The 8 Best Online Banks For Small Business in Canada

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreIf you're a Canadian small business owner, you'll need to consider factors like maintenance fees, debt services, accounting software, and many others when selecting the right business bank account. Unless you are a sole proprietorship, small businesses and corporations in Canada are required by law to maintain a business bank account separate from a personal chequing account for transactions.

In this comprehensive business banking guide, we evaluate and compare 8 top providers in Canada. We will take a look at fees, features, and benefits of challenger business accounts like Tangerine, Wise Business, and Payoneer, as well as some of the major banks in Canada.

With this guide, you can streamline your search for the best bank account and focus your time and energy on driving your small businesses forward.

Best Business Bank Accounts in Canada

- Tangerine — Earn 1.60% to 4.65% APY on your business cash savings

- Wise Business — Send transfers internationally at the market rate

- Payoneer — Integrate with e-commerce stores around the world

- Alterna — Digital account for low-cost day-to-day transactions

- Wealthsimple — Automate investments and earn interest from savings

Key Facts About Business Bank Accounts in Canada

| 👨⚖️ Regulatory body | The Office of the Superintendent of Financial Institutions (OSFI) |

|---|---|

| 🏆 Best business account | |

| 💸 Monthly fee | $0.00 |

| 🔎 No. of business accounts compared | 8 |

| 💱 Applies mid-market exchange rate | |

| 🏦 Largest by assets | RBC, TD Bank, Scotiabank |

The Best Banks For Small Business in Canada

- 01. Online business bank accounts in Canada

- 02. Best for interest on savings — Tangerine

- 03. Best for international payments in Canada — Wise Business

- 04. Low monthly fee high-street account — RBC

- 05. Standard high-street business chequing — TD Bank

- 06. Best for day-to-day transactions — Alterna

- 07. Standard high-street bank with diverse business services — Scotiabank

- 08. Get interest from savings and investments — Wealthsimple

- 09. Best for e-commerce — Payoneer

- 10. Summary of the best business bank accounts in Canada

- 11. FAQ about the best bank accounts for small business in Canada

What is a Business Bank Account?

Business bank accounts are essential for business entities, as companies are prohibited from using personal accounts for business-related transactions. Business bank accounts offer a range of benefits, including receiving customer payments, making partner payments, accessing business loans, and obtaining credit.

Business owners can earn interest on their cash balances and benefit from higher daily spend limits to accommodate their transaction volume. As required by law, business bank accounts provide security by putting your money into ring-fenced accounts, which segregate your business funds from the bank's portfolio.

How To Open a Business Bank Account in Canada

Online banking providers such as Tangerine, Wise Business, Alterna, Payoneer, and Wealthsimple offer the convenience of opening an account online without physical paperwork. On the other hand, licensed Canadian banks such as RBC, TD Bank, and Scotiabank require you to visit a branch for the initial setup process.

What Documents Do I Need to Open a Business Bank Account?

To open a business bank account in Canada, regardless of your business type, you will typically need to provide certain documents. Here is a breakdown based on different business structures:

For a Sole Proprietorship:

- Proof of your identity, such as a government-issued ID.

- Full name and address.

- Social insurance number.

- Register your business with your province to obtain a trade name registration certificate or master business license.

For a Partnership:

- Proof of your identity and that of your partner(s).

- Full name and address.

- Social insurance number.

- Registered declaration of partnership.

- Obtain a trade name registration certificate or master business license, if applicable.

For a Corporation:

- Proof of your identity.

- Full name and address.

- Social insurance number.

- Articles of Incorporation/Association.

- Details of anyone who owns at least 25% of the business, including their name, address, and occupation.

- Obtain a trade name registration certificate or master business license, if applicable.

- Submit an annual financial return or report (which may require the signature of an independent accountant) if the company is 12-18 months or older.

- Canada Revenue Agency registration number.

Choose the Best Business Bank Account in Canada for Your Small Business

When considering the best bank account for your small business in Canada, keep in mind a few important factors:

- Fees: Research and compare the monthly fees, foreign transaction fees, exchange rate margins, ABM withdrawal fees, cash deposit fees, and minimum balance requirements.

- Deposit Insurance: Bank with members of the Canadian Deposit Insurance Corporation, which offer full deposit protection up to $100,000.

- Digital-Only Access: If your business relies on cash or cheque deposits, digital banking may not be the most convenient option for you.

- Business Support: Many online banks integrate with finance and accounting apps, making transactions more streamlined and simplifying your financial management.

- Interest Rates: Compare the annual percentage yield (APY) rates offered by different banks for online savings accounts.

- Bonuses: Explore perks, such as free business chequing accounts, business savings accounts, fee-free overdrafts, safe deposit box rentals, credit card fee rebates, and loyalty points.

