Try GCash Overseas

GCash Overseas is open for registration for the first 1,000 users!

It's available to Filipinos with international SIM cards in Australia, Italy, and Japan with more countries coming to you soon.

Download GCash via Google Playstore or App Store

Sign up using your international mobile number

GCash Overseas Beta is only open to the first 1,000 users

Currently available in Japan, Australia, and Italy

More Guides About GCash Overseas and Sending Remittances to the Philippines

GCash USA to Philippines

January 25, 2024 - by Jarrod Suda

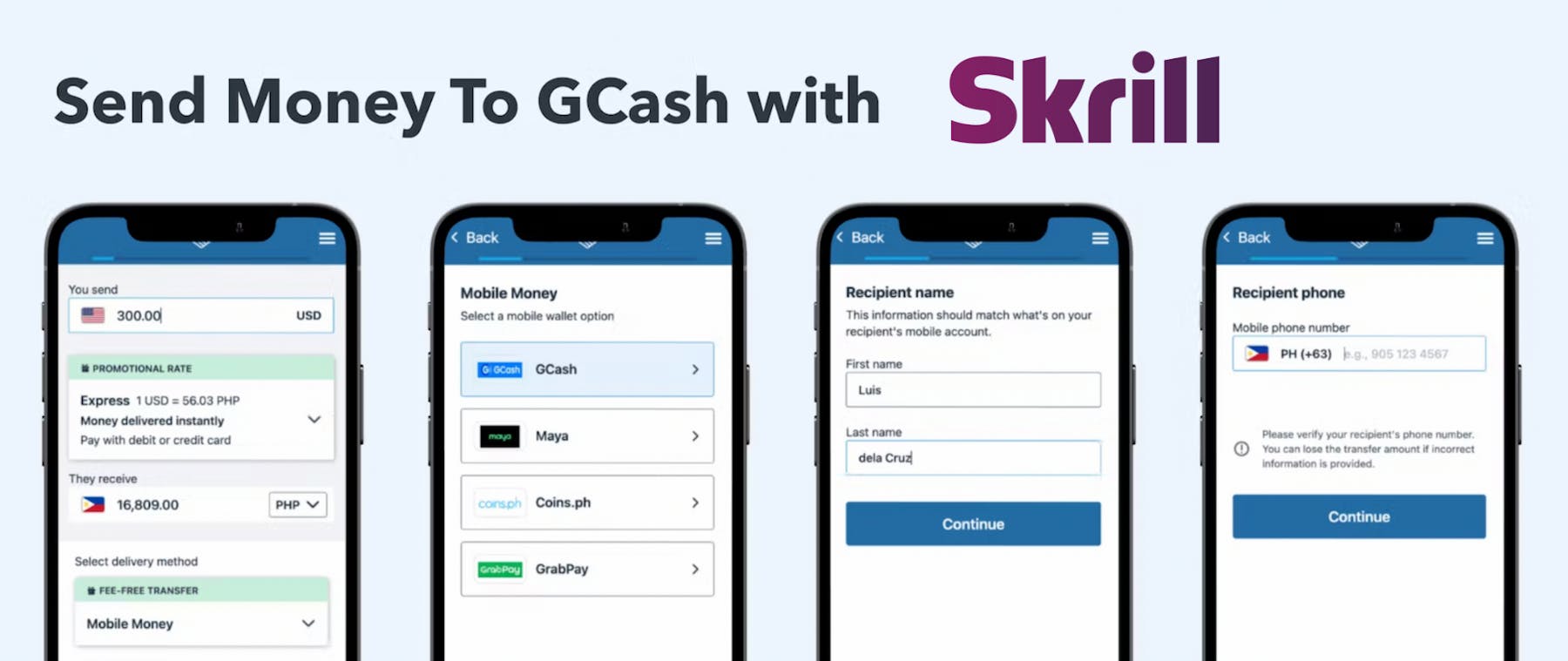

How to Link and Send Money From Skrill to GCash

February 28, 2023 - by Jarrod Suda

Is GCash International?

