Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 50+ money transfer providers

- We've made 100+ test transfers

- Our writers have been testing providers since 2013

Sending Money to Another Mobile Wallet?

Below, you'll find all our guides helping you to send money to various mobile wallets between different countries worldwide:

Other Money Transfer Guides

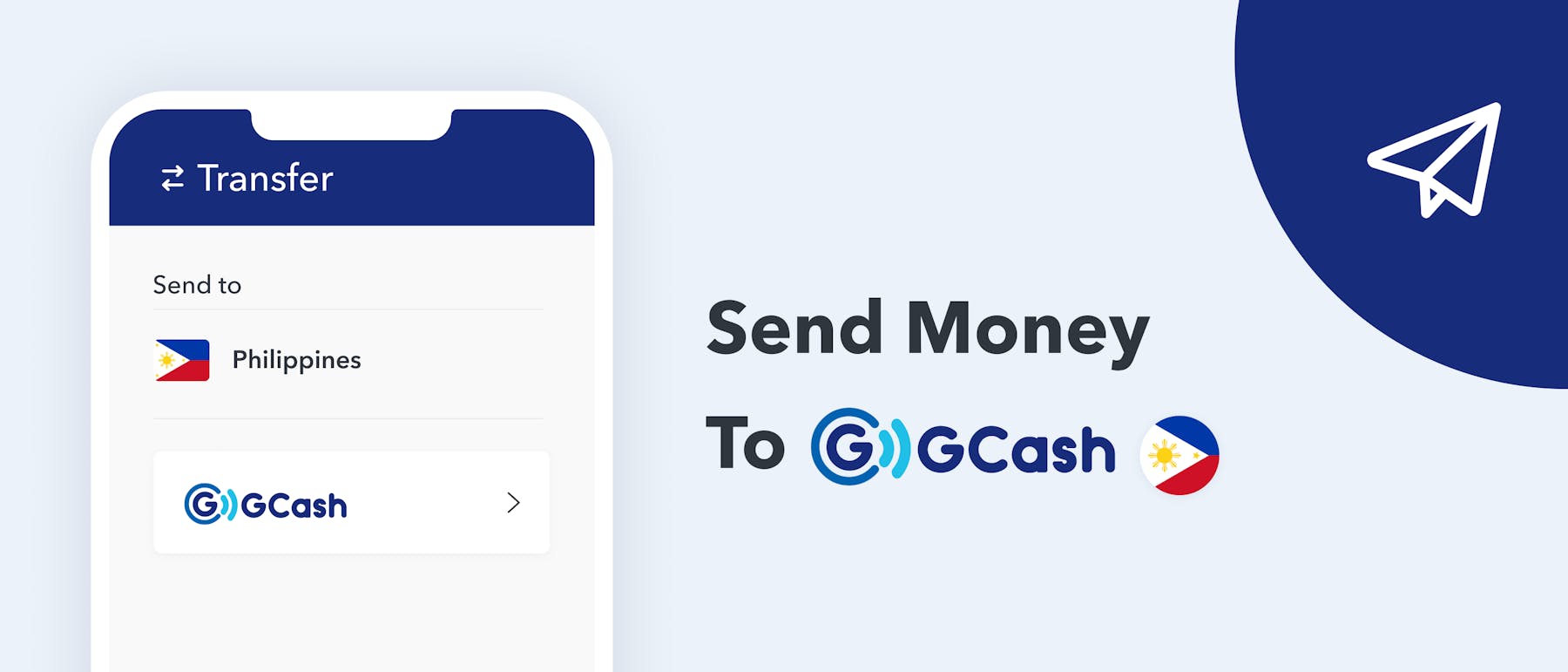

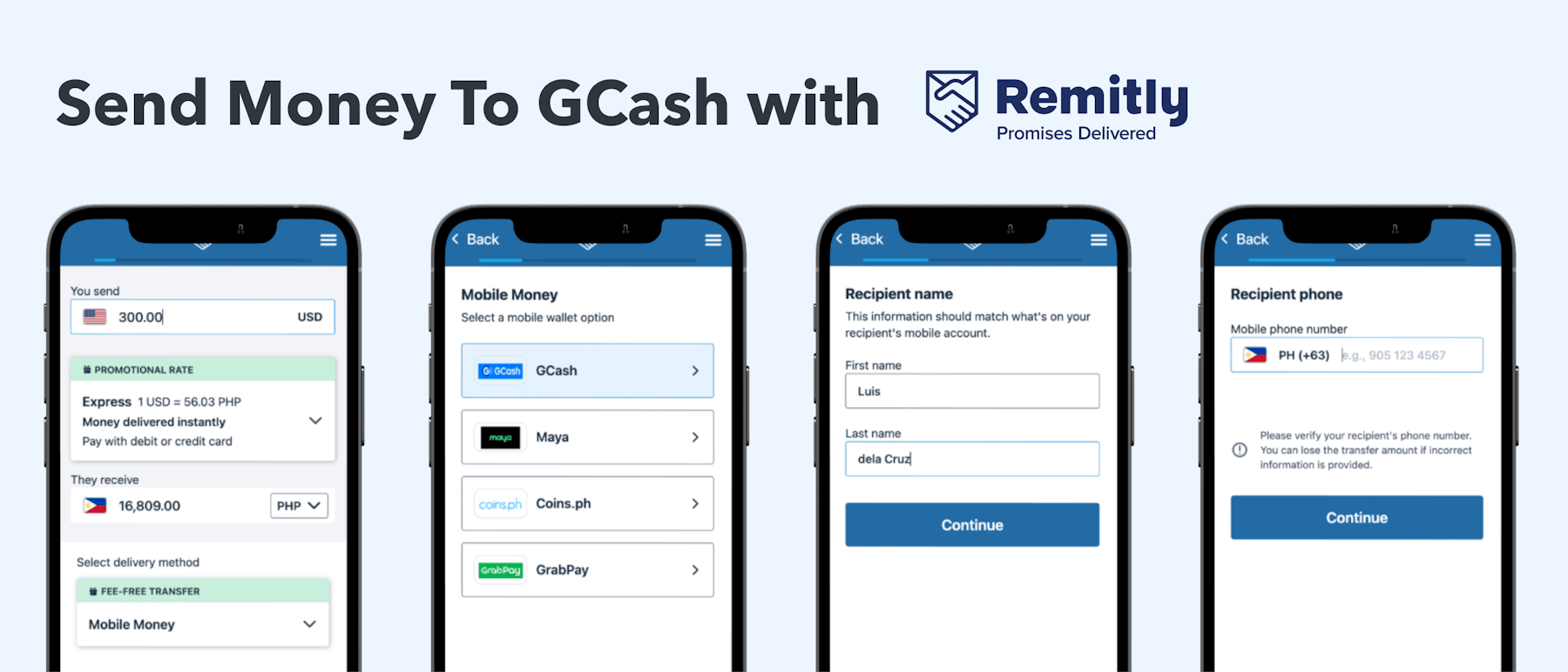

Sending to GCash in the Philippines

February 20, 2024 - by Jarrod Suda

Is GCash International?

