Monese vs Wise Multi-Currency Account: Which is the best? What are the Pros & Cons of each?

François Briod

Guide

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreMonese vs Wise Multi-Currency Account: which one offers the best card for travelling? What about the best way to manage your money digitally? Who offers the most options to add to your account's balance and the lowest fees or best exchange rates to use it at home or around the world? Check out our side-by-side comparison of Monese vs Wise offering and the pros and cons of each company.

📢 Important: Wise Is the New Name for TransferWise

Until March 2021, Wise had been formerly called TransferWise. The company decided to change its name to broaden its appeal and encapsulate the full range of service it offers. While the name is different, it's important to note that the service is still the same, and you're still able to use the service as usual with the same set of login details that you used on TransferWise. See more here.

Monese vs Wise Multi-Currency Account

How does the Borderless account from the mighty Wise compare with Monese, a specialist banking provider in the U.K. and EEA? We’ve carried out the research and explored the facts to share our thoughts so that you can make an informed choice on the right service for your banking and currency exchange needs.

Plans and Fees Winner: Monese 🏆

Monese and the Wise Multi-Currency Account both offer a range of features under their free plans. There’s no charge to open or hold an account; both allow you to send money internationally, customers love both businesses, and both come with good mobile apps. Monese wins in this category, though, due to their more fully-featured services, although if you’re more interested in international money transfers, Wise is the winner.

Overall Banking Service: Monese

Monese offers a more complete banking service that Wise, with options including notifications, direct debits, budgeting and financial planning. The Wise Multi-Currency Account is a more specialized service, ideal for fast and easy international money transfers and providing a local, virtual bank account in major regions.

ATM Withdrawals: Tie

Both providers charge identical fees for withdrawing money from an ATM when you’re overseas. The first €200 per month does not attract a fee, but you’ll pay two percent of any amounts withdrawn above that.

Getting a Debit Card: Monese

Monese has a slight edge here as they’ll deliver your card within 14 days, while Wise takes between two and four weeks.

International Money Transfers: Wise

Wise is the easy winner here, with low fees of 0.35 percent to 2.85 percent, depending on the currency, with most toward the lower end of this range. Monese charges a flat, two percent fee on international money transfers, with a two-euro minimum charge.

Using Your Debit Card Overseas: Tie

The better provider for fees for using your debit card overseas depends on how much you’re spending each month. Monese doesn’t charge a fee for the first €2,000 per month that you spend on the card and charges a flat, two percent fee on any amounts after that. Wise offers excellent exchange rates and charges 0.35 percent to 2.85 percent, depending on the currency. Most Wise fees in popular currencies are lower than one percent. We recommend estimating how much you might spend in a month and calculating for each provider.

