- Languages English

- Country availability United Kingdom

- Services Full bank account

- Monthly fee Very low

- Card delivery time Mid

- Best for Everyday banking

- Bank details UK account no. & sort code

- Supported currencies Pound sterling

- Overdraft Yes

- Annual interest rate Low

- Supports cash deposits Yes

- International transfers Yes

How To Open an Isle of Man Bank Account (Online Even as a Non-Resident)

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Byron Mühlberg

Reviewer

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreAs a crown dependency with a robust and well-regulated financial sector, the Isle of Man offers a compelling option for those seeking to open a bank account. Notably, the Isle of Man is not a part of the European Union (EU), the European Economic Area (EEA), or the United Kingdom (UK). The island's banks provide offshore accounts for non-residents, making it an option for individuals who need to manage cash in multiple major currencies while abroad.

In this comprehensive guide, we delve into the process of opening an Isle of Man bank account for both residents and non-residents. Additionally, we highlight multi-currency alternatives like Wise, Revolut, and Starling Bank, which can complement traditional bank accounts and cater to the diverse financial needs of a global clientele.

Whether you seek the convenience of online banking or require specialised services for managing international finances, this guide aims to equip you with the knowledge to make informed decisions and navigate the world of banking in the Isle of Man with confidence.

In short, here's our recommendation for opening a bank account in the Isle of Man:

- Without proof of UK/EEA residence: Wise Account, which comes with GBP and EUR account details and a VISA debit card to spend in 50+ currencies, including pounds and euros.

- With proof of UK/EEA residence: Revolut gives you your own GBP and EUR mobile account and debit card. You can transfer £1,000 internationally per month fee-free.

- With proof of Isle of Man residence: See below for your extensive options as a legal resident of the Crown Dependency of the Isle of Man.

How To Open an Isle of Man Bank Account For Non-Residents

- 01. What is banking like in the Isle of Man?

- 02. Types of bank accounts in the Isle of Man

- 03. Requirements to open an Isle of Man bank account

- 04. Path 1: Open an Isle of Man account with a high-street bank

- 05. Path 2: Open a bank account with a digital bank

- 06. Path 3: Open a multi-currency account (no residence required)

- 07. How to transfer your money to a bank account in the Isle of Man

- 08. Recapping Isle of Man bank accounts for non-residents online

- 09. FAQ about non-resident banking in the Isle of Man

Key Facts About Banking in the Isle of Man

| 🏦 No. of Banks in the Isle of Man | 11 |

|---|---|

| 👨⚖️ Regulatory Body | Isle of Man FSA |

| 🏆 Best Bank for UK Residents | |

| 💸 Best Money Transfer to the Isle of Man | It varies. Compare now. |

| 💻 Best Account for Non-Residents | |

| 💷 Average Running Costs |

|

Banking in the Isle of Man

For non-residents and expats seeking a reliable and secure offshore banking option, the Isle of Man emerges as a compelling choice. Renowned for its stability and well-regulated financial system, the Isle of Man allows individuals to open bank accounts remotely, catering to the needs of international clients.

In this section, we explore the safety of banking in the Isle of Man, the ideal candidates for account opening, the numerous benefits it offers, as well as the potential barriers non-residents may encounter in the process:

Is Banking Safe in the Isle of Man?

The Isle of Man is widely regarded as a safe and reliable destination for banking and financial services. As a Crown Dependency, it benefits from the stability and oversight provided by the United Kingdom.

Despite its popularity among foreign investors and expatriates seeking to establish offshore companies, the Isle of Man is not technically a tax haven. It adheres to international standards, including the Common Reporting Standard (CRS), Foreign Account Tax Compliance Act (FATCA), and the Automatic Exchange of Information (AEOI). These regulations ensure transparency and cooperation in tax matters, ensuring that banks in the Isle of Man have an obligation under certain circumstances to provide financial documents to the competent authorities.

Overall, the stability of the Isle of Man's financial system, combined with its first-world jurisdictions and adherence to the rule of law, provides a secure environment for managing international finances.

Who Should Open a Bank Account in the Isle of Man?

Expats, foreign investors, and non-residents who are looking to open offshore bank accounts can consider the Isle of Man. One of the significant advantages is that the account setup process can be completed entirely online, making it convenient and accessible for individuals who are not physically present on the island.

