Xoom to GCash: How to Send Money From Xoom to GCash

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreIn the Philippines, GCash is a widely used and well-regarded mobile wallet. However, many people use Xoom to send money to GCash, but it usually results in high transfer fees and unfavourable exchange rates. To shed light on these hidden costs, this article explains how to transfer money from Xoom to GCash.

For a more cost-effective and efficient solution, we recommend Remitly over Xoom for sending remittances to GCash. To find the best option for your needs, you can use Monito's live comparison tool below to compare Remitly with other alternatives to Xoom 👇

Find the best provider to send money to GCash in the Philippines:

How Do I Send a Remittance from Xoom to GCash?

To start transferring money from Xoom to GCash, you need to create a Xoom account by signing up and downloading the mobile app. The process is simple and quick. Once you have set up your Xoom account, you can link it with GCash by using your Xoom account information.

Follow the steps below to link your Xoom account to your GCash account:

How to Send Money From Xoom to GCash

Step 01

Link your GCash and Xoom together

- Open GCash and navigate to "Profile";

- Click "Linked Accounts";

- Click "Xoom" and enter the email registered with Xoom;

- Authorize the link and enter your Xoom password.

![Link accounts to GCash]() GCash

GCash Step 02

Cash In with Xoom

- On the GCash homepage, go to "Cash In";

- Under the Global Partners and Remittance tab, click "Xoom";

- Enter the amount to send to GCash (₱500.00 minimum);

- Confirm the transfer.

![]()

Final step

Compare alternatives instead

Send with Remitly instead ❯- If you are converting foreign currency into Philippine pesos, then Xoom will charge a hidden exchange rate markup;

- Consider alternatives with Monito's comparison engine.

Xoom's Fees to Send a Remittance to GCash

Xoom offers four ways to send money overseas: bank transfer, credit card, debit card, or PayPal balance.

At Monito, we have analyzed search data for thousands of international money transfers from around the world to the Philippines. Xoom was the cheapest option on less than 1% of all of these comparisons done on Monito in 2022. Compare Xoom here.

Overall, sending money with Xoom to GCash will be relatively expensive.

Xoom to GCash International Transfer Fees

If you send a remittance from Xoom to GCash, then you will be charged Xoom's mobile wallet fee. This is a fixed fee for sending money to a mobile wallet, like GCash.

- Fee for Mobile Wallet: €0.99 (or equivalent)

What is often more costly is Xoom's hidden exchange rate markup. To make a profit off of you, Xoom applies an exchange rate that is weaker than the live market rate. Xoom will pocket this difference.

- Exchange rate margin: 1.1% to 4.3% on average

What Are the Best Xoom Alternatives to Send Money to GCash?

