Starling Bank Review: Fees, Functionalities, Credibility, and Monito's Recommendation

Rachel Wait

Guide

A freelance financial journalist, Rachel aims to help consumers get to grip with their finances and break through the jargon so they can make more informed financial decisions.

Byron Mühlberg

Reviewer

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreStarling Bank is an excellent digital bank and current account (9.3/10) roundly recommended by Monito's experts, particularly for its fee-free offering in the UK and abroad (10/10). Starling is a licensed bank, a highly reputable company with a solid service record (9.3/10) and exceptional customer satisfaction ratings among its clients (9.3/10). Starling falls short in some aspects of its account functionality (8.5/10) where — despite offering a capable and flexible current account, card, and mobile app — the bank only offers phone support in emergencies and offers rather limited multi-currency account features.

What We Like About Starling Bank

- Innovative features and services that can be managed in-app,

- Categorised spending insights that make it easier to budget,

- Interest paid on account balances,

- No monthly account fees,

- Fee-free ATM withdrawals and transactions abroad,

- Compatible with Google Pay, Samsung Pay, Apple Pay, Fitbit Pay and Garmin Pay.

What We Dislike About Starling Bank

- Overdrafts are charged at 15% EAR or higher,

- Replacing a card lost overseas could cost £60,

- Interest of -0.5% on euro balances of over €50,000

Our reviewers recommend Starling Bank as a versatile and trustworthy all-around banking alternative or a second account next to a main bank account. Furthermore, because of its innovative multi-currency offering, we also particularly recommend Starling Bank for expats and those with property or business suppliers overseas.

Key Questions About Starling Bank Answered

Verified: 28/2/2023

Min. Deposit | £0 |

|---|---|

Card | Light blue-green debit Mastercard |

Payment Fees | £0 worldwide |

Cashpoint Fees | £0 worldwide |

Account Fees | £0 |

Other Fees | £0 - £5 /month |

Trustpilot | Excellent 4.3/5 |

Reviews | 34000 |

Currencies | GBP, EUR, USD, BGN, CZK, DKK, PLN, HKD, HUF, MXN, NZD, NOK, QAR, RON, SGD, ZAR, SEK, CHF, THB, TRY |

Languages | English |

Verified: 28/2/2023

Headquarters | London (GB) |

|---|---|

Established | 2014 |

Licensing | Financial Conduct Authority (GB) |

Customers | Approx. 2 million |

Private/Public | Private |

Award(s) | Moneyfacts Best Current Account Provider & Best Banking App of the Year (2023); Best British Bank: Best Current Account Provider (2022); Which? Banking Brand of the Year (2022); Innovator of the Year (2021) |

Fun Fact | The bank was named after the bird and intended to represent its sociable, open, and pioneering attitude. |

Verified: 28/2/2023

Who Is Starling Bank For?

Starling Bank is only available for residents of the UK (which doesn't include Gibraltar and the UK Crown Dependencies of Guernsey, Isle of Man, and Jersey). You won't be required to show proof of tax residency in the UK to open an account, but you must be 16 years or older.

How Monito Reviewed Starling's Services

As with all services reviewed by Monito, Starling underwent a rigorous evaluation to assess the quality of its service. To begin with, our experts analysed several key criteria, including customer reviews, the percentage cost of various transaction types, top-up options, access to customer service, as well as business and legal metrics such as revenue, appropriate authorisation, and company size. As with all Monito Scores, Starling's score was peer-reviewed by at least one Monito expert.

Reviews are written independently by Monito's editors and recommendations given are our own. Services you sign up with using our links may earn us a commission. Learn more.

Trust & Credibility

Background check

Licensed as a bank by the PRA and FCA in the UK, and deposits are FSCS protected.

Security & reliability

Accounts are fully secured using segregated user accounts and HTTPS and cards are 3-D Secure.

Company size

Over 2 million customers and nearly $135 million in annual revenue.

Transparent pricing

A full overview of pricing is easily accessible and provides all fees as per the regulator-standard fee schedule.

Is Starling Bank Safe?

Yes, Starling Bank is as safe and secure as any bank. Registered in England and Wales as Starling Bank Limited, the bank is fully licensed and authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) alongside the PRA.

Starling is an independent, privately-owned company with a head office in London and offices in Southampton, Cardiff and Dublin. It has opened more than two million customer accounts.

Service & Quality

Using the mobile app

Well-rated and slick user interface with many interesting features, including 1-Year Fixed Saver (at 5.25% interest), virtual cards, and digital receipts.

Managing the account

Overdraft, interest, and joint accounts are supported, but limited in terms of multi-currency use and number of top-up methods.

Contacting support

FAQ and live chat are available on the current account, but phone support is only available in emergencies.

Making card payments

Contactless, online payments, Apple Pay, Google Pay, and social payments are all supported.

