Azimo Review: Transfer Fees, Safety, Usability, and Monito's Verdict

Laurent Oberholzer

Guide

Co-Founder of Monito, Laurent has been reviewing money transfer services for over six years, and loves to share his expertise in international payments to help others.

Byron Mühlberg

Reviewer

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreAzimo is an excellent money transfer service (8.5/10) recommended by Monito's experts, particularly for money transfers from Europe. Offering a highly reputable transfer platform that's trusted by over one million customers (8.1/10), Azimo offers very competitive fees and rates on Monito for both bank and cash transfers (9.2/10) on relatively sleek and easy-to-use web and mobile app platforms (7.2/10). Moreover, Azimo has earned outstanding customer reviews on TrustPilot (9.6/10), both in terms of the number of reviews and overall ranking.

What Monito Likes About Azimo

- An impressive reach to over 200 countries and territories;

- Various pay-out options (incl. bank deposit, SWIFT, and cash pick-up);

- Available in nine different languages;

- Excellent customer reviews on Trustpilot, Google, and Apple.

What Monito Dislikes About Azimo

- Only available for transfers from Europe, Canada, and Australia;

- Less competitively priced from Canada and Australia than Europe.

As of 31 August 2022, Azimo is no longer available for making international money transfers, as the company is shutting down its service. This means you'll need to find an alternative. Compare the leading international money transfer providers for your next transfer abroad using our comparison engine below:

Key Questions About Azimo Answered

Who Is Azimo For?

Azimo is available in the EU/EEA, Switzerland, the UK, Australia, and Canada and supports international money transfers to over 200 countries and territories worldwide.

See How Azimo Stacks Up

How Monito Reviewed Azimo's Services

As with all services reviewed by Monito, Azimo underwent a rigorous evaluation to assess the quality of its service. To begin with, our experts opened an Azimo account to test out its functionalities, including the ease of registration and speed of transferring money, which provided a well-rounded overview of the platform's strengths and limitations. Next, we weighed this score against several other key criteria, including customer reviews, percentage of fees constituted by exchange rate margins, pay-in options, access to customer service, as well as business and legal metrics such as volume transferred, appropriate authorization, and company size. Finally, we analyzed hundreds of thousands of searches on Monito's comparison engine to determine how often Azimo was the cheapest service and how often it was competitive against its rivals over the past three months, giving a reliable overview of its pricing in relation to the market. As with all Monito Scores, Azimo's score was peer-reviewed by at least one Monito expert.

Reviews are written independently by Monito's editors and recommendations given are our own. Services you sign up with using our links may earn us a commission.

Azimo at a Glance

Criteria | Monito's Score | Review Highlight |

|---|---|---|

8.1/10 | Trusted by around one million customers globally. | |

7.2/10 | Many pay-in methods, but setting up an account can take some time. | |

8.6/10 | Very competitive fees and exchange rates. | |

9.6/10 | An excellent 4.6/5 star rating on Trustpilot from tens of thousands of reviews. |

Last updated: 22/06/2021

💳 Pay-in Options | Bank transfer, debit/credit card, SOFORT, iDeal |

|---|---|

🏧 Pay-out Options | Bank deposit, cash pick-up, mobile wallet deposit, mobile top-up, home delivery |

💶 Min. Transfer Amount | £10.00 |

💷 Max. Transfer Amount | £250,000.00 (SWIFT), £12,000.00 (card) |

💱 Currencies Supported | 80 |

👥 Number of Customers | 1 million |

🔐 Trustpilot Score | 4.6/5 |

📝 Number of Reviews | 50000 |

🌍 Available in | EU/EEA, Switzerland, UK, Australia, Canada |

💬 Languages Supported | English, French, Spanish, Polish, German, Italian, Portuguese, Romanian, Russian |

Last updated: 22/06/2021

📍 Headquarters | Amsterdam (NL) |

|---|---|

📃 Established | 2012 |

🌏 Offices | London (GB), Krakow (PL), Amsterdam (NL) |

👥 Number of Employees | 130 |

📈 Private/Public | Private |

🏆 Award(s) | Remittances award at United Nations (2018), Best Global Money Transfer Company iAMTM (2017) |

✅ Fun Fact | In 2014, Azimo's co-founder Michael Kent went on to found World First as a competitor. |

Last updated: 22/06/2021

Trust & Credibility

Background check

Security & reliability

Azimo's platforms are fully secured and use top-notch security protocols, including segregated user accounts and HTTPS.