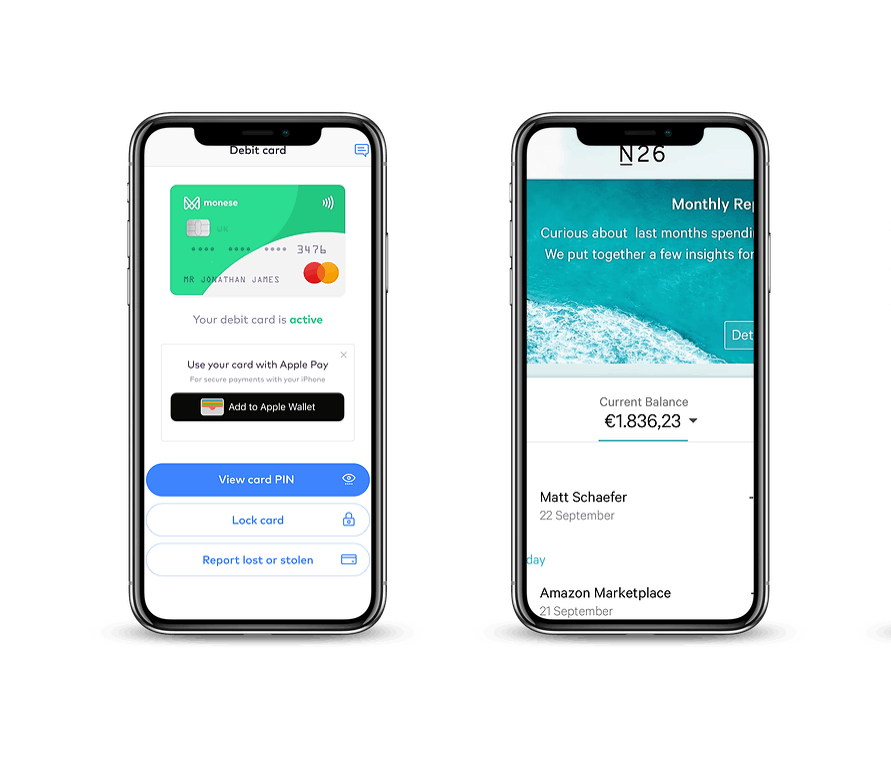

Monese Card vs Wise Multi-Currency Account Card features

The Monese and Wise debit cards are extremely similar. Both are Mastercard debit cards, and both offer Google Pay, Apple Pay and contactless payments. Each provider allows you to block and unblock your debit card from their app if it goes missing.

The overall winner for card features: Tie

Monese vs Wise Multi-Currency Account: How Does the Account Compare?

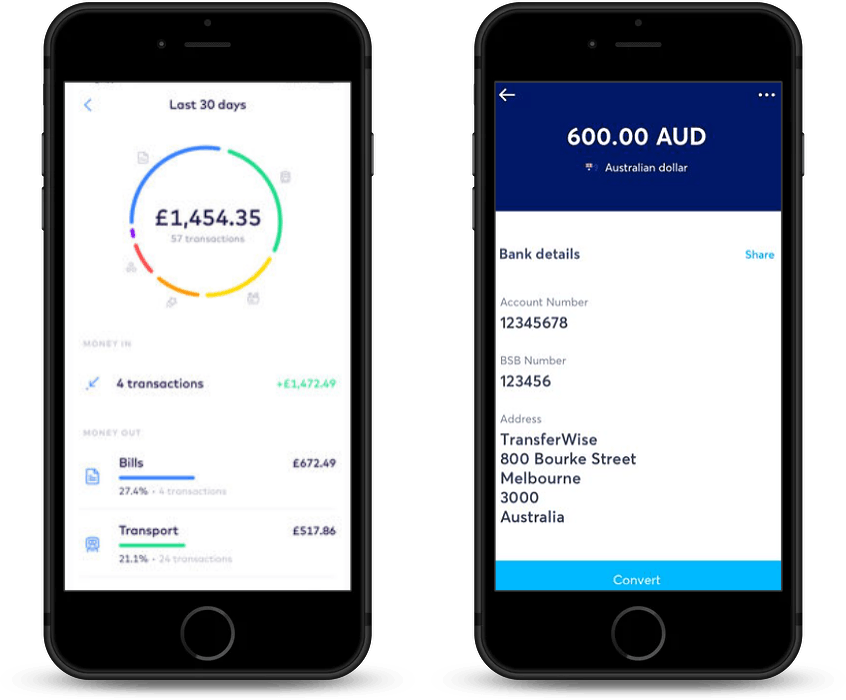

When it comes to account features, it’s difficult to compare like with like when it comes to Wise and Monese. The reason is a simple one—the Wise Multi-Currency Account isn’t a fully-featured bank account. It’s really excellent at a handful of things—low-cost international money transfer, multi-currency accounts, providing bank details across several countries and getting paid like a local. Outside of that, its functionality is limited, unlike Monese which offers several other bank account features.

The overall winner for account comparison: Tie

The Account Experience: Monese

The Wise Multi-Currency Account isn’t really a full bank account in the traditional sense. Although you can easily exchange currencies, pay in money and spend money from the debit card, you can’t set up things like direct debits, automated transfers or other functions more common to fully-featured accounts. Monese offers a more complete banking service, with financial analysis, budgeting, direct debits in the U.K. and more.

