Find the Best Way to Send Money to Switzerland

Top Providers For transfers to Switzerland

Based on 14,155 comparisons made by Monito users in the past 3 months.

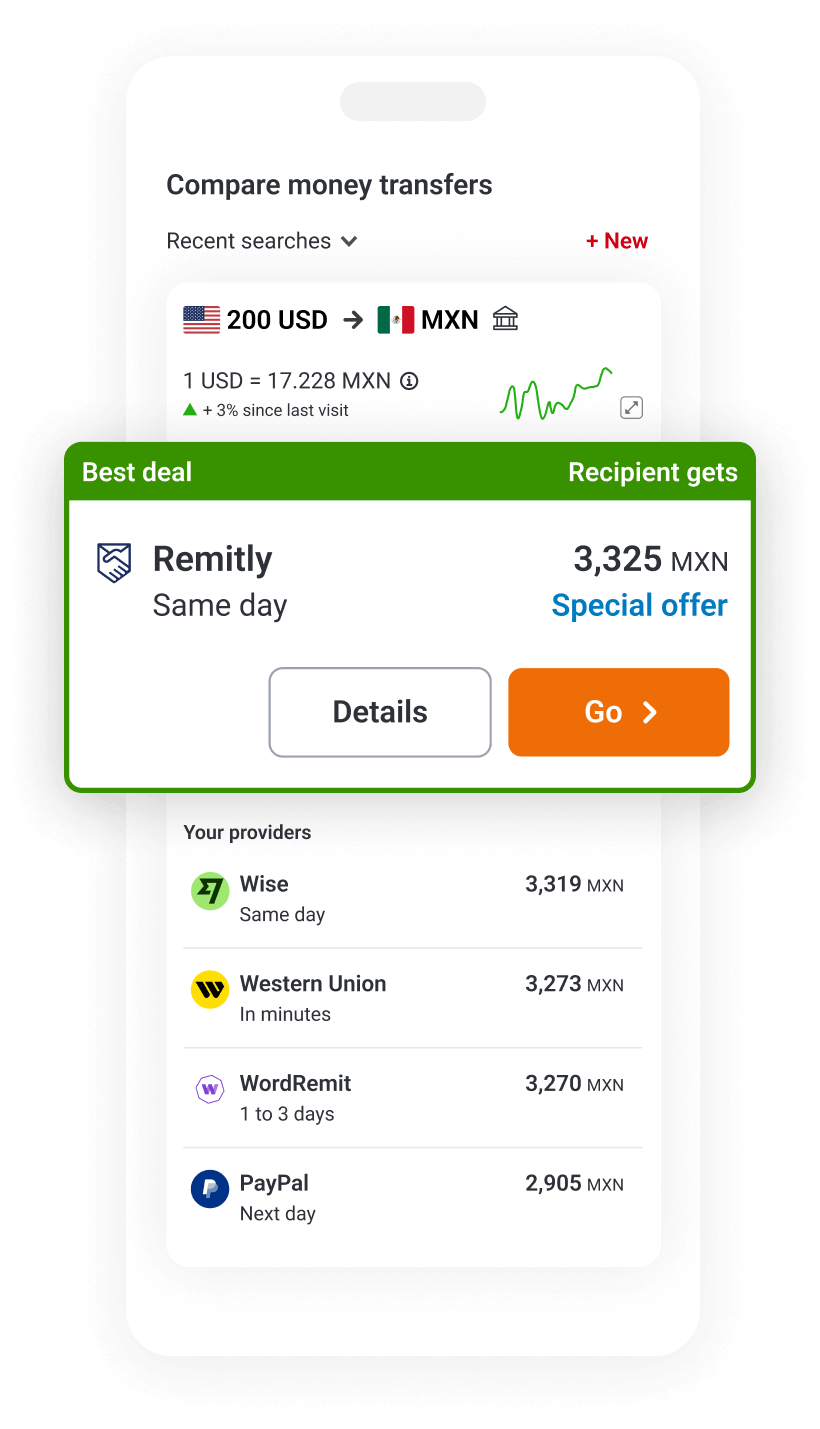

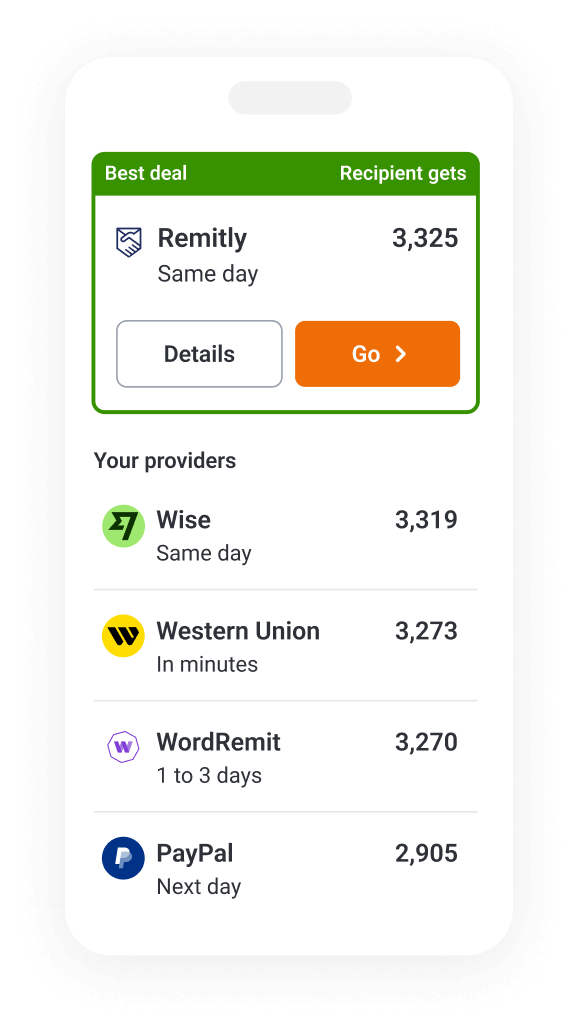

Compare live resultsBest for Transfers to a Bank Account

Best of 50 providers. Compare all

Best for Transfers to Cash Pickup

- 9.0Top providerGo to Western Union

Cheapest

in 100% of all comparisons

Top rated

in 100% of all comparisons

Fastest

in 100% of all comparisons

Best of 1 provider. Compare all

Best-Rated Providers to Send Money to Switzerland

9.5

9.4

9.4

9.4

9.3

9.3

9.3

9.3

9.2

9.2

9.2

9.1

- Send money from UK to Switzerland

- Send money from Italy to Switzerland

- Send money from Germany to Switzerland

- Send money from France to Switzerland

- Send money from Spain to Switzerland

- Send money from Poland to Switzerland

- Send money from Portugal to Switzerland

- Send money from the Netherlands to Switzerland

- Send money from Sweden to Switzerland

- Send money from Austria to Switzerland

- Send money from Luxembourg to Switzerland

- Send money from Belgium to Switzerland

- Send money from Australia to Switzerland

- Send money from Slovenia to Switzerland

- Send money from Estonia to Switzerland

- Send money from Greece to Switzerland

- Send money from Cyprus to Switzerland

- Send money from Denmark to Switzerland

- Send money from Finland to Switzerland

- Send money from Malta to Switzerland