Tangerine — Best for Interest on Savings

Tangerine is one of Canada's best-known online banks. It's also a subsidiary of Scotiabank and offers savings accounts with zero monthly maintenance fees to small business owners.

Account name: Business Savings.

Account type: Cheuqing.

Total cost: Free.

Noteworthy features: 2.9%+ interest.

More info: See our full Tangerine review.

Tangerine Business in Short

To open a Tangerine Business Savings account, you will need to already have a business bank account open at another financial institution and provide proof. They offer a simple fee schedule with free Interac e-Transfers, stop payments, replacement cards, and Scotiabank ABM withdrawals. There's no sign up fee and no minimum balance.

However, they have a 2.5% exchange rate fee on foreign transactions. You'll also be charged for non-sufficient funds fees for over-drafting. Overall, this account is designed for you to collect savings over time and earn interest, without touching your balances too often.

Tangerine Business Advantages

- Free Interac e-Transfers, stop payments, replacement cards;

- Free Scotiabank ABM withdrawals;

- No sign-up fee and no minimum balance requirement;

- 2.9%+ interest on savings;

- Business Guaranteed Investment accounts available for 4.6% interest.

Tangerine Business Disadvantages

- 2.9% rate only applies to balances $500,000.00 or more;

- Balances of $99,999.99 or less get interest of 2.3%;

- 2.5% exchange rate fee on foreign transactions;

- Non-sufficient funds fees for over-drafting.

Final Word

Open a Tangerine Business Savings account and grow your business cash at a great interest rate of 2.9%*. We recommend Tangerine for their free Interac e-Transfers, stop payments, replacement cards, and Scotiabank ABM withdrawals. Overall, it's an ideal option for accumulating savings and earning interest while avoiding unnecessary costs.

*The 2.9% annual interest rates applies as of January 19, 2023 to balances of $500,000.00 or more.