February 10, 2023 - by Jarrod Suda

GCash USA to Philippines

January 25, 2024 - by Jarrod Suda

Sending to GCash from Japan

January 24, 2024 - by Jarrod Suda

Mobile Money

September 30, 2022 - by François Briod

LBC Remittance Partners

November 17, 2022 - by Byron Mühlberg

Xoom to the Philippines

April 6, 2023 - by Byron Mühlberg

PayPal Philippines to US

February 2, 2023 - by Byron Mühlberg

Free international ATM withdrawals with certain banks--who gives you what

March 6, 2019

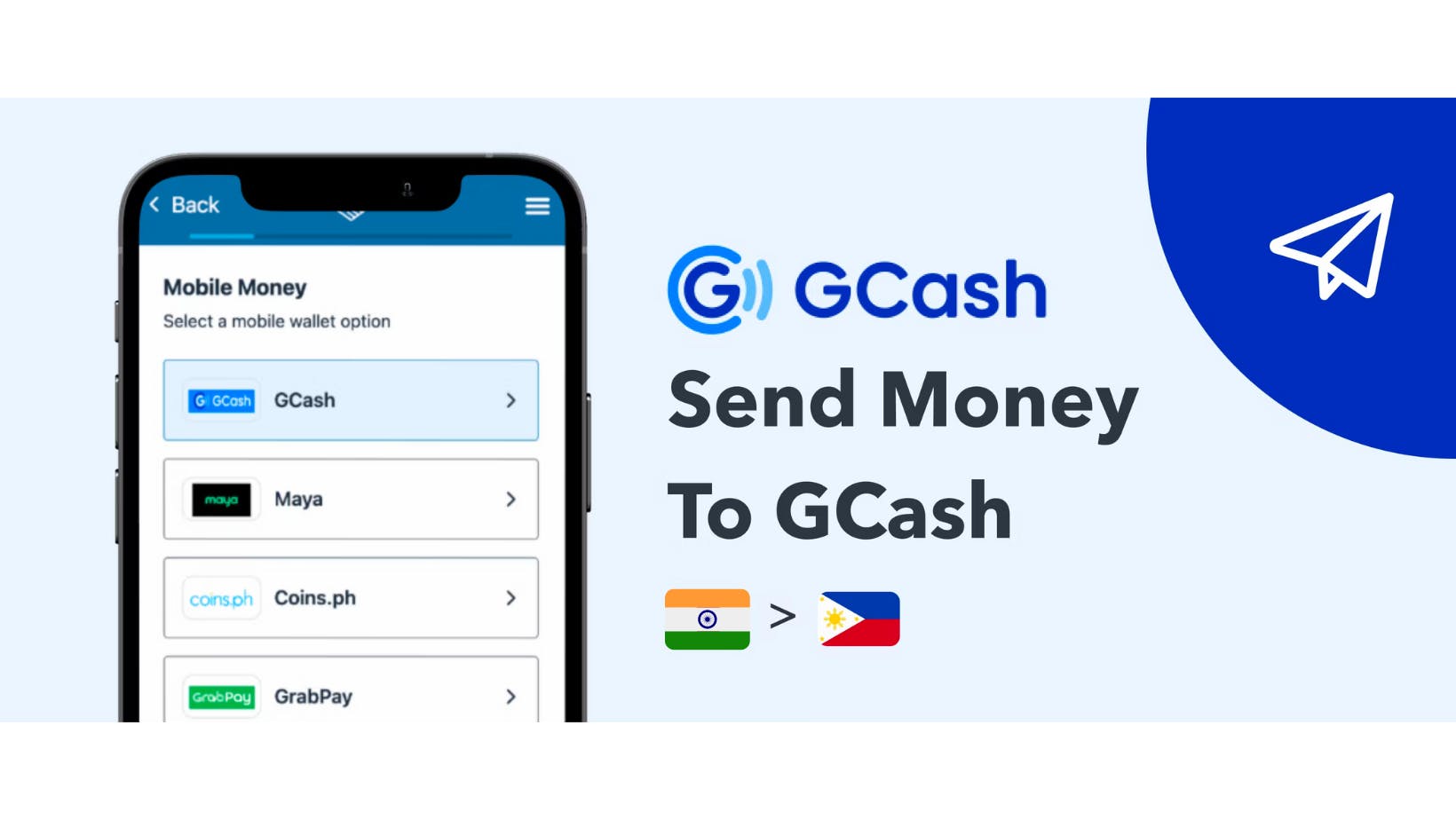

Cheap Transfers to India From USA

October 13, 2023 - by Byron Mühlberg

Sending Money To India With Remitly

February 14, 2023 - by Byron Mühlberg

Open a US Bank Account From India

December 14, 2021 - by Jarrod Suda

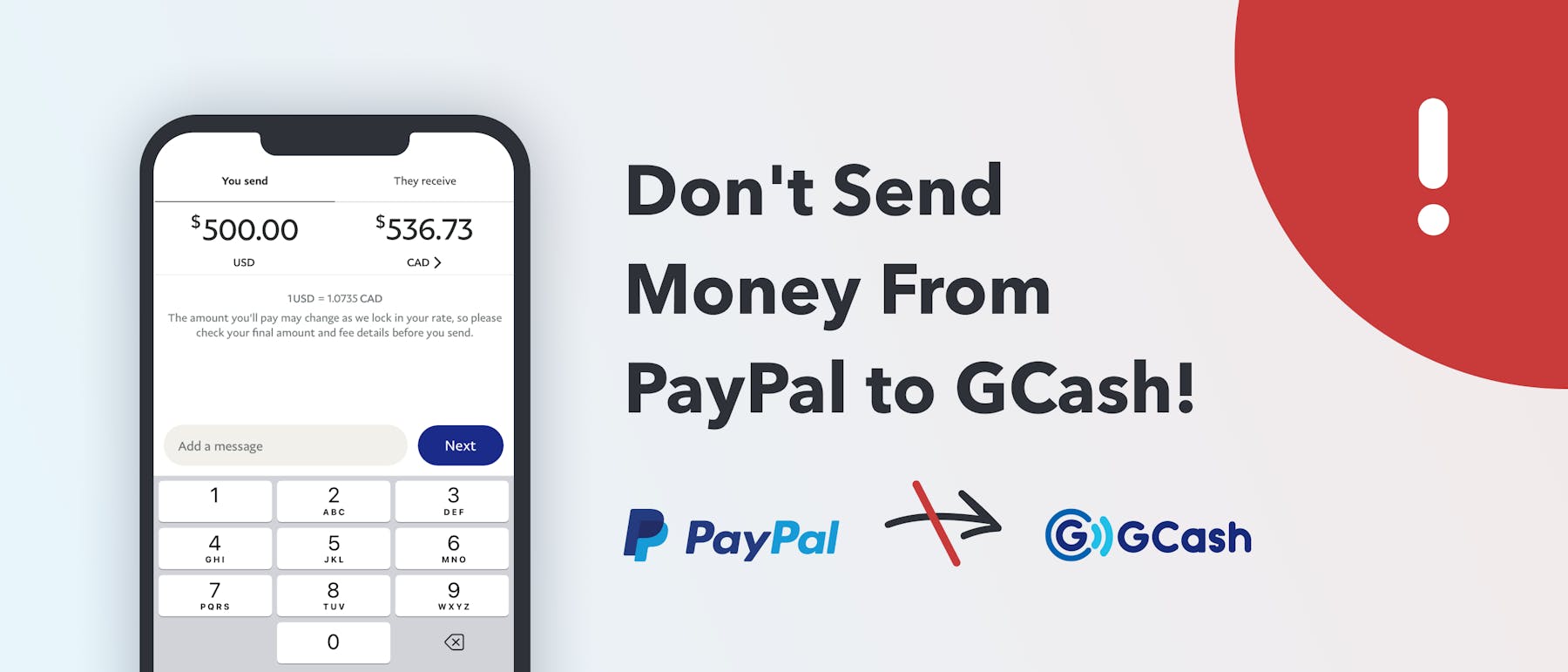

How to Transfer From PayPal to GCash (Plus Cheap Alternatives)