Additionally, those seeking a cost-effective solution for holding multiple currencies will find the Isle of Man an attractive option. If you require a GBP account but prefer not to deal with a UK-based bank, the Isle of Man offers an excellent alternative. Moreover, the English-speaking customer service provided by the banks facilitates smooth communication and transaction processing, even for clients from different parts of the world.

An Isle of Man offshore account is an ideal solution for those living in regions that do not use British pounds but require access to GBP banking services, such as individuals who own rental properties in the UK and receive rental payments in GBP. Other use cases for offshore accounts may include:

- travelling regularly between countries for business;

- financially supporting family members living or studying abroad;

- retiring abroad and receiving pension in a different currency.

Benefits of Opening a Bank Account in the Isle of Man

The Isle of Man presents several compelling benefits for those seeking to open a bank account, particularly for non-residents and expatriates:

- Remote account setup;

- Relatively low minimum requirements for opening accounts;

- Banks are experienced in working with foreign entities;

- Availability of major currencies;

- Deposit insurance provided by the Isle of Man Compensation Scheme;

- Clean reputation in the global financial landscape;

- Sophisticated corporate services.

Barriers to Opening an Isle of Man Bank Account as a Non-Resident

Each bank in the Isle of Man has its own set of requirements, and they may not accept every client profile. Some banks may require Isle of Man residency for personal accounts. Moreover, due to tax regulations, some banks may be restricted from accepting US citizens as clients.

Additionally, for companies intending to establish accounts, they must be prepared to comply with reporting requirements, providing information about directors and shareholders.

Types of Bank Accounts in the Isle of Man

Operating on a banking system based on the UK model, the Isle of Man provides a sense of familiarity, as most financial institutions are branches of well-established UK banks. The main categories for types of bank accounts in the Isle of Man include:

- Personal current and savings accounts for Isle of Man residents;

- Business accounts for companies registered on the island;

- Offshore accounts for non-resident expats;

- Investment accounts tailored for the wealth management of high net worth individuals.

Among the various account types, the Isle of Man offshore account for non-residents stands out as one of the most popular choices. Each bank in the Isle of Man sets its own requirements for account eligibility, so potential account holders should verify if their citizenship aligns with the bank's policies.

Requirements to Open an Isle of Man Bank Account

The requirements to open an Isle of Man bank account vary depending on the type of account and the applicant's status. Let's quickly walk through them below:

Personal Current and Savings Accounts for Isle of Man Residents

To open a personal current or savings account as an Isle of Man resident, individuals must:

- provide proof of legal residency on the Isle of Man;

- be at least 18 years old.

Business Accounts for Companies Registered in the Isle of Man

For companies seeking to establish bank accounts with Isle of Man banks, you must provide passports and evidence of an address for:

- Shareholders of the company;

- Beneficiaries of the company, if any;

- Director(s) of the company;

- Representative(s) of the company.

You must also provide the following company documentation:

- Proof of registered business address in the Isle of Man;

- Proof of tax registration in the Isle of Man.

Offshore Accounts for Non-Residents

While non-residents of the Isle of Man can open offshore accounts, the banks will require documentation of proof of address and identity in order to determine their citizenship status and bank account eligibility. UK citizens, many EEA citizens, some Commonwealth citizens, and individuals from other unrelated countries may be eligible, but you'll have to verify directly with the Isle of Man bank of choice.

Individuals must also be 18 years of age or older and make the minimum required opening deposit, which varies depending on the bank and account type.

Investment Accounts for High Net Worth Individuals

High net worth individuals seeking investment accounts in the Isle of Man should directly consult with the specific branch they wish to use. These accounts typically cater to personalised wealth management services, and the requirements may vary depending on the bank and investment offerings.

Path 1: High-Street Banks in the Isle of Man

Håkan Dahlström (CC BY 2.0, modified)

The biggest high-street banks in the Isle of Man are HSBC, Barclays, Santander, and Bank of Scotland. Other banks regulated and licensed by the Isle of Man Financial Services Authority include Cayman National Bank, Conister Bank, Investec, Nedbank, Standard Bank of Isle of Man, Isle of Man Bank, and Standard Bank of South Africa.

