Related Provider Reviews

9.5

8.4

7.8

HSBC Business Bank Account: 2023 Review of Service & Fees

May 8, 2023 - by Jarrod Suda

Wise Review

April 21, 2023 - by Byron Mühlberg

Remitly Review

March 7, 2024 - by Olivia Willemin

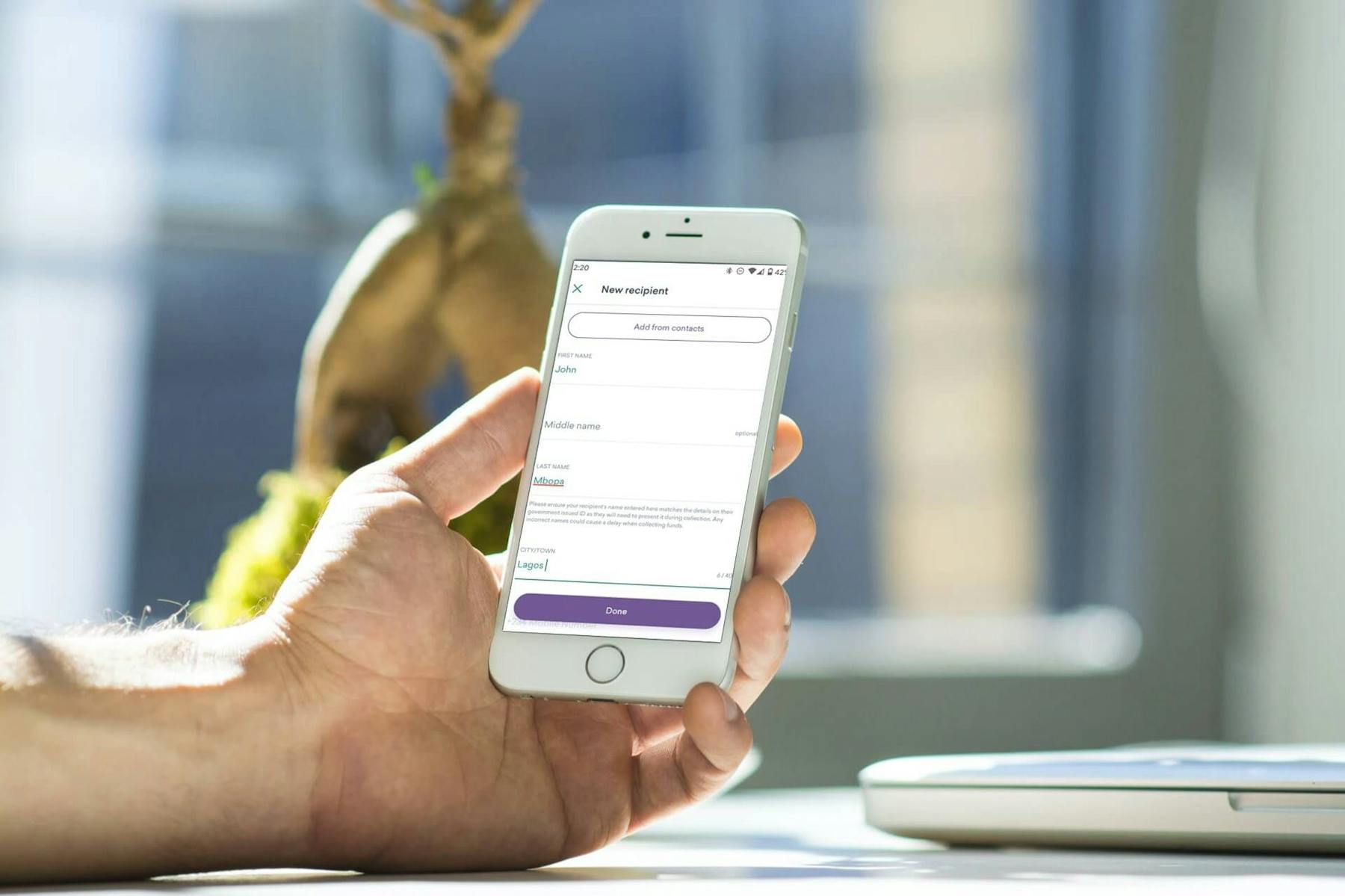

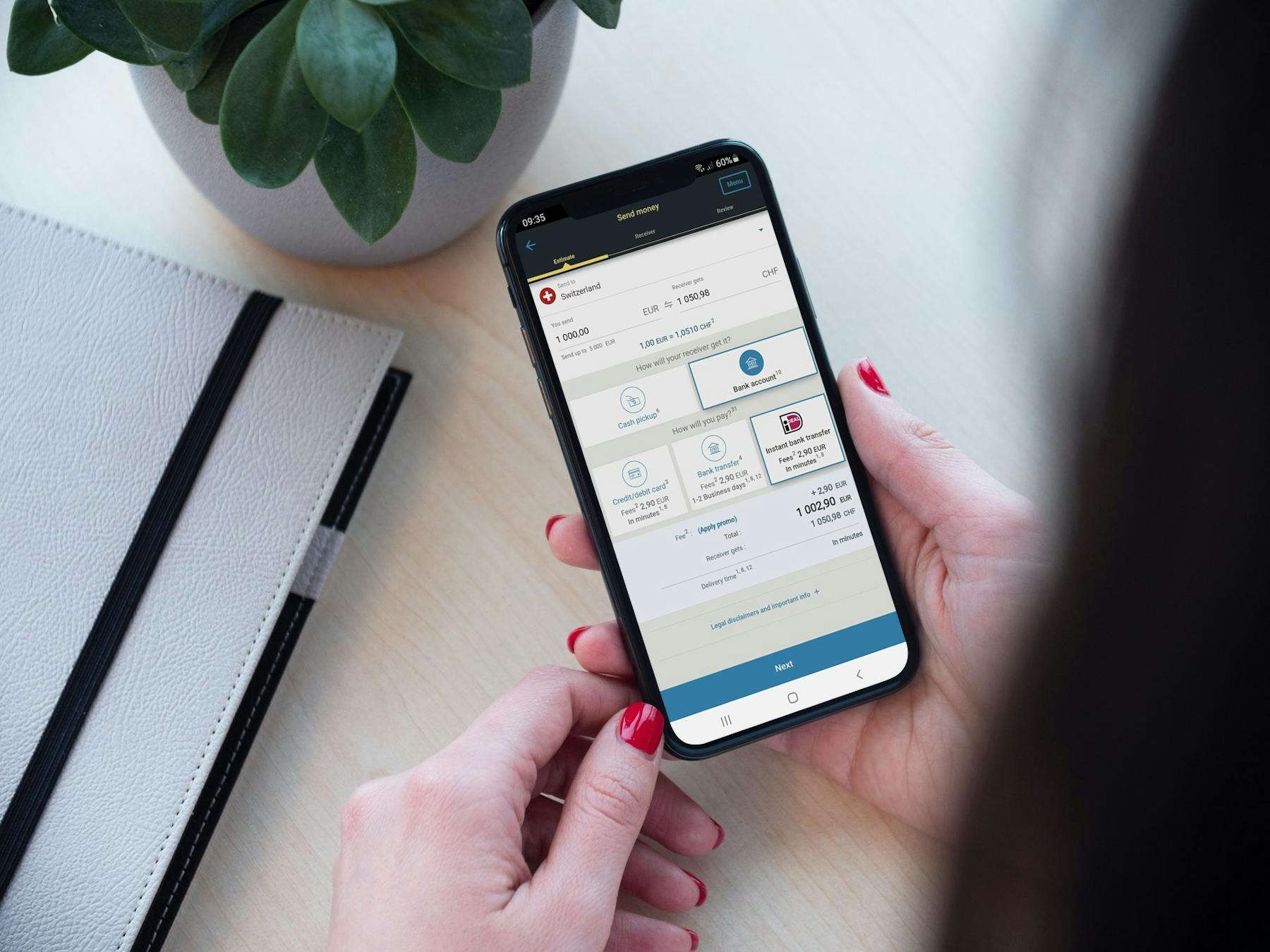

WorldRemit Money Transfer to Uganda

February 29, 2024 - by Lydia Kibet

Sites Like Wise

January 8, 2024 - by Byron Mühlberg

How to Send Money Via WorldRemit to M-Pesa

December 30, 2023 - by Lydia Kibet

The Best Western Alternatives

December 28, 2023 - by Lydia Kibet

Receive Money from Western Union

November 28, 2023 - by Lydia Kibet

How Much Are Western Union's Fees?

