Paysend Review: Exchange Rates, Safety, Alternatives, and Monito's Verdict

Byron Mühlberg

Guide

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Jan Watermann

Reviewer

As a digital nomad, Jan is an expert in cross-border money transfers and internationalization. At Monito, he shares his knowledge by writing content geared primarily towards a German-speaking audience.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

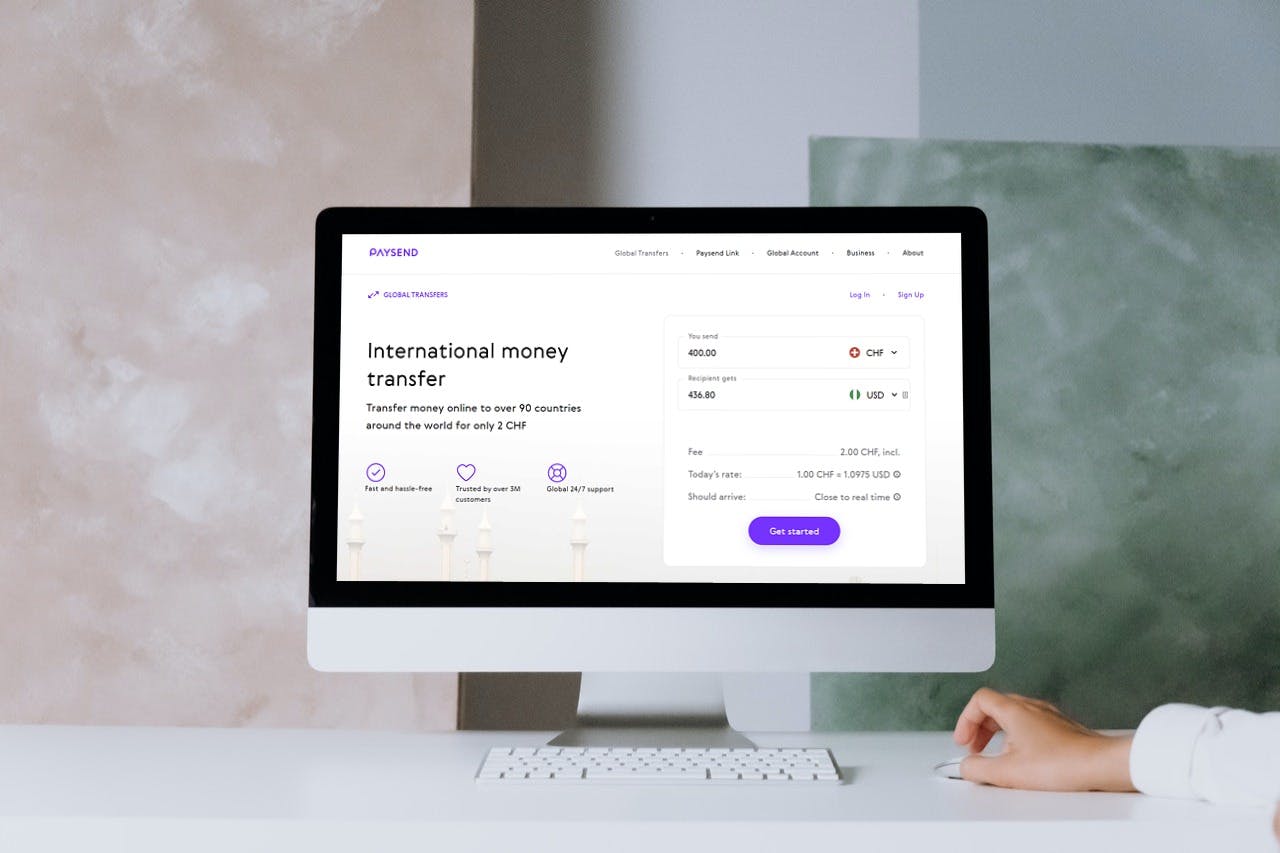

Read morePaysend is an excellent money transfer service (8.5/10) roundly recommended by Monito's experts for card payments across borders. With over seven million customers and moving more than five billion US dollars annually, Paysend is a trustworthy service (7.8/10), although not fully transparent about its pricing. On Paysend's clean, fast, and user-friendly web and mobile apps (8.3/10) that attract all-around positive feedback (8.6/10), users can take advantage of excellent fees and exchange rates (9.3/10) for international payments using their debit or credit cards.