Company size

Since 2012, Azimo has grown to serve around a million customers, employ about 130 people, and handle up to US$1.5 billion worth of annual transactions.

Transparent pricing

Azimo is not transparent in its pricing, failing to disclose that 77% of its fees are hidden in the exchange rate margin.

Can I Trust Azimo

Moving around US$1.5 billion on an annual basis for over a million customers, Azimo is indeed a trustworthy and prominent money transfer service. What's more, Azimo employs around 130 people across its UK and Polish offices, many of whom give the company a 4.2-star rating on the employer review site Glassdoor and describe Azimo as a "fintech with a heart" and a "great fintech company" where employees "truly have the opportunity to make a difference".

Beyond that, Azimo has raised over US$75 million from various investors around the world. This has helped the company establish what it claims is one of the world’s largest digital money transfer networks, allowing Azimo to reach up to five billion people worldwide.

Is Azimo Safe?

Yes, Azimo is as safe and secure as money transfer specialists go. Not only is the company a licensed Authorised Electronic Money Institution — meaning it's duly regulated by the Financial Conduct Authority (FCA) and Her Majesty's Revenue and Customs (HMRC) in the UK — but it also offers institutional-grade security for their platforms, including 256-bit SSL encryption with a 2048-bit signature.

As per FCA regulations, customers’ funds are held in segregated accounts and are kept completely separate from Azimo’s own business accounts. This means that customer money is safe should the company face any financial difficulties. Furthermore, Azimo offers a 100% money-back guarantee and will reimburse customers the full amount of their payment should the transfer be cancelled or refused for any reason.

Service & Quality

Opening an account

Opening an account with Azimo is simple and straightforward enough to do, but it can take some time to complete.

Making a transfer

With an Azimo account registered and ready to go, making a new money transfer is a fast and simple process.

Contacting support

Getting help when needed is possible with Azimo through a live chat, although phone support isn't available.