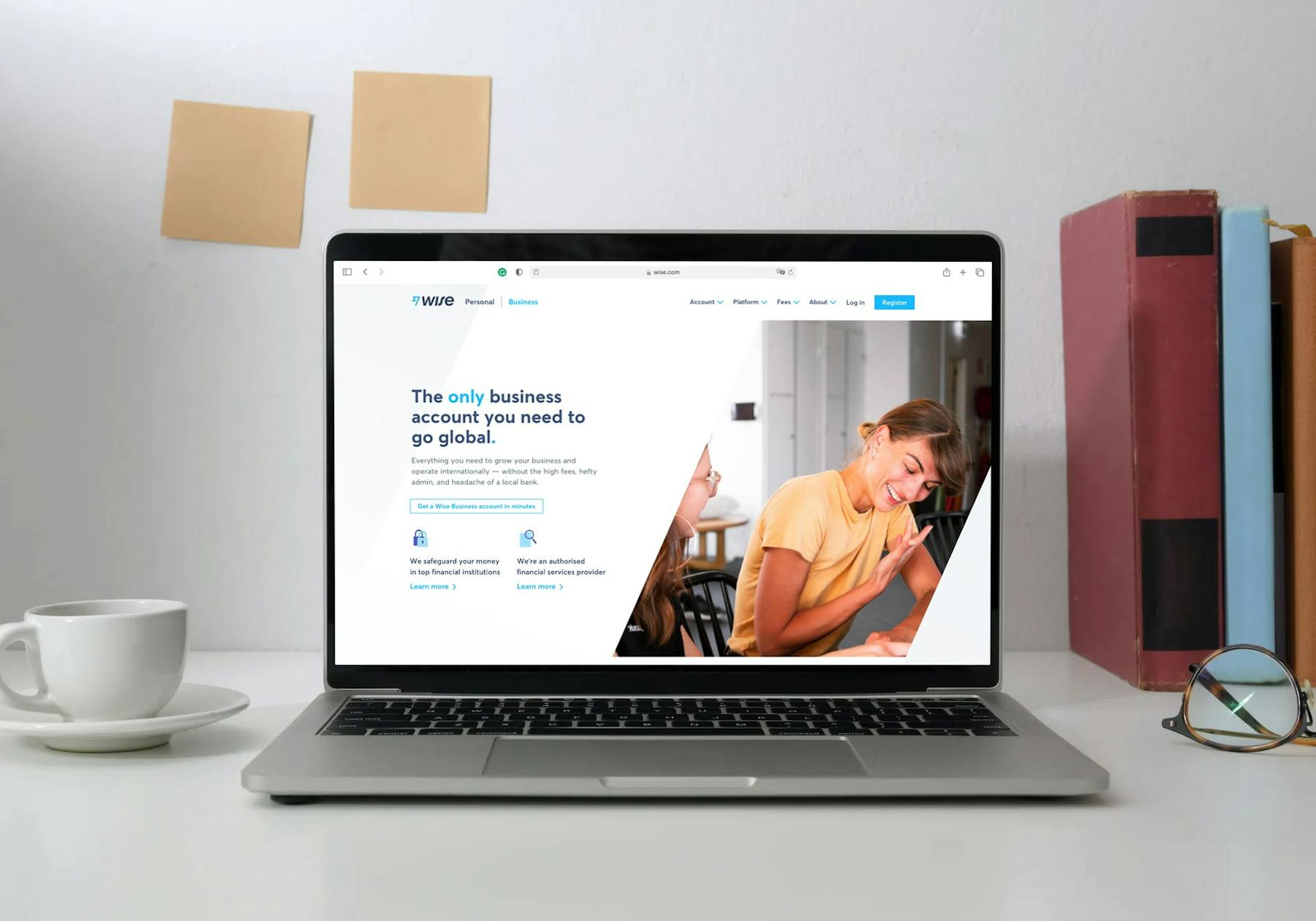

Wise Business — Best Business Account for International Payments

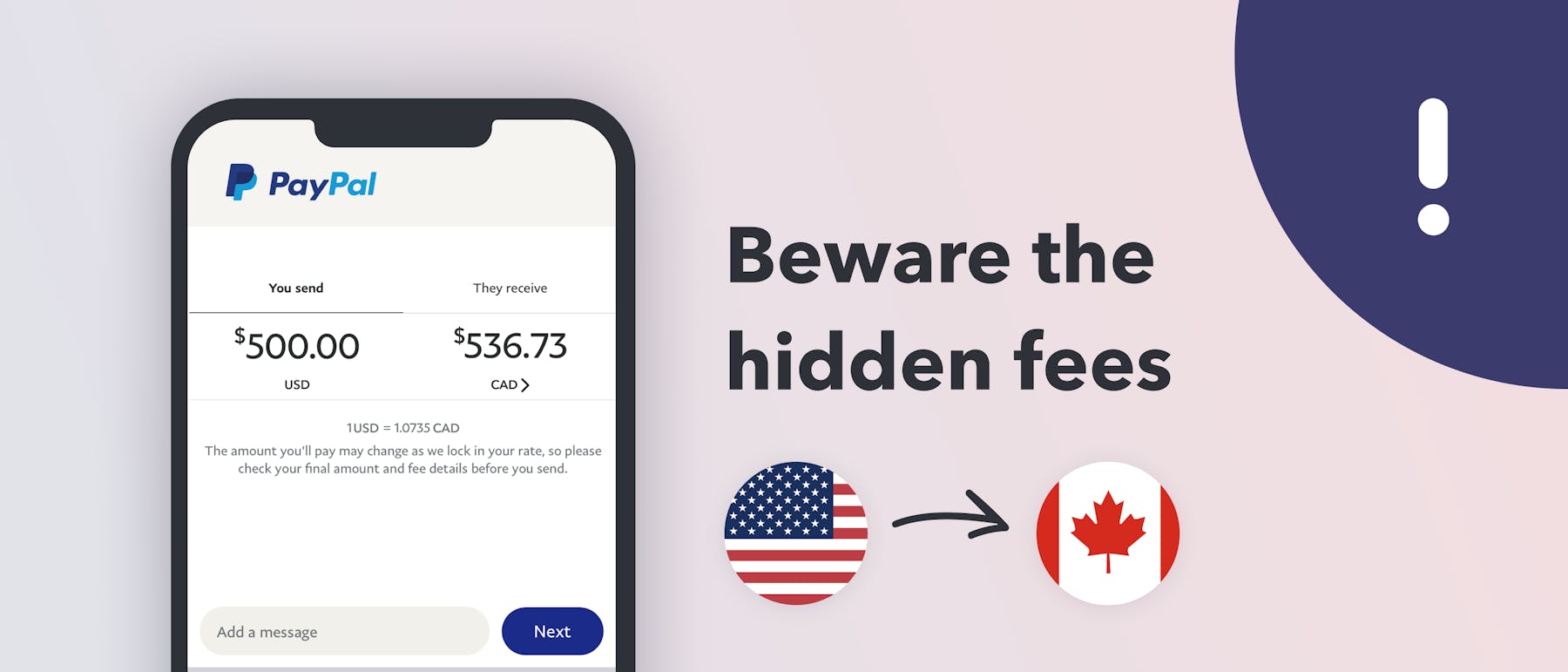

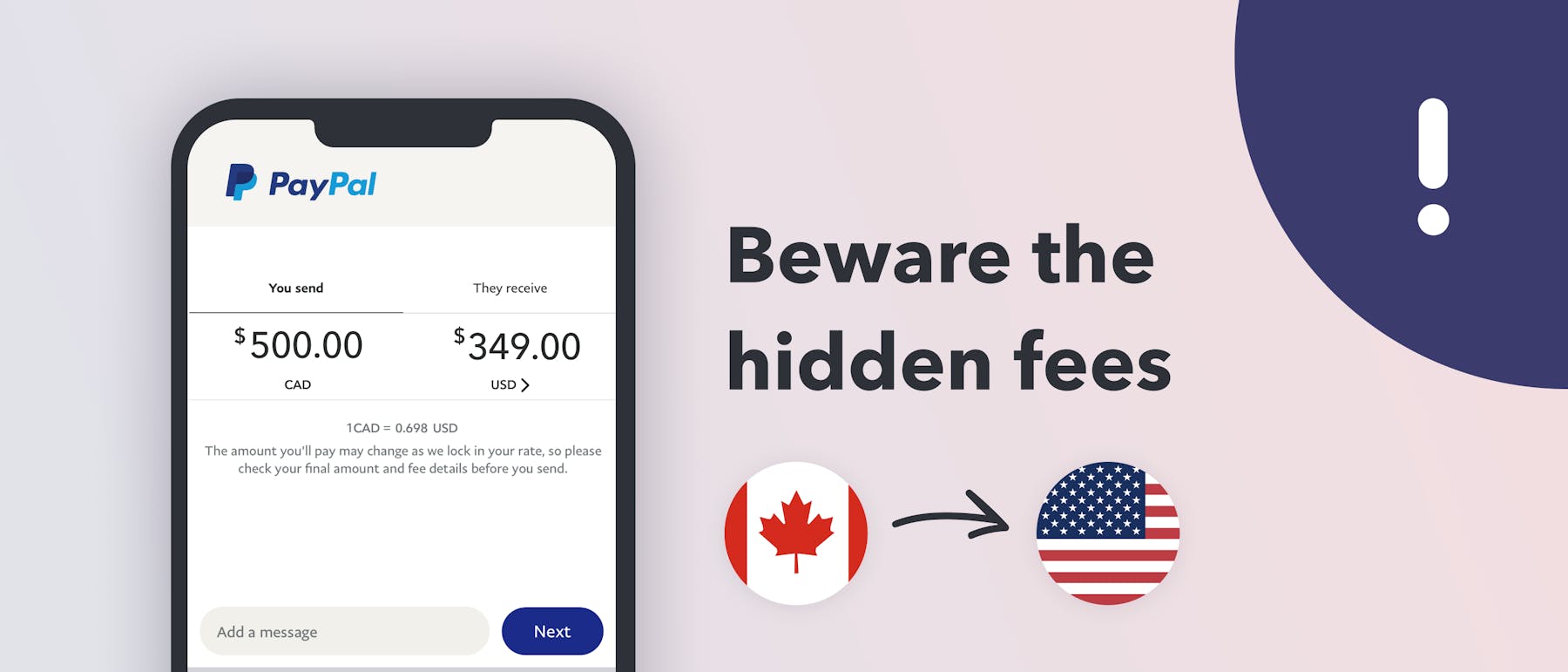

Wise Business is considered one of the best money transfer service globally. They offer the low-cost Wise Business account and card in Canada, along with some of the cheapest international transfers available. This account allows you to manage money in over 50 currencies and provides local bank details in 9 currencies.

With Wise Business, you can seamlessly collect money, withdraw funds from e-commerce stores in up to 9 currencies, and generate invoices using the provided bank details. When you're ready, you can convert your foreign currency revenue into Canadian dollars at the mid-market exchange rate, saving you significant amounts compared to traditional banks.

Account name: Wise Business

Account type: Electronic Money Account (held by Barclays in the UK, Wells Fargo in the US, DBS in Singapore, etc.).

Total cost: $0 per month, $42 opening fee.

Noteworthy features: International money transfers, multiple account details, multi-currency balances.

Availability: Canada, UK, EU/EEA, Liechtenstein, Norway, Switzerland.

More info: See our full Wise Business account review.

Wise Business in Short

Wise Business is open to various types of businesses, including sole traders, limited and public companies, freelancers, partnerships, charities, and trusts in Canada. The application process requires sharing business registration details, location, industry, and personal details of company stakeholders.

Once you're signed up, you'll be able to take advantage of the following features for free:

- Send money and make payments locally and internationally

- Hold, exchange, and top-up over 50+ currencies

- Use the batch tool for efficient invoicing and payment processing

- Integrate with administrative and accounting software like QuickBooks

- Obtain your first multi-currency debit card for free (with a one-time $42 opening fee)

- Access local bank details (AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, and USD)

- Set up direct debits

- Withdraw money from platforms like Shopify and Stripe.

Wise Business Advantages

- Receive international payments without big fees.

- Batch pay up to 1,000 invoices and salaries at once;

- Give select employees access to money management;

- Mid-market exchange rate offered for currency transfers;

- Wise card can be used to avoid foreign transaction fees;

- No setup fees or monthly charges;

- Authorised as an Electronic Money Institution by the FCA.

