Other Money Transfer Guides On GCash and How to Receive Money on GCash Internationally

How to Receive Money From WorldRemit to GCash

February 28, 2023 - by Jarrod Suda

Is GCash International?

February 10, 2023 - by Jarrod Suda

GCash USA to Philippines

January 25, 2024 - by Jarrod Suda

Sending to GCash from Japan

January 24, 2024 - by Jarrod Suda

Sending to GCash in the Philippines

February 20, 2024 - by Jarrod Suda

Cash App in the Philippines: How to Get Access & Use Cash App

February 10, 2023 - by Jarrod Suda

Send Load to the Philippines: Instant Philippines Mobile Recharge

PayPal Alternatives for Business

December 29, 2022 - by Byron Mühlberg

PayPal Conversions

February 2, 2023 - by François Briod

How Much Are Western Union's Fees?

October 12, 2023 - by Jarrod Suda

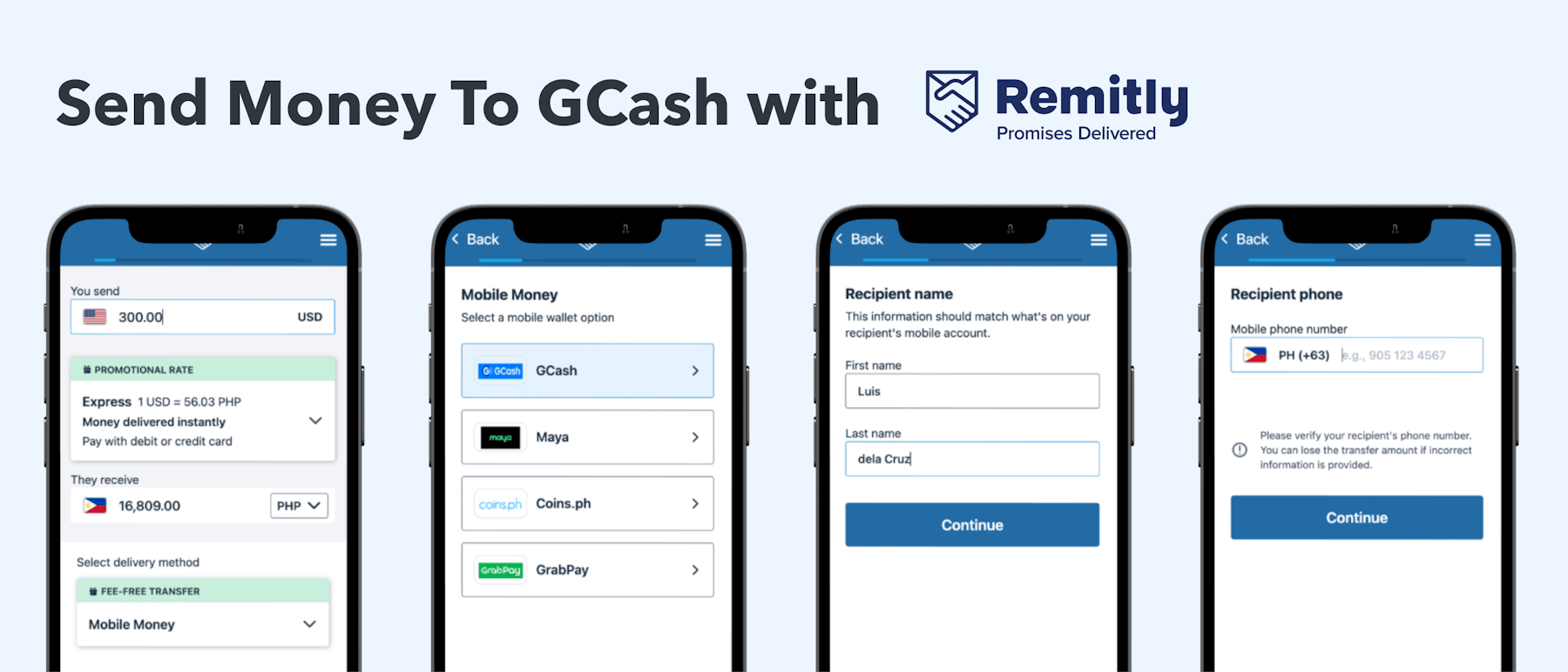

Sending Money From Canada to the Philippines With Remitly Rate

February 9, 2023 - by Jarrod Suda

How to Transfer From Xoom to GCash (Plus Cheap Alternative)

