Mustafa Omar on Unsplash

Mustafa Omar on Unsplash How to Send a Mobile Money Transfer to Kenya: The Best Ways in 2023

Lydia Kibet

Guide

Lydia Kibet is a freelance writer with a knack for personal finance, investing, and all things money. She's passionate about explaining complex topics in easy-to-understand language. Her work has appeared on Business Insider, Investopedia, The Motley Fool, GOBankingRates, and Monito. She currently writes about personal finance, insurance, banking, real estate, mortgages, credit cards, loans, and more.

Byron Mühlberg

Reviewer

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

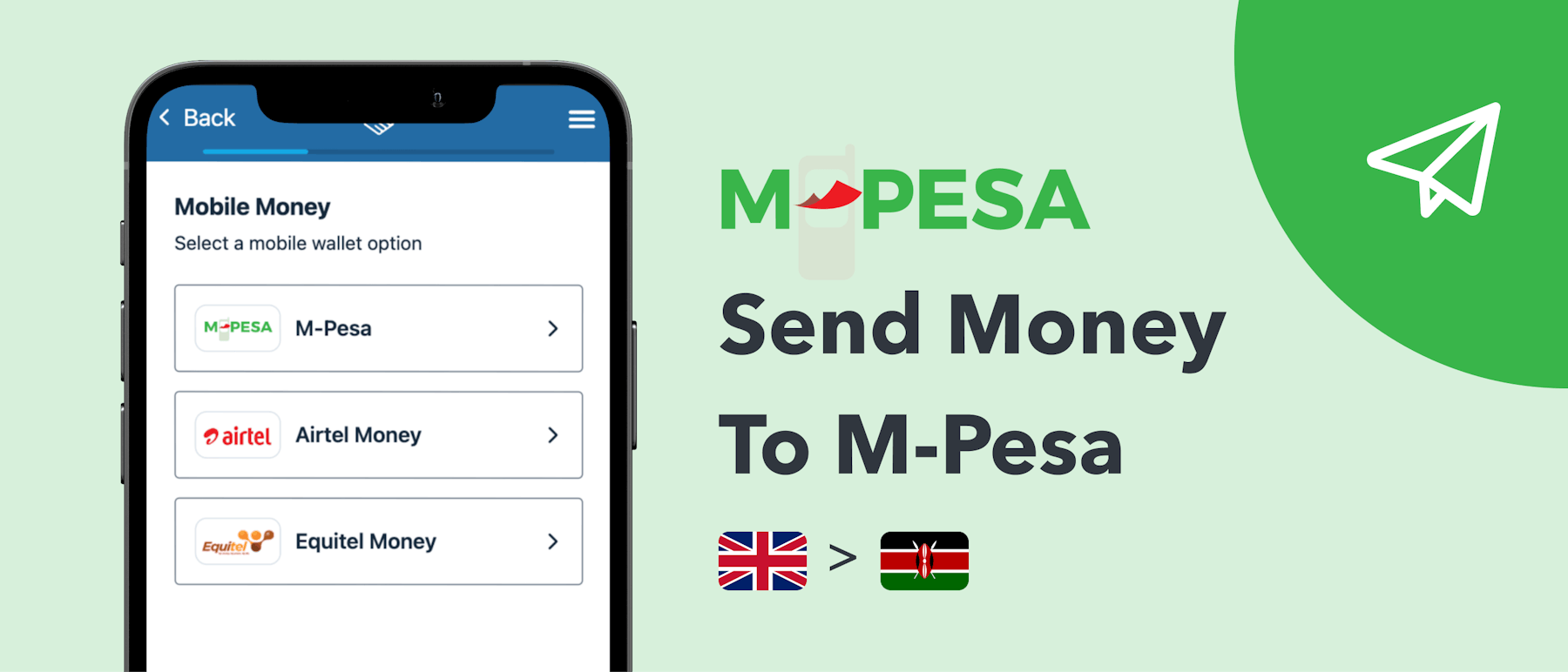

Read moreFor Kenyans living and working abroad, one of the major challenges is finding a fast, secure, and affordable way to send money to mobile wallets in Kenya. In the recent past, the only available options were wire and bank transfers. Fortunately, it's now possible to send money to mobile wallets like M-Pesa, Equitel, and Airtel Money from abroad using money transfer services.

There are several ways to make mobile money transfers to Kenya, and we'll look at a couple of those money transfer services in this post. If you'd like to skip ahead and find the best deal for your next transfer to Kenya, run a search on our real time comparison engine and select 'Transfer to Mobile wallet' to filter for providers who let you pay directly to your recipient's mobile money account 👇

Compare money transfers to Kenya in real time:

Key Facts About Mobile Wallets in Kenya

| Mobile Money Services | M-Pesa, Airtel, Equitel, Orange Money, YuCash |

|---|---|

| Mobile Money Accounts | 68 million |

| International Providers | WorldRemit, Remitly, Western Union, and others (compare here) |

| Transfer Cost to Kenya via Monito | 1% - 3% |

How to Send a Mobile Money Transfer to Kenya

These days, sending money to a mobile money account in Kenya from abroad has never been easier. You can get the job done in a few simple steps:

Step 01

Select Your Preferred Provider

The first thing you need to do is find a trusted money transfer service provider. There are many service providers available, so you should consider factors like cost, availability, and conversion rate. This way, you can select the most suitable company for your needs. Additionally, it’s important to confirm that they have the mobile money transfer option.

