PayPal International Fees & How to Avoid Cross-Border Charges

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Byron Mühlberg

Reviewer

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

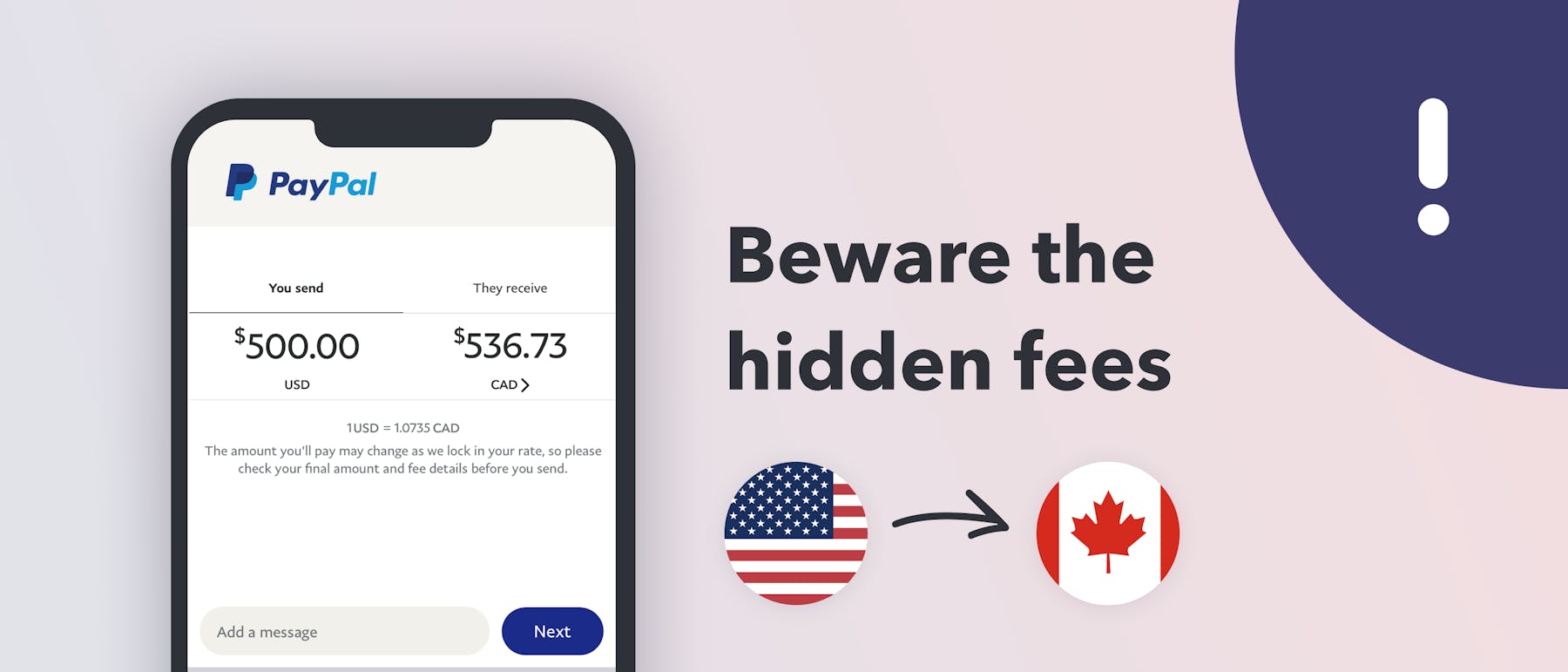

Read moreAlthough PayPal is one of the most well-known money transfer and payment processor companies in the world, it is usually an expensive option for international wires, bank transfers, currency exchange, and business transactions. PayPal also updates its fee schedule often, making it difficult to keep track of its rates.

As a general rule, PayPal's transaction fees will be waived if you send money domestically from your online PayPal account, a linked bank account, or from the PayPal app. However, PayPall will charge a 2.9% fee and a 30-cent fixed fee if you make a transaction with a debit, a credit card, or your PayPal credit.