Wise Business Disadvantages

- Cash or cheque payments aren't supported;

- Negative interest on large Euro account balances;

- Fees to top up the account via debit and credit card;

- Tight limits and conditions to fee-free ATM withdrawals.

How Wise Business Works

To understand how Wise Business works, let's take an example. Suppose you conduct business in the UK and need to pay a supplier in British pounds. With the Wise Business Account, you can:

- Send CAD from your bank account to your Wise CAD account.

- Convert CAD to GBP at a low fee (e.g., for a $1,000 transaction paid with Canadian dollars, the total fee would be around 0.43% or $4.30).

- Pay your supplier in GBP with your Wise debit card, make or receive SEPA (and SWIFT) payments, or set up direct debits.

Final Word

In summary, unlike online business accounts, Wise Business does not charge monthly fees. If you serve international clients, Wise Business allows you to receive payments like a local in their country. If you're tired of incurring international transaction fees when dealing with international clients, Wise Business could be the solution for you.

Royal Bank of Canada — Low Monthly Fee High-Street Account

The Royal Bank of Canada, established in 1864 in Halifax, Nova Scotia and headquartered in Toronto, is the largest bank in Canada in terms of market capitalisation. One of its offerings is the RBC Digital Choice Business Account Package, which provides unlimited electronic debit and credit transactions for a monthly fee of $5.

Account name: Digital Choice Business Account

Account type: Current

Total cost: $5

Royal Bank of Canada in Short

The Royal Bank of Canada provides online and mobile banking for most transactions, ensuring convenience and accessibility for its customers. With a focus on simplicity, it offers a straightforward business banking service that meets the needs of business owners. Additionally, the bank allows you to link your eligible RBC business cards to your Petro-Canada card, providing the benefit of saving 3¢/L on gas at Petro-Canada locations.

Here is list of their standard fees:

- Paper deposits and credit transactions: $2.50 each

- Paper statement without images: $4.00

- Paper statement with images: $5.00

RBC Advantages

- Unlimited credit and debit transfers;

- Unlimited electronic cheque deposits;

- 10 free Interac transfers, $1.50 / transfer thereafter;

- No minimum balance requirement.

RBC Disadvantages

- No free multi-currency accounts;

- High international transaction fees;

- Not specialised for international transfers.

Final Word

If you primarily conduct your banking online or through your mobile device, the RBC Digital Choice Business Account Package may be suitable for you. By embracing digital banking, you can save time and money while accessing various features that assist you in managing your business efficiently.

TD Bank — Standard High-Street Business Chequing

TD Bank, headquartered in Toronto, is one of the leading banks in Canada. It offers Small Business Online Banking, a comprehensive banking solution tailored for small businesses. With a monthly fee of $10 and no minimum daily balance requirement, the account is a standard business account option.

Account name: Small Business Online Banking

Account type: Chequing

Total cost: $10

Mike Mozart, (CC BY 2.0, unmodified)

TD Bank in Short

The TD Bank Small Business Account provides a practical solution for businesses with its streamlined invoicing capabilities. With this account, you can send invoices to your customers at no cost, enabling them to make online payments conveniently. The account also allows you to accept online credit card and ACH payments, with per-transaction fees applied.

Standard Fees at TD Bank

- Minimum Deposit to Open: $25

- Monthly Maintenance Fee: $10

- Accept credit card payments: 3.49%

- Accept ACH payments: 1.99%

- Accept lockbox payments: 1.99% ($5 cap).

Advantages of TD Bank

- $5,000 free Cash Deposits in store (additional $0.25 per $100 thereafter);

- No ATM fees at TD ATMs;

- Free debit card.

Disadvantages of TD Bank

- No free multi-currency accounts;

- $25 minimum balance requirement;

- Does not earn interest;

- No ways to waive monthly fee;

- High international transaction fees;

- Not specialised for international transfers.

Final Word

If you primarily conduct your banking online or through your mobile device, TD Bank's business banking services may be suitable for you. They offer lines of credit and business loans, which you may consider as a small business owner once you grow and scale your company.

Alterna — Best Digital Bank for Day-to-Day Transactions

Alterna Bank, a wholly owned subsidiary of the Ontario-based credit union Alterna Savings, is known for its digital banking solutions. The bank's online accounts and options for business loans allow businesses to access the funds they need to grow and does so in a convenient way. The Alterna eChequing Business Account offers a range of free day-to-day transactions to meet your banking needs. You can enjoy the convenience of making deposits, withdrawals, and transfers at Alterna and THE EXCHANGE® Network ATMs. Withdrawing funds through online, mobile, and telephone banking is also included at no cost.