What Monito Likes About Paysend

- Consistently low and competitive fees and exchange rates,

- A true specialist in international card payments,

- An impressive network of around 110 receiving countries is available.

What Monito Dislikes About Paysend

- Fees are hidden away in nontransparent margins,

- Bank transfers are not supported as a pay-in method in all countries,

- Only one sending country (the country of residence) is available.

Category | Score | Highlight |

|---|---|---|

7.8/10 | Trusted by nearly four million customers | |

8.3/10 | Setting up your transfer is quick and easy | |

9.3/10 | Highly-competitive fees and exchange rates | |

8.3/10 | Excellent ratings on Trustpilot and Google Play |

💳 Pay-in |

|

|---|---|

🏧 Pay-out |

|

⬇ Min. Send | Approx. US$10.00 |

⬆ Max. Send | USD 1,000 |

💱 Currencies | 90 |

👥 Users | 7 million |

🔐 Trustpilot | 4.4/5 |

📝 Reviews | 32000 |

🌍 Available | US, UK, Eurozone and others |

💬 Languages | English, Chinese, Spanish 12 others |

📍 Headquarters | London (GB) |

|---|---|

📃 Established | 2017 |

🌏 Offices | London (GB), Edinburgh (GB), Moscow (RU) |

👥 Employees | 300 |

📈 Private/Public | Private |

🏆 Award(s) | PayTech Awards for Best Consumer Payments (2018) others |

✅ Fun Fact | Paysend was founded by a group of banking and payments professionals who were frustrated by the time and complexity of traditional bank systems. |

How We Review Money Transfer Providers

With more than 50 providers reviewed and 100 test transfers made over the past ten years, we pride ourselves on providing the best reviews of international money transfer services online. Curious how we make them and why you can trust us? Take a look at our process below:

🔎 See how our scoring methodology works

All international money transfer services we review are put through a comprehensive and rigorous scoring methodology, which involves the testing of the platform's functionalities, assessment of customer reviews, fees, pay-in options, customer service, and business metrics. The methodology is also powered by an analysis of millions of searches on Monito's comparison engine to determine each provider's competitiveness in terms of pricing. When the research is done, each Monito Score is then peer-reviewed by at least one Monito expert. Learn more about our scoring methodology here.

🤝 See why you can trust our recommendations

Reviews are written independently by Monito's editors, and the recommendations given are our own. We might make money from some links on our reviews to bring you premium content without pesky banner ads and paywalls. We promise you that this never impacts the independence of our recommendations. Learn more about our promise and our business model here.

Paysend Review

Is Paysend Available in Your Country?

| Paysend | Switzerland |

Trust & Credibility

Background check

Paysend Group Ltd is duly authorised and regulated by the FCA and HMRC in the United Kingdom and by the relevant authorities in all the countries in which it operates.

Security & reliability

Paysend's website is fully secured and makes use of top-notch security protocols, including segregated user accounts and HTTPS.

Company size

Founded in 2017, Paysend boasts over $5 billion transferred in the past year, five million customers, and 300 employees.

Transparent pricing

Paysend is not fully transparent about its pricing, sliding its fees into its exchange rates.

Can I Trust Paysend?

Moving more than US$3.2 billion across borders for around 3.7 million customers every year, Paysend is, without a doubt, a trustworthy choice as a money transfer partner.

Is Paysend Safe?

The short answer is yes, Paysend is safe indeed. Moving more than US$3.2 billion across borders for around 3.7 million customers every year, Paysend is a trustworthy service that offers institutional-grade security and preventative measures, such as two-factor login and verification procedures. What's more, Paysend holds its clients’ funds completely separately from their own business accounts, as per FCA requirements, meaning that should the company have any financial difficulties, your money will remain safe.

