Western Union Prepaid Card 2024 Review: The Netspend Mastercard

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreThe Western Union Netspend Prepaid Mastercard is a reloadable prepaid debit card that can be used anywhere Mastercard is accepted. With no credit check required, it is an accessible option for US residents.

Netspend's strong points are its high APY rate for savings and its safety features, including fraud protection. However, we think that due to its long and complex fee schedule, more transparent prepaid cards are more desirable alternatives.

What Monito Likes About Netspend

- No credit check required to apply;

- No overdraft fees;

- Free cash reloads at Western Union Agent locations;

- Mobile check deposit;

- Up to 5.00% APY as of 2023;

- Fraud protection.

What Monito Dislikes About Netspend

- Monthly fee of $5.95;

- Cash reload fee of $3.95;

- ATM withdrawal fee of $2.50;

- Inactivity fee of $5.00 after 90 days of no transaction;

- $1.00 fee per balance inquiry at an ATM.

We consider Revolut the best prepaid card available as its multi-currency account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link.

Western Union Prepaid Card Review

- 01. How good is Western Union's Netspend prepaid card service?

- 02. What are Western Union's prepaid card fees and exchange rates?

- 03. Is the Western Union prepaid Mastercard safe?

- 04. What do other customers think about the Western Union prepaid card?

- 05. Is Western Union's Netspend prepaid card worth it?

- 06. Frequently asked questions about Western Union's prepaid card

How Good is the Western Union's Netspend Prepaid Card?

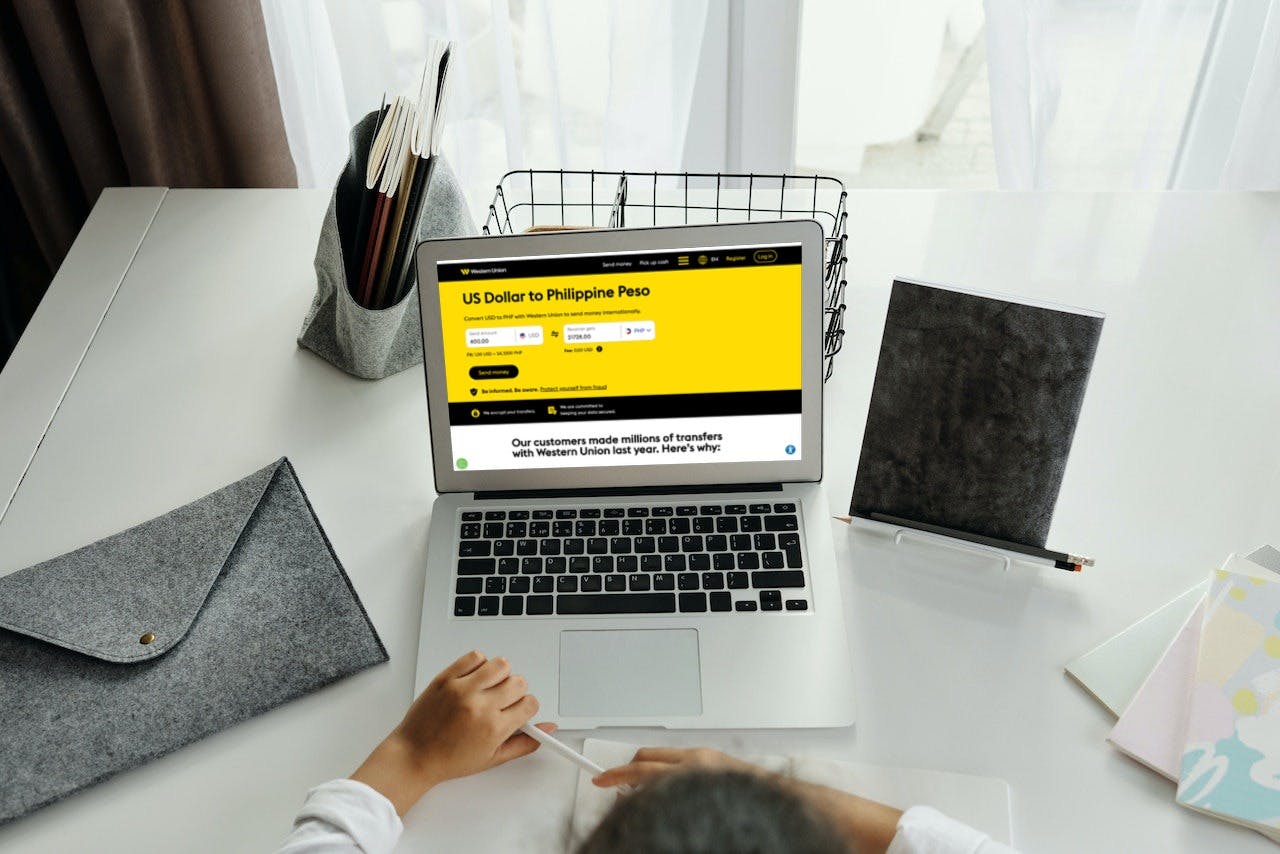

The Western Union Netspend Prepaid Mastercard works like any other prepaid debit card. You can load money onto the card by direct deposit or visiting a Western Union Agent location. Once the money is loaded, you can use the card to make purchases anywhere Mastercard is accepted, pay bills online, or withdraw cash from an ATM.