All deposits in these high-street accounts are protected up to £50,000 in the case of bankruptcy by the Isle of Man Depositors’ Compensation Scheme, making them safe from a customer perspective:

Accounts at High-Street Banks

Below, you'll find the account offerings among major high-street banks that we found the most useful for newcomers to the Isle of Man. These include premium accounts, basic current accounts, and offshore accounts for non-residents. Please check with each bank for details about your citizenship for eligibility:

1. HSBC

HSBC is the UK's largest bank by market value and total assets. Most of the accounts are intended for use by residents of the island, but HSBC does offer an expat account, which is operated out of Jersey, Channel Islands.

- Account: Expat account

- Monthly fee: £0

- Supported currencies: GBP, USD, EUR

- Isle of Man residence: Not required

2. Conister Bank

Consiter Bank is registered in the Isle of Man and offers business accounts, personal loans, and savings accounts to Isle of Man residents or UK passport holders above 18 years of age.

- Account: Fixed term deposit account

- Minimum balance: £5,000

- Isle of Man or UK residence: Required

3. Isle of Man Bank

Isle of Man Bank is an ideal choice for residents of the island. You must be 18 years or older to open an account.

- Account: Current account

- Monthly fee: £0

- Isle of Man residence: Required

4. Isle of Man Standard Bank

Standard Bank of the Isle of Man mostly focuses on wealth management and corporate accounts, but also offers an international offshore account for non-residents (eligibility depending on your citizenship).

- Account: Optimum current account

- Monthly fee: £60 (waived if balance is over £5,000)

- Minimum opening deposit: £5,000

- Supported currencies: GBP, USD, EUR, AUD

- Isle of Man residence: Not required

Path 2: Online Banks

Online banks (sometimes called "challenger banks" or "neobanks") can be either registered banks or non-bank fintechs. They're characterised by not operating out of branches, with all banking services handled online instead. These banks generally offer a more limited range of services than the high-street banks we explored above, but at a fraction of the price and over a user-friendly web or mobile app interface.

If you want to open a GBP bank account without proof of UK or Isle of Man address, then the only online banks that may accept your application will be Monese and Revolut (although these will still require proof of residency in the EU/EEA or another country). On the other hand, Monzo and Starling Bank will require proof of address in the UK. Note that even if you don't submit proof of address, you might still need to supply a UK address to deliver your debit card.

Starling Bank: Best GBP Online Bank

Starling Bank is a fully-authorised bank in the UK that's well known for its fee-free current account.

Because this account is entirely free and gives you access to an impressively complete range of financial services (including overdraft facilities, loans, joint accounts, youth cards, pensions, a euro account, interest rates, etc.), we think Starling offers the best free bank account in the UK — one we think makes an excellent replacement for a bank account at a high-street bank.

- Account name: Personal Account

- Monthly fee: £0

- Int'l transfer cost: 0.5% - 3% (depending on the currency)

- Int'l card payment cost: 0%

- Proof of UK residence required: Yes

- More info: See our full Starling Bank review.

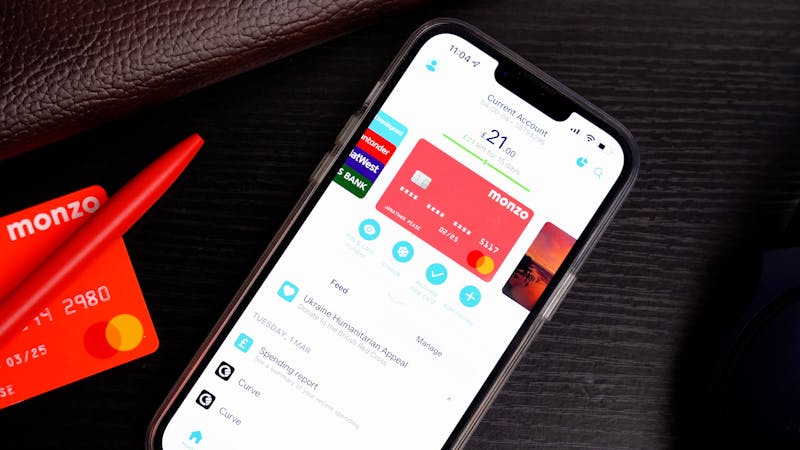

Monzo: Best Bank for Savers

Monzo is a regulated UK bank and probably the country's most famous mobile-only bank account.