October 12, 2023 - by Jarrod Suda

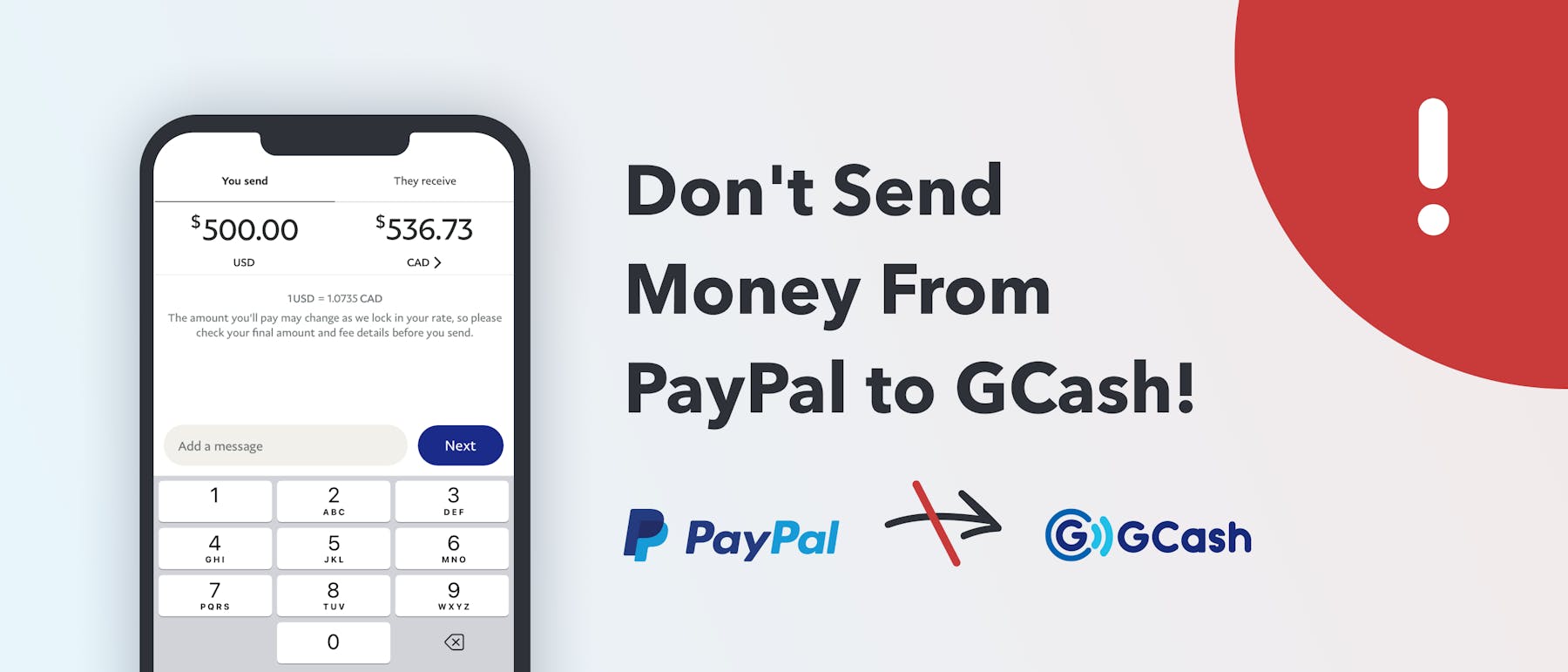

How to Transfer From PayPal to GCash (Plus Cheap Alternatives)

October 11, 2023 - by Jarrod Suda

Wise vs Western Union

October 6, 2023 - by François Briod

Western Union to GCash

October 6, 2023 - by Jarrod Suda

Remitly vs Western Union

October 6, 2023 - by François Briod

Western Union Review

October 6, 2023 - by Byron Mühlberg

WorldRemit Money Transfer Uganda

October 2, 2023 - by Lydia Kibet

Alternatives to Western Union

August 25, 2023 - by Byron Mühlberg

Western Union in Russia

July 13, 2023 - by Jarrod Suda

Receive Money Via Western Union to Kenya

July 5, 2023 - by Lydia Kibet

Remitly Review

May 5, 2023 - by Olivia Willemin