Service & Quality

Opening an account

Opening an account is quick and intuitive, but it can take some time to complete the setup.

Making a transfer

Transferring money is fast and straightforward, regardless of whether you're sending money for the first time or on a daily basis.

Contacting support

By offering a speedy, around-the-clock live chat feature, it's easy to find help when needed.

Paysend's Service Quality

Opening and managing an account, contacting customer service, and funding a transfer with Paysend is very convenient, although sending options are quite limited.

Monito's Impressions During Our Test

Quick, clean, and user-friendly, Paysend's website and mobile apps impressed our reviewers with their simple user experience and helpful prompts and tips. What particularly stood out to us was that the entire transfer process could be completed on a single web page, making it one of the fastest money transfer services we've reviewed. What's more, users can deposit money into their own bank accounts from prepaid cards at almost no cost — a big feather in Paysend's cap. Finally, we liked that Paysend came across as approachable and avoided complicated phraseology and money transfer jargon.

Paysend App Review

The Paysend app has garnered excellent reviews from users across the world. For example, on the App Store, the Paysend app has earned 4.3 out of 5 stars out of a total of around 800 ratings, while on Google Play Store, the app garnered a more considerable 4.7 out of 5 stars from as many as 47 thousand ratings. The Paysend app allows users to make international card payments to bank accounts, cards, Paysend wallets, and cash pickup locations worldwide using a simple, clean interface.

How Paysend Works

Step 01

Check Paysend's rates

Use Monito's comparison engine to see how Paysend's fees and exchange rates weigh up against the rest and ensure they are the cheapest option for your international money transfer. There, you'll be able to discover the cheapest ways to fund your transfer and have the money received.

![]()

Step 02

Create a Paysend Account

Sign up with Paysend by providing your mobile phone number. Once you've verified the number with an SMS code, you'll be asked to add your full name, date of birth, email address, and residential address.

![]()

Step 03

Set Up a Transfer

Once registered, Paysend will direct you to your dashboard, from which you'll be able to confirm your email address and send money. (If you'd like to send abroad a large amount, you'll be required to raise your limits and verify your identity using a photo ID over email.) To get started with your transfer, click the 'Send money' button, and enter the amount you'd like to send, your destination currency, and the pay-out method.

![]()

Step 04

Add a Beneficiary

Further down the page, you'll have the opportunity to enter your beneficiary's payment details. These will be slightly different for bank transfers versus cash pickups but will include your beneficiary's full name, residential address and specify a reason for your transfer regardless of the pay-out method.

![]()

Step 05

Enter Your Card Details

At the bottom of the page, you'll be required to enter your credit or debit card details. This includes your card number, as well as its expiry date and CVC/CVV number.

![]()

Final step

Review and Pay

Try PaysendAfter clicking 'Continue', you'll have the opportunity to review your transfer details and then instruct the payment. Once you've paid, the money should be deducted from your card and processed in a matter of seconds.

Fees & Exchange Rates

Transfers to a bank account

Not always the cheapest, but cheap and competitive in general on Monito.

Transfers to a debit or credit card

Normally the cheapest and most competitive.

Paysend's Fees & Exchange Rates

Paysend is consistently one of the cheapest and most competitive services compared to its top competitors on Monito's comparison engine. When using the service to send money abroad, you'll encounter the following two costs:

Paysend Transfer Fees

Paysend charges a single, low fixed fee for card-to-card and card-to-Paysend-wallet transfers for most money transfer corridors, which remains flat regardless of the amount of money that you send. By default, these fees apply to most money transfer corridors. However, some of the more popular money transfer corridors are fee-free entirely. Card-to-bank transfers always come without a transfer fee.

These Paysend card transfer fees for some of the major sending countries are as follows:

- From the USA: US$2.00

- From Canada: C$3.00

- From the Eurozone: €1.50

- From the UK: £1.00

- From Australia: A$3.00

- From Switzerland: CHF 2.00

Paysend Exchange Rates

All in all, Paysend offers very attractive exchange rates, the margins on which typically range between 0.5% and 2% above the mid-market exchange rate. This makes Paysend a highly competitive service for most transfer corridors, particularly for transfers from the UK to Poland where the margin is as low as 0.3% of the transfer value.