Azimo's Service Quality

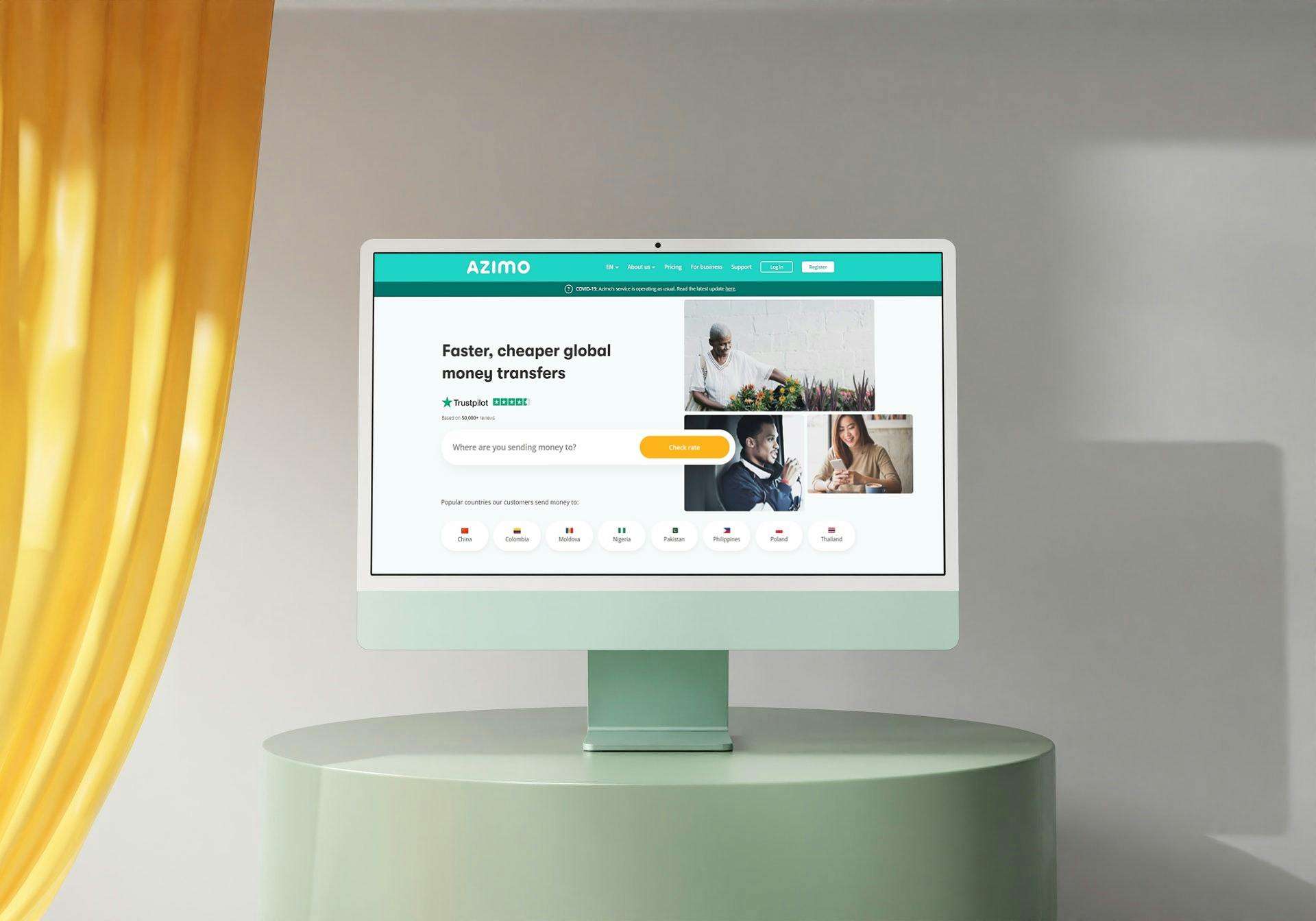

What Is Azimo?

Azimo is an international money transfer specialist that offers a digital alternative to traditional cash-based money transfer operators for sending money abroad. Azimo’s well-designed web and mobile apps allow users to send money conveniently from anywhere and at any time, with transfers paid for by making a local bank transfer, debit or credit card payment, or online money transfer via SWIFT.

What makes Azimo stand out are the number of countries and the variety of ways customers can send their money internationally. With Azimo, not only can you send money to over 200 countries and territories worldwide in more than 80 foreign currencies, but the funds can be received in various ways, such as the traditional cash pick-up in over 270 thousand locations, deposits into the bank accounts of over 20 thousand banks, mobile wallet top-ups, or cash delivery to the recipient’s home.

Azimo is a handy option for migrants sending money back to their home country, as the platform is translated into 9 different languages and their fees and exchange rates make them considerably cheaper than banks or money transfer operators in most cases. To top things off, Azimo has also served around a million customers to date, many of whom have left the company excellent reviews on Trustpilot.

Monito's Impressions During Our Test

Although opening a new account with Azimo can take some time, in general, making a transfer and using the service is easy, with bank and card pay-in options available to choose from. An attractive and user-friendly platform, Azimo impressed our reviewers with its simple user experience and lack of information overload. What particularly stood out to us was that the entire transfer process could be completed on a single web page, making it one of the faster money transfer services we've reviewed.

Azimo Mobile App Review

Azimo's mobile apps have outstanding ratings on Google Play (4.5/5 stars on nearly 27 thousand ratings) and the App Store (4.7/5 stars on nearly 23 thousand ratings). According to Azimo's customers, the app is intuitive, fast, and reliable, making it easy to send money from your smartphone in a few taps.

