KOHO Review: 2024 Fees, Interest, Credit Card & Credit Building

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Byron Mühlberg

Reviewer

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreKoho Financial Inc offers an excellent debit card and current account (8.3/10) recommended by Monito's experts for its money saving features, including interest on savings, cash back on purchases, and credit building capabilities (7.9/10). KOHO has a growing reputation across Canada (7.8/10) and phenomenal feedback from its customers (9.7/10). In addition to its low everyday fees (7.9/10), KOHO's easy-to-use mobile app offers Canadians an attractive alternative to traditional banking.

What Monito Likes About KOHO:

- Competitive and affordable fee structure,

- Features include spending categorisation and round-up for savings,

- Helps improve credit history through on-time payment reporting,

- Attractive cash back percentages on specific purchases.

What Monito Dislikes About KOHO

- Lacks functionality for international money transfers,

- Minor fees for ATM withdrawals and no free ATM network,

- Credit building feature comes with a subscription fee.

KOHO is a premier Canadian virtual account that gives you control your finances and budgets with:

- unlimited free e-Transfers;

- zero-interest overdraft protection;

- an account that earns you interest;

- a card that offers cash back;

- an optional credit builder platform.

KOHO Review

How Monito Reviewed KOHO's Services

As with all services reviewed by Monito, KOHO underwent a rigorous evaluation to assess the quality of its service. To begin with, our experts analysed several key criteria, including customer reviews, the percentage cost of various transaction types, top-up options, access to customer service, as well as business and legal metrics such as revenue, appropriate authorisation, and company size. As with all Monito Scores, KOHO's score was peer-reviewed by at least one Monito expert.

Reviews are written independently by Monito's editors, and the recommendations given are our own. Services you sign up with using our links may earn us a commission. Learn more.

Trust & Credibility

Background check

KOHO partners with federally regulated banking institution, Peoples Trust Company, and the KOHO card is issued by Mastercard.

Security & reliability

KOHO is not technically a bank. It partners with Peoples Trust Company, a CDIC member.

Company size

Founded recently in 2014 with a growing retail customer base of over 500,000.

Transparent pricing

Easy to find and understand fee schedule, except for the foreign transaction fee

Is KOHO Safe?

Yes, KOHO is a legitimate and safe fintech option. Koho Financial Inc. is a Canadian company founded in Vancouver in 2014. While it is a relatively young company, it has managed to build a medium-sized customer base of around 500,000 users. KOHO partners with Peoples Trust Company, a federally regulated banking institution, to store your money.

The KOHO card issued to customers is powered by Mastercard, ensuring global acceptance and ease of use. Moreover, the website uses HTTPS to ensure secure data transmission during online interactions.

Koho Financial maintains a transparent pricing structure, with detailed fee schedules readily available on their website. While most fees are clearly disclosed upfront, we had to consult the FAQ website to find KOHO's 1.5% foreign transaction fee for the Essential Plan.

Is KOHO a Bank?

Koho Financial Inc. is not a bank. Instead, it operates as a fintech company that provides a wide range of financial services and solutions. KOHO partners with Peoples Trust Company, a federally regulated bank in Canada. This partnership ensures that in the event of KOHO facing financial difficulties, KOHO account holders' funds would be made whole up to $100,000 CAD — returned by Peoples Trust Company, the CDIC-insured partner bank.

Service & Quality

Using the mobile app

Overall good customer consensus about the UX and the app's many features.

Managing the account

No cash deposits or international money transfers available, and no multi-currency options.

Contacting support

Extensive FAQ and 24/7 support in-app, by phone, or by email.

Making card payments

3-D secure card compatible with Apple Pay and Google Pay but lacks social payment features.

KOHO's Service Quality

KOHO offers a high-quality digital Canadian checking account with several useful features to enhance your banking experience. You'll receive instant notifications for all transactions, and the automatic spending categorisation makes budgeting a breeze. Additionally, KOHO provides both physical and virtual cards for easy access to your funds.

The online checking account is easy to use and allows free top-ups using a debit card or bank transfer. Moreover, the joint accounts feature is ideal for families managing their finances together.

However, credit card top-ups and cash and check deposits are not available with KOHO. Furthermore, the service does not support international money transfers, and the account functions exclusively in CAD.

KOHO Interest Rates

The round-up feature automatically saves your spare change, contributing to your savings. KOHO's member plans have varying interest rates. Members enjoy an impressive 5% interest on their balance (as of April 2024).

Additionally, KOHO provides a cover feature, offering up to $250 worth of overdraft without penalty or interest fees.