Account name: Small Business eChequing

Account type: Current

Total cost: $5 per month (Waived if you keep a minimum daily closing balance of $3,000 throughout the month)

Alterna in Short

The account allows you to make ACCEL® and Maestro® debit payments both within the United States and internationally. Pre-authorized credits, bill payments, and pre-authorized payments/debits (PAP/PAD) can be conveniently managed through online, mobile, and telephone banking. You can also make deposits using Alterna's Deposit Anywhere™ feature and perform transfers through online, mobile, and telephone banking. Lastly, making debit card payments at point-of-sale terminals is included as part of the account's free day-to-day transactions.

Here are the most common current account fees:

- Monthly Fee: $5

- Day-to-day Transactions: Unlimited electronic day-to-day transactions

- Interac e-Transfers (Send and Request Money): 6 free per month, $1.50 per after

- In-branch cash deposit of up to $1,000 per day: $2 per $1,000 deposit

- All-in-One® Statement: $3 per paper statement

- e-Statement: Free

- Cheque Images in Statements: $2

- Chargebacks: $5

Alterna Advantages

- 24/7 account access for convenient banking;

- Access to over 3,300 surcharge-free ATMs in THE EXCHANGE® Network;

- Eligible deposits insured up to the maximum amount through CDIC for added safety;

- No monthly fee with a minimum daily closing balance of $3,000;

- Free unlimited electronic debit and credit transactions;

- Free incoming Interac e-Transfers®;

- 6 free Interac e-Transfer® Send or Request Money transactions per month.

Alterna Disadvantages

- Not specialised in foreign exchange;

- Not available to residents of Quebec;

- No physical branch locations west of Toronto;

- Monthly fee if minimum balance is not maintained;

- Limited number of free Interac e-Transfers per month;

- Not specialised for international transfers.

Final Word

In conclusion, Alterna Bank is a solid digital choice for Canadian small businesses. With its online platform, it offers convenient access to your account anytime, anywhere. The absence of a monthly maintenance fee, as long as you maintain the minimum balance requirement, makes it an attractive option for cost-conscious businesses. Additionally, the inclusion of a few free Interac e-Transfers® each month adds value to your banking experience.

While it may have limitations, such as being unavailable to residents of Quebec and no branches west of Toronto, Alterna Bank provides a reliable and accessible banking solution for small businesses in Canada.

Scotiabank — High-Street Option With Many Business Services

Scotiabank, also known as the Bank of Nova Scotia, is a global bank with its headquarters in Toronto. Tangerine is also a subsidiary of Scotiabank. It provides a wide range of financial services for small businesses in Canada, including Savings & GIC, Credit Cards, Loans & Leases, Lines of Credit, and Payments & Merchants Services. One of its offerings is the Basic Business Account, which offers a simple and convenient way to manage Canadian and US Dollar funds for small businesses.

Account name: Basic Business Account

Account type: Current

Total cost: $10.95 per month

Scotiabank in Short

Scotiabank offers the Basic Business Account, providing a straightforward solution for managing Canadian and US Dollar funds. This account is designed with account fees that are tailored to your usage, ensuring cost-effectiveness for your business. With Scotiabank's partnership with Chase Merchant Services, you can also experience improved cash flow by receiving funds the next day.

Here are the most common current account fees:

- Mail deposit: $5.00

- Branch deposit: $1.50

- ABM deposit: $1.25

- Cheque: $1.50

- Night deposit: $1.25

- Remote deposit: $1.00

- Merchant credit: $1.00

- Merchant debit: $1.00

- ABM withdrawal: $1.25

- Bill payment (ABM, Internet or Telephone): $1.25

- Self-service transfer (ABM, Internet or Telephone): $1.00

Scotiabank Advantages

- 24/7 access through online banking;

- Access to credit and loans;

- One free transaction for every $1,500 in your minimum monthly balance;

- Account maintenance fee waived when the minimum monthly balance is $8,000+.

Scotiabank Disadvantages

- Fees for cheques, deposits, and withdrawals;

- Low ratings on Trustpilot from customers;

- High international transaction fees;

- Not specialised for international transfers.

Final Word

Scotiabank provides various business account options with features, including a standard small business chequing account. While it is generally high in fees with a lot of fine print in the fee schedule, Scotiabank does offer a wide range of other accounts to consider when your business grows. It may be a viable choice to pair along with digital bank Tangerine, which is a subsidiary that offers convenient and low-fee digital banking solutions.

Wealthsimple — Get Interest From Savings and Investments

Wealthsimple is a Canadian financial technology company that offers online investment management services. It was founded in 2014 and is headquartered in Toronto. The company provide automated investment portfolios known as robo-advisors, which are tailored to each client's risk tolerance and financial goals. Wealthsimple offers a range of investment options, including diversified portfolios of ETFs (exchange-traded funds) and accounts for registered businesses in Canada.