An excellent choice if you're looking to avoid fees, Monzo (like Starling) charges no fees for day-to-day card use in the UK and abroad. Moreover, because it offers one of the most advanced and comprehensive savings systems we've seen from any challenger bank (allowing lots of flexibility over your time horizon and savings goals), we think Monzo is especially well-suited for managing and growing wealth, regardless of your individual goals.

- Account name: Monzo

- Monthly fees:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£5.00 | |

£15.00 |

- Int'l transfer cost: 0.2% - 2.5%

- Int'l card payment cost: 0%

- Proof of UK residence required: Yes

- More info: See our full Monzo review.

Suits Me: Best For New Arrivals

Suits Me is a reliable banking alternative for new arrivals in the UK.

It offers an easy and fast account opening process without requiring credit checks or proof of address. Additionally, Suits Me gives you a prepaid debit Mastercard, online banking services, and the ability to receive payments from employers and other sources (e.g. Faster Payments, BACS, and CHAPS, although not international SWIFT transfers).

- Account names: Essential, Premium, Premium Plus

- Monthly fees:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£4.97 | |

£9.97 |

- Int'l transfer cost: Not available

- Int'l card payment cost: £1.00 + 2%

- Proof of UK residence required: No

- More info: Go to the website.

Path 3: Multi-Currency Accounts

Online multi-currency accounts aren't full banks but rather fintech companies (known formally as Electronic Money Institutions or EMIs) that often compete to offer the cheapest ways to transfer money globally. However, in addition to money transfers and currency exchange, multi-currency wallets normally come complete with a debit card, multi-currency account balances, and even foreign bank details.

Below, we go over three of the most prominent multi-currency fintechs: Revolut, Wise, and Monese.

Revolut: Best GBP Account for EEA Residents

Probably the UK's most famous fintech, there's a good chance you've heard of Revolut.

Using its innovative personal finance platform, you'll not only have access to a broad range of financial services unique among free online accounts, but you'll also be able to take advantage of these services at a comparatively low price. However, because it's not yet a bank in the UK, we think Revolut is best used as a powerful spending tool next to a main bank account, as opposed to in place of it (even if that bank account is in your home country).

Although Revolut is also available in the US, Australia, Singapore, Switzerland, and Japan, its GBP account details are only available to EU/EEA and UK customers who get both an EU IBAN account (in Lithuania) and a British current account number, sort code, and SWIFT code.

- Account names: Standard, Plus, Premium, Metal

- Monthly fee:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£3.99 | |

£7.99 | |

£14.99 | |

£55.00 |

- Int'l transfer cost: 0.5% - 1.5%

- Int'l card payment cost: 0%

- Proof of UK residence required: Not necessarily

- More info: See our full Revolut review or visit the website.

Wise: Best GBP Account for Non-EEA Residents

The Wise Account is the best way to open a British pound account from abroad (especially if you're not from the EU/EEA and don't have access to Revolut).

Wise will work for you no matter whether you want to hold money in pounds, spend money on holidays abroad, shop online, or receive earnings from the Isle of Man. Fortunately, after opening your account online, you'll only be required to verify your identity; you won't need to show proof of residence in the Isle of Man or the UK to sign up and obtain the VISA debit card (although you will need to show proof of residence in the EU/EEA, US, Singapore, Japan, Australia, or New Zealand).

Here's what Wise has to say about opening an account without proof of residence in the UK⁵:

"You can then choose to either supply proof of address from a standard list of documents, or to send in a selfie, in which you're holding your proof of ID. This can be a great alternative if you're still waiting to move to the UK or haven't yet got bills and other paperwork registered in your name."

Wise's Top Features

Your Wise Pound account will be held by Barclays Bank and come with the following details unique to you:

- A sort code;

- An account number;

- A British IBAN (starting with "GB").

This means you'll be able to spend and be paid just like a local in the Isle of Man and convert your GBP balance into your home currency without the exorbitant bank fees. Here's an overview of the other features you'll get:

- Local bank details, not just in the UK, but also in the US, EU, Australia, New Zealand, Singapore, Romania, Canada, and Hungary.

