- Languages English

- Country availability United Kingdom

- Services Full bank account

- Monthly fee Very low

- Card delivery time Mid

- Best for Everyday banking

- Bank details UK account no. & sort code

- Supported currencies Pound sterling

- Overdraft Yes

- Annual interest rate Low

- Supports cash deposits Yes

- International transfers Yes

Monzo vs Revolut

In our standardized review process, our experts:

- test the products that they write about;

- read the fine print of the fees and pricing;

- listen to what customers have to say.

What’s the Difference Between Monzo and Revolut? Which Is Better for Your Needs and Preferences?

François Briod

Guide

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Byron Mühlberg

Reviewer

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

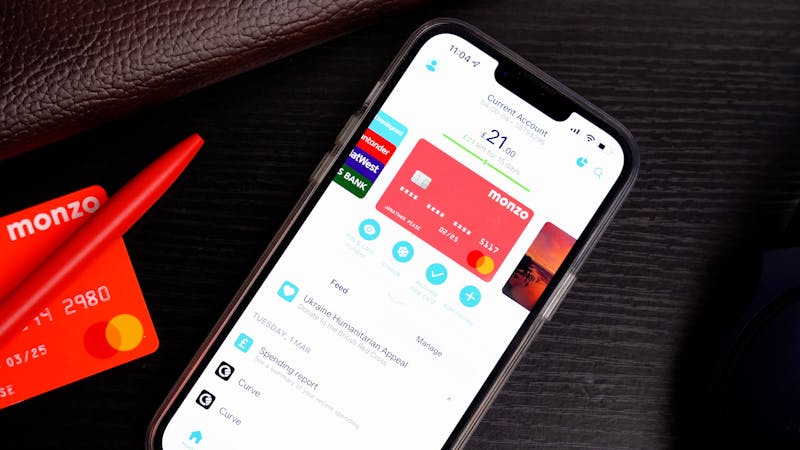

Read moreMonzo and Revolut are two powerful digital finance platforms offering a wide range of similar financial services such as current accounts, debit cards, mobile apps, and various features designed for people with busy lifestyles.

In this side-by-side review, we compare Revolut and Monzo to help you make an informed decision about which might suit you best. Read on to see how they stack up with each other across multiple areas, including fees, product quality, and customer satisfaction.

Although Monzo and Revolut are great options, we firmly recommend Starling Bank if you want a full bank account in the UK. In our opinion, Starling combines the ease of online finances with the trust of institutional banking in a way unmatched by Monzo or Revolut. Plus, its current and savings accounts are almost entirely fee-free!

Before diving in, it's important to remember that Monzo and Revolut approach their services quite differently. Monzo is a fully-featured bank account, whereas Revolut functions as a prepaid debit card that lets you make payments in many different currencies. Furthermore, in this review, we only compare the services' standard plans — namely the 'Monzo' and 'Revolut Standard' accounts respectively.

If you'd like to see how Monzo and Revolut stack up against similar products in the UK, check out our live fintech comparison engine at the bottom of this article!

That out the way, let's get straight to our in-depth comparison of Monzo and Revolut: ―

Key Facts About Monzo & Revolut

| 🔎 Monzo is better | as a bank account (e.g. with overdraft facilities, savings, joint accounts, youth accounts, interest rates, etc.). |

|---|---|

| 🔎 Revolut is better for | as a low-cost spending tool to save money on foreign transactions |

| 🏆 Best UK challenger bank | |

| 💸 Average monthly fee | £0 |

| 📶 Size (customers) |

|

| 📶 Size (revenue) |

|

| 💱 Monzo currency exchange fee | 0.35% - 2.85% |

| 💱 Revolut currency exchange fee | 0.3% - 2% |

Trust & Credibility

Background check

Fully licensed and authorized in every country in which it does business.

Licensed as a bank by the PRA and FCA in the UK, and deposits are FDIC protected.

Security & reliability

Segregated user accounts, HTTPS, 3-D Secure cards (issued by Mastercard or VISA).

Accounts are fully secured using segregated user accounts and HTTPS and cards are 3-D Secure.