PayPal's international fees are even more expensive. Even if you send money directly using your Paypal balance or the PayPal app, you'll be charged high fees and bad exchange rates. In this end-to-end guide, we will offer tips for avoiding PayPal's international fees and offer cheaper alternatives, including Revolut, Cash App, and Payoneer.

Key Facts About PayPal's International Fees

| 🏦 Domestic Transfer with PayPal | $0.00 |

|---|---|

| 💳 Domestic Transfer with Card | 2.90% + fixed fee |

| 💰 Currency Conversion Fee | 5.00%+ |

| 💱 Exchange Rate Margin | 4.00%+ |

| 🌐 Sending with Xoom | 2.9%+ fee & weak fx rate |

| 🤔 Cheapest Alternative? |

If you want to make an international payment or money transfer, then we highly recommend you first run a search on our comparison engine below (since PayPal is never the cheapest option):

Find cheaper ways than PayPal to transfer money or exchange currency:

The Ultimate Guide to PayPal's International Fees and Rates

- 01. Does PayPal charge a fee to send money domestically?

- 02. Can I use PayPal for international transactions?

- 03. What are PayPal’s currency conversion fees?

- 04. I need to withdrawal money out of PayPal

- 05. I do business through PayPal as a vendor

- 06. I want to send and receive donations on PayPal

- 07. I'm buying, selling, and transferring cryptocurrencies

- 08. Cheaper alternatives to PayPal

- 09. How to avoid PayPal's international fees

Does PayPal Charge a Fee to Send Money Domestically?

The basic principle to note is that domestic bank transfers and transfers between PayPal users are free of charge. You can use your PayPal balance to pay for a purchase or make a donation as long as it is a domestic transaction.

However, if you use a credit or debit card, then you will incur a 2.9% fee and a 30-cent fixed transaction fee. If you're a merchant or the host of a fundraiser, PayPal will charge you a percentage and fixed fees on every good or service you sell.

Payment Method | Fee Amount |

|---|---|

PayPal balance or bank account | No fee |

Cards | 2.90% + fixed fee |

Amex Send™ Account | No fee |

Can I Use PayPal for International Transactions?

Yes, PayPal is available in 200 countries, making it one of the most widely adopted financial platforms in the world. If both the sender and the receiver have a PayPal account, then PayPal will charge a foreign transaction fee:

- Foreign Transaction Fee: This fee is around 5% of what you send. But it will be at least $0.99 and no more than $4.99.

If your recipient does not have a PayPal account, then Xoom (which is owned by PayPal) will process the transaction. Xoom is a money transfer service that's integrated into PayPal that will help you send money to your recipient's bank account. However, it is usually very expensive for most countries and currencies.

Instead, we highly recommend using our real-time comparison engine to find better international money transfer rates than PayPal.

Payment Method | Fee Amount |

|---|---|

| 0.05 |

Debit/Credit Card | 0.05 |

Amex Send™ Account | 0.05 |

PayPal’s International Currency Conversion Fees

When you send money internationally to another account, PayPal will convert your currency to foreign currency and charge a fee:

- Currency Conversion Fee: The fee for changing US dollars to Canadian dollars is about 3.5%. For almost all other currency exchanges, this fee will be around 4%.

Remember, the currency conversion fee is in addition the foreign transaction fee. Plus, there isn't a minimum or maximum limit for this conversion fee (aka hidden exchange rate margins). The larger the transaction amount, the more you'll pay.

Transaction Type | Fee |

|---|---|

Paying in a different currency | 0.04 |

Sending money in a different currency | 0.04 |

Sending money with PayPal Payouts in a different currency | 0.04 |

If you use Xoom to send money, they have their own fee system. Learn more with our in-depth Xoom review :

- Xoom Commission: Xoom will typically charge between 2.9% and 3.3% of the total amount you are sending.

- Exchange Rate Margin: In addition to the commission, Xoom also weakens the exchange rate against your favor. They usually add about 0.4% to 1.5% to the current rate, and they pocket this difference.

Compare Xoom, PayPal, and cheaper ways to send money abroad:

Fees For Making Withdrawals Out of PayPal

It is free to withdraw money out of your Paypl balance into your home bank account. This could take up to three business days, which is why PayPal offers Instant Transfers as a service for a 1.75% fee.