- Hold, exchange, and top-up up to 56 currencies.

- A multi-currency VISA debit card that's handy for paying in foreign currencies without hidden fees.

- Access to Wise's powerful international money transfer service right from your account balance.

An Example of How Wise is Useful

To understand how helpful Wise can be for expats and non-residents in the Isle of Man, let's say that you've just moved from Paris to London and need an active online account to receive and spend pounds sterling. With a Wise, you'll be able to...

- send euros from your bank to your Wise euro account,

- convert all or part of your euro balance into sterling at a low fee of around 0.56% or €6.02 to add £1,000,

- pay with your Wise debit card, make or receive SEPA and SWIFT payments, and set up direct debits.

You'll also have UK bank details to share with an employer. Note that this account does not offer overdraft facilities, and you also won't earn interest on any in-credit balances.

Monese: Another Option for EEA Residents

Monese is a mobile-only challenger bank that offers fully-fledged checking accounts to more than two million customers in the UK and across much of Europe.

Because Monese doesn't require you to prove your residence to meet the minimum creditworthiness standards to open an account in the UK, we think Monese is especially well-suited for new arrivals to the UK from the EEA. Although we don't find Monese quite as feature-rich as Revolut, we do think it has an advantage over Wise if you plan to split your life between the UK and a country in Europe.

Although you only get a Euro IBAN (starting with 'BE') if you're an EU/EEA resident, you will be able to use this to receive British pounds too. It's illegal to discriminate based on the origin of an IBAN in the Isle of Man, UK, and EU.

Here's an overview of Monese's offering:

- Account name: Starter, Classic, Premium

- Monthly fee:

- Int'l transfer cost: 0.5% - 1.5%

- Int'l card payment cost: 0% (0.4% - 0.8% for cash withdrawals)

- Proof of UK residence required: Not necessarily

- More info: See our full Monese review.

How To Send Money to an Isle of Man Bank Account

Thomas Lefebvre on Unsplash

Once you've opened a bank account in the Isle of Man, you'll need to consider how to move your funds across, a process that can be exceptionally costly if you're depositing money from a currency other than pounds. To deposit money into your new pound sterling account from your home currency before you move, you'll need to go to your online banking and choose between one of two options:

- Sending a wire transfer through your bank directly;

- Sending a bank transfer via a money transfer specialist.

We don't recommend using your bank to transfer money internationally, as the fees can be exorbitant, and the waiting times can be lengthy. This is mainly because banks wire funds over the SWIFT network, which adds many timely and expensive steps to the money transfer process.

Send Money to an Isle of Man Bank Account Online

Instead, if the amount you'd like to send to the Isle of Man is in the order of several hundred or thousand Pounds or equivalent, then we recommend you use a money transfer specialist service (Wise is one among many.) To compare which services are cheapest for your transfer amount and your home country to the Isle of Man, run a search on Monito's real-time comparison engine here.

On the other hand, if you're moving large amounts of money from your home currency to your new bank account in the Isle of Man (i.e. anything upwards of £30,000 or equivalent), services such as Wise may not be your cheapest bet. Instead, we recommend exploring your options among the foreign exchange brokers that support transfers from your country to the Isle of Man. These services specialise in negotiating favourable exchange rates on your behalf. They are the most cost-effective option for transferring large sums of money (such as life savings or liquid investments) across borders.

To find out which service will offer you the best deal in real-time, run a search on our comparison engine below:

Find the best deal when sending money to the Isle of Man:

Recap: What Are the Best Online Bank Accounts in the Isle of Man?

To conclude, let's recap the main recommendations we explored in this non-resident banking guide:

- Revolut: Best GBP non-resident account for EU/EEA residents.

- Wise: Best GBP non-resident account for non-EU/EEA residents.

- Starling Bank: Best low-cost online bank for UK residents.

- Standard Bank: Best international account in the Isle of Man.

- HSBC: Best offshore banking experience for expats.

- Monito: Best way to compare money transfers to the Isle of Man.

See our guide on the best online-only banks in the UK for more options.

FAQ About Opening a Bank Account Online in the Isle of Man For Non-Residents

🏦 Can I open an Isle of Man bank account without proof of address?