February 10, 2023 - by Jarrod Suda

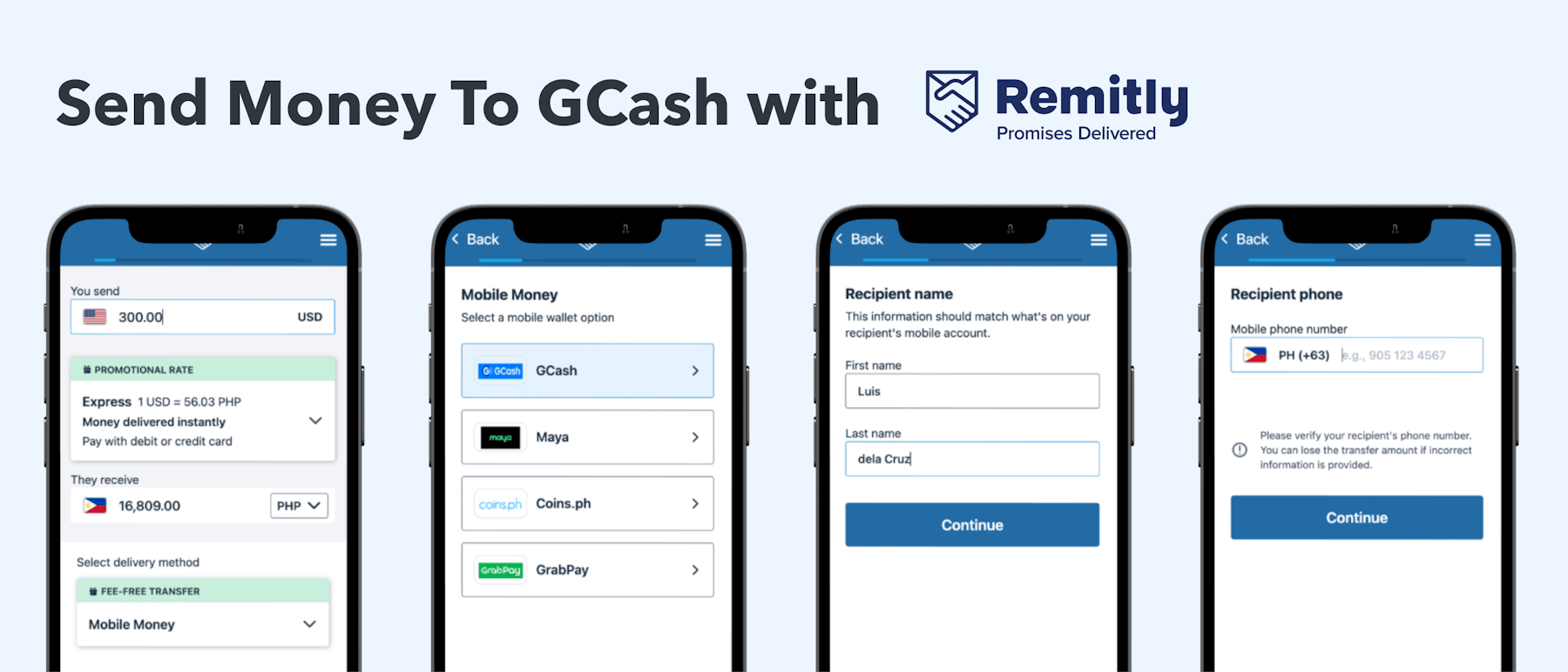

How to Send and Receive Money From Remitly to GCash

March 9, 2023 - by Jarrod Suda