For customer support, KOHO excels with 24/7 assistance available through the mobile app, online FAQ page, phone, or email.

KOHO Mastercard Prepaid Card

KOHO's Mastercard prepaid card will be delivered for free in approximately 10 days. With the KOHO mobile app, you can effortlessly track your expenses in real-time. The card is 3-D secure and compatible with Apple Pay and Google Pay, making it easy to make secure and contactless transactions.

One of KOHO's biggest selling points is its cash back benefits. Essential plan members receive 1% cash back on groceries and transportation, while Everything plan members (at a $19 monthly fee) enjoy even more benefits, including 2% cash back on groceries, eating/drinking, and transportation, as well as 0.5% cash back on all other purchases. Additionally, Everything plan members can earn an impressive 6% cash back on bookings made through booking.com.

KOHO Credit Building

KOHO offers a credit building feature, which is beneficial for individuals looking to improve their credit history. For Essential plan members, the cost is an optional $10, while Extra plan members would pay $7. Everything plan members enjoy a reduced rate of $5.

Here's how KOHO's credit builder works:

- KOHO opens a line of credit for you.

- You choose an amount to set aside from your line of credit, which becomes untouchable.

- Each month, KOHO reports that amount as an on-time payment to Equifax, boosting your credit score with every payment.

A higher credit score can lead to lower interest rates on significant purchases like cars and houses, resulting in potential savings for you. Learn more about the best no-fee credit cards in Canada.

Fees & Exchange Rates

Everyday use

No fees to top up the account by bank transfer, direct debit, or debit card.

ATM withdrawals

$2-3 CAD fee per ATM withdrawal.

Online spending

Good for domestic spending within Canada.

International spending

Essential plan levies a foreign transaction fee on spending and ATM withdrawals abroad.

KOHO's Fees and Exchange Rates

KOHO offers various membership plans with different features and monthly costs. The available plans are as follows:

- Essential Plan: $4/month ($0 if you set up recurring direct deposits or deposit $500 per month)

- Extra Plan: $9/month

- Everything Plan: $19/month

For everyday use, KOHO provides excellent rates with no non-sufficient funds fees and free domestic e-transfers. Topping up your account through a bank transfer is also free. However, if you need to withdraw cash from an ATM, there is a minor fee ranging from $2 to $3, as KOHO does not have a fee-free ATM network.

