Foto di Stefano Ferrario da Pixabay

Foto di Stefano Ferrario da Pixabay ATM & Cash Withdrawals | Home & Abroad

6 Debit Cards With the Best Exchange Rates When Using ATMs Abroad

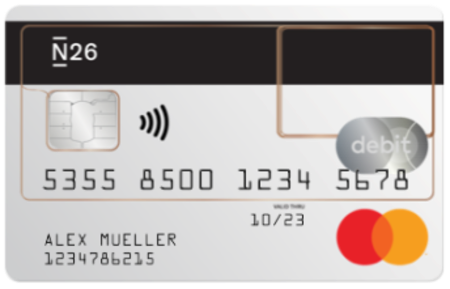

Have a look at this comparison table of the six best debit cards offered by digital banks around the world. N26 is offered in the EU/EEA (although the free account is currently only available to new customers in Germany and Austria), Starling Bank and Monese are available in the UK, and Juno is available in the US. Revolut and Wise are multi-currency accounts that offer debit cards in dozens of countries worldwide.

N26 | Revolut | Wise | OnJuno | Starling Bank | Monese | |

|  |  |  |  |  | |

Foreign currency exchange | 0.00% | 0%-2% on the first £1,000, 2% thereafter | 0.35% - 2.85% depending on the currency | 0.00% | 0.00% | 0% between GBP, EUR, and RON 2.5% for other and additional 1% on weekends |

ATMs fees | 0% on the first three euro withdrawals per month, 1.7% thereafter | 0% on the first €200 per month, 2% thereafter | 0% on the first €/£200 per month, 1.75% thereafter | 0%, waives first withdrawal per month | 0% | £1.50 |

Card Delivery Fee | €0 | €5.50 / £4.99 | €6 / £5 | $0 | £0 | €4.95 / £4.95 |

Trustpilot score | 3.4/5 20,659 reviews | 4.4/5 105,640 reviews | 4.6/5 149,609 reviews | 4.3/5 183 reviews | 4.3/5 27,199 reviews | 3.9/5 25,617 reviews |

| Go to N26 | Go to Revolut | Go to Wise | Go to OnJuno | Go to Starling Bank | Go to Monese |

Best Alternatives for Debit Cards To Use at ATMs Abroad

Our Guides on Travel Money and International Living