Frequently Asked Questions about Wise Business (formerly TransferWise for Business)

See Wise Business' Top Competitors

How to Set Up a Company in the UK in 2022

May 26, 2023 - by Jarrod Suda

What Do I Need To Open a Business Bank Account for an LLC?

December 7, 2022 - by Jarrod Suda

Disregarded Entity LLCs: Meaning and How to Start One in 2022

November 25, 2022 - by Jarrod Suda

Tide Business Review

December 29, 2022 - by Rachel Wait

Payoneer Review

November 25, 2022 - by Byron Mühlberg

7 Best Online Business Bank Accounts for UK Small Business

February 27, 2023 - by Jarrod Suda

Revolut Business Review: Fees, Exchange Rates, Functionalities, and More

December 29, 2022 - by Rachel Wait

Best Free Bank Accounts UK

January 9, 2024 - by Byron Mühlberg

Best UK Challenger Banks

January 16, 2024 - by Byron Mühlberg

9 Best Sole Trader Bank Accounts for Self-employed in the UK

January 20, 2023 - by Jarrod Suda

Novo Business Review

June 21, 2023 - by Jarrod Suda

Compare Best 7 Business Bank Accounts for UK Startups 2023

September 22, 2023 - by Jarrod Suda

Best Small Business Banks in Canada

January 9, 2024 - by Jarrod Suda

Top 10 Online Small Business Checking Accounts in the USA in 2023

December 29, 2022 - by Jarrod Suda

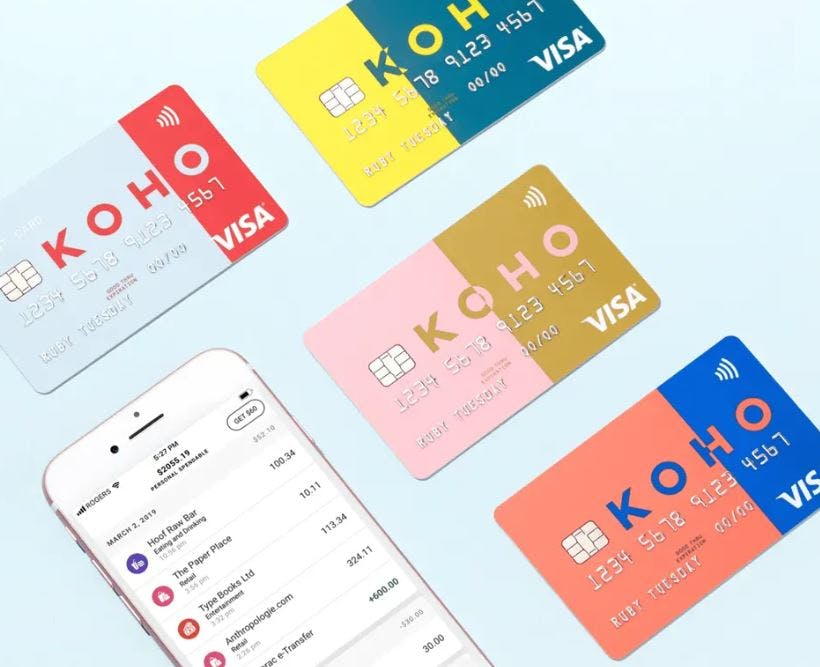

KOHO Financial Review

April 23, 2024 - by Jarrod Suda

4 Best Cash Advance Apps With No Direct Deposit Required

April 23, 2024 - by Jarrod Suda

7 Best Cash Advance Apps That Work With Chime in 2024

April 17, 2024 - by Jarrod Suda

How to Pay a Foreign Contractor

March 27, 2024 - by Byron Mühlberg