Company size

28 million customers, 6,000 employees worldwide

Over 5.5 million customers and nearly $150 million in annual revenue.

Transparent pricing

Pricing is accessible, but it doesn't provide every fee found on the regulator-standard fee schedule.

A full overview of pricing is relatively accessible and provides every fee as per the regulator-standard fee schedule.

Monzo vs Revolut: Are They Trustworthy?

Both Monzo and Revolut are large, duly licensed firms that you can most certainly trust with your money, and neither is an inherently worse choice than the other in this regard.

Revolut scored higher on our trust metrics mostly because they're a larger company. With over 26 million customers globally, Revolut is far larger than Monzo, which has around 5.5 million customers only in the UK. We also found Revolut's fees to be easier to access than Monzo's, which counted in their favour (although we didn't have the impression that either company was trying to obscure or hide any fees).

The only major difference is that, in the UK, Revolut is not licensed as a bank, while Monzo is. While this doesn't necessarily make Revolut inherently riskier, it does mean that Revolut doesn't offer deposit insurance in case of bankruptcy. Monzo, on the other hand, is a licensed bank, meaning it adheres to the Financial Services Compensation Scheme (FSCS) and that up to £85,000 in client deposits will be guaranteed by the government if the company was to go under.

Interestingly, as of 2022, both Monzo and Revolut have consistently failed to draw a profit and still report operating losses each year. Again, this isn't necessarily a major drawback for you as a customer. If you're using Monzo (even as your main bank account), you're completely secure if you hold less than £85,000 in deposits. With Revolut (whose deposits aren't FSCS-insured), as long as you use them as a secondary account, you should be fine here too.

🖊 Licensing | E-Money Institution (FCA) | Bank (FCA, PRA) |

|---|---|---|

📃 FSCS-Insured | ✘ | ✔ |

💰 Profitable | ✘ | ✘ |

📈 Publicly Listed | ✘ | ✘ |

| Try Revolut | Try Monzo |

Correct as of 3/3/2022

Service & Quality

Using the mobile app

Well-designed, well-rated, and packed with helpful features.

Well-rated and slick user interface with many interesting features, including instant spending notifications and easy budgeting.

Managing the account

Many top-up methods and currencies (though lacks overdraft and interest).

Overdraft, interest, and multiple top-up methods are supported, but only one currency is available (GBP).

Contacting support

FAQ and live chat are available, but phone support is lacking.

FAQ and live chat are available on the standard plan, but phone support isn't available to all users.

Making card payments

Contactless, online payments, Apple Pay, Google Pay, and social payments.

Contactless, online payments, Apple Pay, Google Pay, and social payments are all supported.

Monzo vs Revolut: Which Has the Better Account & Card?

Simply put, both Monzo and Revolut are excellent platforms, and are at the top of their game when it comes to low-cost financial services in the UK. Monzo offers you a fully-fledged current account, a debit Mastercard with no foreign transaction fees, an international money transfer service through Wise, and a range of other benefits. Similarly, Revolut provides you with an online account, a debit VISA or Mastercard, access to international money transfers, and several other innovative offerings.

Both have easy-to-use mobile apps that are popular with users and feature notifications, direct debits, budgeting, financial planning, and multi-currency balances. (However, as we'll see later, Revolut may charge a fee for faster transfers or to accounts not held with Revolut, whereas Monzo does not.)

Monzo claims to be a replacement for a traditional account and offers a range of services to help you replace your existing bank. Revolut is slightly more limited as it’s effectively a prepaid card that gives you multiple currency options and lets you send money overseas quickly and easily. That said, Revolut is still an excellent service and provides several additional features not available to Monzo (not to mention the fact that it's available in more countries).

Revolut Card vs Monzo Card

The cards offered by Monzo and Revolut come with almost identical features. Both are debit Mastercards, and both offer contactless payments, Apple Pay and Google Pay. Note that the Revolut debit card may be on the VISA network in some countries. Mobile apps from each provider allow you to block and unblock your debit card if it goes missing. Revolut also offers virtual cards, whereas Monzo doesn’t.

