How to Send Money Via WorldRemit to M-Pesa

Lydia Kibet

Guide

Lydia Kibet is a freelance writer with a knack for personal finance, investing, and all things money. She's passionate about explaining complex topics in easy-to-understand language. Her work has appeared on Business Insider, Investopedia, The Motley Fool, GOBankingRates, and Monito. She currently writes about personal finance, insurance, banking, real estate, mortgages, credit cards, loans, and more.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreFor Kenyans living and working abroad, sending money to loved ones back home has never been easier. Thanks to technological advancements and new digital remittance services like WorldRemit, international money transfers are now fast, convenient, and affordable.

WorldRemit is one of the most popular digital remittance platforms, facilitating international money transfers to more than 130 countries. The platform supports mobile wallet as one of the transfer options, meaning you can send money straight to your recipient’s M-Pesa wallet.

If you’re wondering how to send money via WorldRemit to M-Pesa, this guide is for you. Below, we provide a step-by-step guide to using WorldRemit for your transfers.

Find the Best Rates to Send Money to M-Pesa

How to Send Money Via WorldRemit to M-Pesa

You can use WorldRemit to send money to your recipient’s M-Pesa wallet in minutes. Here are the steps to take:

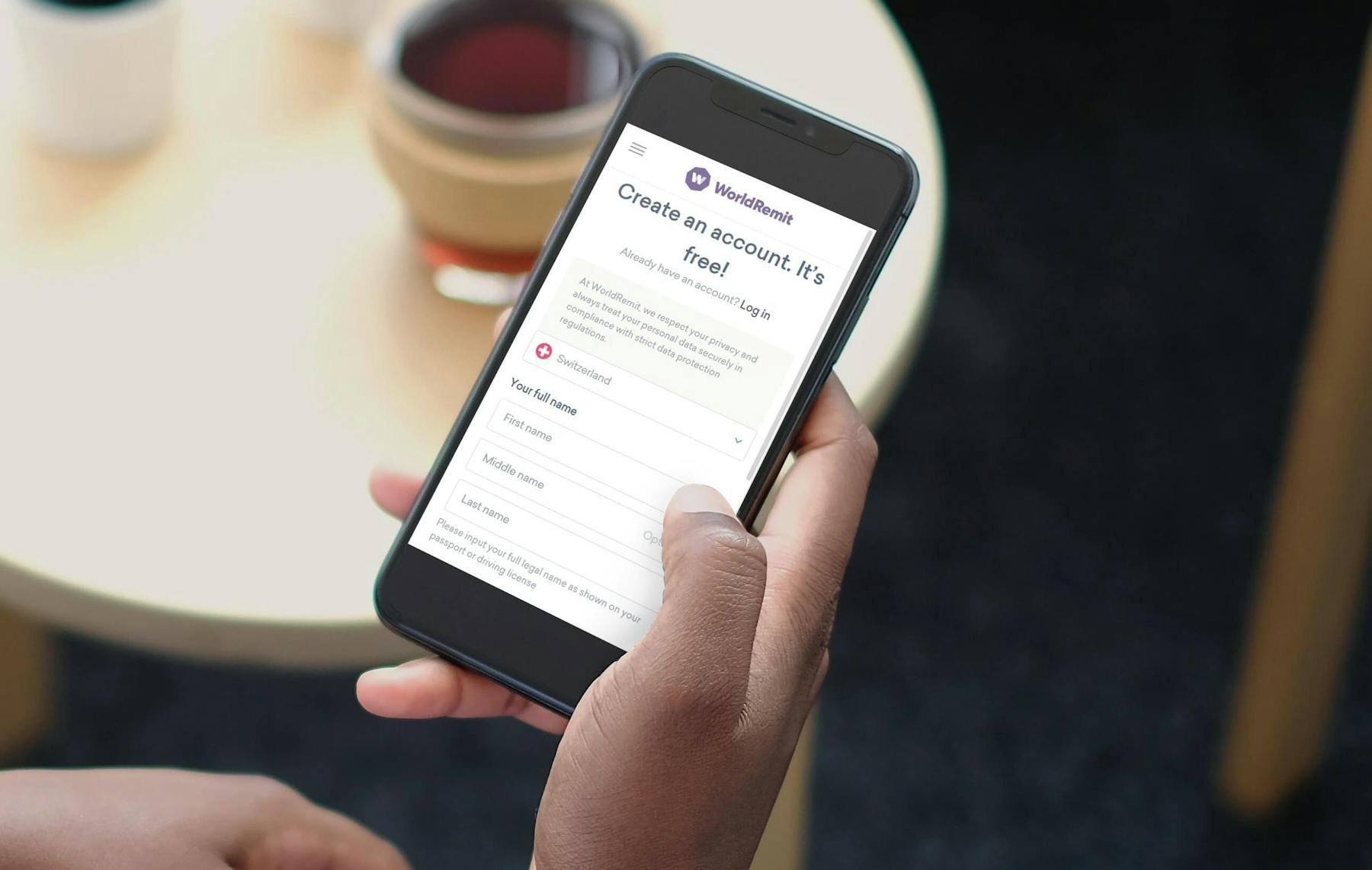

- Create an account or log in if you have one: If you don’t have a WorldRemit account, you can create one by signing up on the company’s official website or downloading the mobile app. You’ll sign up with your email address and provide a few details for identity verification.

- Choose your recipient’s country: On the homepage, you’ll select the country you want to send the money to. Choose Kenya from the dropdown list, and you’ll be guided to Kenya’s homepage.

- Choose your transfer method: The transfer methods available depend on the country chosen. Since you’re sending the money via M-Pesa, you will select “Mobile Money” as your transfer method.

- Enter the amount: The next step is to enter the amount of money you wish to send. The amount should not exceed the limit, which is $5,000 per transfer. Your recipient’s M-Pesa account can only hold a maximum of Ksh.500,000, so ensure their account has the capacity for your transfer to be successful.