Also, keep in mind that the withdrawal limit for instant bank transfers is $25,000 per transaction. The withdrawal limit to debit or credit cards is $5,000 per transaction.

Method | Fee |

|---|---|

Standard withdraw to local bank account | $0.50 USD |

Instant withdrawal to local bank account | 1.75% of amount transferred |

Withdraw to linked debit card | 1.75% of amount transferred |

Have paper check mailed to you | $1.50 USD |

Merchant Fees: Selling With PayPal

PayPal's fixed fees for merchants who use the service to sell goods and services are so complex that they deserve an article of their own. The company offers many solutions for businesses to complete customer transactions.

In general, PayPal’s payment processing rates range from 1.9% to 4.99%, plus a fixed fee that ranges from 5 cents to 49 cents. In addition, be aware that you will lose money to their weak exchange rates if you receive transactions that require currency conversion.

As a business owner, the most common fee you will probably encounter is the rate for Standard Credit/Debit Card Payments:

- 2.99% plus $0.49 per transaction.

For a full and easy-to-navigate view of PayPal's fees, please reference the table below that we have prepared. Here is the information that corresponds to each tab:

1: Domestic Commercial Transactions

- 1a: Fixed Fee For Domestic Commercial Transactions

- 1b: Fixed Fee For QR Code 10.01 USD+

- 1c: Fixed Fee For QR Code 10.00 USD or Less

2: PayPal Online Card Payment Services

- 2a: Fixed Fee For Online Card Payment

3: Other PayPal Products

How Customers Pay | Merchant Fee |

|---|---|

PayPal Checkout | 3.49% + fixed fee |

PayPal Guest Checkout | 3.49% + fixed fee |

QR code Transactions – 10.01 USD and above | 1.90% + fixed fee |

QR code Transactions – 10.00 USD and below | 2.40% + fixed fee |

QR code Transactions through third party integrator | 2.29% + 0.09 USD |

Pay with Venmo | 3.49% + fixed fee |

Send/Receive Money for Goods and Services | 0.0299 |

Standard Credit and Debit Card Payments | 2.99% + fixed fee |

For international commercial transactions | Additional 1.5% |

Currency received | Fixed fee |

|---|---|

US dollar | 0.49 USD |

Australian dollar | 0.59 AUD |

Brazilian real | 2.90 BRL |

Canadian dollar | 0.59 CAD |

Czech koruna | 9.00 CZK |

Danish krone | 2.90 DKK |

Euro | 0.39 EUR |

Hong Kong dollar | 3.79 HKD |

Hungarian forint | 149.00 HUF |

Israeli new shekel | 1.60 ILS |

Japanese yen | 49.00 JPY |

Malaysian ringgit | 2.00 MYR |

Mexican peso | 9.00 MXN |

New Taiwan dollar | 14.00 TWD |

New Zealand dollar | 0.69 NZD |

Norwegian krone | 3.90 NOK |

Philippine peso | 25.00 PHP |

Polish zloty | 1.89 PLN |

Russian ruble | 39.00 RUB |

Singapore dollar | 0.69 SGD |

Swedish krona | 4.09 SEK |

Swiss franc | 0.49 CHF |

Thai baht | 15.00 THB |

UK pounds sterling | 0.39 GBP |

Currency received | Fixed fee |

|---|---|

US dollar | 0.10 USD |

Australian dollar | 0.10 AUD |

Brazilian real | 0.20 BRL |

Canadian dollar | 0.10 CAD |

Czech koruna | 3.00 CZK |

Danish krone | 0.70 DKK |

Euro | 0.10 EUR |

Hong Kong dollar | 0.80 HKD |

Hungarian forint | 30.00 HUF |

Israeli new shekel | 0.40 ILS |

Japanese yen | 12.00 JPY |

Malaysian ringgit | 0.70 MYR |