October 11, 2023 - by Jarrod Suda

Western Union to GCash

October 6, 2023 - by Jarrod Suda

How to Receive Money From WorldRemit to GCash

February 28, 2023 - by Jarrod Suda

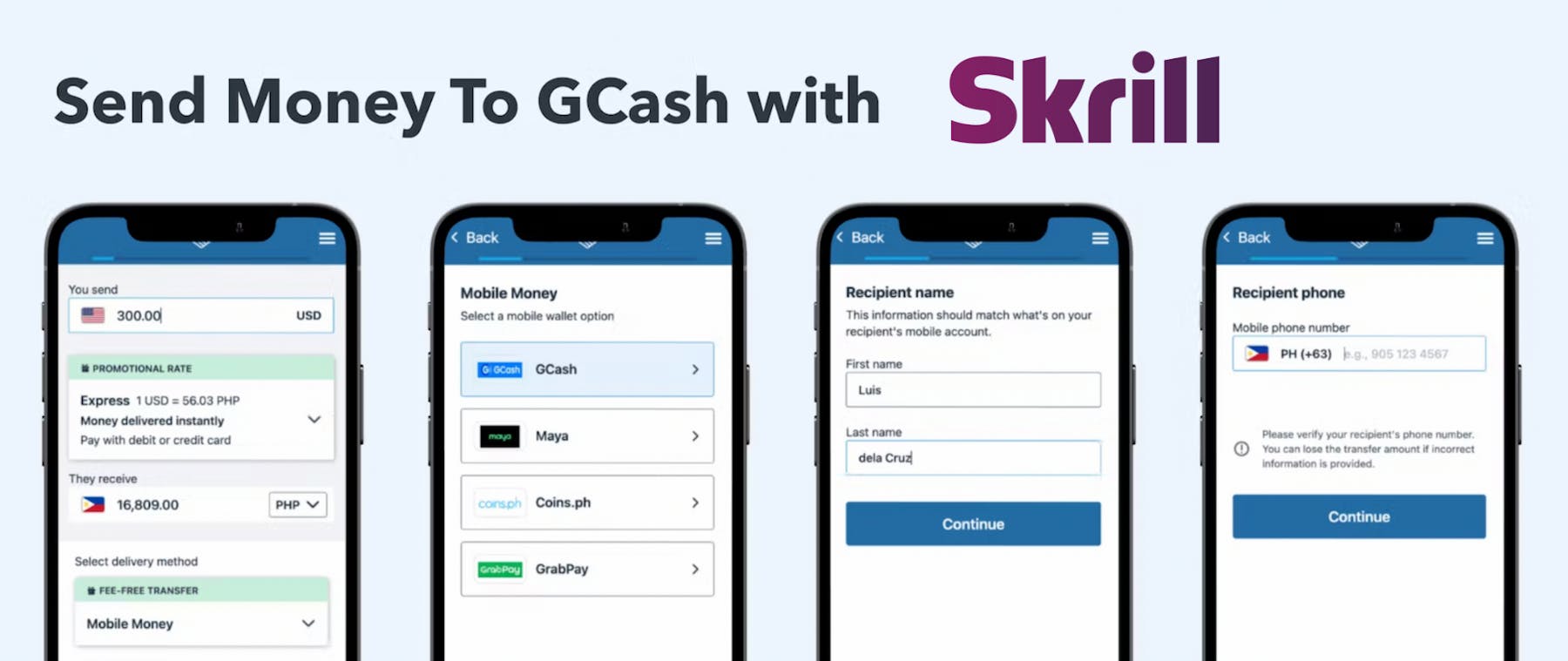

How to Link and Send Money From Skrill to GCash

February 28, 2023 - by Jarrod Suda

Would you Like to Send Load to the Philippines? 📲

Find all operators to send top-up to the Philippines, to India or other regions.