Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 50+ money transfer providers

- We've made 100+ test transfers

- Our writers have been testing providers since 2013

You Might Also Be Interested

7 Best Virtual Banks in Canada in 2024

January 8, 2024 - by Jarrod Suda

Cash App vs PayPal: Which Has Better Safety, Fees & FX-rates?

December 22, 2022 - by Jarrod Suda

PayPal Conversions

February 2, 2023 - by François Briod

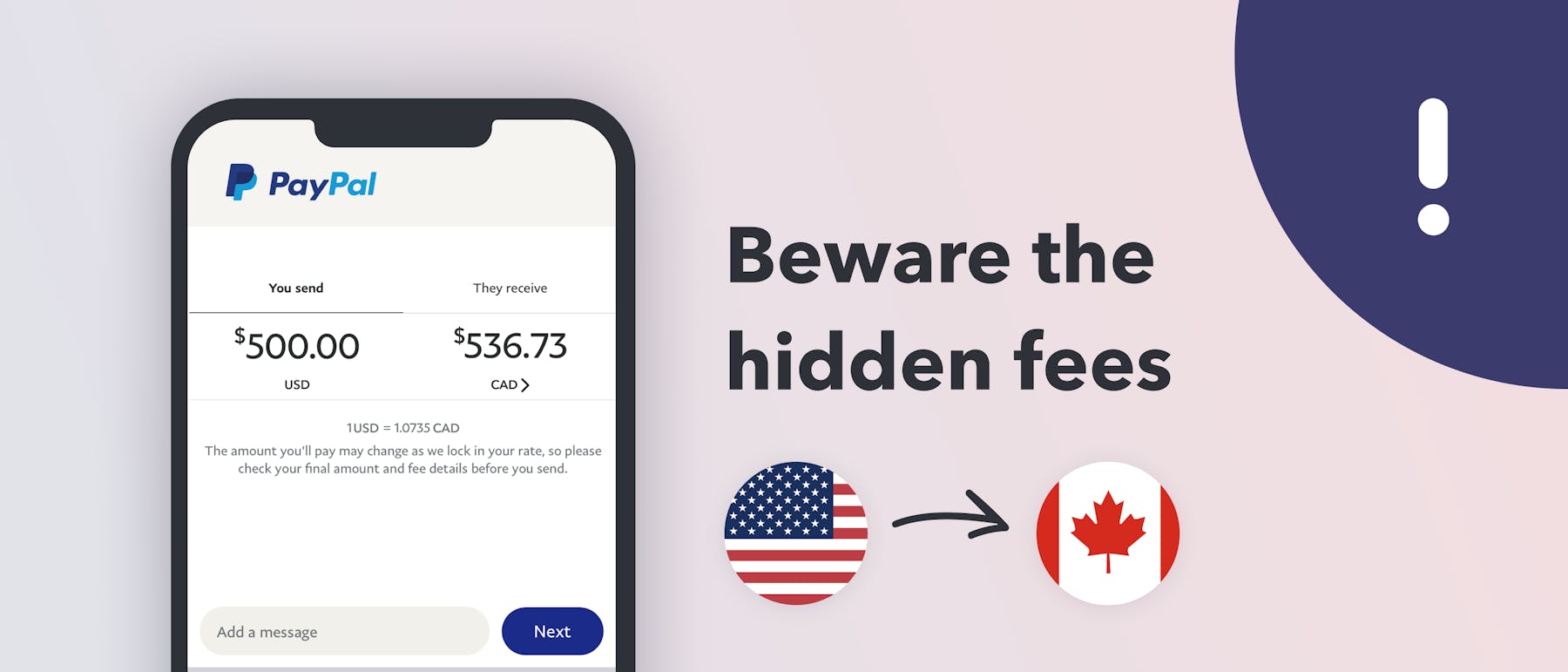

PayPal International Fees & How to Avoid Cross-Border Charges

November 29, 2023 - by Jarrod Suda

Best Money Transfer Apps in Canada

January 9, 2024 - by Jarrod Suda

Best Ways To Send Money Internationally

March 27, 2024 - by François Briod

Cheapest Ways To Exchange Money

February 5, 2024 - by Jarrod Suda

Tips For Your First Online Money Transfer

January 31, 2024 - by Byron Mühlberg

How To Send Money Internationally (Use These 5 Services)

January 16, 2024 - by Jarrod Suda

Best Small Business Banks in Canada

January 9, 2024 - by Jarrod Suda

Cash App Canada

January 9, 2024 - by Jarrod Suda

Can You Transfer Large Amounts?

December 13, 2023 - by Byron Mühlberg

Does Venmo Work With GCash?

November 8, 2023 - by Byron Mühlberg

A Guide to PayPal's International Fees

October 31, 2023 - by Byron Mühlberg

These Are the 5 Best No-Fee Credit Cards in Canada in 2023

October 23, 2023 - by Jarrod Suda

Neo Financial Review

October 16, 2023 - by Jarrod Suda

How Much Are Western Union's Fees?

October 12, 2023 - by Jarrod Suda