Account Experience

Both platforms offer a range of features to make your financial life easier. Monzo offers direct debits in British pounds and has a direct debit switching service to make migrating from your old account easier. Revolut offers direct debits in Pounds and Euros. Monzo also allows for joint accounts, whereas Revolut does not. Both providers have financial services, including notifications, financial analysis, and budgeting. Revolut offers savings 'pots,' though we find Monzo's advanced savings features to be much more capable due to their flexibility and budgeting features.

Revolut is available only through a mobile app, whereas Monzo provides a mobile app with a website available for emergencies. In this way, Monzo might not be your best bet if you prefer banking on your PC over your smartphone.

Local Accounts Available in Specific Currencies

Monzo is currently available in the UK and only offers accounts in British pounds (although they are currently starting out in the US). Revolut offers more local currency options. It can provide accounts in GBP, EUR, NOK and PLN, so if you’re in the EU or from Poland or Norway, Revolut is probably the better choice.

Other Account Features

Monzo offers savings accounts at rates of up to 1.16%. They also provide an overdraft by percent APR/EAR that doesn't exceed 50 pence per day in the UK. Monzo is a member of the 'Current Account Switching Service', making it easy to move your existing account to them from another bank.

On the other hand, Revolut doesn't offer interest on savings or offer overdrafts. At more premium plans, Revolut does provide extra services like Pay Per Day travel insurance, automatic donations, and rounding-up on transactions.

Topping up Your Account

Monzo also offers cash and bank transfers for topping up an account and allows you to use a cheque. Revolut will enable you to top up your account with a bank transfer, debit card, or credit card, which is more convenient, although you may be charged a fee for card top-up.

|  | |

💳 Contactless | ✔ | ✔ |

🔒 3D Secure | ✔ | ✔ |

🍎 Apple Pay | ✔ | ✔ |

💻Google Pay | ✔ | ✔ |

🌐 Virtual Card | ✔ | ✔ |

🧾Account Details | GBP | GBP, EUR |

⬆ Top-Up Methods | Bank transfer, cash, cheque | Bank transfer, debit/credit card |

💱 Currencies | GBP | GBP and 31 others |

📤Direct Debits | ✔ | ✔ |

🪙 Interest | Up to 1.16% | ✘ |

💸 Overdraft | ✔ | ✘ |

👥 Joint Account | ✔ | ✘ |

📱 Platform(s) | Mobile app | Mobile app, website |

| Try Monzo | Try Revolut |

Last updated: 25/5/2023

Fees & Exchange Rates

Everyday use

No monthly fees and few running costs for day-to-day use.

Zero everyday costs such as monthly fees, transfer fees, and local ATM withdrawal fees.

ATM withdrawals

Withdrawals over £200 or equivalent /month cost 2%. Third-party ATM charges, fair use limits, and weekend surcharges may also apply.

Withdrawals are free but are only available up to a daily limit of £400 and a monthly limit of £5,500.

Online spending

Ordinary online spending comes at no cost (except for FX markups on weekends)

Ordinary online spending comes at no cost, neither in the default currency nor in a foreign currency.

International spending

Low fees for overseas spending, although minor conversion fees and weekend surcharges can apply.

No fees for spending abroad, although Mastercard's exchange rate can apply to foreign currency transactions.

Monzo vs Revolut: How Do the Fees Compare?

Users of both Monzo and Revolut are able to access an impressive number of services through the basic plans of the two providers respectively. For example, neither charges you to open or hold an account, both allow you to send money internationally for very low fees, and both come with good mobile apps with no hidden costs.

However, when it comes to pricing in general, Monzo takes the lead over Revolut as they have lower overall fees and don’t charge for providing you with a debit card, whereas Revolut does. (Monzo is significantly cheaper than UK high-street banks for handling day-to-day finances.)

International ATM Withdrawals

When it comes to withdrawing cash overseas, Monzo gives you a free limit of £200 every 30 days but charges you 3% of the amount withdrawn after that (this is outside the EEA only — inside the EEA it's always free up to a fixed withdraw of £400 per day). With Revolut, the first £200 per month does not attract a fee (though fair use limits and weekend surcharges might apply), but you’ll be charged 2% of any amount withdrawn above that.

