- Languages English

- Country availability United Kingdom

- Services Full bank account

- Monthly fee Very low

- Card delivery time Mid

- Best for Everyday banking

- Bank details UK account no. & sort code

- Supported currencies Pound sterling

- Overdraft Yes

- Annual interest rate Low

- Supports cash deposits Yes

- International transfers Yes

How To Open a Jersey Bank Account (Offshore as a Non-Resident)

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Byron Mühlberg

Reviewer

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreJersey, functioning as a Crown Dependency with a robust and sophisticated financial sector, presents a variety of options for you to establish a bank account in 2023. Noteworthy is the fact that Jersey stands distinct from the European Union (EU), the European Economic Area (EEA), and the United Kingdom (UK). The independent island's financial institutions extend offshore account options to non-residents, offering management of their assets in multiple currencies while abroad.

Within this guide, we do an in-depth exploration of opening a bank account in Jersey, for both resident and non-resident applicants. Additionally, we spotlight alternatives with multi-currency capabilities, such as Wise, Revolut, and Starling Bank. These options complement conventional bank accounts and cater to the needs of global retail clients.

Whether you are seeking a multi-currency platform or a wealth management account, this guide aims to give you the best information you need as you enter the banking sector in Jersey.

In short, here's our recommendation for opening an account in Jersey:

- With proof of UK residence: Starling Bank gives you your own free GBP & EUR account and debit card. Enjoy SEPA banking, deposit insurance, and zero fx-rate markup when exchanging currencies.

- Without proof of UK/EEA residence: Wise Account comes with free GBP and EUR account details and a VISA debit card to spend in 50+ currencies, including pounds and euros.

- Private offshore account: See below for your options as a high net-worth individual seeking wealth management in Jersey.

How To Open a Jersey Bank Account For Non-Residents

- 01. What is banking like in Jersey?

- 02. Who should open a bank account in Jersey?

- 03. Path 1: Open an offshore Jersey bank account with a high-street bank

- 04. Path 2: Private bank accounts in Jersey

- 05. Path 3: Custodian or depository bank accounts in Jersey

- 06. Path 4: Open a bank account with a digital bank

- 07. Path 5: Open a multi-currency account

- 08. How to transfer your money to a bank account in Jersey

- 09. Recapping Jersey bank accounts for non-residents online

- 10. FAQ about non-resident banking in Jersey

Key Facts About Offshore Banking in Jersey

| 🏦 No. of Banks in Jersey | 23 |

|---|---|

| 👨⚖️ Regulatory Body | JFSC |

| 💷 Average Offshore Costs |

|

| 🏆 Best Bank for UK Residents | |

| 💻 Best Account for Non-Residents | |

| 💸 Best Money Transfer to Jersey | It varies. Compare now. |

What is Banking Like in Jersey?

Jersey's finance sector is mainly aimed at investment management, wealth management, real estate investing, and institutional capital. It's not a common destination for retail or commercial banking.

If you are a high net-worth non-resident, gaining access to offshore accounts will tend to be easier for you, mainly since banks would consider you as a profitable client to manage. As a testament to its robustness, Jersey has consistently maintained an AA-credit rating from Standard and Poors as of 2021.

Why Are Jersey Bank Accounts So Attractive?

Jersey is a self-governing Crown Dependency of the UK that benefits from the stability of the UK banking system. This unique combination positions Jersey as a technically independent entity too. While it is protected through integration into the legal and political system of the UK, it also sets its own banking and finance regulations, which tend toward lower overall taxes.

Benefits of Opening a Bank Account in Jersey in 2023

In addition to its unique, independent status as as Crown Dependency, the banking sector is brimming with libertarian and entrepreneurial culture. The banking sector in Jersey has been used by wealthy British since the 1920s, primarily to avoid getting taxed on net worth and on assets that are passed down to inheritors.

Let's delve deeper into the unique advantage points offered by the Jersey banking sector:

Non-Residents and International Client Specialists

Jersey's banking professionals are equipped with a long experience of serving international clients, particularly at managing multi-currency accounts, financing offshore mortgages, and holding assets across Europe. Highly skilled, English-speaking relationship managers and support staff help to constitute Jersey's mature financial sector.

Low Tax Environment and Tax Certainty

Jersey has no capital gain tax, transfer tax, VAT, withholding tax, corporate tax, inheritance tax, or wealth tax.