Western Union Prepaid Card Features

Fraud protection is a service usually provided by credit card companies, but Western Union Netspend also offers this, which does set it apart from other debit cards. On Venmo or Cash App, for example, your money will not be guaranteed if you send it to the wrong person or get caught in a scam.

Netspend also has a savings account that connects to the card. You can earn up to a 5.00% Annual Percentage Yield (APY), which is much higher than the national average (as of January 2023). However, it only applies to deposits up to $1,000. The APY will be reduced to 0.50% on balances over $1,000.

In addition, the prepaid Mastercard will come with the following services:

- Direct deposit;

- 0.50% to 5.00% APY on savings;

- Online account management;

- Mobile check deposit;

- Over 130,000 free ATMs;

- Free account alerts;

- Fraud protection.

How to Load Money on the Western Union Netspend Prepaid Mastercard

You can top up the prepaid Netspend Mastercard through a variety of methods, including the following:

- Direct deposit: Paychecks and government benefits checks can be loaded on the card via direct deposit without a fee.

- Western Union transfer: Users can accept a Western Union transfer to the Western Union Netspend Prepaid Mastercard.

- Mobile check deposit: Users can deposit checks to their Western Union Prepaid Mastercard via the card’s mobile app for free, but it takes 10 days to clear. For same-day processing, a fee between 1% to 4% may be applied.

- Online bank transfer: You can make a domestic bank transfer of US dollars to the Western Union Prepaid Mastercard online.

- Cash reload: The Western Union card uses the Netspend Reload Network for cash loads. The network has over 130,000 partner locations, however, partner locations may charge a fee between $2.00 to $3.95 for this service.

What are Western Union's Prepaid Card Fees and Exchange Rates?

Western Union's Netspend prepaid card comes with several fees to use its full services. As we list them in this section, you may find that their fee schedule is quite extensive. That 5.00% APY interest you get with the savings account may easily cancel out, which is why we recommend Revolut as a more straightforward alternative.

Bear in mind that you can reduce your monthly fee to $5 if your card receives at least $500 in direct deposits each month — such as through checks, direct deposits, or government benefits.

Western Union Prepaid Card Fees

Before we discuss alternatives, let's have a look at the Netspend prepaid card fees:

- Monthly fee: $9.95;

- Western Union reload fee: $0.00;

- Cash reload fee: $3.95;

- ATM withdrawal fee: $2.50;