Receiving Your Debit Card

Monzo doesn't charge a fee for providing you with a debit card, though the card takes one to two weeks to arrive. Revolut provides a card within nine working days and normally charges a fee of €5.50/£4.99 to send you a debit card. Revolut can also deliver your card within two to nine business days via 'Express Delivery', but you’ll need to pay a fee of between £6 and £10 for the speedy service, depending on exactly how fast it ends up arriving.

International Money Transfers

Monzo provides currency exchange services through integration with Wise — a much-loved way to send money abroad that offers superb exchange rates and low, transparent fees. This means you’ll pay a fee of 0.35% to 2.85% of the amount you’re transferring, depending on the currency.

Revolut’s pricing is more complex and depends on the currency, your plan, your fair use limits, the volume you trade, and whether you exchange currency during or outside market hours. Over the weekends, Revolut’s currency exchange service can be expensive. Revolut lets you hold over 30 currencies, and you can exchange money between them quickly.

Using Your Debit Card Overseas

There’s good news from Monzo when it comes to using your card overseas: the bank doesn't charge any commission for FX services when you pay with your card abroad. Revolut, by comparison, charges zero to 2% on the first £1,000 or equivalent you spend overseas in a month (though, as always, fair use limits and weekend surcharges may apply), then charges a 2% fee afterwards.

💷 Maintenance | £0 | £0 |

|---|---|---|

🏧 Foreign Withdrawals | 3% | 2% |

💳 Foreign Payments | 0 | 0%-2% |

💸 Int'l Transfers | 0.35%-2.85% |

|

🚚 Card Delivery | £0 | £4.99 |

📆 Delivery Speed | Up to 5 business days | Up to 9 business days |

| Try Monzo | Try Revolut |

Last updated: 25/5/2023

Customer Satisfaction

Customer review score

Trustpilot rating of 4.3 out of 5 stars.

Average Trustpilot rating of 4.5 out of 5 stars.

Number of positive reviews

Over 113 thousand four- and five-star reviews.

Over 15,000 four- and five-star reviews.

Monzo vs Revolut: What Are Customers Saying?

With millions of customers each — many of whom report overwhelmingly positive feedback — Monzo and Revolut are both large, popular, and well-liked digital finance apps. As such, we see this section as a draw, with no clear winner between the two.

In the end, we therefore think its safe to say that both services impress their customers by and large.

🌍 Availability | UK, US | UK, EEA, US, Australia, Singapore, Switzerland, and Japan |

|---|---|---|

💬 Languages | English | English, French 21 others |

👥 Customers | 5.5 million | 16 million |

🔒 Trustpilot | 4.3/5 (26K reviews) | 4.3/5 (133K reviews) |

📞 Support | Email, call centre, in-app live chat | 24h in-app live chat |

🗨 Support Languages | English | English, French 5 others |

| Try Monzo | Try Revolut |

Last updated: 25/5/2023

Monzo vs Revolut: The Verdict

In general, whether Monzo or Revolut is the better service will depend entirely on your needs and preferences:

If you're looking for a bank account, low fees (especially on transactions overseas), excellent savings capabilities, and basic credit services such as loans and interest, then use Monzo instead of Revolut, which doesn't offer these services. On the other hand, if you're already happy with your primary bank account and you're only looking for a spending tool to enable you to hold and spend balances in multiple currencies and use it flexibly in your day-to-day at a low cost, then we recommend Revolut, as Monzo doesn't offer any multi-currency functionality.

If you'd like to dive deeper into either of these two platforms, we recommend looking at our in-depth Monzo review or Revolut review respectively. Watch Monito's review of Revolut in video. Also, to compare Revolut and Monzo to other alternatives, don't forget to take a look at our rankings of the three best fintechs in the UK (hint — neither Monzo nor Revolut is number one!).

At the end of the day, whichever service you choose, you probably won't make a mistake, and there's a high chance you'll end up more than satisfied with your decision.