Local Accounts Available in Specific Currencies: Wise

Although Monese offers accounts in both pounds and euros, the Wise Multi-Currency Account gives you several more options. You can get an account in pounds, euros, U.S. dollars, Australian dollars and New Zealand dollars.

Other Bank Account Features: Wise

Neither Monese nor Wise offer interest on savings, have an overdraft facility or provide joint accounts. Monese services are only available through their mobile app, while Wise also offers a web interface to the Borderless account.

Monese provides balances in both GBP and EUR, while Wise offers a huge range of currency balances.

Monese does not require a local address or a credit check to open an account, meaning they’re great if you’ve just arrived. Wise gives you a local, virtual bank account in the U.S., U.K., Europe, Australia and New Zealand, so you can easily receive a transfer from a bank in any of those countries.

Neither service is guaranteed by the Financial Services Compensation Scheme, but they are both licensed as Electronic Money Institutions, which means customer accounts are kept segregated from operational accounts and customers would receive their balance back if either service went bust.

If you lose your phone, Monese allows you to install the app to a new phone and continue using it. You can also install the Wise app to a new phone, but if you have a new number and need to use SMS to validate your account, you’ll need to contact Wise support. You can still use the Wise web interface if you don’t have access to your smartphone.

If your card is lost or stolen, Wise and Monese let you freeze and unfreeze cards via their apps.

Topping up Your Account: Wise

Monese lets you top up with cash in the U.K. and via a bank transfer in the U.K. and Europe. Wise has a more convenient top-up service—you can pay in funds with a bank transfer, credit card or debit card.

Monese vs Wise Multi-Currency Account: Service Coverage and Customer Satisfaction

Wise and Monese offer excellent customer support, but Wise wins this one for their wider service availability. Both providers received excellent Trustpilot reviews and offer support in many languages.

The overall winner for service coverage and customer satisfaction: Wise

Service Availability: Wise

The Wise Multi-Currency Account has more widespread availability than Monese. The Wise Multi-Currency Account is available almost anywhere, although the linked debit card is only available in the EEA, Switzerland and the United States. Monese availability is limited to the EEA—the European Union plus Iceland, Liechtenstein and Norway.

Languages Supported: Tie

Both services are supported across 12 languages. Monese offers services in EN, FR, ES, DE, IT, PT, BG, RO, PL, CZ, TR and LT. Wise offers services in EN, FR, ES, DE, IT PL, PT, RO, TR, RU, JA and HU.

Number of Customers: Wise

Wise wins this category easily, with 4 million customers. Monese currently has around one million customers.

Customer Satisfaction: Wise

Not surprisingly, Wise wins in this area—it’s a very popular currency exchange service with low, transparent fees and excellent exchange rates. They score very highly for Trustpilot reviews, with an average of 9.2 out of ten. Monese still does very well, with an average Trustpilot review score of 8.9 out of ten.

Customer Support Hours: Tie

Both providers offer support through email and call centres, although hours do vary by country.

Monese App vs Wise Multi-Currency Account: App Features and Reviews

The Wise and Monese apps both score well with customers across Android and iOS devices. On the Google Play store, Android users rated Wise at 4.6 out of five and Monese at 4.5 out of five. iOS users rated both app sat 4.8 out of five on the Apple store. Because Wise’s app was originally designed for international money transfers, it’s not quite as optimized for other banking features.

The reason we’re awarding this area to Monese is that their app does slightly more, including automatic spending categorization for your money.

The overall winner for app features and reviews: Monese

The overall winner of our comparison depends on your needs from these services. For everyday banking, Monese wins due to their more fully-featured offerings. If you mainly want to transfer currencies, pay low fees and get a virtual bank account in several countries, then Wise is the winner.

The overall winner for the overall verdict: Monese for everyday banking, Wise for currency exchange and international money transfers.

When it comes to Wise versus Monese, it’s not a clear-cut comparison. If you’re sending or receiving money internationally, Wise is hard to beat, but for every day banking, Monese is the better choice.

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.