WorldRemit Money Transfer in Uganda

Lydia Kibet

Guide

Lydia Kibet is a freelance writer with a knack for personal finance, investing, and all things money. She's passionate about explaining complex topics in easy-to-understand language. Her work has appeared on Business Insider, Investopedia, The Motley Fool, GOBankingRates, and Monito. She currently writes about personal finance, insurance, banking, real estate, mortgages, credit cards, loans, and more.

Byron Mühlberg

Reviewer

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreDigital money transfer services like WorldRemit have made remittances faster, cheaper, and more convenient for both the sender and the receiver.

Initially, your only options for sending money internationally were banks and legacy platforms. While these are still viable options even today, they often cost more and take longer to facilitate the transfers.

If you live abroad and would like to send money to Uganda, WorldRemit is one of your best choices. This global remittance service provides international money transfers in more than 130 countries and over 70 currencies.

Find the best rates in real time with Monito’s comparison engine.

Find the Best Exchange Rates

Why Use WorldRemit

There are several digital remittance services you can use to send money to Uganda, so why choose WorldRemit? Here are some benefits of using WorldRemit for money transfers to Uganda.

Global Availability

One of the advantages of WorldRemit is its global reach, facilitating transfers between more than 130 countries. You can send money to Uganda from virtually anywhere in the world using WorldRemit.

Convenience

With WorldRemit, you can send money fast and conveniently. Their user-friendly platform allows you to send money using your phone at the comfort of your home. Besides, you can make money transfers 24/7.

Competitive Exchange Rates

Traditional money transfer services like banks and legacy platforms like Western Union typically offer a weaker exchange rate, while digital remittance services like WorldRemit offer competitive rates.

Companies like WorldRemit have less overhead given their digital nature, often resulting in favorable conversion rates for the customer.

Multiple Transfer Options

With WorldRemit, you can send money via bank transfer, mobile money transfer, cash pick-up, and even airtime top-up. Your recipient can choose their preferred payment method for maximum convenience.

Security

With WorldRemit, safety is always guaranteed. The service is an authorized and regulated money transfer service with multiple security checks to protect your money and personal information.

How To Send Money to Uganda Using WorldRemit

Using WorldRemit to send money to Uganda is a relatively fast and straightforward process. Here are the steps you need to follow:

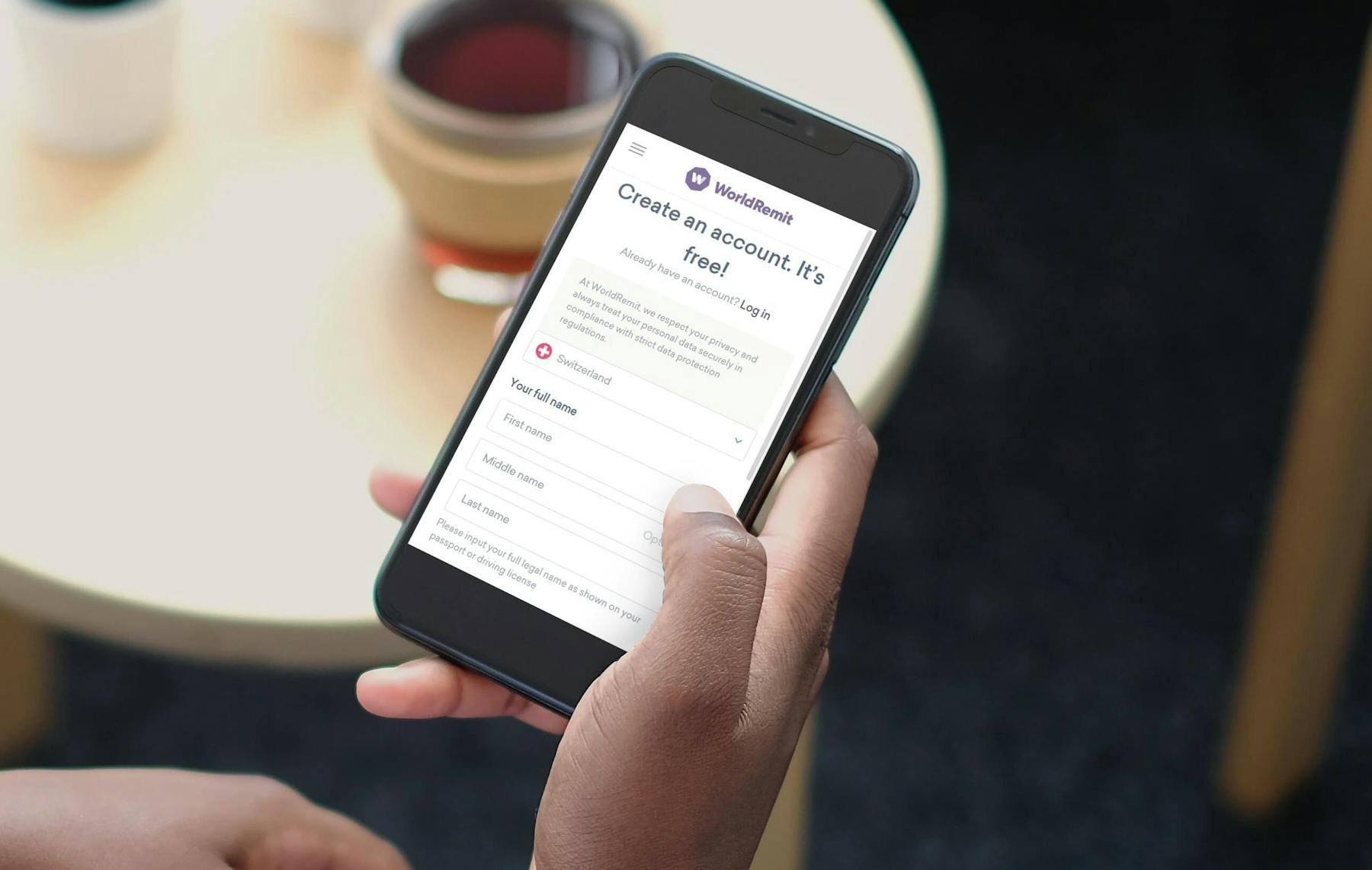

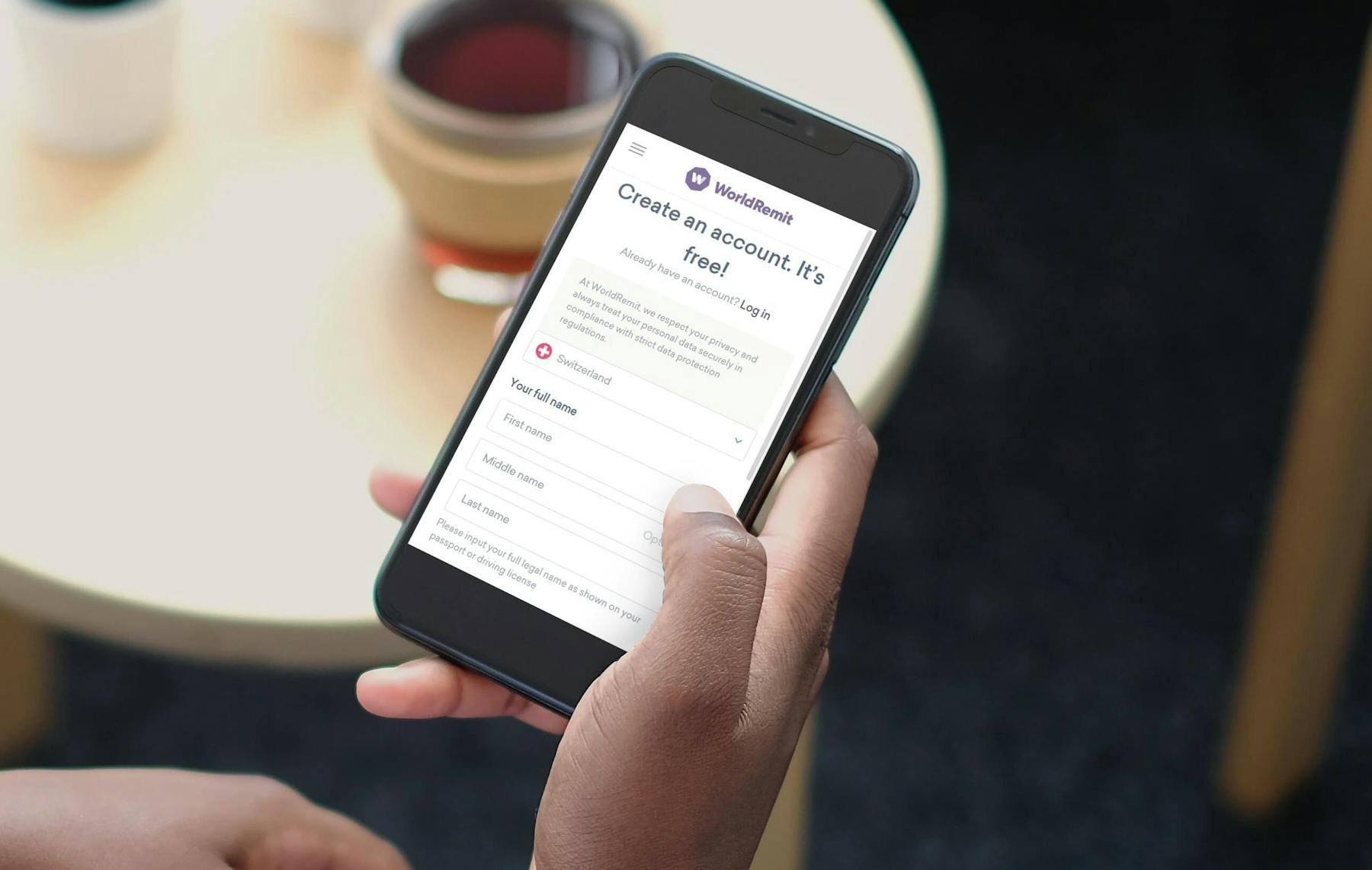

1. Create Your Account

If you don’t have a WorldRemit account, you can start by signing up on the official website or downloading the app from the App Store or Google Play. You’ll sign up with your email address and create a password to secure your account.

You’ll also have to provide the following details:

- Your full name

- Gender

- Physical address

- Mobile phone number

Depending on where you are and how much you want to send, you may have to verify your identity before transacting on the platform. Fortunately, verification is also a simple process that involves collecting a copy of your government-issued ID. The verification can be completed within 5 minutes of submitting your documents.

2. Initiate the Transfer

Once you have an account, you can send and receive money via WorldRemit. You can begin the transfer by selecting the recipient country from the list of countries available. In this case, you’ll choose Uganda.

Next, you’ll enter the amount you wish to send and select your preferred receive method. WorldRemit will show you the exchange rate and all fees upfront before you make the transfer.