Compare Monzo and Revolut to Other Top Fintechs

Filter your results

Languages

See allCountry availability

1See allServices

Monthly fee

Card delivery time

Best for

Bank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Overall Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

Filter your results

Languages

See allCountry availability

1See allServices

Monthly fee

Card delivery time

Best for

Bank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Starling Bank Monito Score 9.1

- Monzo Monito Score 9.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Everyday banking +1

- Everyday banking

- Saving money

- Bank details UK account no. & sort code

- UK account no. & sort code

- Supported currencies Pound sterling +2

- Pound sterling

- US dollar

- Euro

- Overdraft Yes

- Annual interest rate High

- High

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Wise Multi-Currency Account Monito Score 8.9Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +21

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Polish

- Dutch

- Slovenian

- Polish

- Romanian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +37

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- New Zealand

- Malaysia

- Services Multi-currency account

- Multi-currency account

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN +11

- Euro IBAN

- Hungarian account no.

- US account & routing no.

- UK account no. & sort code

- Australian account & BSB no.

- New Zealand account no.

- Canadian account

- transit

- institution no.

- Romanian account no.

- Singaporean account no. & bank code

- Turkish IBAN

- Supported currencies US dollar +50

- US dollar

- Euro

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Pound sterling

- Croatian kuna

- forint

- Japanese yen

- Malaysian ringgit

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Romanian leu

- Swedish krona

- Singapore dollar

- Turkish lira

- United Arab Emirates dirham

- Chilean peso

- lari

- Moroccan dirham

- Pakistani rupee

- Tanzanian shilling

- Uruguayan peso

- ZMK

- Argentine peso

- Botswana pula

- Chinese yuan

- Egyptian pound

- Ghanaian cedi

- Indian rupee

- Kenyan shilling

- Mexican peso

- Ukrainian hryvnia

- Vietnamese Dong

- Costa Rican colon

- Israeli new shekel

- South Korean won

- Malaysian ringgit

- Thai baht

- Ugandan shilling

- CFA franc

- Bangladeshi taka

- Sri Lankan rupee

- Nigerian naira

- Philippine peso

- Russian ruble

- rand

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Revolut Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +20

- English

- German

- French

- Portuguese

- Spanish

- Dutch

- Slovenian

- Polish

- Romanian

- Italian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +35

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending online +1

- Spending online

- Spending while abroad

- Bank details UK account no. & sort code +1

- UK account no. & sort code

- Euro IBAN

- Supported currencies United Arab Emirates dirham +26

- United Arab Emirates dirham

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Euro

- Pound sterling

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Russian ruble

- Qatari riyal

- Romanian leu

- Saudi riyal

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- US dollar

- rand

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Conotoxia Multi-Currency Card Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages Polish +1

- Polish

- English

- Country availability Austria +28

- Austria

- Belgium

- Bulgaria

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- United States

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +19

- Euro

- US dollar

- Pound sterling

- Swiss franc

- Australian dollar

- Canadian dollar

- Czech koruna

- Danish krone

- denar

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Russian ruble

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- rand

- Polish zloty

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Monese Monito Score 8.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +11

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Czech

- Estonian

- Lithuanian

- Polish

- Romanian

- Turkish

- Country availability Austria +30

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details UK account no. & sort code +2

- UK account no. & sort code

- Euro IBAN

- Romanian account no.

- Supported currencies Euro +2

- Euro

- Pound sterling

- Romanian leu

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Zen Monito Score 7.1Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +7

- English

- Polish

- German

- Spanish

- French

- Greek

- Italian

- Ukrainian

- Country availability Austria +29

- Austria

- Belgium

- Bulgaria

- Cyprus

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Gibraltar

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Low

- Low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +29

- Euro

- US dollar

- Pound sterling

- Polish zloty

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Chinese yuan

- Croatian kuna

- Czech koruna

- Danish krone

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Kenyan shilling

- Mexican peso

- New Zealand dollar

- Norwegian krone

- Qatari riyal

- Romanian leu

- Saudi riyal

- Singapore dollar

- rand

- Swedish krona

- Swiss franc

- Thai baht

- Turkish lira

- Ugandan shilling

- United Arab Emirates dirham

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Pockit Monito Score 6.7Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Travel card

- Travel card

- Monthly fee Moderate

- Moderate

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details No account details (balance only)

- No account details (balance only)

- Supported currencies Pound sterling

- Pound sterling

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.