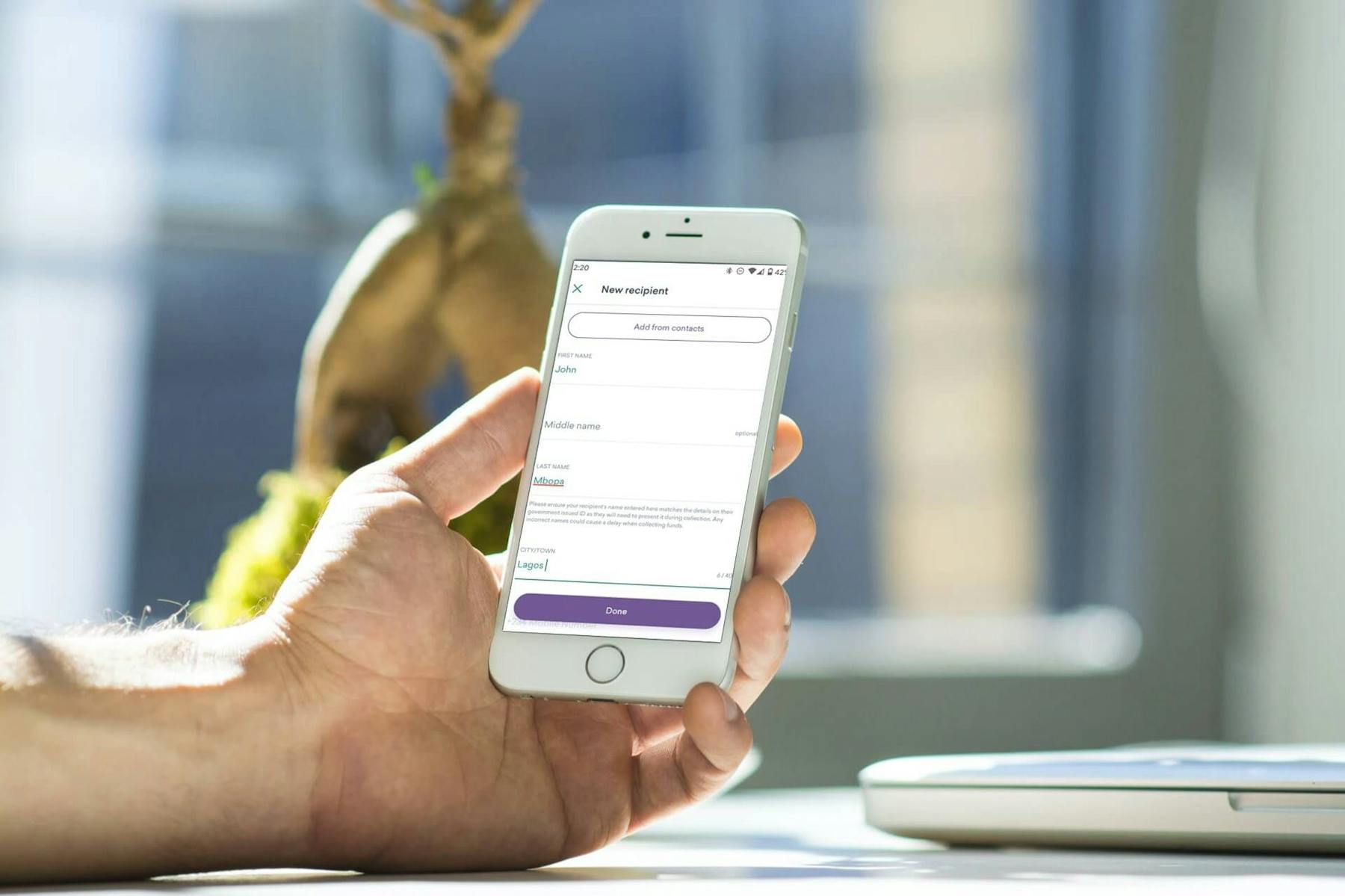

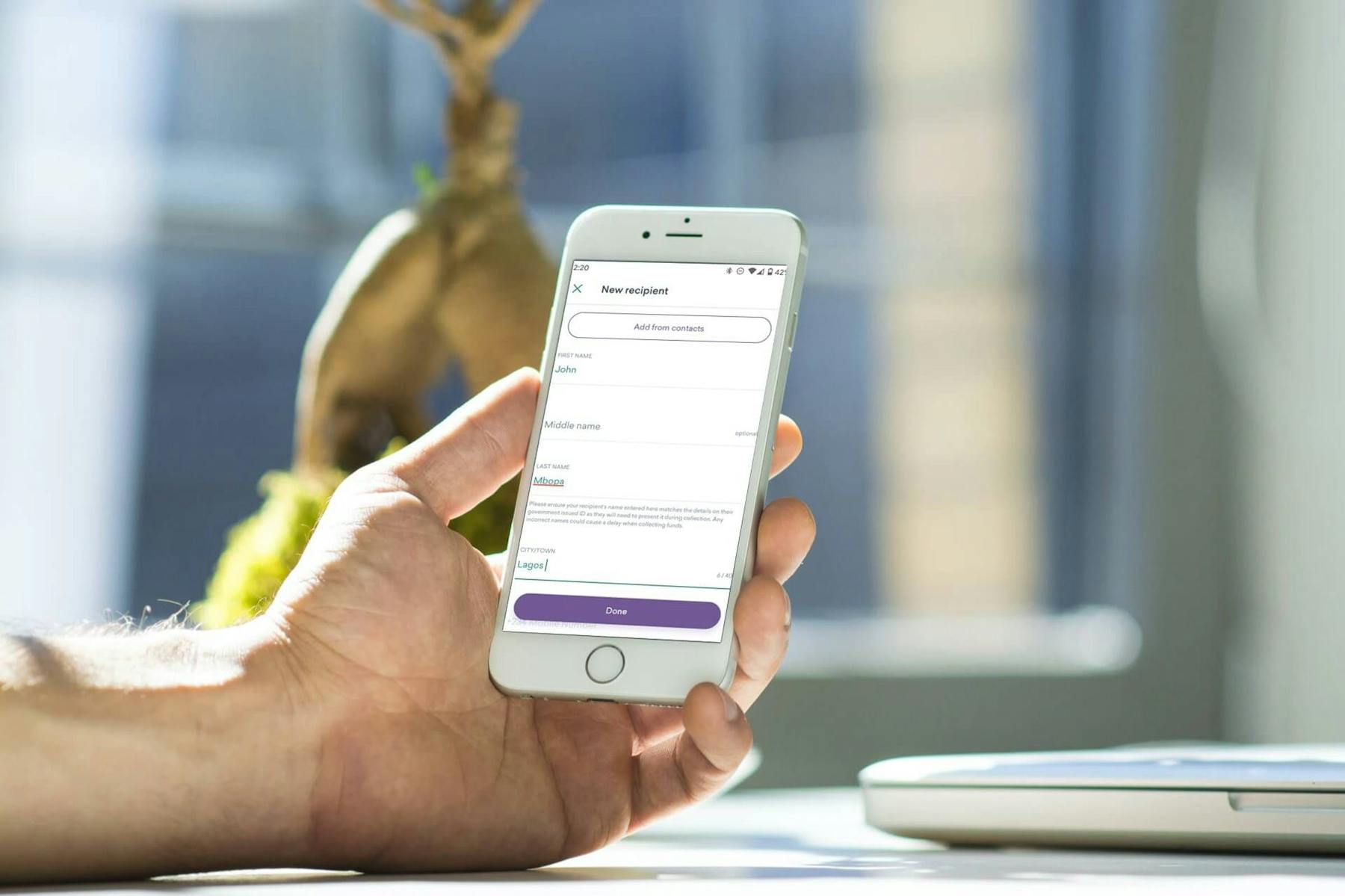

- Enter the recipient’s details: You’ll need to provide your recipient’s details, including their phone number and official name.

- Pay for the transfer: You will be shown a summary of the transfer, including the recipient’s details, the transfer amount, and the fees to be paid. Confirm these details before completing the transfer. You can pay for the transfer by transferring money from your bank account to your WorldRemit account or using a debit card.

Once the transfer is complete, you and the recipient will receive email and SMS notifications that the funds have been credited.

How to Receive Money from WorldRemit in Kenya

WorldRemit supports three transfer methods:

- Bank transfer

- Cash pickup

- Mobile wallet

How you receive money in Kenya from WorldRemit depends on the transfer method chosen by the sender. You can choose your most preferred method depending on your needs.

If the sender is transfering a huge sum of money, bank transfer might be the best option because it has higher limits. If the money is needed urgently, then mobile wallet transfer would be most suitable because it’s the fastest method, although it limits the amount to be sent.

Below, we go over these options in more detail.

Bank Transfer

WorldRemit allows you to send money to your friend or family member’s bank account in Kenya. It’s one of the most secure options, and you can send higher sums of money.

Some of the banks you can send money to in Kenya from WorldRemit include:

- Equity Bank

- KCB Bank

- Co-operative Bank of Kenya

- Standard Chartered

Bank transfers typically take at least one working day to be processed. WorldRemit notifies you and the recipient via email once the funds have been credited.

Sometimes WorldRemit requires more information from you before processing the transfer in order to comply with their regulatory requirements.

You can only send money to bank accounts in Kenya in two currencies; Kenyan Shillings and US dollars. The maximum amount you’re allowed to send per transfer is $19,000 or its equivalent in Kenyan Shillings.