However, taxation in Jersey might vary according to the client's nationality. For example, US citizens need to be aware that they are taxed on worldwide income and hence, must account for their Jersey account with the IRS. It's recommended to consult a tax specialist to navigate these nuances based on your citizenship and residency.

Deposit Insurance Scheme

Deposits in Jersey are insured up to £50,000 per person per bank since 2009, providing an essential safety net for retail depositors and small commercial clients, in the event that your bank declares bankruptcy.

Access to SEPA Transfers

Jersey banks facilitate SEPA transfers, or Single Euro Payments Area, and they can process large-value transactions in euro (€) with other SEPA countries at considerably lower costs.

There are also banks in the United Kingdom like Starling Bank that offer Euro accounts, which operate in the SEPA system. We recommend you inquire to your high-street bank in the UK if they offer Euro accounts.

Should I Open a Jersey Bank Account?

The advantages of opening a Jersey bank account are generally skewed in favour of high net-worth individuals. For retail non-resident customers or foreign businesses seeking standard, day-to-day banking services, local options like Starling Bank and Wise might be more cost-effective.

Profiles That Will Benefit Most From a Jersey Bank Account

Several kinds of clients could profit from Jersey's banking services:

- UK citizens planning to relocate abroad;

- Non-residents who meet the required financial thresholds;

- High net worth individuals in need of private banking, wealth management, and asset management services;

- Jersey-based corporations, trusts, and foundations;

- Foreign entities managed by Jersey trust and company service providers;

- Private equity and hedge funds.

Requirements to Open a Jersey Bank Account

Expats and non-resident are among the most common profiles seeking offshore bank accounts. The process of opening an offshore bank account in Jersey generally involves the following steps, although the requirements may vary by bank:

- Submission of a valid ID;

- Proof of permanent residence (not necessarily in Jersey);

- A completed application form;

- Personal financial statements;

- Jersey tax declaration forms.

Path 1: Offshore Bank Accounts in Jersey For Expats

Håkan Dahlström (CC BY 2.0, modified)

Non-citizens and non-residents of either Jersey or the UK who desire wealth planning services can open offshore bank accounts, especially if the bank deems you to be a profitable client. Most offshore accounts will charge a service fee (usually as a percentage of your assets under management) along with other fees for various transactions, loans, or currency conversions.

Among the biggest high-street banks in Jersey are HSBC, Barclays, Santander, and Lloyds. Many of the United Kingdom's largest high-street banks have branches in Jersey, giving you a wide range of options. Deposits in these high-street accounts are protected up to £50,000 in the case of bankruptcy by Jersey's Depositors’ Compensation Scheme, making them safe from a customer perspective:

Accounts at High-Street Banks

Below, you'll find the account offerings among major high-street banks that we found the most useful for newcomers to Jersey. These include premium accounts, expat accounts, and offshore accounts for non-residents. Please check with each bank for details about your citizenship for eligibility:

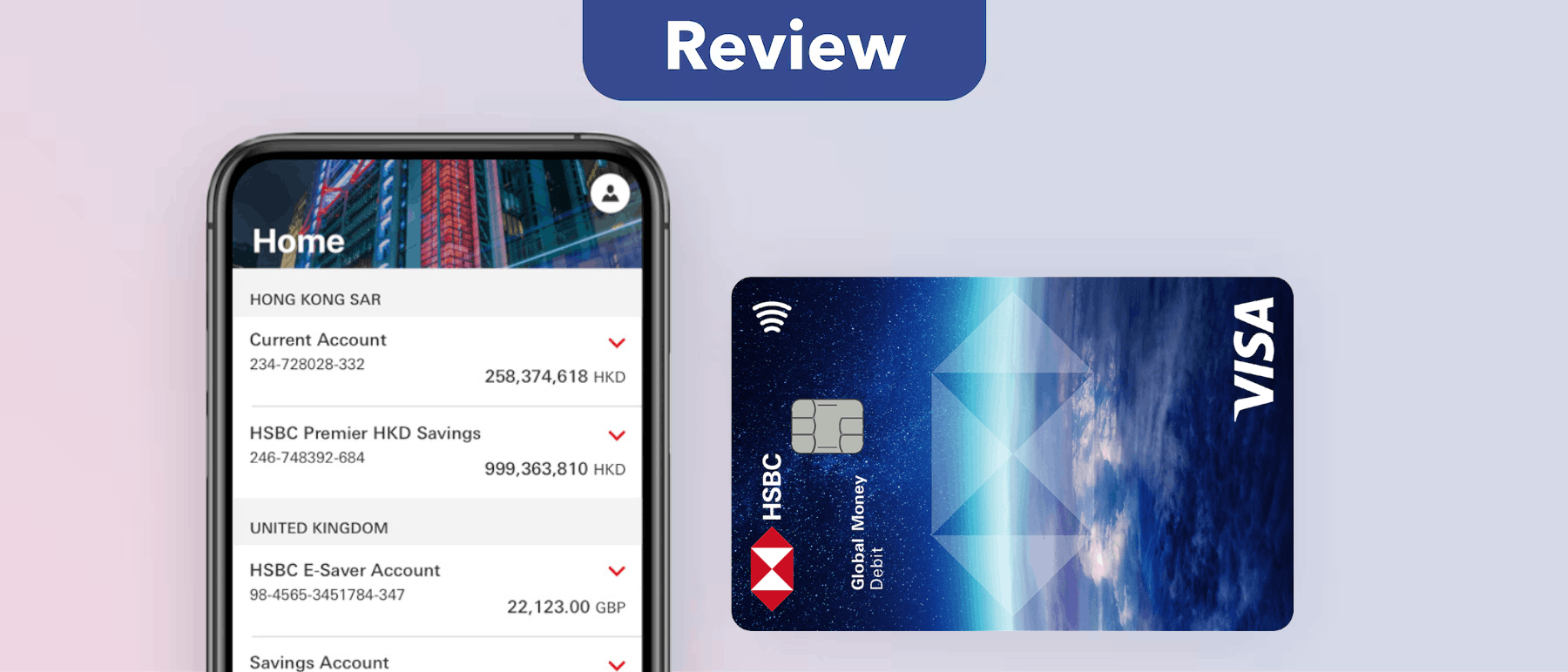

1. HSBC

HSBC is the UK's largest bank by market value and total assets. HSBC offers an expat account, which is operated out of Jersey, and charges no monthly fees as long as you meet certain criteria. They charge foreign transaction fees on their expat debit cards, and their foreign currency exchange service applies rates that are weaker than the mid-market rate.

- Account: Expat account

- Monthly fee: £35 (waived if balance is over £50,000)

- Minimum balance: £50,000

- Jersey or UK residence: Not required

2. Citibank

Citi International Personal Bank, London offers offshore accounts in Jersey for non-residents and non-citizens. You will get a dedicated manager, a debit card, and access to their online banking platform. The dedicated Relationship Manager service is only available for clients who hold the minimum balance of $200,000 (or equivalent amount in the account currency) or pay the monthly relationship fee of $150.

- Account: Offshore Bank Account

- Monthly fee: $150 (waived if balance is over $200,000)

- Minimum balance: $200,000

- Jersey or UK residence: Not required

3. Standard Chartered

Jersey Branch of Standard Chartered offers an international offshore account for non-residents. The renown bank offers international banking services across Asia, Africa and the Middle East, although they have an extensive fee schedule.

- Account: Offshore Bank Account

- Monthly fee: $100 (waived if balance is over $100,000)

- Minimum opening deposit: $100,000

- Jersey or UK residence: Not required

Path 2: Private Bank Accounts in Jersey

Tailored for high-net-worth individuals, these accounts usually involve high minimum deposits (sometimes exceeding £1,000,000). The private banking services in Jersey are designed to provide personalised asset management, with a dedicated relationship manager.

If you are a high net worth individual seeking these accounts in Jersey, you should directly consult with the specific branch you wish to use. The eligibility requirements may vary depending on the bank and on your portfolio of assets and liabilities. Your relationship and level of trust with your asset manager will be a key factor in choosing the right account for you.

Path 3: Custodian or Depository Bank Accounts in Jersey

Custodian and depositary banks in Jersey play essential roles in preserving large financial assets for both businesses and individuals. These institutions differ significantly from traditional retail and commercial banks.

If you operate an investment fund, then you may wish to find a depositary bank to work with in Jersey. If you are a business or individual who needs their financial assets to be held and safeguarded, then a custodian bank in Jersey may be the right choice for you.