Fees & Exchange Rates

Transfers to a bank account

Azimo priced competitively in 86% of Monito bank searches and was the cheapest option in 37% of cases.

Transfers to cash pickup

Azimo priced competitively in 55% of Monito cash searches and was the cheapest option in 29% of cases.

Azimo's Fees & Exchange Rates

Often both competitive and the cheapest money transfer service of all on Monito's comparison engine, Azimo's fees and exchange rates are generally very well-priced. The total cost of sending money internationally with Azimo varies depending on the sending and receiving country and can generally be broken down as follows:

Azimo Transfer Fees

Azimo charges either a fixed fee or a commission depending on which countries and currencies customers are sending between and the desired pay-in and pay-out methods. For example, a typical fixed fee for bank transfers to major corridors (e.g. the UK to the US and many others) is £1.99.

As a result of the above fees, the smaller the transfer with Azimo, the pricier the fees. On the other hand, the more you send abroad, the more affordable the fees become.

Azimo Exchange Rates

As with transfer fees, the exchange rate offered by Azimo will depend on the pay-out method you choose. Unlike many banks, the exchange rate is locked in advance, meaning that you'll know exactly how much money will arrive before sending it.

Azimo makes money on exchange rates in much the same way as banks, and other currency exchange specialists do: by offering a slightly poorer exchange rate to the customer than the one they trade at themselves (i.e. the mid-market exchange rate.) This markup fee, known as an exchange rate margin, is expressed as a percentage cost and tends to fall very broadly between 0.05% and 2.50% of the transfer value at Azimo, depending on the currencies in question.

To get a better picture of how Azimo's exchange rate margins break down, take a look at Azimo's exchange rates for bank transfers between several major currency pairs below:

Destination Currency | Azimo Exchange Rate | Mid-Market Exchange Rate | Exchange Rate Margin |

|---|---|---|---|

Polish złoty | 5.23373 | 5.261825 | 0.53% |

Pakistani rupee | 218.31838 | 221.20725 | 1.31% |

Indian rupee | 102.06196 | 103.26337 | 1.16% |

US dollar | 1.40434 | 1.40785 | 0.25% |

Romanian leu | 5.69118 | 5.717597 | 0.46% |

Euro | 1.15526 | 1.16126 | 0.52% |

Philippine peso | 67.21612 | 67.734472 | 0.77% |

Quoted: 15/06/2021 19:15 GMT +01:00

Destination Currency | Azimo Exchange Rate | Mid-Market Exchange Rate | Exchange Rate Margin |

|---|---|---|---|

US dollar | 1.20835 | 1.212386 | 0.33% |

Indian rupee | 87.58744 | 88.929235 | 1.51% |

Moroccan dirham | 10.33906 | 10.689258 | 3.28% |

Colombian peso | 4365.66489 | 4480.61 | 2.57% |

Russian ruble | 86.4541 | 87.609623 | 1.32% |

Polish złoty | 4.50727 | 4.531814 | 0.54% |

Turkish lira | 10.11039 | 10.374099 | 2.54% |

Quoted: 15/06/2021 19:15 GMT +01:00

Destination Currency | Azimo Exchange Rate | Mid-Market Exchange Rate | Exchange Rate Margin |

|---|---|---|---|

US dollar | 0.76815 | 0.768185 | 0.00% |

Indian rupee | 55.6147 | 56.344862 | 1.30% |

Nepalese rupee | 89.69178 | 90.565796 | 0.97% |

Canadian dollar | 0.93387 | 0.936782 | 0.31% |

British pound | 0.54551 | 0.545628 | 0.02% |

Malaysian ringgit | 3.08452 | 3.162238 | 2.46% |

Pakistani rupee | 117.38977 | 120.69408 | 2.74% |

Quoted: 15/06/2021 19:15 GMT +01:00

Destination Currency | Azimo Exchange Rate | Mid-Market Exchange Rate | Exchange Rate Margin |