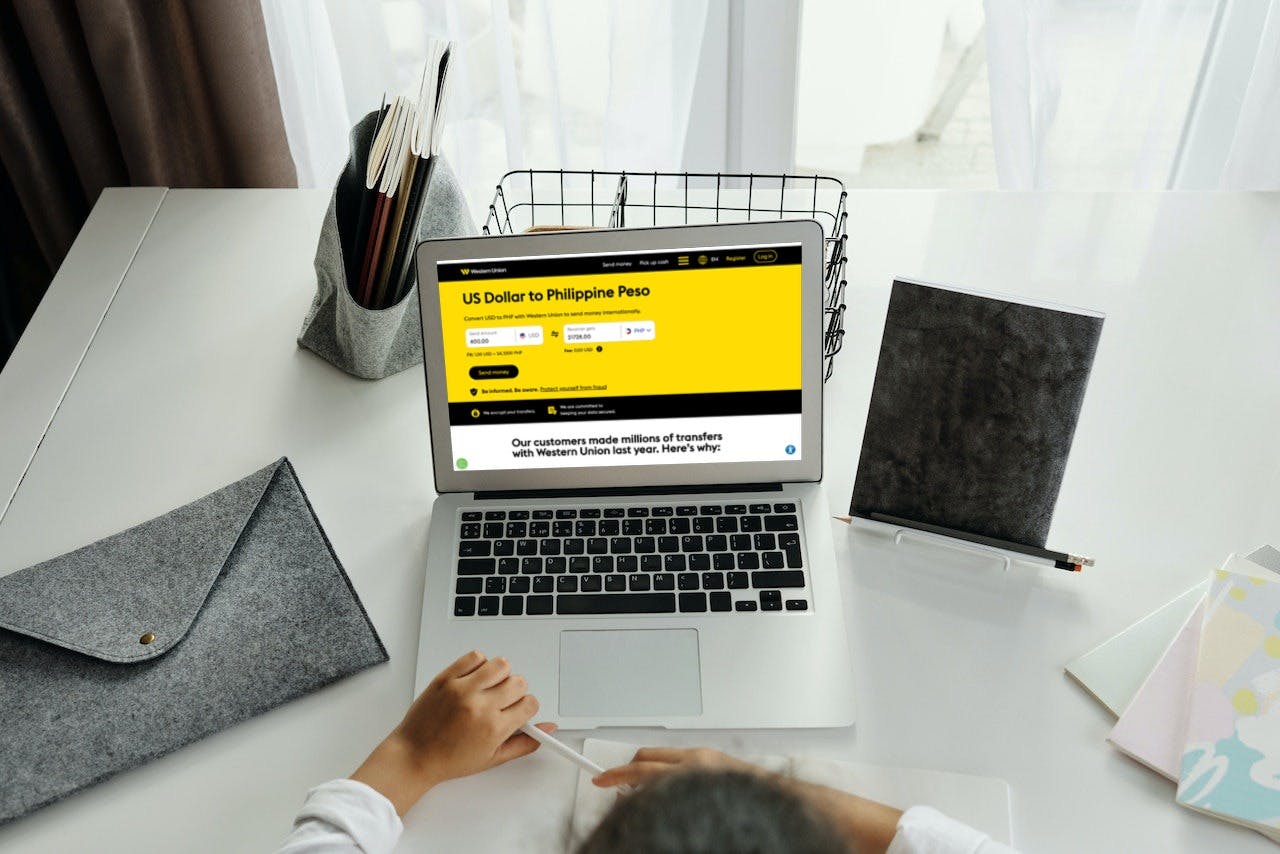

Western Union to GCash

October 6, 2023 - by Jarrod Suda

How to Transfer From Xoom to GCash (Plus Cheap Alternative)

