Find the Best Way to Send Money to Canada

Top Providers For transfers to Canada

Based on 51,566 comparisons made by Monito users in the past 3 months.

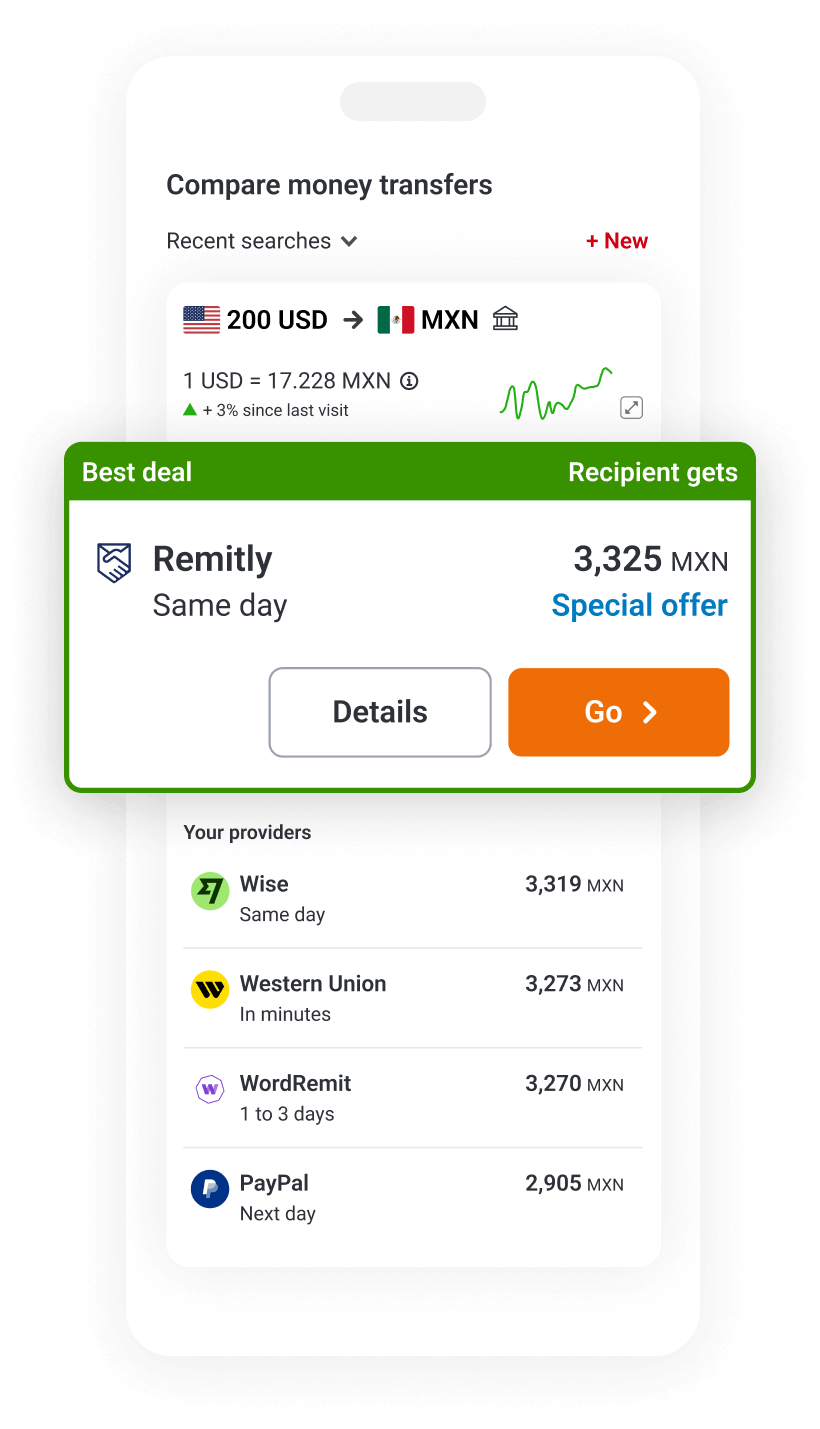

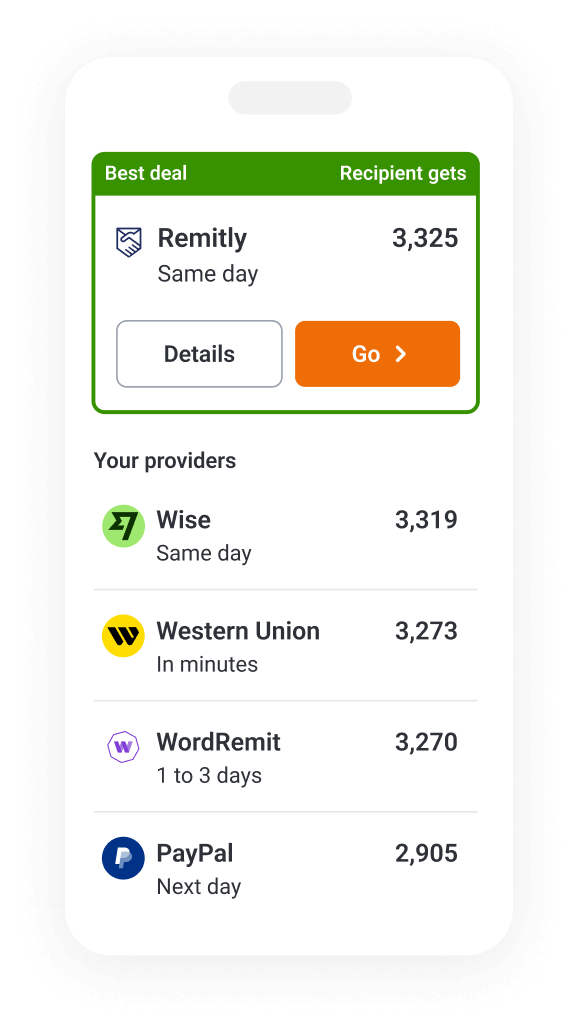

Compare live resultsBest for Transfers to a Bank Account

Best of 58 providers. Compare all

Best for Transfers to Cash Pickup

- 9.3Top providerGo to Remitly

Cheapest

in 92% of all comparisons

Top rated

in 96% of all comparisons

Fastest

in 92% of all comparisons

Best of 3 providers. Compare all

Best-Rated Providers to Send Money to Canada

9.5

9.4

9.4

9.4

9.3

9.3

9.3

9.3

9.2

9.2

9.2

9.1

Sending an Airtime Top-Up to Canada? 📲

With Monito, you can take advantage of lightning-fast airtime and data top-ups with our trusted partner, Rebtel

Recharge airtime or mobile data online by entering your loved one's number and letting Rebtel take care of the rest!

- Send money from UK to Canada

- Send money from Germany to Canada

- Send money from Italy to Canada

- Send money from France to Canada

- Send money from Australia to Canada

- Send money from Poland to Canada

- Send money from the Netherlands to Canada

- Send money from Spain to Canada

- Send money from Sweden to Canada

- Send money from Austria to Canada

- Send money from Slovakia to Canada

- Send money from Portugal to Canada

- Send money from Belgium to Canada

- Send money from Switzerland to Canada

- Send money from Finland to Canada

- Send money from Cyprus to Canada

- Send money from Latvia to Canada

- Send money from Denmark to Canada

- Send money from Greece to Canada

- Send money from Ireland to Canada