Take a look at the graph below to see how Paysend's exchange rates differ across a number of key money transfer corridors:

Quoted: 28/05/2021 14:00 GMT +01:00

Destination | Currency | Paysend Rate | Mid-Market Rate | Margin (%) | Margin |

|---|---|---|---|---|---|

Indian rupee | 71.659 | 72.486 | 1.14% | US$28.53 | |

Canadian dollar | 1.1868 | 1.2117135 | 2.06% | US$51.40 | |

Mexico | 19.7357 | 20.058408 | 1.61% | US$40.19 | |

British pound | 0.69 | 0.71 | 1.57% | US$39.12 | |

Philippine peso | 47.083 | 47.832738 | 1.57% | US$39.15 |

Quoted: 28/05/2021 14:00 GMT +01:00

Destination | Currency | Paysend Rate | Mid-Market Rate | Margin (%) | Margin |

|---|---|---|---|---|---|

US dollar | 0.8095854922 | 0.82538328 | 1.91% | C$47.79 | |

Indian rupee | 59.1741 | 59.844064 | 1.12% | C$27.95 | |

Philippine peso | 38.8802 | 39.481196 | 1.52% | C$38.01 | |

Mexican peso | 16.3784 | 16.549008 | 1.03% | C$25.74 | |

British pound | 0.5712327202 | 0.58278606 | 1.98% | C$49.50 |

Quoted: 28/05/2021 14:00 GMT +01:00

Destination | Currency | Paysend Rate | Mid-Market Rate | Margin (%) | Margin |

|---|---|---|---|---|---|

Indian rupee | 87.5678 | 88.15592 | 0.67% | €16.67 | |

US dollar | 1.1983 | 1.2159212 | 1.45% | €36.21 | |

Polish złoty | 4.4517 | 4.4868758 | 0.78% | €19.59 | |

Turkish lira | 9.9274 | 10.444614 | 4.95% | €83.30 | |

Philippine peso | 57.858 | 58.145011 | 0.49% | €12.33 |

Quoted: 28/05/2021 14:00 GMT +01:00

Compare Paysend's fees & exchange rates:

Customer Satisfaction

Trustpilot reviews

Excellent Trustpilot ratings.

Google Play reviews

Good Google Play ratings, although scattered complaints.

Customer Reviews of Paysend

Paysend has received overwhelmingly positive reviews from customers across all platforms. On Trustpilot, around 89% of 23 thousand customers who gave their feedback rated the service five out of five stars. Among the hundreds of reviews we surveyed, the following key themes and sentiments emerged from Paysend customers:

Positive Paysend Reviews

- Convenient card payments that are easy to make;

- The exchange rates are favourable;

- Money arrives quickly at the destination.

Negative Paysend Reviews

- Live chat customer support can be delayed;

- Default maximum sending limits are low;

- Raising sending limits can take a long time.

FAQ About Paysend

🇺🇸 Can I use Paysend in the USA?

Yes. As of September 2020, Paysend's mobile app and website have been fully available to US residents for international card transfers from the US dollar to over 110 countries across the globe.

🔒 Can I trust Paysend?

Yes, you can trust Paysend. Moving more than US$3.2 billion across borders for around 3.7 million customers every year, Paysend is a trustworthy service that offers institutional-grade security and preventative measures, such as two-factor login and verification procedures. What's more, Paysend holds its clients’ funds completely separately from their own business accounts, as per FCA requirements, meaning that should the company have any financial difficulties, your money will remain safe.

💻 How does Paysend work?

Paysend is an international card payment platform. It works by debiting money from the credit or debit card of your choice and crediting the amount (minus the fees) into your beneficiary's bank account, card, Paysend wallet, or by making cash available for your recipient to pick up at an agent location. To sign up with Paysend, you can use their clean, user-friendly website or mobile app. You'll need your mobile phone number to begin with, and later you'll be required to validate your identity.

🇳🇬 Can Paysend send money to Nigeria?