Yes, some banks in the Isle of Man and other Crown Dependencies offer Offshore Accounts to non-residents. However, we consider the Wise Account the best GBP account for non-residents because you can manage your money in 50+ currencies.

💶 Is it possible to have a Euro bank account?

Yes, it is possible to have a Euro bank account in the Isle of Man, and some banks offer bank accounts in Euros. However, the fees for such accounts are quite high. For low-fee (or even free) solutions, take a look at our guide to the best Euro bank accounts in the UK.

📁 What documents are required to open an Isle of Man bank account?

To open a bank account in the Isle of Man, you'll generally need two things:

- Proof of your identity: E.g. Passport, drivers license, or national identity card. In general, if you are a foreign national, your best bet is to use your passport.

- Proof of the address in the Isle of Man: E.g. a recent utility bill, rental contract, council tax bill. Mobile phone bills are generally not accepted.

If you don't have proof of address, then we recommend opening a Wise Account or Revolut Account to take care of your finances until you sort one out.

🏡 How do I get proof of residence in the Isle of Man?

Each bank accepts different documents, but in general, you will be asked to show two official documents, for example:

- Utility bills

- Local authority council tax bill for the current council tax year

- Current Isle of Man driving license

- Bank, Building Society or Credit Union statement

- Mortgage statement

- A council or housing association rent card or tenancy agreement for the current year

- Solicitors letter within the last three months confirming the property purchase (or the land registry confirmation of address)

- HMRC self-assessment letters

- Electoral Register entry

- NHS Medical card

💼 Can a foreigner open a bank account in the Isle of Man?

Foreigners can open a traditional bank account in the Isle of Man as long as they have proof of the address, which sometimes it's hard to get. The good news is that there are companies like Starling Bank or Monese which offer GBP bank accounts even without proof of the address. All the information about opening a bank account in the UK you will find in our blog post.

🛂 How can a non-resident open an Isle of Man bank account?

While you will have to check with each bank to ensure your eligibility based on your citizenship and client profile, some Isle of Man banks offer offshore accounts to non-residents. HSBC and Standard Bank are two that offer such services.

💻 Can I open an Isle of Man bank account online?

Yes, it's possible to open a bank account online at most Isle of Man banks, although many high-street banks will require you to come in for an appointment too. For expat and offshore accounts with HSBC and Standard Bank, you may be able to open accounts online.

References

1. List of Banks in the Isle of Man. Wikipedia.

2. Optimum Bank Account. Standard Bank.

3. Non-Resident Bank Accounts. HSBC.

4. How do I go about opening a bank account in the Isle of Man? Gov.im.

Compare Top Online Banks in the Isle of Man

Filter your results

Languages

See allCountry availability

1See allServices

Monthly fee

Card delivery time

Best for

Bank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Overall Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

Filter your results

Languages

See allCountry availability

1See allServices

Monthly fee

Card delivery time

Best for

Bank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Starling Bank Monito Score 9.1

- Monzo Monito Score 9.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Everyday banking +1

- Everyday banking

- Saving money

- Bank details UK account no. & sort code

- UK account no. & sort code

- Supported currencies Pound sterling +2

- Pound sterling

- US dollar

- Euro

- Overdraft Yes

- Annual interest rate High

- High

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Wise Multi-Currency Account Monito Score 8.9Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +21

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Polish

- Dutch

- Slovenian

- Polish

- Romanian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +37

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- New Zealand

- Malaysia

- Services Multi-currency account

- Multi-currency account

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN +11

- Euro IBAN

- Hungarian account no.

- US account & routing no.

- UK account no. & sort code

- Australian account & BSB no.

- New Zealand account no.

- Canadian account

- transit

- institution no.

- Romanian account no.

