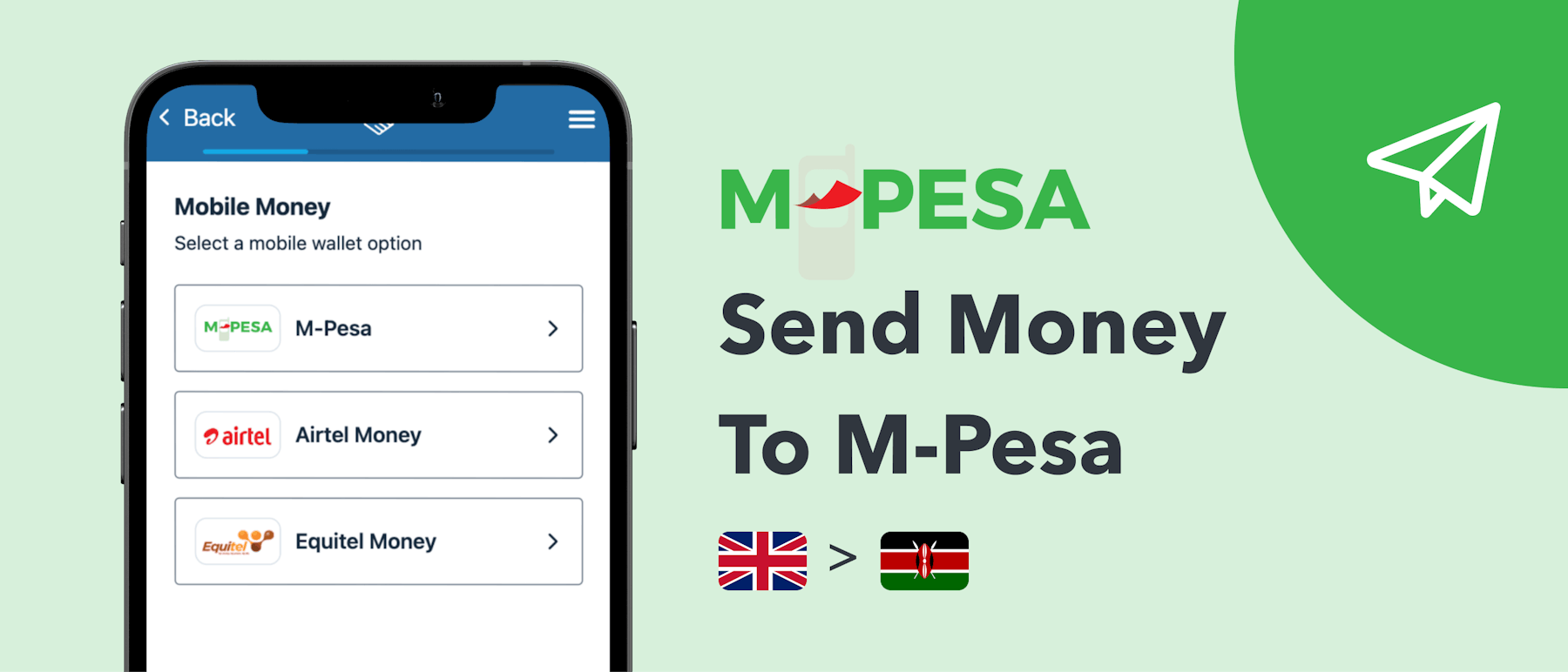

How to Send Money from Sendwave to M-Pesa

Lydia Kibet

Guide

Lydia Kibet is a freelance writer with a knack for personal finance, investing, and all things money. She's passionate about explaining complex topics in easy-to-understand language. Her work has appeared on Business Insider, Investopedia, The Motley Fool, GOBankingRates, and Monito. She currently writes about personal finance, insurance, banking, real estate, mortgages, credit cards, loans, and more.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreWith the current technological advancements in the financial sector, remittance has been made faster and cheaper than ever. Today, if you need to send money to friends and family abroad, you have plenty of options to choose from.

Sendwave is one of the best choices for sending money, especially to African and Asian countries. Moreover, you can use Sendwave to conveniently send money directly to your recipient’s mobile wallet.

In this guide, we address any questions you may have regarding sending money directly to your recipient’s M-Pesa wallet using Sendwave.

Compare your options using Monito’s real-time comparison engine:

Find affordable rates to send money to M-Pesa

Brief Overview of Sendwave

Sendwave is a digital remittance company that was founded back in 2014. It allows its users in over 50 countries to send money to recipients in more than 145 countries.

Some of the countries supported in Europe and North America are the UK, the USA, France, Canada, Italy, Ireland, and Spain.