Mexican peso | 2.00 MXN |

New Taiwan dollar | 3.00 TWD |

New Zealand dollar | 0.15 NZD |

Norwegian krone | 1.00 NOK |

Philippine peso | 5.00 PHP |

Polish zloty | 0.50 PLN |

Russian ruble | 3.00 RUB |

Singapore dollar | 0.20 SGD |

Swedish krona | 1.00 SEK |

Swiss franc | 0.10 CHF |

Thai baht | 4.00 THB |

UK pounds sterling | 0.10 GBP |

Currency received | Fixed fee |

|---|---|

US dollar | 0.05 USD |

Australian dollar | 0.05 AUD |

Brazilian real | 0.10 BRL |

Canadian dollar | 0.05 CAD |

Czech koruna | 1.50 CZK |

Danish krone | 0.35 DKK |

Euro | 0.05 EUR |

Hong Kong dollar | 0.39 HKD |

Hungarian forint | 15.00 HUF |

Israeli new shekel | 0.20 ILS |

Japanese yen | 6.00 JPY |

Malaysian ringgit | 0.20 MYR |

Mexican peso | 0.55 MXN |

New Taiwan dollar | 2.00 TWD |

New Zealand dollar | 0.08 NZD |

Norwegian krone | 0.47 NOK |

Philippine peso | 2.50 PHP |

Polish zloty | 0.23 PLN |

Russian ruble | 1.50 RUB |

Singapore dollar | 0.08 SGD |

Swedish krona | 0.50 SEK |

Swiss franc | 0.05 CHF |

Thai baht | 1.80 THB |

UK pounds sterling | 0.05 GBP |

How Customers Pay | Merchant Fee |

|---|---|

Advanced Credit and Debit Card Payments | 2.59% + fixed fee |

Payments Advanced | 2.89% + fixed fee |

Payments Pro | 2.89% + fixed fee |

Virtual Terminal | 3.09% + fixed fee |

For international commercial transactions | Additional 1.5% |

Currency received | Fixed fee |

|---|---|

US dollar | 0.49 USD |

Australian dollar | 0.59 AUD |

Brazilian real | 2.90 BRL |

Canadian dollar | 0.59 CAD |

Czech koruna | 9.00 CZK |

Danish krone | 2.90 DKK |

Euro | 0.39 EUR |

Hong Kong dollar | 3.79 HKD |

Hungarian forint | 149.00 HUF |

Israeli new shekel | 1.60 ILS |

Japanese yen | 49.00 JPY |

Malaysian ringgit | 2.00 MYR |

Mexican peso | 9.00 MXN |

New Taiwan dollar | 14.00 TWD |

New Zealand dollar | 0.69 NZD |

Norwegian krone | 3.90 NOK |

Philippine peso | 25.00 PHP |

Polish zloty | 1.89 PLN |

Russian ruble | 39.00 RUB |

Singapore dollar | 0.69 SGD |

Swedish krona | 4.09 SEK |

Swiss franc | 0.49 CHF |

Thai baht | 15.00 THB |

UK pounds sterling | 0.39 GBP |

PayPal product | Merchant Fee |

|---|---|

Payflow Pro Transaction | Additional 0.10 USD |

Payflow Link Transaction | Additional 0.10 USD |

Zettle Card Transactions | 2.29% + 0.09 USD |

Zettle Manual Card Entry | 3.49% + 0.09 USD |

Zettle QU Code Transactions | 2.29% + 0.09 USD |

Micropayments (in the US) | 4.99% + fixed fee |

Fees For Receiving and Sending Donations With PayPal

It is free for you to send a donation via PayPal to a fundraiser domestically. If you send a donation to someone abroad, then you'll be charged the same currency conversion fees as any other international PayPal transfer.

Fees become a bit more complicated if you are the creator of the fundraiser who is asking for donations. We show this in the table below. What you need to know is that fees for using PayPal's 'Donate' button or PayPal's 'Checkout for Donations' both charge 2.89% plus a fixed fee. This fixed fee varies by currency (also shown in the table).

PayPal also offers listed fundraisers, which are promoted by PayPal on the web and app. The fee is 2.99%. However, if the fundraiser is unlisted and distributed by the host only, there is no fee charged.