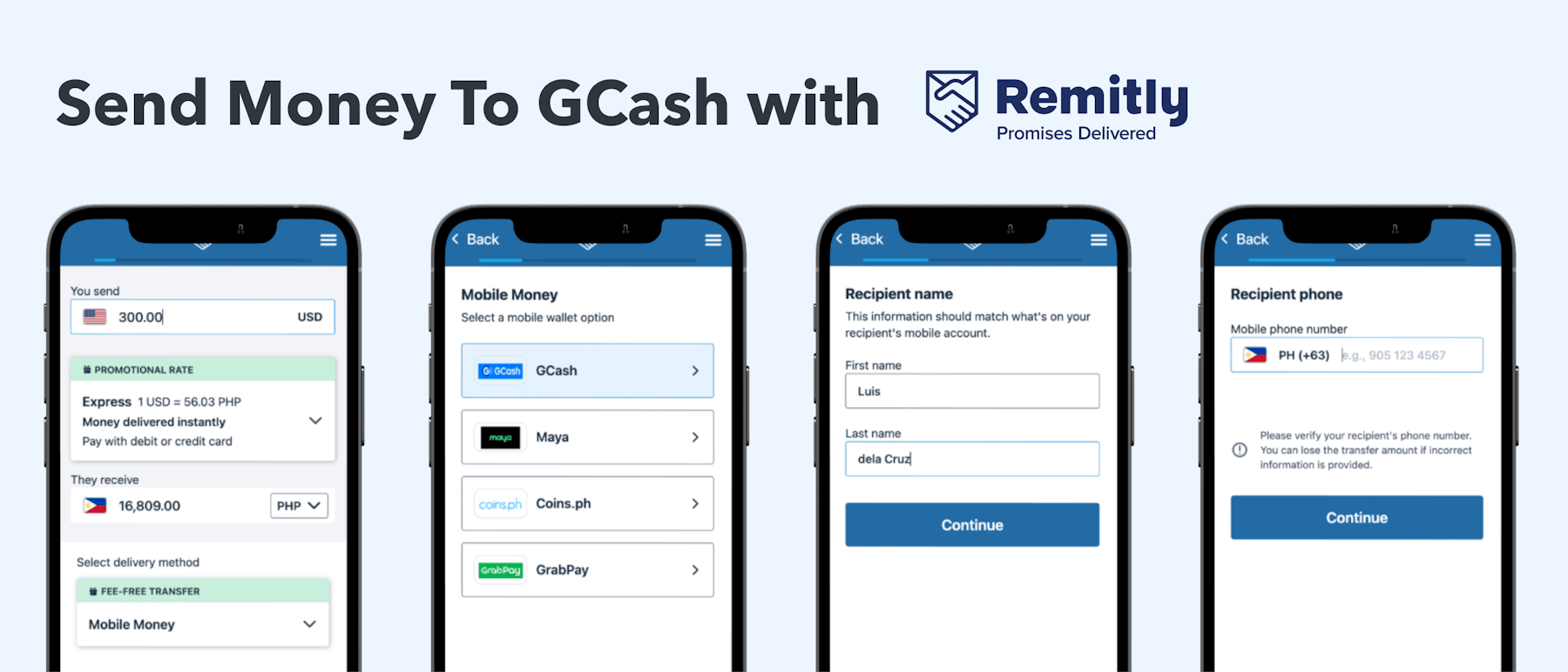

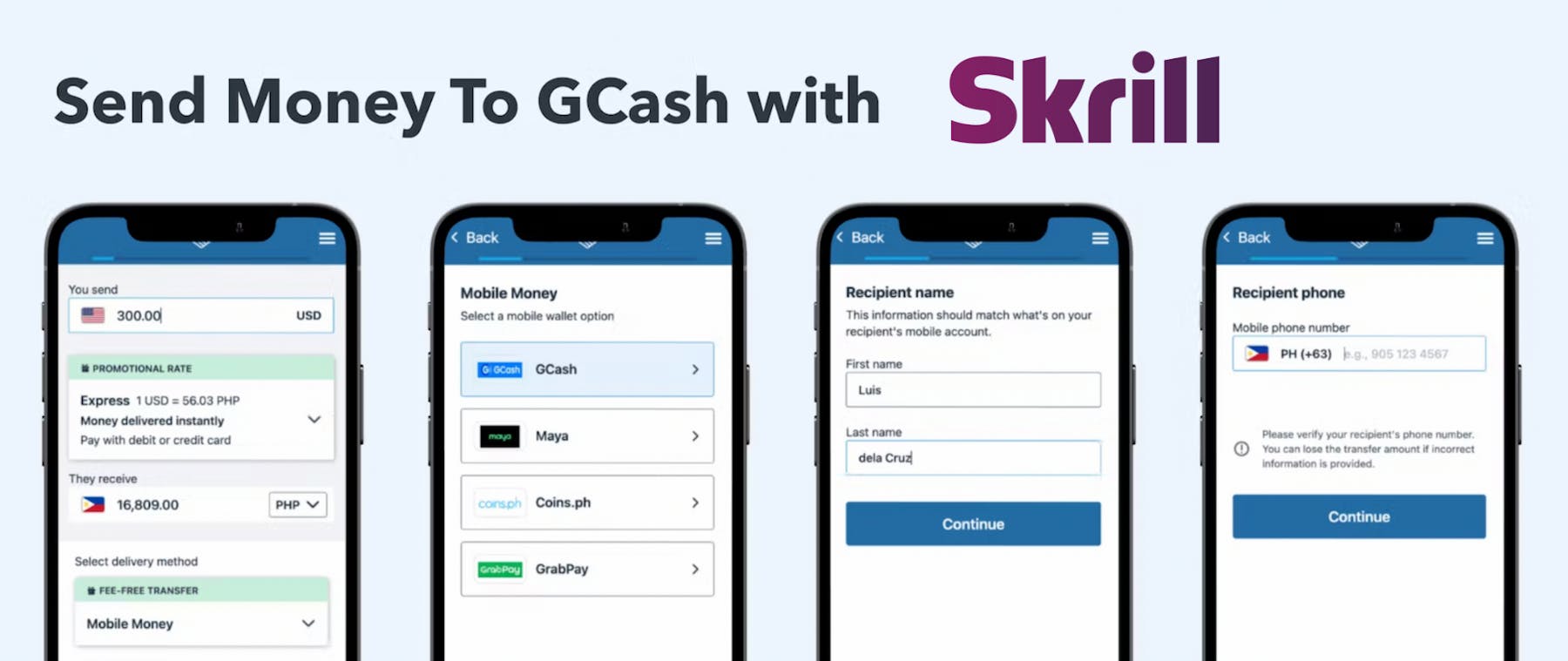

If you're looking to send money to GCash, Remitly is a great option. On average, it's one of the cheapest ways to send remittances to the Philippines, especially when compared to Xoom.

In fact, according to Monito's 2022 search data, Remitly was the top choice for remittances to the Philippines. WorldRemit took second place while Wise took third in 2022.

Remitly is available in many countries across North America, Europe, and Asia, including the United States, India, and Japan. To get started, simply open an account with Remitly and follow their easy sign-up process. With competitive rates and reliable service, you can feel confident in your choice to use Remitly for your money transfers to GCash.

Remitly

Like Xoom, Remitly is also a GCash partner. You'll have two ways to send money from Remitly to GCash. You can enjoy instant transfer speed if you pay by debit card (Express). Or if you pay by bank account (Economy), then the transfer can take 3 to 5 days to arrive in your GCash wallet.

Remitly to GCash Transfer Fees

The fixed fee that Remitly will charge you will depend on your selected delivery service. Economy transfers are completely free. The Express service gets you instant transfers for $3.99 per transfer.

- Economy transfer fee: Free

- Express transfer fee: $3.99

Remitly to GCash Exchange Rates

For both the Economy Service and the Express Service, Remitly will apply the same exchange rate on your international remittance to GCash. On average, Remitly applies a foreign exchange rate of 0.5% to 2.0%, which is weaker than the real mid-market price. The company also offers a promotional markup of just 0.02% for first-time transfers.

- Exchange rate margin: 0.5% to 2.0%

Remitly to GCash Transfer Limits

The GCash wallet limit to receive funds is P100,000. The maximum you can send per month is $30,000 (or an equivalent amount).