|---|---|---|---|

US dollar | 0.82108 | 0.821049 | 0.00% |

Indian rupee | 59.38096 | 60.231933 | 1.41% |

Euro | 0.67691 | 0.677167 | 0.04% |

Philippine peso | 39.09198 | 39.501059 | 1.04% |

Polish złoty | 3.06512 | 3.0682269 | 0.10% |

Moroccan dirham | 6.93639 | 7.2376219 | 4.16% |

Australian dollars | 1.06393 | 1.0675428 | 0.34% |

Exchange rates quoted: 16/06/2021 08:15 GMT +01:00

Other Fees

Because Azimo uses local accounts to collect and disburse funds, there should be no fees charged by the sending or receiving banks and no intermediary bank fees.

However, a 2.99% fee does apply to credit card payments.

Azimo is no longer available. Compare alternatives instead:

Customer Satisfaction

Customer review score

With a 4.6/5 star rating on Trustpilot, there’s no doubt that Azimo has made an overwhelmingly positive impression on its customers.

Number of positive reviews

With an impressive almost 43 thousand 4- and 5- star reviews on Trustpilot, Azimo is much-loved by its customers, speaking to its quality of service.

Customer Reviews of Azimo

Azimo is much-loved by its customers, receiving an overall 4.6/5 stars on Trustpilot and a total of around 43 thousand 4- and 5- star reviews. Some of the major sentiments Azimo customers have expressed include:

Positive Azimo Reviews

- Customers were very satisfied with how fast their money was delivered;

- Using Azimo is an easy, uncomplicated, and pleasant experience;

- Exchange rates are good and fees are low;

- Azimo is reliable and trustworthy.

Negative Azimo Reviews

- A few customers experienced delays in their transfers;

- Azimo’s customer service was sometimes a bit slow;

- On very rare occasions, customers had issues with Azimo’s pay-out partner in the receiving country (e.g. wrong address or poor service).

How Azimo Works

Step 01

Check Azimo's Rates

Use Monito's comparison engine to see how Azimo’s fees and exchange rates weigh up against the rest and make sure they are indeed the cheapest option for your international money transfer. There, you'll be able to discover both the cheapest ways to fund your transfer and have the money received.

![]()

Step 02

Register for an Azimo Account

Sign up for Azimo by entering your full name, email address, and the country from which you'd like to send money internationally. Enter a password and click forward to register.

![]()

Step 03

Enter Your Personal Information

In the next step, Azimo will ask you for more personal details to complete your profile. You'll be required to enter your mobile phone number, date of birth, and full residential address (including postcode.) Click 'Confirm details' to continue to the next step.

![]()

Step 04

Set-up Your Transfer

To set up your transfer with Azimo, you will be required to choose your recipient's country, the receiving currency, and the delivery method (e.g. bank deposit, SWIFT transfer, cash pick-up, etc.)

![]()

Step 05

Add Your Beneficiary

Further down the page, you'll be required to enter your beneficiary's personal and banking details, including their full name and bank account number. Optionally, you'll also be able to enter their email address to keep them up to date on the status of the transfer, as well as a payment reference.

![]()

Step 06

Finalize Your Transfer

At the bottom of the page, you'll be able to choose how much money you'd like to send and specify your payment method. Azimo will present the exchange rate you'll pay, the fixed fee, the receiving amount, and the total amount to be paid, including fees.

![]()

Final step

Review and Pay

Go To AzimoIn the final step at the very bottom of the page, you'll be asked to select the purpose of your money transfer (e.g. gift, investment, travel expense, etc.) and then provide your card details. By clicking 'Send money,' you will instruct the money transfer to the destination you specified above.

Find More About Azimo Alternatives

Frequently Asked Questions About Azimo

Can I trust Azimo? 🤝

Yes, Azimo can most certainly be trusted. Not only is the company a licensed Authorised Electronic Money Institution, meaning it's duly regulated by the Financial Conduct Authority (FCA) and Her Majesty's Revenue and Customs (HMRC) in the UK, but it also offers institutional-grade security for their platforms, including 256-bit SSL encryption with a 2048-bit signature.