Payment Type | Fee |

|---|---|

Donate Button | 2.89% + fixed fee |

PayPal Checkout for Donations | 2.89% + fixed fee |

PayPal Fundraisers (Listed Fundraisers) | 0.0299 |

PayPal Fundraisers (Unlisted Fundraisers) | No Fee |

Currency | Fee |

|---|---|

US dollar | 0.49 USD |

Australian dollar | 0.59 AUD |

Brazilian real | 2.90 BRL |

Canadian dollar | 0.59 CAD |

Czech koruna | 9.00 CZK |

Danish krone | 2.90 DKK |

Euro | 0.39 EUR |

Hong Kong dollar | 3.79 HKD |

Hungarian forint | 149.00 HUF |

Israeli new shekel | 1.60 ILS |

Japanese yen | 49.00 JPY |

Malaysian ringgit | 2.00 MYR |

Mexican peso | 9.00 MXN |

New Taiwan dollar | 14.00 TWD |

New Zealand dollar | 0.69 NZD |

Norwegian krone | 3.90 NOK |

Philippine peso | 25.00 PHP |

Polish zloty | 1.89 PLN |

Russian ruble | 39.00 RUB |

Singapore dollar | 0.69 SGD |

Swedish krona | 4.09 SEK |

Swiss franc | 0.49 CHF |

Thai baht | 15.00 THB |

UK pounds sterling | 0.39 GBP |

Fees for Buying, Selling, and Transferring Cryptocurrencies on PayPal

When using PayPal to buy, sell, or transfer cryptocurrencies, fees will apply depending on the type of transaction (buying, selling, or transacting). Here's what you need to know:

Purchase or sale amount | Fee |

|---|---|

1.00 – 4.99 USD | $0.49 USD |

5.00 – 24.99 USD | $0.99 USD |

25.00 – 74.99 USD | $1.99 USD |

75.00 – 200.00 USD | $2.49 USD |

200.01 – 1000.00 USD | 0.018 |

1000.01 USD + | 0.015 |

Transfer Type | Fee |

|---|---|

Receiving a crypto transfer | No fee |

Transferring crypto to another PayPal account | No fee |

Transferring crypto to non-PayPal address | You will be charged a cryptocurrency network fee, payable in the crypto of your transfer. This varies by the type of crypto, but PayPal will show this fee on screen before you complete the transaction. |

Cheaper Alternatives to PayPal

PayPal has long been a popular choice for online payments, but it's not always the best option for every situation. Especially when it comes to travel and international shopping, PayPal's conversion fees can add up quickly and leave you with less money in your pocket. That's why it's worth considering some alternatives that may better suit your needs. We'll introduce you to three alternatives to PayPal: Revolut, Cash App, and Payoneer.

1 — Revolut

Revolut, on the other hand, is an international peer-to-peer solution that offers a multi-currency account. With this powerful account, you'll get the real mid-market exchange rate instead of a weak markup by PayPal. This makes Revolut a great choice for anyone who frequently travels or shops online from international marketplaces. Plus, Revolut also offers other features like fee-free ATM withdrawals and the ability to hold and exchange up to 28 different currencies.

2 — Cash App

Cash App is a domestic peer-to-peer platform that allows you to easily send and receive money from friends and family without any hidden fees. Unlike PayPal, Cash App has a straightforward fee schedule that is easy to understand, making it a great choice for anyone looking for a simple and transparent way to send money domestically.

It is becoming easier to use every day, as it is one of the fastest-growing peer-to-peer networks in the United States and the UK. You can send money for no fees and no exchange rate markups to the UK with Cash App too.

3 — Payoneer

For merchants, we recommend Payoneer. This platform offers good integrations into other online marketplaces and uses the mid-market exchange rate to do international transactions, meaning there's no exchange rate margin as you would see with PayPal. Instead, Payoneer charges a flat percentage fee when you withdraw funds to your local bank account. Payoneer also gives you unique bank account details in over 10 foreign currencies, making it a great choice for anyone who does business internationally.

How to Avoid PayPal's International Fees

PayPal fees can add up quickly for debit or credit card payments, instant transfers, and any transactions involving foreign currency. These fees can be steep for businesses too, making PayPal a less favorable option compared to its competitors.

To avoid PayPal fees, there are several strategies to consider:

- Fund transactions through your PayPal account to avoid additional fees associated with credit and debit cards.

- If you are operating as a business, compare the business fees offered by Revolut Business, Cash App business, and Payoneer.