In summary, we highly discourage using Xoom. While Xoom is a trusted GCash partner that links seamlessly to your GCash account and is fast, its fees are often very high.

Instead, we recommend Remitly as an international money transfer service to the Philippines. Not only was it the cheapest provider in the world in 2022 for nearly 22% of all searches on Monito. It was also the cheapest service for 39% of Monito comparisons for transfers to the Philippines.

If you're still not sure if its the cheapest or safest, use our real-time comparison engine below to compare Remitly to other top remittance companies 👇

Find a Xoom alternative to send remittances cheaply to GCash:

Frequently Asked Questions About How to Send Money From Xoom to GCash

How do I send money to GCash?

You can use an international money transfer service, such as Remitly or WorldRemit, to send your money directly to the GCash mobile wallet. These companies are far cheaper, faster, and more transparent than traditional banks or Xoom.

How do I claim money from Xoom Philippines?

To receive money from Xoom to GCash, follow these steps:

- On the GCash homepage, go to "Cash In";

- Under the Global Partners and Remittance tab, click "Xoom";

- Enter the amount to send to GCash (₱500.00 minimum);

- Confirm the transfer.

How do I link Xoom to GCash?

Here's how to link Xoom to GCash on the mobile app:

- Open GCash and navigate to "Profile";

- Click "Linked Accounts";

- Click "Xoom" and enter the email registered with Xoom;

- Authorize the link and enter your Xoom password.

How can I send money from USA to GCash?

You have many options to send money from the USA to GCash in the Philippines. Remitly and Skrill are two that we recommend. For a full explanation, read our guide on how to send money to GCash from the USA.

Other Money Transfer Guides On GCash and How to Receive Money on GCash Internationally

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.