How Custodian Banks in Jersey Work

Unlike retail banks, custodians do not provide standard banking services such as accounts or loans; instead, they function as guardians of assets, encompassing equities, bonds, precious metals, fine art, and cash, whether in physical or electronic form. Alongside safeguarding these assets, custodian banks offer account administration, tax support, management of dividend and interest payments, facilitation of foreign exchange transfers, and the execution of transactions.

Given the responsibility of preserving assets valued at millions or billions of dollars, custodian banks tend to be notable, established entities. Respected names in the field include BNP Paribas Securities Services, BNY Mellon, Citi, JPMorgan Chase, and State Street Bank and Trust Company.

How Depositary Banks in Jersey Work

Conversely, depositary banks specialise in overseeing the operations of investment funds. In addition to safeguarding financial assets, depositary banks actively monitor cash flows, maintain records, and ensure adherence to local regulations. They are entirely liable for potential asset losses — a safeguard that operates much like an insurance policy, ultimately protecting investors.

Depositary bank responsibilities include the supervision over various fund activities, including valuations, risk analysis, and investor transactions. Second, they play a role in guaranteeing compliance with local regulations. Unlike custodian banks, which execute actions based on client instructions, depositary banks exercise independent judgment on investments, transfers, and other operations within the funds they oversee.

Path 4: Online Banks in the UK

Online banks (sometimes called "challenger banks" or "neobanks") do not operate out of branches, with all banking services handled online instead. These banks generally offer a more limited range of services than the high-street banks we explored above, but at a fraction of the price and over a user-friendly web or mobile app interface.

Monzo and Starling Bank are two neobanks that are duly licensed in the United Kingdom. Both will require proof of residency or citizenship in the UK.

Starling Bank: Best GBP Online Bank

Starling Bank is a fully-authorised bank in the UK that's well known for its fee-free current account.

Because this account is entirely free and gives you access to an impressively complete range of financial services (including debit cards, overdraft facilities, loans, joint accounts, youth cards, pensions, a euro account, interest rates, etc.), we think Starling offers the best free bank account in the UK — one we think makes an excellent replacement for a bank account at a high-street bank.

- Account name: Personal Account

- Monthly fee: £0

- Int'l transfer cost: 0.5% - 3% (depending on the currency)

- Int'l card payment cost: 0%

- Proof of UK residence required: Yes

- More info: See our full Starling Bank review.

Monzo: Best Bank for Savers

Monzo is a regulated UK bank and probably the country's most famous mobile-only bank account.

An excellent choice if you're looking to avoid fees, Monzo (like Starling) charges no fees for day-to-day card use in the UK and abroad. Moreover, because it offers one of the most advanced and comprehensive savings systems we've seen from any challenger bank (allowing lots of flexibility over your time horizon and savings goals), we think Monzo is especially well-suited for savings, regardless of your individual goals.

- Account name: Monzo

- Monthly fees:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£5.00 | |

£15.00 |

- Int'l transfer cost: 0.2% - 2.5%

- Int'l card payment cost: 0%

- Proof of UK residence required: Yes

- More info: See our full Monzo review.

Suits Me: Best For New Arrivals

Suits Me is a reliable banking alternative for new arrivals in the UK.

It offers an easy and fast account opening process without requiring credit checks or proof of address. Additionally, Suits Me gives you a prepaid debit Mastercard, online banking services, and the ability to receive payments from employers and other sources (e.g. Faster Payments, BACS, and CHAPS, although not international SWIFT transfers).

- Account names: Essential, Premium, Premium Plus

- Monthly fees:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£4.97 | |

£9.97 |

- Int'l transfer cost: Not available

- Int'l card payment cost: £1.00 + 2%

- Proof of UK residence required: No

- More info: Go to the website.

Path 5: Multi-Currency Accounts (Retail Account)

While Jersey's multi-currency bank accounts mostly cater to high-net-worth individuals, you can open a multi-currency account without needing to meet certain income thresholds. These retail bank accounts offer a cost-effective solution for managing day-to-day transactions in multiple currencies and offering the cheapest ways to transfer money abroad.

They are typically free to open, have no minimum balance requirement, and do not charge monthly maintenance fees. Multi-currency wallets normally come complete with a debit card and even foreign bank details.

Below, we go over three of the most prominent multi-currency fintechs: Revolut, Wise, and Monese.