Account name: Business Save

Account type: Investment

Total cost: 0.5% management fees on managed investing accounts

Wealthsimple in Short

Wealthsimple offers a savings account with a competitive interest rate of 1.1% for businesses. Their investing account provides commission-free stock trading and a management fee of 0.5% for managed investing accounts. With instant deposits of up to $50,000 and access to customer support from real humans, Wealthsimple provides a user-friendly and accessible investment platform. To get started, a minimum investment of $1 is required, and they offer paid tiers that provide lower management fees.

Wealthsimple Advantages

- Competitive 1.1% interest rate for business savings;

- Commission-free stock trading with $0 trading fees;

- Access to customer support from real humans;

- Instant deposits of up to $50,000;

- Data encryption and two-factor authentication;

- CIPF protection for your accounts in the event of insolvency.

Wealthsimple Disadvantages

- Management fees of 0.5% for managed investing accounts;

- Minimum investment requirement of $1;

- Paid tiers for lower management fees.

Final Word

Wealthsimple is a platform for businesses to consider to passively grow their wealth. However, it's important to note that Wealthsimple is not designed to function as a traditional chequing account. If you're seeking a comprehensive banking solution that includes everyday transactional capabilities, loans, or lines of credit, it may be more appropriate to consider a traditional bank. Nevertheless, if you're looking to invest surplus funds and take advantage of features like $0 commission stock trading, managed investing accounts with low management fees, and access to customer support, Wealthsimple is a highly recommended platform.

Payoneer — Best for E-Commerce Businesses

Payoneer, an American financial services company, offers customers a range of digital payment services, access to working capital, money transfers, and the ability to access local bank details. With account numbers supporting CAD, AUD, GBP, USD, EUR, and four other currencies, Payoneer enables you to receive payments as if you were a local in those respective currencies. Due to its seamless integration with leading marketplaces across different currencies, Payoneer is an excellent choice for small businesses, freelancers, and companies operating in the borderless e-commerce market.

Account name: Payoneer

Account type: Cheuqing (Bank details for GBP, USD, EUR, AUD, CAD, SGD, JPY, and HKD).

Total cost: $0 to sign up.

Noteworthy features: Connects to thousands of marketplaces.

Availability: Global.

More info: See our full Payoneer Review.

Payoneer in Short

Payoneer provides a single free account that enables enterprises of all sizes to venture into global markets, receive local payments, and withdraw revenue to a local bank account. This serves as a cost-effective alternative to paying fees for wire transfers or local bank withdrawals. Rather than offering tiered paid services, Payoneer implements a comprehensive fee structure, which we will outline below.

Payoneer Advantages

- Get paid into local bank accounts;

- Coverts foreign currency at the mid-market rate;

- Withdraw multi-currency earnings into local account at low cost;

- Connect with thousands of online marketplaces;

- Access working capital and manage cash flow

- 24/7 multilingual support;

- Authorised as an Electronic Money Institution.

Payoneer Disadvantages

- Charges fee to withdraw Payoneer balance to your Canadian bank;

- Charges fixed transaction fee when converting foreign revenue;

- Charges annual fee for Payoneer's MasterCard.

Payoneer's Fee Schedule

In short, Payoneer is a global infrastructure that connects you to a network of customers, suppliers, and online marketplaces. To access this powerful service, there are fees associated with various transactions. Transactions between Payoneer users are free, whether you are sending or receiving payments.

Receiving payments into your Payoneer account is free for most currencies, except for USD, which may have a fee ranging from 0 to 1% depending on the country. If you receive payments from specific marketplaces like Airbnb or Fiverr, please refer to their websites for the relevant fee information.

- Get Paid: Payments by credit card will cost you 3% per transaction, regardless of currency. If you get an ACH bank debit from an American customer, that will cost 1% per transaction.

- Withdraw to Bank: The principle here is to avoid foreign currency exchanges. Withdrawing your EUR Payoneer balance to your Canadian bank will cost a flat fee of $1.50 (the same applies to USD to USD banks and EUR to EUR banks). Foreign currency withdrawals (i.e. USD Payoneer balance to GBP account in the UK) will cost 2% of the transaction. Withdrawing in a non-local currency (i.e. withdrawing your USD into a USD account in the UK) will also cost you 2% per transaction.

- Pay: If you pay suppliers or partners by bank transfer, Payoneer will charge 2% per payment. A fixed fee will also apply if the payment is made in AUD, GBP, USD, EUR ($1.50, £1.50, $1.50, €1.50 respectively).

- Currency Transfer: For each transfer from one currency to another, you will pay 0.5% of each transfer.

- Inactivity Fee: Pay a $29.95 penalty for not making a transaction or Payoneer card payment in 12 months.