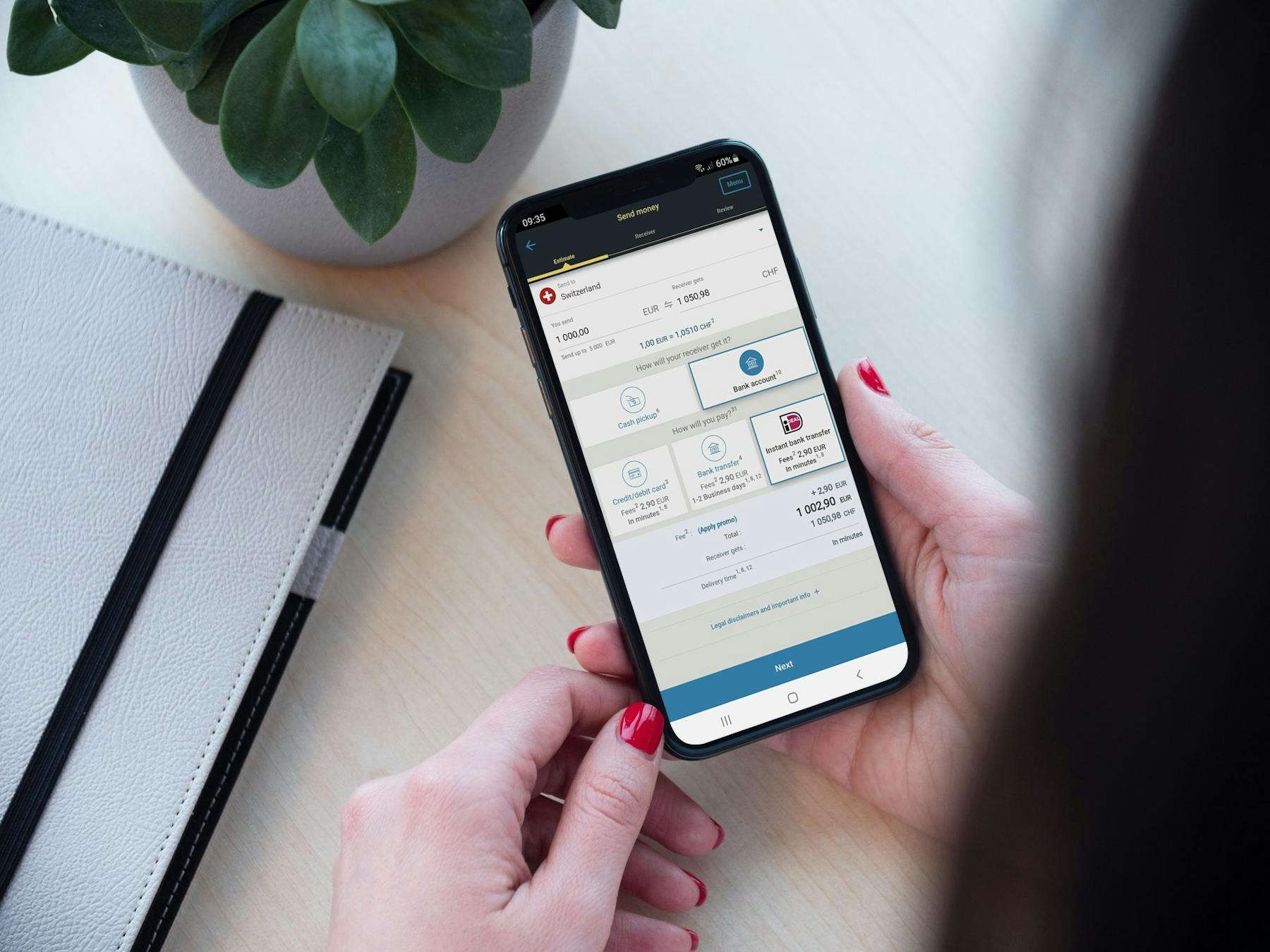

- International ATM withdrawal fee: $4.95;

- Inactivity fee (after 90 days of no transaction): $5.00;

- Balance inquiry at an ATM: $100;

- Foreign transaction fee: 3.5%.

Western Union Exchange Rate Fees

You can easily receive international money transfers from Western Union directly to your prepaid Netspend card. What is important to note is that Western Union will charge a fee per transfer, plus an additional exchange rate markup. In other words, Western Union will apply an exchange rate on your international money transfer that is weaker than the live mid-market rate.

For a full rundown on Western Union's fees and exchange rates, we recommend you read our definitive guide on Western Union transfer fees.

Card Limits

The Western Union prepaid card's maximum daily spending limit is $4,999.99. The maximum cash you can withdraw per day is $940.00.

Is the Western Union Prepaid Mastercard Safe?

Yes, the Western Union Netspend prepaid card is a safe and trustworthy option. Western Union is one of the oldest and largest international money transfer companies in the world, having served over 150 million customers worldwide.

Furthermore, its Netspend Mastercard is issued by Pathward, N.A., and Republic Bank & Trust Company, which are members of the FDIC. Your funds will be in a segregated account from the company's funds. In the rare case of insolvency by the issuant bank, your deposits up to $250,000 would be insured by federal compensation.

If someone uses the Netspend card fraudulently, you will not be liable for those losses. While you must notify Netspend immediately if a fraud incident or stolen card occurs, their team will work to protect your funds.

Western Union Prepaid Card Customer Reviews

The app connected to Western Union's prepaid card has received mixed reviews from customers online. On the Apple App Store, the Western Union Netspend Prepaid got an average of 3.2 out of 5 stars from 169 reviews. It fared better on Google Play with a 4.1 out of 5 stars from 5,997 reviews.

Positive Western Union Netspend Prepaid Reviews

- Never charges a fee for an overdraft of $10 or less;

- Good user interface;

- Easy to load up from a Western Union branch.

Negative Western Union Netspend Prepaid Reviews

- Complicated sign-up process;

- Long wait times for phone customer support;

- Log in screen has some bugs.

Verdict: Is It Worth It?

The Western Union Netspend Prepaid Mastercard is a solid option for those who want a prepaid card that you can reload for free at Western Union locations. However, the fees associated with the card should be taken into consideration before applying.

If you are looking for a card that you can top up with a direct deposit in 24 different currencies at the real mid-market rate (no foreign exchange markup), then we recommend you open a free account with Revolut.

Frequently Asked Questions About the Western Union Netspend Prepaid Card

Does Western Union have prepaid cards?

Yes. Western Union offers the Netspend prepaid card, which you can top up with direct deposit or at any Western Union location.

Where can I buy a Western Union Netspend card?

You can order a card online or pick up one at select Western Union locations.

How do I use the Western Union Netspend card?

Simply top the card up with money and spend wherever Mastercard is accepted. It is connected to a mobile app so you can see how much is loaded on the account.

How do I receive money on my Western Union Netspend card?

Receive money on your Western Union Netspend card with any of the following methods:

- Direct deposit;

- Western Union transfer;

- Mobile check deposit;

- Online bank transfer;

- Cash reload.

Other Guides on Western Union Reviews, Western Union Fees, and Western Union Alternatives

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.