Revolut: Best GBP Account for UK and EEA Residents

Probably the UK's most famous fintech, there's a good chance you've heard of Revolut. Revolut offers a multi-currency account in 20+ currencies, and you can exchange up to £1,000 per month without any service fees. It offers current account details for GBP and EUR without any monthly fees as well.

Since it's not yet a bank in the UK, we think Revolut is best used as a powerful spending tool next to a main bank account, as opposed to in place of it (even if that bank account is in your home country).

Although Revolut is also available in the US, Australia, Singapore, Switzerland, and Japan, its GBP account details are only available to EU/EEA and UK customers who get both an EU IBAN account (in Lithuania) and a British current account number, sort code, and SWIFT code.

- Account names: Standard, Plus, Premium, Metal

- Monthly fee:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£3.99 | |

£7.99 | |

£14.99 | |

£55.00 |

- Int'l transfer cost: 0.5% - 1.5%

- Int'l card payment cost: 0%

- Proof of UK residence required: Not necessarily

- More info: See our full Revolut review or visit the website.

Wise: Best GBP Account for Non-EEA Residents

The Wise Account is the best way to open a British pound account from abroad (especially if you're not from the EU/EEA and don't have access to Revolut).

Wise's Top Features

Your Wise Pound account will be held by Barclays Bank and come with the following details unique to you:

- A sort code;

- An account number;

- A British IBAN (starting with "GB").

This means you'll be able to spend and be paid just like a local in Jersey or the UK and convert your GBP balance into your home currency without the exorbitant bank fees. Here's an overview of the other features you'll get:

- Local bank details, not just in the UK, but also in the US, EU, Australia, New Zealand, Singapore, Romania, Canada, and Hungary.

- Hold, exchange, and top-up up to 56 currencies.

- A multi-currency VISA debit card that's handy for paying in foreign currencies without hidden fees.

- Access to Wise's powerful international money transfer service right from your account balance.

Monese: Another Option for EEA Residents

Monese is a mobile-only challenger bank that offers fully-fledged checking accounts to more than two million customers in the UK and across much of Europe.

Because Monese doesn't require you to prove your residence to meet the minimum creditworthiness standards to open an account in the UK, we think Monese is especially well-suited for new arrivals to the UK from the EEA. Although we don't find Monese quite as feature-rich as Revolut, we do think it has an advantage over Wise if you plan to split your life between the UK and a country in Europe.

Although you only get a Euro IBAN (starting with 'BE') if you're an EU/EEA resident, you will be able to use this to receive British pounds too. It's illegal to discriminate based on the origin of an IBAN in Jersey, the UK, and the EU.

Here's an overview of Monese's offering:

- Account name: Starter, Classic, Premium

- Monthly fee:

- Int'l transfer cost: 0.5% - 1.5%

- Int'l card payment cost: 0% (0.4% - 0.8% for cash withdrawals)

- Proof of UK residence required: Not necessarily

- More info: See our full Monese review.

How To Send Money to a Jersey Bank Account

Once you've opened a bank account in Jersey, you'll need to consider how to move your funds across, a process that can be exceptionally costly if you're depositing money from a currency other than pounds. To deposit money into your new pound sterling account from your home currency before you move, you'll need to go to your online banking and choose between one of two options:

- Sending a wire transfer through your bank directly;

- Sending a bank transfer via a money transfer specialist.

Jersey banks deal with international money transfers all the time but may offer favourable rates for only extremely high-volume transfers with clients that the work with closely. We generally don't recommend using your bank to transfer money internationally, as the fees can be exorbitant, and the waiting times can be lengthy. This is mainly because banks wire funds over the SWIFT network, which adds many timely and expensive steps to the money transfer process.

Send Money to a Jersey Bank Account Online

Instead, if the amount you'd like to send to Jersey is in the order of several hundred or thousand Pounds or equivalent, then we recommend you use a money transfer specialist service (Wise is one among many.) To compare which services are cheapest for your transfer amount from your home country to Jersey, run a search on Monito's real-time comparison engine here.

On the other hand, if you're moving large amounts of money from your home currency to your new bank account in Jersey (i.e. anything upwards of £30,000 or equivalent), services such as Wise may not be your cheapest bet. Instead, we recommend exploring your options among the foreign exchange brokers that support transfers from your country to Jersey. These services specialise in negotiating favourable exchange rates on your behalf. They are the more cost-effective option for transferring large sums of money (such as life savings or liquid investments) across borders.