Different banks also have different limits, so it’s important to confirm with the specific bank you’re sending to before attempting the transfer.

You will need the following information from your recipient to send money to their bank account:

- Their full name as it appears on their ID

- The recipient’s address

- Their account details: the bank name, branch name, and account number

- Recipient’s mobile number

- Reason for sending the money

- The recipient’s email address (optional)

Before making the transfer, ensure you confirm your recipient’s details. Their name must match the name on their bank statement. Confirming these details will help make the processing smoother and faster and avoid delays.

Cash Pickup

WorldRemit also allows you to send money to your recipient in Kenya in cash. The process is similar to sending via M-Pesa, except you pick cash pickup as the transfer method.

After selecting Cash Pickup as your preferred transfer method, you’ll enter your recipient’s details. The following will be required:

- The recipient’s full name as it appears on their government ID.

- The recipient’s address

- The recipient’s mobile number

- The reason for the money transfer.

- Recipient’s email (optional)

Next, you’ll enter the amount you wish to send. You can pay for the transfer using a debit or credit card, or via bank transfer.

When collecting the funds, your recipient will have to provide the following:

- Valid photo ID: national ID, passport, or foreign passport.

- Quote “WorldRemit” and the reference number: WorldRemit sends you and the recipient an email and SMS with the transfer reference number that will be needed when collecting the funds.

WorldRemit to M-Pesa Limit in Kenya

You can send a maximum of Ksh.150,000 per transfer to M-Pesa accounts. Your recipient can hold up to Ksh.500,000, so ensure they have the capacity before sending money.

If you’re sending money to multiple recipients, your combined daily limit for all the transfers should not exceed Ksh.500,000.

You can send a minimum of Ksh 1, and you can send a maximum of 20 transfers over a 30-day period.

Benefits of Using M-Pesa for WorldRemit Money Transfer

Given the three transfer methods, why choose M-Pesa?

- Speed: Using M-Pesa for the transfer is the fastest method, and the money typically reaches your recipient within minutes. This makes the method the most suitable option for when the money is needed urgently, like in case of an emergency.

- Safety: your recipient receives the money in their account, meaning they don’t have to carry large amounts of cash, which can be dangerous.

- Convenience: sending money via M-Pesa is the most convenient method because your recipient doesn’t have to visit a physical location to pick up the money. The money is delivered straight to their account, and they don’t need to fill any paperwork to access it.

Final Thoughts

WorldRemit is one of the most convenient and affordable platforms you can use to send money to Kenya. You can use the service to transfer money straight to your recipient’s M-Pesa wallet.

WorldRemit may not always be the best option, depending on your specific situation, so it’s important to compare all your options before choosing a money transfer service provider.

Monito’s real time comparison engine will help you find the best rates to send money to M-Pesa.

Find the Best Rates to Send Money to Kenya

FAQs About WorldRemit to M-Pesa

What are WorldRemit to M-Pesa charges?

The transfer fee ranges between $0.99 and $5.99, depending on factors like the currency and the amount. Your recipient isn’t charged anything for the transfer, but they may have to pay local operators when withdrawing the money.

How long does WorldRemit to M-Pesa take?

WorldRemit to M-Pesa transfers are typically instant. The money should arrive within minutes. If not, you can contact WorldRemit support. Sometimes, a problem arises during processing, like when the recipient’s name doesn’t match the name registered on their account.

Is WorldRemit available in Kenya?

No, WorldRemit isn’t available in Kenya. However, Kenyans can receive money sent via WorldRemit. WorldRemit has partnered with several banks in Kenya, including Equity, Co-operative Bank, Diamond Trust Bank, and KCB, meaning Kenyans can also receive money via bank transfer.

Is WorldRemit free?

WorldRemit allows users to send their first three money transfers for free to any destination. Afterward, charges apply. WorldRemit charges typically depend on the transfer criteria, including the destination, transfer method, and amount being sent.

You May Also Like These Money Transfer Guides

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.