February 10, 2023 - by Jarrod Suda

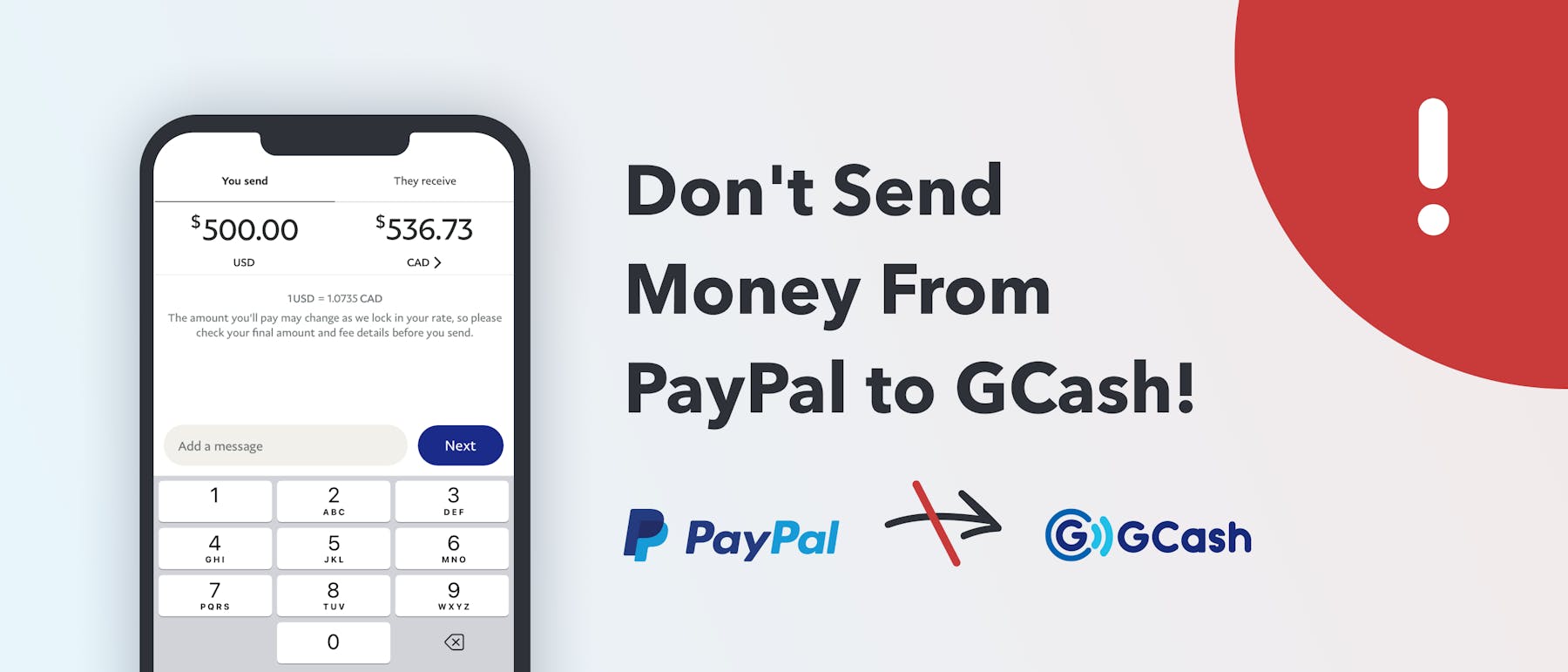

How to Transfer From PayPal to GCash (Plus Cheap Alternatives)