To find out which service will offer you the best deal in real-time, run a search on our comparison engine below:

Find the best deal when sending money to Jersey:

Recap: What Are the Best Online Bank Accounts in Jersey For Non-Residents?

To conclude, let's recap the main recommendations we explored in this non-resident banking guide:

- Starling Bank: Best overall online bank for UK residents and citizens.

- Revolut: Best GBP account for EU/EEA residents and citizens.

- Wise: Best GBP account for non-EU/EEA residents and citizens.

- HSBC: Best offshore banking experience for expats.

- Monito: Best way to compare money transfers to Jersey.

See our guide on the best online-only banks in the UK for more options.

FAQ About Opening a Bank Account Online in Jersey For Non-Residents

🏦 Can I open a Jersey bank account without proof of address?

Yes, many banks in Jersey and other Crown Dependencies offer Offshore Accounts to non-residents. However, we consider Starling Bank to be the best account for non-residents because you can manage your money in GBP and EUR for free, with no exchange rate margin when converting currencies.

🇬🇧 What is the best Jersey bank account for non-residents?

Wise and Starling Bank offer the best multi-currency accounts to non-Jersey or non-UK residents. However, some high street banks like HSBC and Standard Chartered do offer offshore accounts to non-residents too.

💶 Is it possible to have a Euro bank account?

Yes, it is possible to have a Euro bank account in Jersey, as many banks offer bank accounts in Euros. However, the fees for such accounts are quite high. For low-fee (or even free) solutions, take a look at our guide to the best Euro bank accounts in the UK.

🛂 How can a non-resident open a Jersey bank account?

While you will have to check with each bank to ensure your eligibility based on your citizenship and client profile, many Jersey banks offer offshore accounts to non-residents. HSBC and Standard Chartered are two that offer such services.

How do I open a bank account in Jersey?

When you choose the best bank for your profile, you will need to complete the following steps:

- Submission of a valid ID;

- Proof of permanent residence (not necessarily in Jersey);

- A completed application form;

- Personal financial statements;

- Jersey tax declaration forms.

References

1. Moving to Jersey: Opening a Jersey Bank Account. Government of Jersey. Accessed 11 August 2023.

2. Tariff of Charges. HSBC. Accessed 11 August 2023.

3. Legal Information. HSBC Expat. Accessed 11 August 2023.

4. Account Opening. Standard Chartered. Accessed 11 August 2023.

5. Offshore Bank Account. Citibank. Accessed 11 August 2023.

6. Jersey. Wikipedia. Accessed 11 August 2023.

7. Custodian and Depository Accounts. Jersey Finance. Accessed 11 August 2023.

8. Money and Tax. Government of Jersey. Accessed 11 August 2023.

Compare Top Online Banks in Jersey

Filter your results

Languages

See allCountry availability

1See allServices

Monthly fee

Card delivery time

Best for

Bank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Overall Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

Filter your results

Languages

See allCountry availability

1See allServices

Monthly fee

Card delivery time

Best for

Bank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Starling Bank Monito Score 9.1

- Monzo Monito Score 9.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Everyday banking +1

- Everyday banking

- Saving money

- Bank details UK account no. & sort code

- UK account no. & sort code

- Supported currencies Pound sterling +2

- Pound sterling

- US dollar

- Euro

- Overdraft Yes

- Annual interest rate High

- High

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Wise Multi-Currency Account Monito Score 8.9Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +21

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Polish

- Dutch

- Slovenian

- Polish

- Romanian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +37

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- New Zealand

- Malaysia

- Services Multi-currency account

- Multi-currency account

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN +11

- Euro IBAN

- Hungarian account no.

- US account & routing no.

- UK account no. & sort code

- Australian account & BSB no.

- New Zealand account no.

- Canadian account

- transit

- institution no.

- Romanian account no.

