which neobank is best?

To find out which neobank is the best, we have developed the Monito Score, which uses over 50 criterion of safety, fees, service quality, and customer satisfaction, to rate the best neobanks in the USA, the UK, Europe, and the world.

Are neobanks safe?

All legit neobanks will be registered and regulated by the competent financial regulation authorities of their home country. As a company founded in London, Starling Bank is regulated by the UK's FCA. As an American fintech platform, Chime's account partner with FDIC member banks to provide deposit insurance. If a neobank company does not have evidence of registration with the competent finance authorities, then take serious caution.

How do neobanks earn money?

Neobanks use a different business model from traditional high street banks. Neobanks generally do not use debt instruments, such as loans, and do not gain profit from interest payments. While neobanks do profit from their paid premium members, companies make much of their revenue from interchange — these are fees paid by merchants when customers make purchases using a debit card.

Is Monzo a neobank?

Are neobanks FDIC insured?

Yes, only legit neobanks will be insured by the FDIC. Many neobanks are not licesed banks, and instead are fintech platforms that offer digital banking services. These kinds of neobanks partner with FDIC-insured banks to keep your money safe.

Are neobanks government guaranteed?

Yes, legit and registered neobanks are placed under high standards of financial regulations. This means that your deposits will be fully segregated from the company's accounts, so that in the rare case of the company's bankruptcy, your funds will not be touched. You will be guaranteed a set amount by the government.

Why are neobanks popular?

Neobanks are popular because their fintech platforms are often more powerful and more user-friendly to those of more traditional high street banks. Neobanks also run no physical branches, meaning the signing up, cashing checks, and depositing funds can all be done remotely from your desktop or smartphone.

Can neobanks lend money?

Some neobanks can lend money, if they have been issued a government-issued bank license. N26 is one such partner in Germany that offers loans to its European customers. Many other neobanks cannot lend money. The Wise Multi-Currency Account, for example, is a basic checking account service that works with licensed banks around the world to help you send and hold multiple currencies across borders.

Can neobanks’ popularity outlast the pandemic?

Due to the pandemic, many customers will continue to adopt digital neobanking for its ability to conduct basic finances remotely and easily. Since many neobanks are actually fintech platforms that partner with FDIC-insured banks, these neobanks are not legally allowed issue loans, mortgages, or other debt instruments, meaning that licensed high street banks will remain relevant and important to the global financial system in a post-pandemic world. To adjust to the needs of customers, however, it is likely that more neobanks gain bank licenses or more traditional banks adopt neobank technology. This is good news for customers, as more choice can lead to higher competition and quality of services.

What is the best online accounts in the US?

According to Monito's experts, Chime is the best all-rounder mobile finance app in the US. Revolut is best for frequent travelers. Current has the best interest on savings. Sable is best for those without a social security number.

Disclaimers

Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. Credit Builder card issued by Stride Bank, N.A.

¹ Out-of-network ATM withdrawal and over-the-counter advance fees may apply. See here for details.

² To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Chime Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

³ The Annual Percentage Yield ("APY") for the Chime Savings Account is variable and may change anytime. The disclosed APY is effective as of September 20, 2023. No minimum balance is required. Must have $0.01 in savings to earn interest.

⁴ On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score. Results may vary.

⁵ SpotMe® on Credit is an optional, no-interest/no-fee overdraft line of credit tied to the Secured Deposit Account available to qualifying members with an active Chime Credit Builder Account. SpotMe on Debit is an optional, no-fee overdraft service attached to the Chime Checking Account available to qualifying members after Visa debit card activation. Both SpotMe on Credit and SpotMe on Debit are sometimes collectively referred to as "SpotMe" or, if you have signed up to use SpotMe with only one account, "SpotMe" means the elected service. To qualify for SpotMe, you must receive $200 or more in qualifying direct deposits to your Chime Checking Account monthly. Qualifying members will be allowed to overdraw their Chime Checking Account and/or Secured Deposit Account (associated with your Chime Credit Builder credit card) up to $20 but may be later eligible for a higher limit of up to $200 or more based on Chime account history, direct deposit frequency and amount, spending activity and other risk-based factors. The SpotMe limit will be displayed within the Chime mobile app and is subject to change at any time, at Chime’s sole discretion. Although Chime does not charge any overdraft fees for SpotMe, there may be out-of-network or third-party fees associated with ATM transactions. SpotMe Debit Terms and Conditions and SpotMe on Credit Terms and Conditions.

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.