- Singaporean account no. & bank code

- Turkish IBAN

- Supported currencies US dollar +50

- US dollar

- Euro

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Pound sterling

- Croatian kuna

- forint

- Japanese yen

- Malaysian ringgit

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Romanian leu

- Swedish krona

- Singapore dollar

- Turkish lira

- United Arab Emirates dirham

- Chilean peso

- lari

- Moroccan dirham

- Pakistani rupee

- Tanzanian shilling

- Uruguayan peso

- ZMK

- Argentine peso

- Botswana pula

- Chinese yuan

- Egyptian pound

- Ghanaian cedi

- Indian rupee

- Kenyan shilling

- Mexican peso

- Ukrainian hryvnia

- Vietnamese Dong

- Costa Rican colon

- Israeli new shekel

- South Korean won

- Malaysian ringgit

- Thai baht

- Ugandan shilling

- CFA franc

- Bangladeshi taka

- Sri Lankan rupee

- Nigerian naira

- Philippine peso

- Russian ruble

- rand

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Revolut Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +20

- English

- German

- French

- Portuguese

- Spanish

- Dutch

- Slovenian

- Polish

- Romanian

- Italian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +35

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending online +1

- Spending online

- Spending while abroad

- Bank details UK account no. & sort code +1

- UK account no. & sort code

- Euro IBAN

- Supported currencies United Arab Emirates dirham +26

- United Arab Emirates dirham

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Euro

- Pound sterling

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Russian ruble

- Qatari riyal

- Romanian leu

- Saudi riyal

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- US dollar

- rand

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Conotoxia Multi-Currency Card Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages Polish +1

- Polish

- English

- Country availability Austria +28

- Austria

- Belgium

- Bulgaria

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- United States

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +19

- Euro

- US dollar

- Pound sterling

- Swiss franc

- Australian dollar

- Canadian dollar

- Czech koruna

- Danish krone

- denar

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Russian ruble

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- rand

- Polish zloty

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Monese Monito Score 8.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +11

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Czech

- Estonian

- Lithuanian

- Polish

- Romanian

- Turkish

- Country availability Austria +30

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details UK account no. & sort code +2

- UK account no. & sort code

- Euro IBAN

- Romanian account no.

- Supported currencies Euro +2

- Euro

- Pound sterling

- Romanian leu

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Zen Monito Score 7.1Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +7

- English

- Polish

- German

- Spanish

- French

- Greek

- Italian

- Ukrainian

- Country availability Austria +29

- Austria

- Belgium

- Bulgaria

- Cyprus

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Gibraltar

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Low

- Low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +29

- Euro

- US dollar

- Pound sterling

- Polish zloty

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Chinese yuan

- Croatian kuna

- Czech koruna

- Danish krone

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Kenyan shilling

- Mexican peso

- New Zealand dollar

- Norwegian krone

- Qatari riyal

- Romanian leu

- Saudi riyal

- Singapore dollar

- rand

- Swedish krona

- Swiss franc

- Thai baht

- Turkish lira

- Ugandan shilling

- United Arab Emirates dirham

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Pockit Monito Score 6.7Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Travel card

- Travel card

- Monthly fee Moderate

- Moderate

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details No account details (balance only)

- No account details (balance only)

- Supported currencies Pound sterling

- Pound sterling

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

Non-Resident Bank Accounts in the UK vs Other Countries

Many countries allow non-residents to open a bank account within their legal jurisdictions, but exactly what kind of requirements non-residents face can differ drastically from country to country and even bank to bank. See the list below to get a better idea of this:

Country | Which non-residents can open an account? |

|---|---|

Parties with close ties, expats, immigrants, investors, students | |

Any interested party | |

Parties with close ties | |

Parties with close ties, investors, students | |

Parties with close ties, Investors | |

Investors only | |

Parties with close ties, investors, students | |

Parties with close ties, investors, expats, students | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Any interested party | |

Parties with close ties, investors | |

Investors only | |

Investors only | |

Parties with close ties, investors, expats | |

Parties with close ties, investors, expats | |

Any interested party |

Last updated: 18/2/2022

Country | Which non-residents can open an account? |

|---|---|

None | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Any interested party | |

None |

Last updated: 18/2/2022

Country | Which non-residents can open an account? |

|---|---|

Any interested party | |

Any interested party | |

Parties with close ties, investors |

Last updated: 18/2/2022

Country | Which non-residents can open an account? |

|---|---|

Parties with close ties, students |

Last updated: 18/2/2022

Country | Which non-residents can open an account? |

|---|---|

Any interested party | |

Parties with close ties, investors |

Last updated: 18/2/2022

Other Banking Guides for Offshore and Expat Accounts

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.