- Incorporate PayPal costs into service pricing when dealing with international partners, particularly for large or frequent transactions.

- Deduct PayPal and other payment processing fees as necessary business costs, providing a potential avenue for recouping some of the expenses at tax time.

- Most importantly, use an international money transfer service instead of PayPal to send money abroad.

According to Monito's search engine, PayPal is one of the worst options for converting currency and sending money abroad because they apply very weak exchange rates to your transfers. Use our comparison search engine below to find a more transparent and cost-effective solution 👇

Compare PayPal fees for bank transfers and currency exchange:

Frequently Asked Questions About PayPal Fees, Rates, and Charges

What are the fees for using PayPal?

The fees for using PayPal depend on the type of transaction and the location of the buyer and seller. Peer-to-peer payments using a PayPal balance or local bank transfer are typically free, while using debit or credit cards and making instant transfers can be more expensive. Sending money abroad or spending at foreign merchants also incurs high fees, and businesses using PayPal may face numerous fees that are less competitive than other payment processors.

What are the fees for transferring money from PayPal to a bank account?

Transferring money from PayPal to a bank account is generally free when using a local bank account and no currency conversion is involved. However, if currency conversion is needed or if it is an instant transfer, then there is a fee of 1.75% of the transferred amount.

How can I avoid paying fees on PayPal?

You can avoid paying fees on PayPal by choosing to send money through PayPal balance or a linked bank account, rather than using a credit or debit card. Additionally, use our comparison engine to find a cheaper provider for international currency conversions. Finally, if you are a merchant, consider using alternative payment platforms with lower fees like Payoneer for business transactions.

How much does PayPal charge to send money?

PayPal charges a fee of 2.9% + $0.30 USD per transaction to send money domestically or internationally, unless the payment is funded by a PayPal balance or a bank transfer. International transfers cost 5.00% of the total transaction, plus they exchange your money at a weaker rate than the market rate. Use our comparison engine to find a cheaper provider for international money transfers.

What is the currency conversion fee for PayPal?

- 5.00% of the total transaction;

- 4.00%+ exchange rate margin.

Use our comparison engine to find a cheaper provider for international money transfers.

What is the exchange rate for PayPal?

PayPal's exchange rate is typically 4.00% weaker or more than the real mid-market exchange rate. This leaves you with a large hidden exchange rate margin fee, which is why we highly recommend you run a search on our comparison engine to find a cheaper provider for international money transfers.

Is there a PayPal fees calculator?

Have a look at these useful calculators to understand PayPal fees and how they apply:

- NerdWallet PayPal Fee Calculator: Calculate PayPal fees for digital, in-person, or card payments.

- The Fee Calculator: Use The Fee Calculator to compare PayPal and Stripe fees side-by-side.

- SaleCalc: Provides detailed fees for various PayPal transactions and third-party marketplaces.

Does PayPal charge a fee for receiving money?

PayPal generally does not charge a fee for receiving money, unless the payment is coming from another country or currency. In such cases, a currency conversion fee may apply, which is detailed in the tables here.

How much is the PayPal fee for $100?

If you are an online merchant, the most common PayPal fee will charge you when customers pay you is 3.49% + $0.49. The fee for a $100 transaction would be $3.98. The total money you would receive after fees is $96.02.

Why did PayPal charge me a fee for receiving money?

PayPal charges you a fee as a recipient if your sender used a currency conversion. This is a sneaky hidden fee. Use our comparison engine to find more transparent providers for international money transfers.

How much is the PayPal fee for $3,000?

If you're sending $3,000 domestically to another PayPal user, then the fee will be $0.00. If you are sending this abroad, PayPal will charge you for making a currency conversion. This is 5.00% of the amount plus a fixed fee. However, PayPal has a max limit of $4.99, so you'd pay $4.99 for a $3,000 transfer.

Keep in mind that your recipient will lose money because PayPal will also apply a weak exchange rate on top of the transfer. This is why we recommend you run a search on our comparison engine instead.

Compare PayPal to Cheaper and More Transparent International Money Transfer Companies

Other Guides About PayPal Fees and Better Ways to Send Money

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.