You can use Sendwave to send money from any of these countries to the following African countries:

- Kenya

- Tanzania

- Uganda

- Senegal

- Nigeria

- Cameroon

- Liberia

- Madagascar

- Ivory Coast

Sendwave Transfer Options

Like most digital remittance platforms, Sendwave offers multiple money transfer options. The availability of each transfer type depends on the recipient’s country.

You should choose your transfer method based on factors like the amount of money involved and the urgency of the transaction.

The transfer options are the following:

- Bank transfers are most suitable for making huge transfers but might not be the best if the money is urgently needed.

- Direct-to-card transfers: You can send money directly to your recipient’s debit card. This option will depend on factors like your recipient’s country and bank’s policy.

- Cash pick-up: Sendwave has several agents in recipient countries who facilitate cash pick-up services.

- Mobile wallet payment: You can use Sendwave to transfer money directly to your recipient’s mobile wallet. This is the most convenient method as the transaction is completed within minutes.

Below, we focus specifically on sending money to your recipient via M-Pesa.

Sending Money from Sendwave to M-Pesa

You can send money directly to your recipient’s M-Pesa wallet using Sendwave by taking the following simple steps:

Step 1: Download the Sendwave App

To get started, you’ll first download the Sendwave app, available on both the Apple App Store and the Google Play Store. The app has about 500,000 active users and positive testimonials, proving its legitimacy.

Step 2: Create your Account

Once you’ve downloaded the app, you can create your account by providing the information required. You’ll be asked for identification in the form of your passport, driver’s license, or visa from your sending country.

Step 3: Link Your Debit Card

You’ll need to link your debit card to your new Sendwave account to facilitate transfers. For users in the US and Canada, Sendwave only accepts debit cards. For European countries, both credit cards and debit cards are accepted.

However, company credit cards are not accepted.

Step 4: Verify Your Identity

Sendwave will ask for government-issued Identification to verify your identity. You’ll also be asked several questions during the process in addition to providing documentation.

Verification of your identity helps the company comply with regulations. It also helps keep your account safe, so you’re the only one with access. Therefore, ensure you comply by providing detailed, correct information.