February 10, 2023 - by Jarrod Suda

Western Union to GCash

October 6, 2023 - by Jarrod Suda

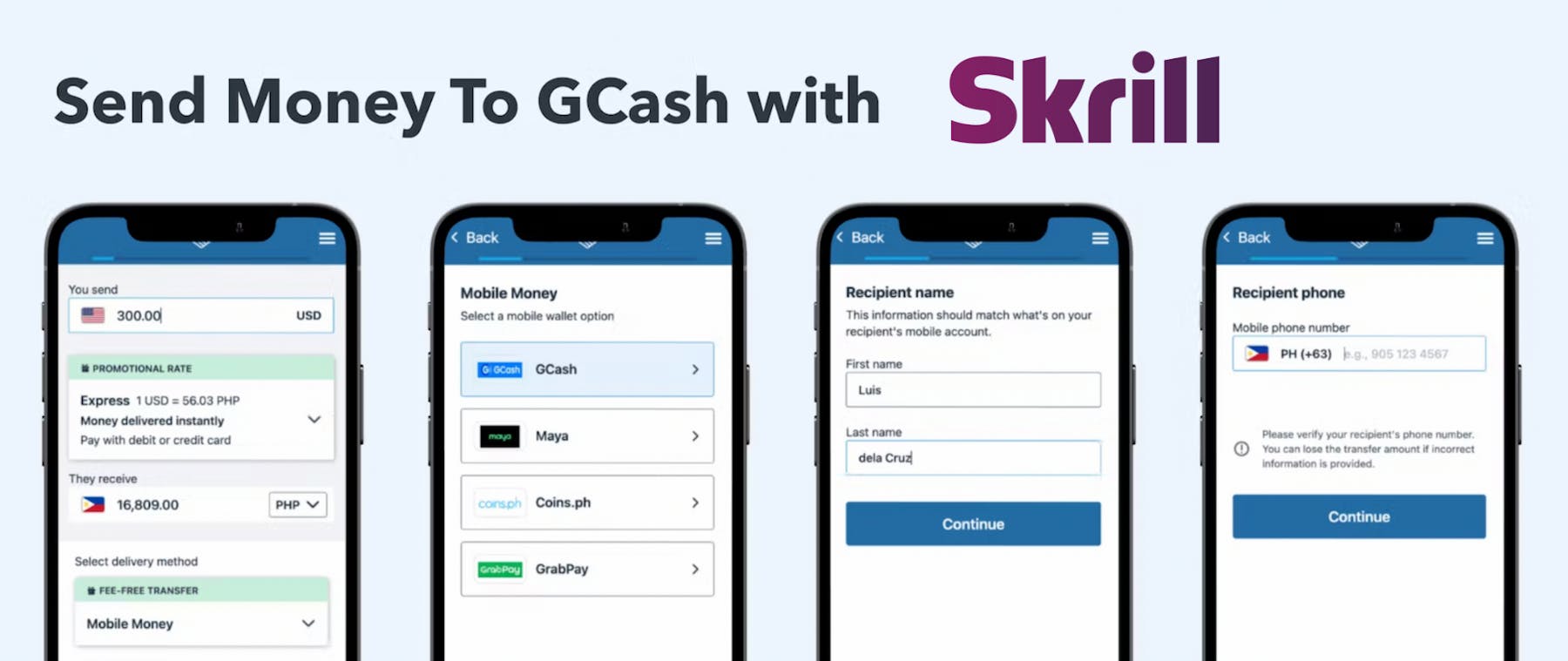

How to Link and Send Money From Skrill to GCash

February 28, 2023 - by Jarrod Suda

Monito Awards

April 8, 2024 - by François Briod

Best Ways To Send Money Internationally

March 27, 2024 - by François Briod

Cheapest Ways To Exchange Money

February 5, 2024 - by Jarrod Suda