Starling Bank's Product & Service Quality

UK-based digital-only Starling Bank was founded by Anne Boden in 2014 and has gone from strength to strength in its bid to shake up the banking sector. Determined to embrace the sector’s technological changes, the neobank received its UK banking licence in 2016 and launched the UK’s first mobile-only current account in 2017.

Having expanded its range, Starling now offers personal, business and children’s accounts. These can all be managed by a modern, intuitive app, allowing customers to gain a greater understanding of their spending patterns and set aside 'pots' of money using the 1-Year Fixed Saver feature, which earns interest at 4.48%.

What Type of Bank Accounts Does Starling Offer?

When it comes to the accounts on offer, Starling Bank is a bit of an all-rounder. As well as offering personal and joint accounts for adults, customers can also choose from a debit card for younger children and an account for teens. Businesses are also catered for, with the neobank offering a business account for limited companies and other registered businesses, as well as sole traders.

Accounts can be opened by downloading the app to your Android or iOS device. You’ll need to create an account and fill in personal details such as your name, date of birth and address before verifying who you are by recording a short selfie video and taking a photo of your ID (such as a driving licence or passport).

For those opening a business account, evidence of your trading activities will also be required to confirm that your business does what you say it does. Companies House documents can’t be accepted.

Starling is part of the UK’s Current Account Switch Service. This means if you’re switching from another bank, Starling will take care of the switching process for you. The switch should be completed within seven working days, and if anything goes wrong, it’s up to Starling Bank to rectify it.

Starling Bank Personal Accounts

Managing Starling’s personal and joint accounts can be done via the app, your laptop or computer. There are no monthly fees on the account, but should you wish to manage money across multiple accounts, you can open an additional account at no additional cost (this includes the euro account, which is covered later).

Keen travellers will also be pleased to note that there are no fees for adding money to your Starling Bank card, withdrawing cash from an ATM or spending transactions when you travel.

A round-up of the top features of Starling’s personal accounts can be found below:

- A Mastercard debit card,

- No monthly fees,

- No fees for overseas ATM withdrawals or transactions,

- Guaranteed Mastercard exchange rate,

- Withdraw money from ATMs and deposit cash at any one of the Post Office’s 11,500 branches,

- In-app features such as categorised spending insights and overdraft management,

- Option to give someone a Connected card if they are spending on your behalf – this is capped at £200, but money is held in a designated ‘space’ in your app.

The challenger bank has also branched out into children’s accounts, having launched its teen account in 2018 and the Starling Kite debit card in 2020. The teen account is for those aged 16 and 17 and operates similarly to adult accounts, while the Kite card is for children aged between six and 15 years.

Starling Bank Business Accounts

Limited companies and other registered businesses can apply for Starling Bank’s Business Current Account, while sole traders can apply for the Sole Trader business account. There are no monthly fees for the accounts, but should you wish to make use of the bank’s Business Toolkit feature, this will set you back £7 a month. The Toolkit aims to help streamline your bookkeeping, create invoices quickly and manage bills.

That aside, many of the business bank account features are similar to those for personal accounts. As such, there are no fees for ATM withdrawals or card transactions abroad, and your spending will automatically be categorised. UK bank transfers are also free of charge, and you’ll have the ability to connect to QuickBooks, Xero, or FreeAgent.

Cash deposits can only be made at the Post Office, which may be an issue if there is no branch near you, and there is a 0.3% fee (minimum £3) to pay. Cheques can be made in-app for free.

There is also an overdraft of up to £150,000 in-app, but interest will be charged. If you have a Sole Trader account, the interest rate will be the same as for personal account overdrafts at 15% EAR.

For other business accounts, the interest will be confirmed in-app when you apply, and an annual fee will also apply – this is either 1.5% of your limit or £50, whichever is greater.

Euro and Dollar Accounts

In an effort to challenge fintech rival Revolut, Starling also offers no-fee personal accounts and euro accounts for both personal and business users and a dollar account for business account holders. The business euro account costs £2 a month, and the dollar account will set you back £5 a month.

Through the accounts, customers can hold, send and receive euros or dollars for free, as well as transfer money between GBP, EUR and USD accounts 24/7. This includes weekends, but as you’ll always see the exchange rate before the conversion is made, you’ll have the option to wait until Monday morning if you prefer.

The fly in the ointment is the negative interest rate of -0.5% AER that applies to balances above €50,000 in the euro account (for both personal and business users).

On the positive side, international transfers can be carried out relatively cheaply. Money can be sent to 35 countries in 20 currencies worldwide, including euros, US dollars, South African rands, and Turkish liras. A competitively priced 0.4% transfer fee will apply, while delivery fees start at 30p per transfer. Payments over the SWIFT network attract a flat fee of £5.50.