- Singaporean account no. & bank code

- Turkish IBAN

- Supported currencies US dollar +50

- US dollar

- Euro

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Pound sterling

- Croatian kuna

- forint

- Japanese yen

- Malaysian ringgit

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Romanian leu

- Swedish krona

- Singapore dollar

- Turkish lira

- United Arab Emirates dirham

- Chilean peso

- lari

- Moroccan dirham

- Pakistani rupee

- Tanzanian shilling

- Uruguayan peso

- ZMK

- Argentine peso

- Botswana pula

- Chinese yuan

- Egyptian pound

- Ghanaian cedi

- Indian rupee

- Kenyan shilling

- Mexican peso

- Ukrainian hryvnia

- Vietnamese Dong

- Costa Rican colon

- Israeli new shekel

- South Korean won

- Malaysian ringgit

- Thai baht

- Ugandan shilling

- CFA franc

- Bangladeshi taka

- Sri Lankan rupee

- Nigerian naira

- Philippine peso

- Russian ruble

- rand

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Revolut Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +20

- English

- German

- French

- Portuguese

- Spanish

- Dutch

- Slovenian

- Polish

- Romanian

- Italian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +35

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending online +1

- Spending online

- Spending while abroad

- Bank details UK account no. & sort code +1

- UK account no. & sort code

- Euro IBAN

- Supported currencies United Arab Emirates dirham +26

- United Arab Emirates dirham

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Euro

- Pound sterling

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Russian ruble

- Qatari riyal

- Romanian leu

- Saudi riyal

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- US dollar

- rand

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Conotoxia Multi-Currency Card Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages Polish +1

- Polish

- English

- Country availability Austria +28

- Austria

- Belgium

- Bulgaria

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- United States

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +19

- Euro

- US dollar

- Pound sterling

- Swiss franc

- Australian dollar

- Canadian dollar

- Czech koruna

- Danish krone

- denar

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Russian ruble

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- rand

- Polish zloty

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Monese Monito Score 8.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +11

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Czech

- Estonian

- Lithuanian

- Polish

- Romanian

- Turkish

- Country availability Austria +30

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details UK account no. & sort code +2

- UK account no. & sort code

- Euro IBAN

- Romanian account no.

- Supported currencies Euro +2

- Euro

- Pound sterling

- Romanian leu

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Zen Monito Score 7.1Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +7

- English

- Polish

- German

- Spanish

- French

- Greek

- Italian

- Ukrainian

- Country availability Austria +29

- Austria

- Belgium

- Bulgaria

- Cyprus

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Gibraltar

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Low

- Low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +29

- Euro

- US dollar

- Pound sterling

- Polish zloty

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Chinese yuan

- Croatian kuna

- Czech koruna

- Danish krone

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Kenyan shilling

- Mexican peso

- New Zealand dollar

- Norwegian krone

- Qatari riyal

- Romanian leu

- Saudi riyal

- Singapore dollar

- rand

- Swedish krona

- Swiss franc

- Thai baht

- Turkish lira

- Ugandan shilling

- United Arab Emirates dirham

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Pockit Monito Score 6.7Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Travel card

- Travel card

- Monthly fee Moderate

- Moderate

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details No account details (balance only)

- No account details (balance only)

- Supported currencies Pound sterling

- Pound sterling

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

Non-Resident Bank Accounts in Jersey vs Other Countries

Many countries allow non-residents to open a bank account within their legal jurisdictions, but exactly what kind of requirements non-residents face can differ drastically from country to country and even bank to bank. See the list below to get a better idea of this:

Country | Which non-residents can open an account? |

|---|---|

Parties with close ties, expats, immigrants, investors, students | |

Any interested party | |

Parties with close ties | |

Parties with close ties, investors, students | |

Parties with close ties, Investors | |

Investors only | |

Parties with close ties, investors, students | |

Parties with close ties, investors, expats, students | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Any interested party | |

Parties with close ties, investors | |

Investors only | |

Investors only | |

Parties with close ties, investors, expats | |

Parties with close ties, investors, expats | |

Any interested party |

Last updated: 11/08/2022

Country | Which non-residents can open an account? |

|---|---|

None | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Any interested party | |

None |

Last updated: 11/08/2022

Country | Which non-residents can open an account? |

|---|---|

Any interested party | |

Any interested party | |

Parties with close ties, investors |

Last updated: 11/08/2022

Country | Which non-residents can open an account? |

|---|---|

Parties with close ties, students |

Last updated: 11/08/2022

Country | Which non-residents can open an account? |

|---|---|

Any interested party | |

Parties with close ties, investors |

Last updated: 11/08/2022

Other Banking Guides for Offshore and Expat Accounts

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.