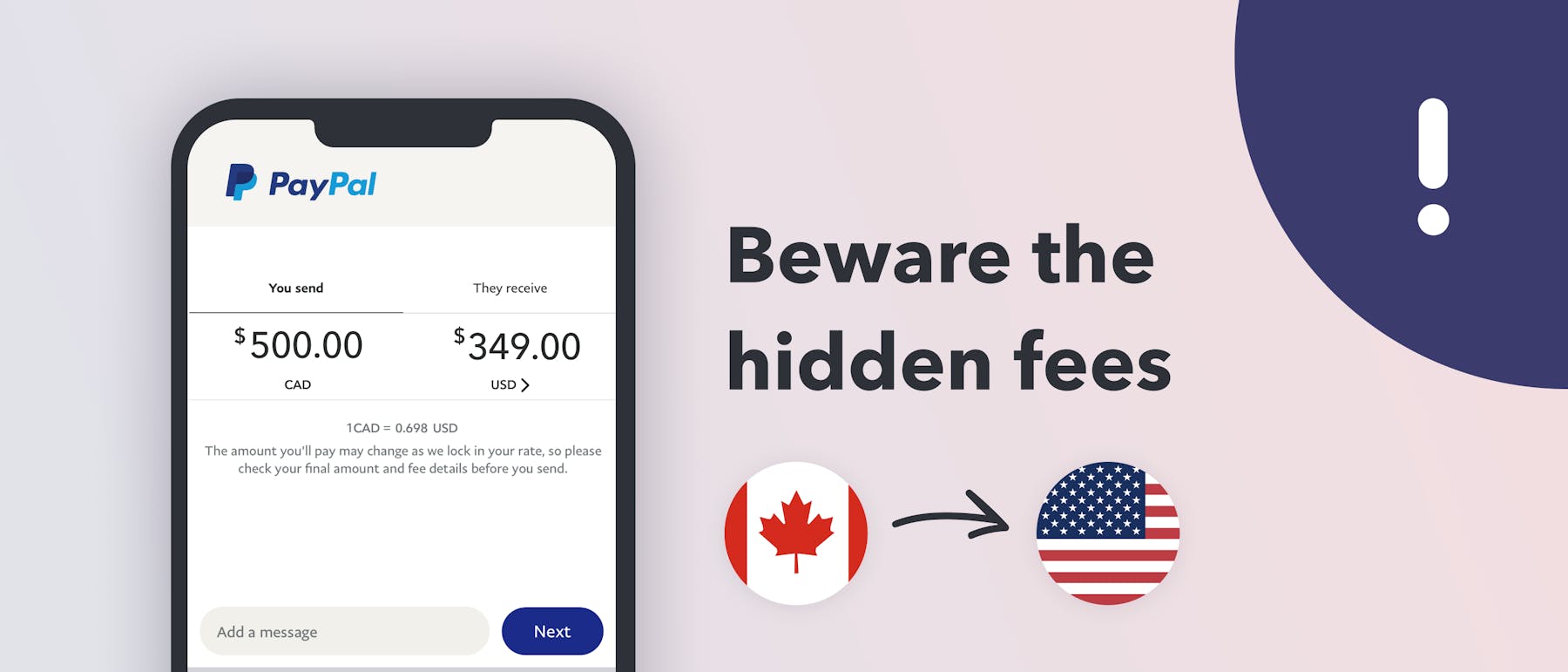

KOHO International Fees

For international use, you'll have more fees to consider. Only Extra and Everything plan members receive one free international ATM withdrawal per month and zero foreign transaction fees.

While shopping online with Canadian vendors is seamless, be aware that KOHO's Essential plan charges a 1.5% foreign transaction fee for international card purchases. This fee applies to every purchase or cash withdrawal in a foreign country. Since KOHO partners with MasterCard, your purchases will use MasterCard's exchange rate on foreign purchases (monitor here).

If you frequently travel abroad, it may be advisable to explore other debit cards with no foreign transaction fees, which we cover in our guide on the best debit cards for international travel.

Customer Satisfaction

Customer review score

KOHO received a 4.7/5 star rating on average between the App Store and Google Play.

Number of positive reviews

On the App Store and Google Play, KOHO garnered around 100,000 four- and five-star reviews.

Customer Satisfaction

KOHO has very good reviews on both the Apple App Store and on Google Play, with an average satisfaction score of 4.7/5 stars. In total, around 100,000 customers left four- and five-star reviews. We summarise the pros and cons below:

Positive KOHO Reviews

- Features are more flexible and useful than traditional banks,

- High interest and cash back on purchases, including subscriptions,

- Great app design with useful spending categorisation,

- Credit building has helped customers improve credit scores.

Negative KOHO Reviews

Some customers reported the following negative points of feedback:

- Glitches with double-charging for certain transactions,

- Accounts blocked and cards frozen,

- Trouble with e-transfers getting processed,

- Difficulties contacting customer service.

Frequently Asked Questions About KOHO

What is KOHO?

KOHO is a financial technology company (fintech) that provides a range of digital financial services, offering users a convenient and modern banking experience.

How does KOHO work?

KOHO operates by collaborating with Peoples Trust Company to offer a comprehensive suite of services through their card and mobile app, empowering users with budgeting tools, interest on their balances, cashback rewards, and the option to build credit.

What is the KOHO app?

The KOHO app is a feature-rich mobile application that serves as a financial hub, enabling users to track their transactions, set budgets, earn interest on their savings, enjoy cashback rewards on purchases, and even access credit-building services within the Canadian financial landscape.

Is KOHO a bank?

No, KOHO is not a bank itself; rather, it partners with Peoples Trust Company, which is a CDIC member, to ensure users' deposits are protected under the Canada Deposit Insurance Corporation.

Is KOHO worth it?

Indeed, we think KOHO stands out as a worthwhile option for virtual banking in Canada, providing greater flexibility and modern financial solutions compared to conventional brick-and-mortar banks.

Is KOHO a credit card?

KOHO primarily offers a debit card for transactions, but it also features an optional credit-building feature, allowing users to enhance their credit history.

How does KOHO make money?

KOHO generates revenue through commissions on credit card transactions and various monthly payment plans. Unlike traditional banks, KOHO avoids imposing monthly fees and additional charges on its users.

What is KOHO credit building?

KOHO credit building is a service that empowers users to build their credit history and improve their credit score by demonstrating responsible financial behavior, such as making on-time payments, using a secure credit line.

Does KOHO report to a credit bureau?

Yes, KOHO reports users' timely payments to Experian, one of the prominent credit bureaus, contributing to the establishment of a positive credit record.

Does KOHO build credit?

KOHO's credit-building subscription allows users to proactively build a strong credit history, creating opportunities for future financial endeavours.

Other Virtual Bank Guides on Apps and Neobanks in Canada

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.