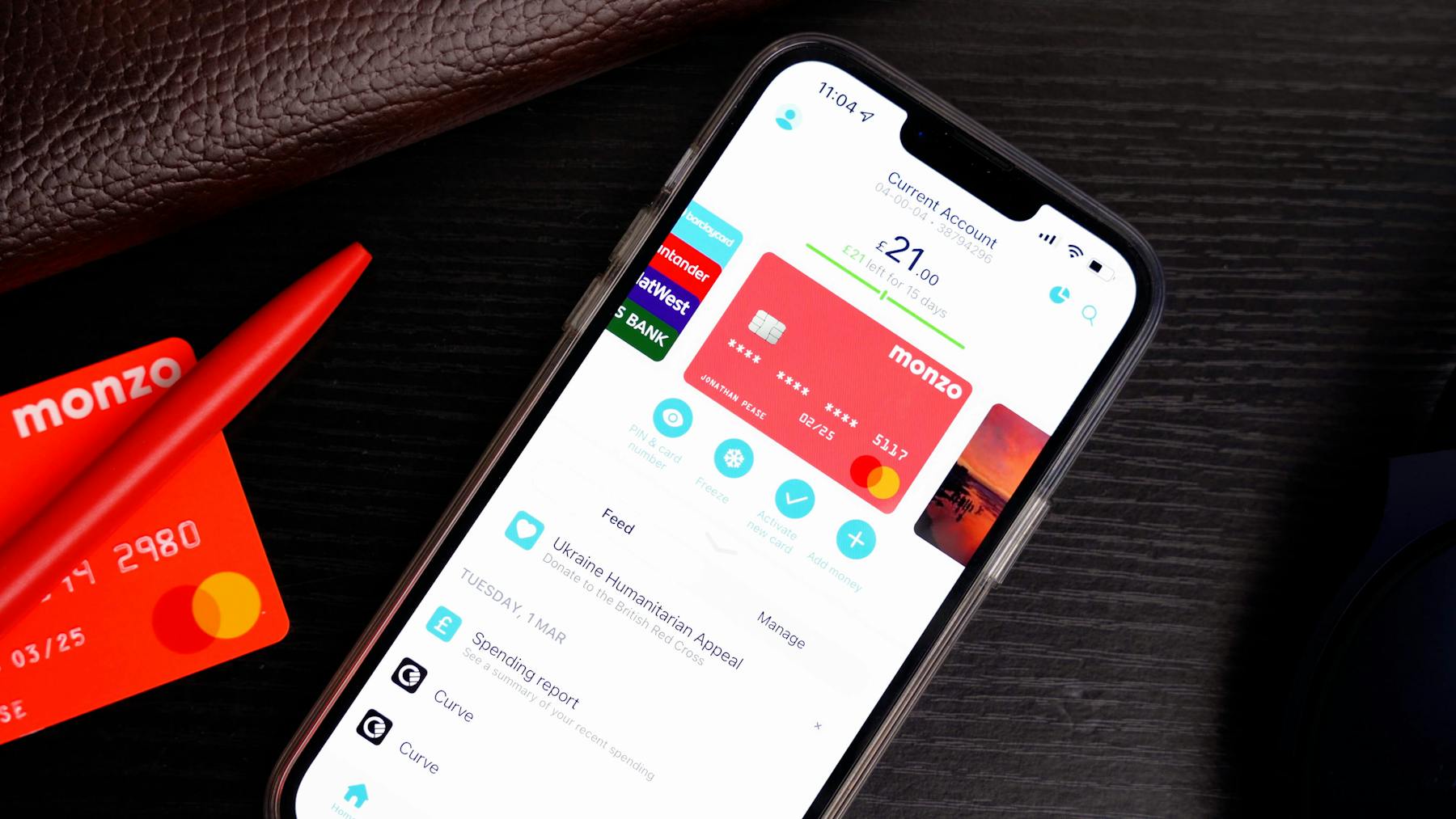

What Does the Starling Bank App Have To Offer?

Although customers can manage their Starling accounts on a laptop or computer, most of the account features are operated through the app. Its ease of use and no-nonsense layout have resulted in 4.7 out of 5 stars on the Google Play Store from around 53 thousand reviews. Some of the key features include:

- Instant notifications whenever payments leave or enter your account,

- Categorised spending insights so you can see exactly where you’re spending your money, making budgeting easier,

- Ability to send money to nearby Starling customers or split bills through a payment link,

- Transactions automatically rounded up to save the change,

- Ability to lock your card if it goes missing.

Business bank account holders can also benefit from the following:

- Instant payment notifications, whenever you pay someone or get paid,

- Spending analytics to break down your monthly spending and sort it by category,

- Ability to add digital receipts to payments,

- Separate spaces to keep tax and overheads to one side.