Yes. Paysend is among several dozen international money transfer operators authorised by the Central Bank of Nigeria (CBN) to send money to Nigeria. However, following a November 2020 decision by the central bank, money transfers into Nigeria are only permitted in US dollars, meaning you'll only be allowed to send money to Nigeria with Paysend in that currency and no longer in Nigerian naira.

📤 How do I send money on Paysend?

Once you've completed the signup process, sending money over Paysend is remarkably simple. You will be required to input your destination currency, the amount you'd like to send, your pay-out method, your beneficiary's banking details (or equivalent for other transfer types), and finally, your own credit or debit card details. What we found most impressive about the transfer process was that all of the steps are completed on a single page, allowing for a quick and seamless customer experience.

📥 How do I receive money on Paysend?

As a recipient of a Paysend transfer, you'll be able to receive money directly into your bank account as a deposit. You'll also have the option of having the money credited to your card, or as a Paysend link into your Paysend wallet. Finally, in some countries, you'll also have the option of physically picking up your money transfer in cash from one of Paysend's partnered agent locations.

💳 Does Paysend accept prepaid cards?

Yes, Paysend does accept prepaid cards, and you'll be able to use them on Paysend's mobile app or website just as you would an ordinary debit or credit card. However, bear in mind the limits your prepaid card may impose, as there may be maximum transfer amounts or a lower balance relevant to your card issuer or service. Find out more about sending money through Paysend using a prepaid card here.

🔏 Does Paysend have buyer protection?

No, Paysend's terms of service do not include buyer protections. This means Paysend will not intervene in disputes between buyers and sellers to rectify potential issues in the same way that eBay or PayPal would, for example. Instead, Paysend recommends in the event customers have disputes with merchants that they "settle these with the recipients [of the transactions]," adding that the company is "not responsible for any obligation and/or commitment provided or made by the recipient of your payment made".

🇨🇦 Does Paysend work in Canada?

Yes. As of June 2020, Paysend's mobile app and website have been fully available to Canadian residents for international card transfers from the Canadian dollar to over 110 countries across the globe.

🇮🇳 Does Paysend work in India?

No, as of May 2021, it's not yet possible to open a Paysend account in India. However, it is possible to use Paysend to send money to India from abroad.

🇺🇦 Does Paysend work in Ukraine?

No, as of May 2021, it's not yet possible to open a Paysend account in Ukraine. However, it is possible to use Paysend to send money to Ukraine from abroad.

💳 Does Paysend accept American Express?

Yes and no. It's possible to send money through Paysend using an American Express card, but it's not possible to receive money on one. Currently, the only card issuers supported for receiving transfers at Paysend are Visa, Mastercard, UnionPay, Humo, and Verve.

👨⚖️ Is Paysend legit?

Yes, Paysend is legit indeed. Moving more than US$3.2 billion across borders for around 3.7 million customers every year, Paysend is a completely legitimate service that offers institutional-grade security and preventative measures, such as two-factor login and verification procedures. What's more, Paysend holds its clients’ funds completely separately from their own business accounts, as per FCA requirements, meaning that should the company have any financial difficulties, your money will remain safe.

⏱ How long does it take to send money with Paysend?

For Paysend transfers to cards or for cash pickup, the funds normally become available within a matter of seconds or minutes. Transfers to bank accounts, on the other hand, tend to take slightly longer to arrive. According to Paysend, these transfers typically around one business day, although they can be as long as three business days at the extreme.

⛔ How do I delete my Paysend Global Account?

To close a Paysend Global Account, you'll need to contact Paysend via email or over WhatsApp and provide them with your full name, date of birth, mobile phone number, and either the last four digits of your Paysend card or the amount of your last top-up. Find out more about how to get the job done here.

🧭 Where is Paysend based?

Paysend is based out of London, UK, where it is organized and headquartered. The company also has offices in the UK in Edinburgh and in Moscow, Russia.

🧾 Who owns Paysend?

Paysend is wholly owned by the Paysend Group Limited, an Edinburgh-based financial technology company that was incorporated in April 2017.