Final Word

One of the most remarkable aspects of Payoneer is its extensive global infrastructure, connecting you to the world's largest and most expansive online marketplaces. This software simplifies the payment process for customers, making Payoneer the most appealing online business account for e-commerce businesses. Additionally, its low fees for international money transfers make Payoneer an ideal solution for those aiming to expand their customer base internationally.

The Best Online Small Business Accounts in Canada Compared

To wrap things up, let's take a look at how the product, service, and fees of a few of the free online business accounts we explored compare to one another in Canada:

|  |  | |

Account Name | Tangerine Business Savings | Wise Business IMT | Payoneer Account |

CA Bank Details Included | ✔ | Pay €50 one-time fee first | ✔ |

Free Debit Card | ✔ | ✔ | ✘ |

3D Secure | ✔ | ✔ | ✔ |

Overdraft | ✔ | ✘ | ✘ |

Free Multi-Director Access | ✘ | ✔ | ✘ |

Accepts Cheque | ✔ | ✘ | ✘ |

Invoicing Included | ✘ | ✘ | ✔ |

Integrated Accounting | ✘ | ✘ | ✔ |

Multi-Currency Accounts | 2 | 9 | 8 |

Account Opening Fee | 0 | €50 one-time fee | €0, no monthly fee |

Local Transfer Fee | Free | Free | 2% + €1.50 |

Currency Transfer Fee | 0.025 | From 0.43% | 0.005 |

Int'l Card Transaction Fee | ✔ | ✘ | 0.01 |

Deposit Protection | ✔ | ✔ | ✔ |

No. of Customers | 2 million | 10 million | 5 million |

Trustpilot | 1.2/5 (1,279 Reviews) | 4.6/5 (140K Reviews) | 4.4/5 (2.8K Reviews) |

Customer Service | Email, Phone, Chat | Email, resource center | |

| Go to Tangerine | Go to Wise Business | Go to Payoneer |

Best Bank Accounts for Small Businesses in Canada in 2024

We've compiled a list of the best accounts for small businesses and divided them into the following categories, the best for savings, international payments, managing investments, and e-Commerce businesses.

Best for Interest on Savings — Tangerine

Tangerine — Select from digital savings options to return interest on your business cash | Read our full review or go to their website.

Best for International Payments in Canada — Wise Business

Wise Business — Make international payments at the real exchange rate | Read our full review or go to their website.

Low Monthly Fee High-Street Account — RBC

RBC — Enjoy a low monthly fee from a large Canadian high-street bank

Standard High-Street Business Chequing — TD Bank

TD Bank — Another standard high street option in Canada that offers business credit and loans.

Best For Day-to-Day Transactions — Alterna

Alterna — Best for free to low-cost day to day transactions between customers and business partners.

Standard High-Street Option With Diverse Business Services — Scotiabank

Scotiabank — One of the largest, most global Canadian high-street banks with many services for small businesses.

Get Interest From Savings and Investments — Wealthsimple

Wealthsimple — Automate your business savings and investments for long-term wealth accumulation.

Best for E-commerce — Payoneer

Payoneer — Tap into global markets and withdraw in 8 different currencies | Read our full review or go to their website.

FAQ About the Best Small Business Bank Accounts in Canada

🔐 Is online banking in Canada safe?

Yes, online banks in Canada are safe and secure financial institutions. They are all regulated by the competent authorities in their countries of origin, including the Financial Regulator.

💼 What is the best online business bank account for a small business?

To take advantage of low-cost international banking, Tangerine and Wise Business offer innovative multi-currency accounts that exchange money for very low rates, especially when compared to high-street banks. Payoneer is an American company that operates globally and provides a very powerful infrastructure for borderless e-commerce companies.

👨⚖️ How do I open an online business bank account in Canada?

To open an online business bank account in Canada, you will have to provide the bank with your registration information and information about company shareholders. Thanks to innovative online banks, this process can be done online or through an app in a matter of minutes.

💰 How do online banks in Canada make money?

Online banks generate revenue through paid memberships, which gives customers access to more services that are not offered in their free plans. While online banks can reduce their pricing because they don’t maintain brick-and-mortar offices, they may also charge fees like traditional high-street banks. These fees might include international transaction fees, currency exchange fees, and bank transfers.

What is the biggest business bank in Canada?

The Royal Bank of Canada (RBC) is the largest of the Big Five, banks in Canada with about $1.05 trillion of assets under management.

Can I use my personal bank account for business Canada?

It depends. You can use a personal bank account for business if you are a freelancer. However, if you are a registered company, you must use a business bank account for business finances, and must segregate them from your personal finances.

The content in this page is intended for general information purposes only and does not constitute financial advice. If you have any questions about your personal circumstances, we recommend seeking professional and independent advice. Monito does not offer financial advise.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Read More About the Top Online Business Bank Accounts in Canada

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.