Fees & Exchange Rates

Everyday use

No everyday costs such as monthly fees, transfer fees, and local ATM withdrawal fees.

ATM withdrawals

Withdrawals are free at home and abroad, incurring only a Mastercard exchange rate margin for foreign currency withdrawals.

Online spending

Online spending comes at no cost, neither in British pounds nor in a foreign currency.

International spending

No fees for spending abroad, although Mastercard's exchange rate applies to foreign currency transactions.

Starling Bank's Fees & Exchange Rates

Starling Bank is a good choice for spending at home and abroad, offering extremely low fees for most types of transactions. As mentioned above, there are no fees for using the Starling Bank card for foreign transactions or withdrawing cash at an ATM. Considering how high fees can be on standard debit cards, this is definitely something to shout about.

Starling uses Mastercard’s exchange rate, but unlike many traditional banks, no fees are added on top. Many debit cards from traditional banks will incur Mastercard’s exchange rate plus the bank’s own exchange rate margin.

Interest on Account Deposits

Similar to bunq, Starling Bank is one of the few neobanks to offer interest on deposits. Both the personal and teen accounts offer 3.25% per annum on balances up to £85,000. While this might not seem worthy of celebration, it is still noteworthy when you consider that many other financial service providers offer no interest at all.

Moreover, because Starling has a UK banking licence, deposits up to £85,000 will be protected under the Financial Services Compensation Scheme – it is no coincidence that the £85,000 limit is the maximum amount on which interest is paid.

Fees and Exchange Rates for Online Transfers

To get a better idea of how Starling Bank's pricing compares to those of other providers for sending an international money transfer, take a look at the table below:

|  |  |  | |

Sent (GBP) | £1,000 | £1,000 | £1,000 | £1,000 |

Exchange Rate Margin (GBP) | £0 | £0 | £45.40 | £35 |

Fees (GBP) | £9.50 | £4.28 | £2.99 | £5 |

Received (EUR) | 1127 | 1134 | 1084 | 1111 |

| Try Starling ❯ | Try Wise ❯ | Compare fees | Compare fees |

Quoted: 28/2/2023 12:30 GMT +1

Customer Satisfaction

Customer review score

Excellent Trustpilot rating of 4.3 out of 5 stars.

Number of positive reviews

Nearly 30,000 four- and five-star reviews.

Starling Bank Customer Reviews

Overall, Starling Bank scores highly on the Trustpilot review platform, earning a respectable 4.3 stars out of 5 from around 34 thousand reviews. Customers praise the fuss-free banking, easy application process and intuitive mobile app. On the other hand, most of the negative feedback centres around the bank’s poor customer service and slow response times (an area which, according to our tests, the bank has improved significantly since its early years).

Additionally, as part of a regulatory requirement, Ipsos MORI carried out an independent survey in August 2022 asking around a thousand Starling Bank customers (and others) whether they would recommend the provider to family and friends. Regarding overall service quality, 81% said they would recommend Starling Bank, and 85% said they would recommend Starling’s online and mobile banking services. However, only 69% of Starling’s customers said they would recommend the bank’s overdraft services.

Is Starling Bank Right for You?

In our opinion, if you’re looking for fuss-free banking that can be carried out online or in-app, Starling Bank is well worth considering. Catering for individuals and businesses alike, Starling Bank offers a number of innovative banking features, helping to make budgeting and savings goals easier, as well as keeping on top of your business invoices and general bookkeeping.

It also wins points for its euro and US dollar accounts (for businesses) and euro accounts (for personal customers) that may appeal to expats, cross-border companies, or those with property or business suppliers overseas. International transfers are competitive, both for fees and exchange rates.

That being said, if you’re looking to make cross-border payments on a more frequent basis, it’s also worth considering banking services such as the Wise Multi-Currency Account and Revolut. Compare your options carefully to ensure you’re getting the best deal.

FAQ About Starling Bank

🔒 Is Starling Bank safe?

Yes, Starling Bank is fully licensed and regulated by the FCA. Deposits of up to £85,000 are also protected under the Financial Services Compensation Scheme.

💲 Are Starling Bank accounts free?

All of Starling’s personal accounts are free unless you apply for a second account, where a £2 monthly fee will apply. The Kite account costs £2 a month after a free first month, and the business euro and US dollar accounts cost £2 a month and £5 a month, respectively.

🔢 What IBAN do Starling customers get?

Starling Bank customers will get a UK IBAN, starting with the letters GB.

🌍 Are Starling Bank accounts available in the EU?

Currently, Starling Bank only operates in the UK. And although the bank is currently pursuing a banking licence from the Central Bank of Ireland that would allow it to operate around the EU, an expansion to Europe is not planned in the foreseeable future.

Also See These UK Challenger Banks