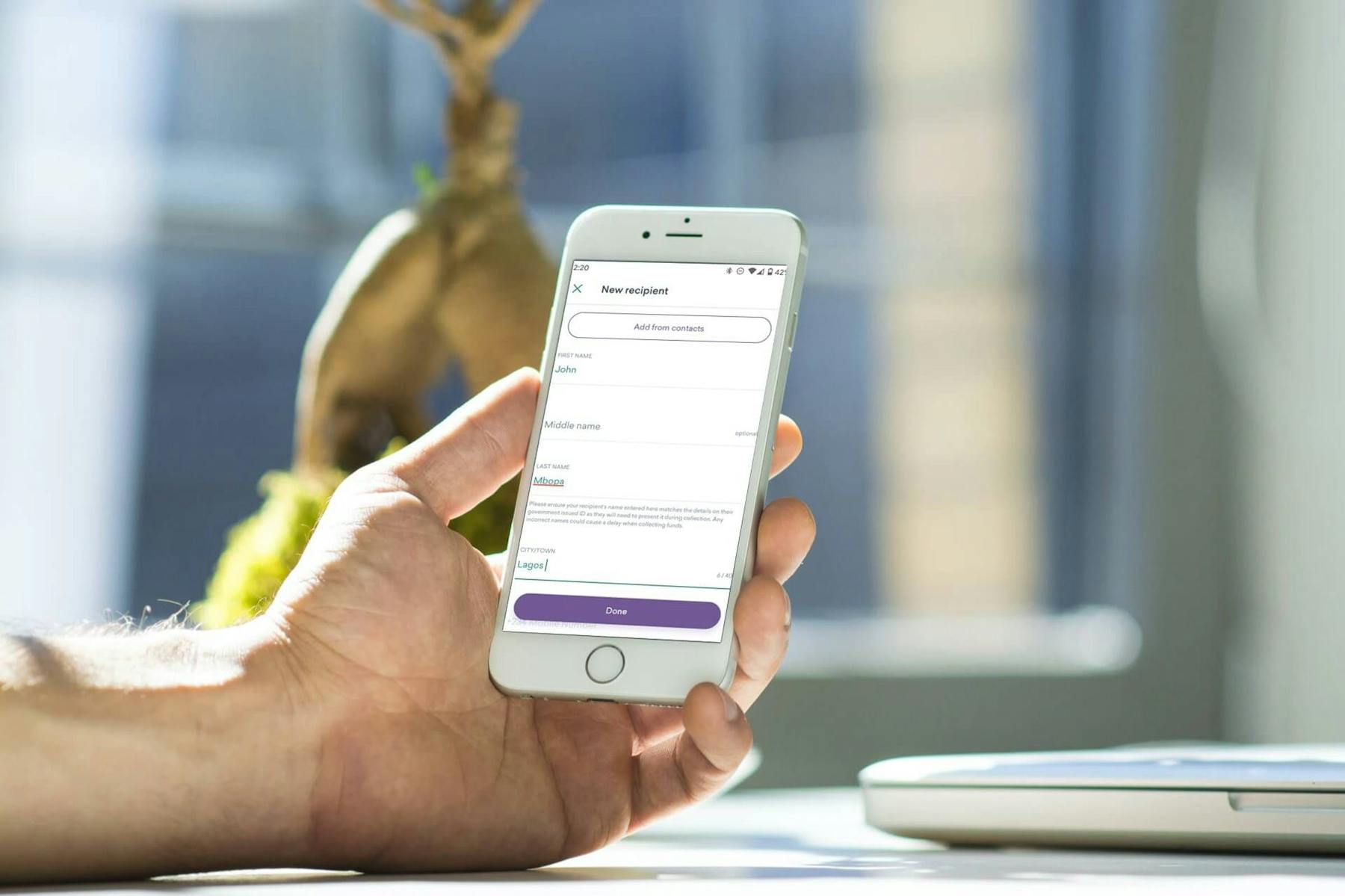

Step 5: Enter Your Recipient’s Information

To start the transfer, select the recipient’s country, which, in this case, is Kenya. Next, you’ll follow the prompts to provide the recipient’s details. These details will depend on the chosen transfer method.

Since you’re using M-Pesa, you’ll enter the recipient’s first and last name, followed by their registered M-Pesa phone number. Ensure the name you enter matches the name on their ID to avoid delays.

Step 6: Enter the Amount

Next, enter the amount you wish to send. Ensure the amount does not exceed Sendwave’s mobile wallet transfer limit. Additionally, remember that your recipient can only hold up to Ksh 500,000 in their M-Pesa wallet.

Step 7: Send

The last step is to review the transfer details to ensure everything is in order before sending. Once you’re satisfied, you can hit send.

Sendwave Transfer Fees

One of Sendwave's biggest selling points is that it doesn’t charge transfer fees. This makes it one of the most affordable digital remittance services.

So, how does the company make money? Instead of charging transfer fees, Sendwave charges a small markup on the prevailing mid-market rate.

This means, depending on your recipient’s currency, there’ll be a spread on the mid-market rate of up to about 4%.

Other major legacy platforms, such as Western Union, make money from both exchange rate spreads and transfer fees, making transfers more expensive. With Sendwave, you don’t have to worry about transfer fees.

Sendwave Transfer Limits

As a new customer, Sendwave limits your sending amount to $999 per day and $2,999 per month.

You can raise your Sendwave limit to $2,999 daily and $12,000 monthly by verifying your account using a government-issued ID.

Pros and Cons of Using Sendwave

If you’re on the fence about using Sendwave, looking at the pros and cons of using the platform can help you make an informed decision.

Pros:

- No fees: Sendwave doesn’t charge transfer fees, making transfers relatively cheaper than other remittance platforms. Its transparent payment model means you know exactly what to expect.

- Convenience: As a mobile-based remittance platform, Sendwave is widely accessible, meaning you can send money on the go. Moreover, sending money via mobile wallet means your recipient receives it within minutes.

- Low transfer limits: Sendwave offers the lowest minimum transfer limit, allowing transfers of as little as $1 to most destinations.

Cons:

- Limited payment options: Sendwave only allows you to pay for transfers via debit card if you’re in the US or Canada.

- Limited worldwide coverage: Unlike other international money transfers, Sendwave has limited global coverage. For instance, it only allows transfers to 11 countries in Africa.

Final Thoughts

Sendwave is a great option for sending money directly to your recipient’s M-Pesa wallet. It is one of the most affordable digital remittance platforms since it doesn’t charge transfer fees.

As a mobile-based company, it conveniently allows you to send money on the go, and your recipient receives it within minutes.

You can compare your options with Monito’s real-time comparison engine:

Compare your options to find affordable rates for sending money to M-Pesa:

FAQs About Sending Money from Sendwave to M-Pesa

How long do Sendwave transfers take?

For mobile money transfers, the money is delivered to the recipient within 30 seconds. The transfers take longer if you’re using bank transfer or cash pickup.

What payment methods does Sendwave accept?

Sendwave only accepts debit cards for users in the US and Canada. It does not accept credit cards or PayPal. This helps the company save on costs and keep transfers affordable.

Is Sendwave safe to use?

Yes. Sendwave is a licensed digital remittance service with up to 500,000 active users and positive testimonials from customers. All the information you provide is strictly for identity verification and is kept secure.

You May Also Like These Money Transfer Guides:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.