October 11, 2023 - by Jarrod Suda

Sending to GCash from Japan

January 24, 2024 - by Jarrod Suda

Sending to GCash in the Philippines

February 20, 2024 - by Jarrod Suda

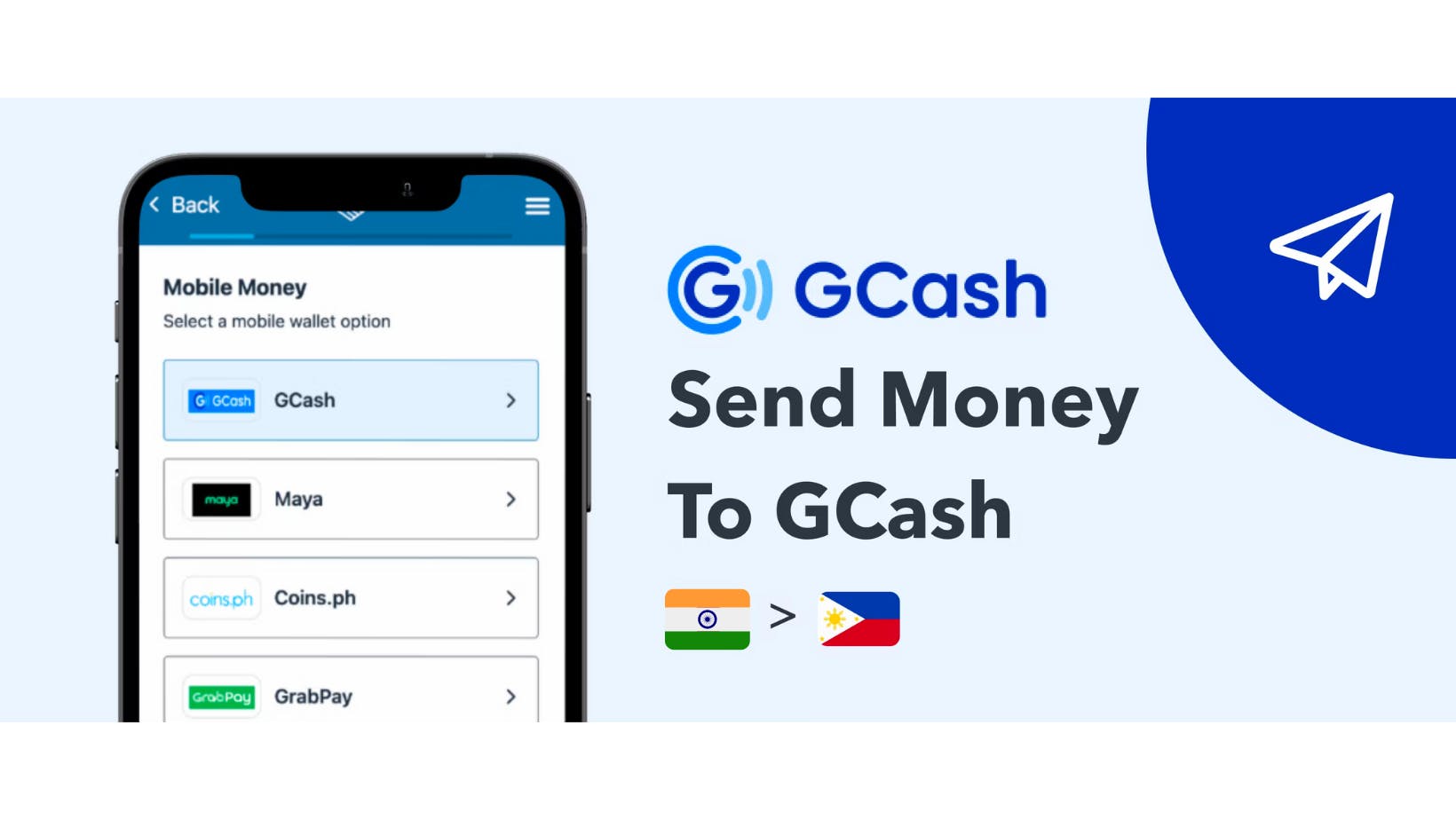

Sending to GCash from India

February 2, 2023 - by Jarrod Suda

How to Receive Money From WorldRemit to GCash

February 28, 2023 - by Jarrod Suda

Sending Money to the Philippines From the USA via Remitly Rate

February 14, 2023 - by Jarrod Suda

Cash App in the Philippines: How to Get Access & Use Cash App

February 10, 2023 - by Jarrod Suda

Sending Money From Canada to the Philippines With Remitly Rate

February 9, 2023 - by Jarrod Suda

Should I Send Money From US to Philippines w/ Western Union?

February 21, 2023 - by Jarrod Suda

LBC Remittance Partners

November 17, 2022 - by Byron Mühlberg

Payoneer Review

November 25, 2022 - by Byron Mühlberg

How To Open a Bank Account in the Philippines While Abroad

July 14, 2023 - by Jarrod Suda

Monito Awards

April 8, 2024 - by François Briod