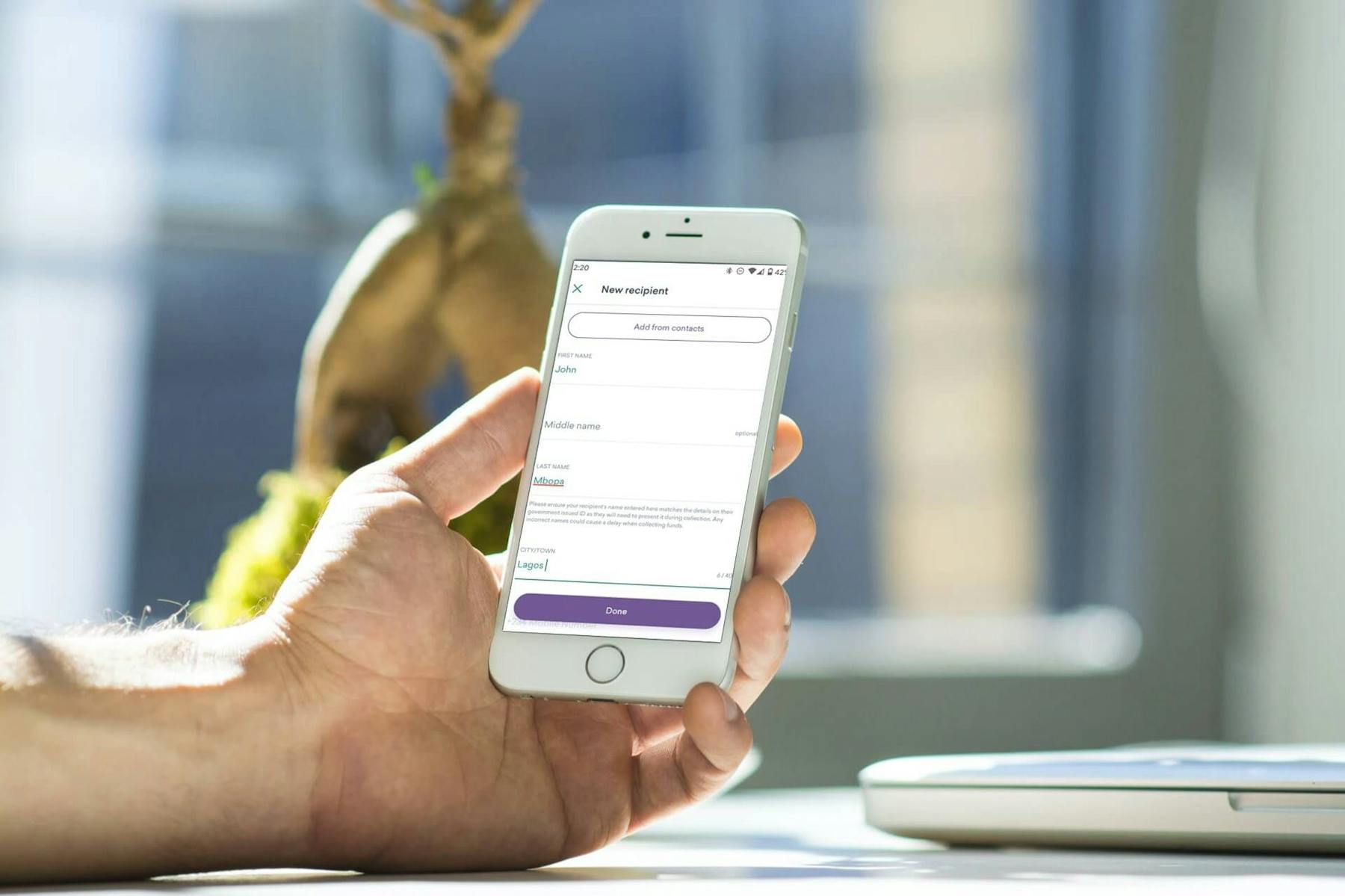

3. Enter Your Recipient’s Details

You must have your recipient’s details before starting the transfer. The specific details required will depend on the transfer method you choose. Generally, you should expect to provide the following information regarding your recipient:

- Full name: Enter the recipient’s full official name as it appears on their ID.

- Address: You need to specify the recipient’s city.

- Account details: If you choose to send via bank transfer, you must provide your recipient's bank name, specific branch name, and account number.

- Mobile number: You must also provide the recipient’s contact number so they can be updated.

- Sending reason: You also have to indicate why you’re sending the money. Options include “purchase of services,” “family or friend support,” and more.

- Email: You can also provide the recipient’s email address, which is optional. WorldRemit will email your recipient with details of the transfer.

4. Pay for the Transfer

WorldRemit offers various payment methods. You can deposit into your WorldRemit account via bank transfer or using a debit or credit card. Depending on your country of residence, you may have more options, including:

- Apple Pay

- Mobile money

- Trustly

- Interac

- iDeal

- Poli

How To Receive Money From WorldRemit in Uganda

How you receive money from WorldRemit in Uganda depends on the chosen transfer method. You can either receive it via mobile money or cash pick-up.

Mobile Money

With mobile money accounts, there isn’t much required from you as the recipient. The sender has two options for sending money to Uganda via mobile money: MTN Uganda and Airtel money.

To receive the money, you must have an active account that’s fully registered under your name. Mobile money transfers are usually instant, making them the more convenient option for most.

WorldRemit notifies you and the sender via email when the funds have been credited to your account. Sometimes, WorldRemit may require additional information before processing the transfer, in which case they will email you.

WorldRemit does not charge you any transfer fees as the recipient, but local operators may charge you for withdrawing the funds, depending on the mobile operator’s policy. In this case, local rates apply.

Cash Pick-Up

If the sender chose cash pick-up as the transfer method, you can collect the money from any of WorldRemit’s branches in Uganda. The funds are usually available for pick up within a few minutes, but there may be a need to provide more information before the transfer is processed.

You’ll be required to provide the following when collecting the money:

- Valid photo ID: This can be your national ID card, Ugandan passport, driving license, or foreign passport.

- Transfer number: WorldRemit notifies you and the sender when the funds are ready for pick-up. They also send a transfer reference number, which you’ll need to quote when collecting the money.

FAQs About WorldRemit Transfer in Uganda

Is WorldRemit still operating in Uganda?

As of June 6, 2022, WorldRemit ceased outbound financial services from Uganda, but the decision does not affect customers receiving funds in the country. So, you can still receive money via WorldRemit without disruption.

Which banks use WorldRemit in Uganda?

All major banks in Uganda use WorldRemit.

Where is WorldRemit located in Uganda?

WorldRemit has branches in La-Cedri Bureau de Change, Shumuk Forex Bureau, Finca, City Forex Bureau, Unimoni, MoneyWorld, Guild Frank Forex Bureau, and Diamond Trust Bank.

Read Our Other WorldRemit Money Transfer Guides

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.