Can I use Azimo in the USA? 🗽

No, Azimo is currently not supported for outgoing international money transfers from the USA. As of June 2021, Azimo is available in the EU/EEA, Switzerland, the UK, Australia, and Canada.

Can Azimo send money to Nigeria? 🌴

Yes. Azimo is among several dozen international money transfer operators authorised by the Central Bank of Nigeria (CBN) to send money to Nigeria. However, following a November 2020 decision by the central bank, money transfers into Nigeria are only permitted in US dollars, meaning you'll only be allowed to send money to Nigeria with Azimo in that currency and no longer in Nigerian naira.

How do I send money via Azimo? 💻

To send money via Azimo, you'll either need to create a new user account on Azimo or log in to an existing one. From there, you'll have the option to set up a money transfer to any one of around 80 foreign currencies in 200 countries and territories using a single, easy-to-understand sending page. To get the job done, you'll need to enter your beneficiary's banking details and specify how you'd like to pay for the money transfer.

Does Azimo work in Pakistan? 🕌

Yes, Azimo can send money to Pakistan, but it's impossible to use the service to send money abroad from Pakistan. To send money to Pakistan with Azimo, you can choose to make a bank transfer to any Pakistani bank account or transfer the money for cash pick-up at any one of around 6,200 agent locations across the country.

Does Azimo work on weekends? 🍸

Yes, it's possible to instruct a new Azimo money transfer on a weekend. However, transfers sent on or over weekends or bank holidays may take slightly longer to work on weekends, as SWIFT transfers and domestic bank transfers in general tend only to be processed on business days.

Does Azimo accept PayPal? 📱

No, it's currently not possible to fund or receive an Azimo international money transfer using PayPal. To use your PayPal balance to fund your Azimo transfer, you'll first need to withdraw the funds from your PayPal wallet into your bank account, from which you'll be able to bank a bank deposit internationally via Azimo.

Does Azimo work in Canada? 🍁

Yes, it's possible both to send money to and receive money from Canada using Azimo.

Does Azimo work in Germany? 🍺

Yes, it's possible both to send money to and receive money from Germany using Azimo.

How long does Azimo take to transfer money abroad? ⏱

In general, Azimo is a speedy money transfer service. While exact transfer times vary depending on the currency, fund-in, and fund-out methods, most international money transfers take less than 24 hours with Azimo, with cash pick-up transfers generally being processed faster than bank and SWIFT transfers.

How do I delete my Azimo account? ⛔

You can only delete your Azimo if you haven't used it to send money within the last five years. This is due to stringent regulatory procedures that Azimo is obligated to follow. However, it is possible to deactivate your Azimo account, which can be done by contacting customer support.

How do I track my Azimo transfer? 🔍

You can track your Azimo transfer in one of two ways. One option is to log in to your Azimo web dashboard or mobile app and look for the status feature on the homepage. The other option is to follow the progress of your transfer via email updates or push notifications, when activated.

Is Azimo safe to use? 🔐

Yes, Azimo is as safe and secure as money transfer specialists go. Not only is the company a licensed Authorised Electronic Money Institution — meaning it's duly regulated by the Financial Conduct Authority (FCA) and Her Majesty's Revenue and Customs (HMRC) in the UK — but it also offers institutional-grade security for their platforms, including 256-bit SSL encryption with a 2048-bit signature.

Is Azimo reliable and legitimate? 👨⚖️

Moving around US$1.5 billion on an annual basis for over a million customers, Azimo is indeed a trustworthy and prominent money transfer service.

Is Azimo better than Wise? ⚖

Azimo and Wise are excellent money transfer services that you can depend on to offer top-notch currency exchange solutions. However, when it comes to fees and exchange rates, Wise is by far the more competitive service according to millions of annual searches run on Monito's real-time comparison engine. Take a look at Monito's full side-by-side review to learn more.

Where is Azimo based? 🧭

Azimo is headquartered in London, UK, and has offices in Krakow, Poland, and Amsterdam, the Netherlands.