Step 02

Sign Up and Create Your Account

Once you’ve found the best money transfer service provider, visit their official website or download their app, depending on the service provider, and begin the sign-up process. Most service providers do not charge you for signing up, so you’ll just provide basic information like your name and address. Some providers may ask for a photographic ID for verification.

Final step

Make the Money Transfer

Compare providers via MonitoWhen your account is up and running, you can start making transfers. Most providers have very user-friendly user interfaces, and initiating money transfers is easy.

Best Mobile Money Transfer Providers to Kenya

While the banks in both your adopted country and Kenya are reliable options for sending money, they may not have the best conversion rates, and they also don't typically support money transfers to a mobile wallet account. Moreover, bank transfers may take up to two working days to process. Here are some fast and affordable ways to make mobile money transfers from wherever you are:

From the UK to Kenya

Exchanging pounds for Kenyan shillings can be quite expensive, but you can use third-party money transfer service providers to send money conveniently and affordably from the UK to Kenya. These are your top three options for sending money from the UK to mobile wallets in Kenya:

Paysend

A specialist in international card payments, Paysend is a flexible and fast-growing money transfer platform that supports credit and debit card payments to an impressive network of nearly 100 receiving countries through various pay-out options, including mobile wallets in Kenya.

You can sign up for Paysend using your mobile phone number in many countries worldwide, including the US, Canada, the UK, Europe, and Australia. Once you're registered, you can send money to anybody's M-Pesa or Airtel account in Kenya.

Remitly

Remitly is a popular digital remittance service based in the United States. The platform facilitates mobile money transfers to several countries across the world. Remitly is available in both Kenya and UK, so it's an excellent option for sending money between the two countries.

To use Remitly, you create an account for free on their website or mobile app. Their money transfer options include M-Pesa, Airtel Money, and several banks. You can choose your preferred option before making the transfer. You can pay for the transfer using debit/credit/prepaid cards or bank transfer.

WorldRemit

WorldRemit is a UK-based money transfer platform and one of your best options for sending money from the UK to mobile wallets in Kenya. It is one of the most popular digital money transfer platforms, enabling transfers to over 130 destinations worldwide.

You can sign up for WorldRemit on their website or using their mobile app. You'll need an email address to create your account. You'll also provide some basic information to verify your identity. Once your account is running, you can start sending money transfers by choosing your recipient and preferred transfer option.

Small World

Small World is one of the most affordable legacy money transfer platforms. The platform allows money transfers from the UK to mobile wallets in Kenya, including M-Pesa and other options.

Small World is a trusted money transfer platform with over 15 million users globally. You can create your Small World account by signing up on their official website or downloading the app. You'll have to provide the necessary documents for identity verification; then, you can proceed to make mobile money transfers.

From the USA to Kenya

You can conveniently send money from the USA to Kenya via legacy or digital platforms. Here are some of the fastest and most affordable platforms for sending money from the US to mobile wallets in Kenya:

Remitly

As a US-based and fully online remittance platform, Remitly is one of the fastest and most affordable ways to send money from the US to Kenya. It offers some of the cheapest fees and exchange rates, which is why it is well-rated by its over three million customers.

You’ll need an email address to create your Remitly account, after which you’ll be asked to provide personal details to verify your identity. Once you have your account, you can choose your preferred transfer option for sending money to Kenya, including M-Pesa, Airtel Money, and more.

Western Union

Legacy platforms are still a pretty reliable choice for sending money from the US to Kenya. In the past, you had to visit a Western Union agent with physical cash to make transfers, but you can now use the platform for mobile money transfers.

You can sign up and create your account on their official website or download the app for convenience. The next step is selecting your recipient’s country and preferred transfer option. You have three options: Bank Account, Cash Pickup, and Mobile Wallet.

From Australia to Kenya

You no longer have to worry about exchanging Aussie dollars for Kenyan shillings and sending money back home to your loved ones. There are several third-party services that do all the work for you. Here are some of your top options for making mobile money transfers from Australia to Kenya.

Wise

One of your top options for sending money from Australia to Kenya is Wise. It is a foreign exchange and mobile money transfer platform that facilitates money transfers to over 150 destinations globally, among which is Kenya.

To make a mobile money transfer using Wise, you’ll first have to set up your account by signing up for free using your email address or Facebook account. After setting up the account, you can choose your transfer option and the amount you’d like to send. Wise shows you all the fees upfront and an estimate of how long it will take for the money to arrive.

Remitly

Remitly is one of the best platforms for making mobile money transfers. This US-based digital money transfer platform allows users to send money to recipients in over 145 countries. You can use it to send money fast and affordably from Australia to mobile wallets in Kenya.

You can send money using Remitly in a few simple steps. Simply sign up for an account, verify your identity, and then enter your recipient’s name and mobile number to transfer the money directly into their mobile wallet. The money typically arrives in Kenya within a few minutes.

MoneyGram

You can also go traditional and use legacy platforms such as MoneyGram. MoneyGram is a trusted platform that offers competitive exchange rates and is one of the options you can use for sending money from Australia to mobile wallets in Kenya.

While the platform has many service agents and physical locations in both countries, using your phone is more convenient. Visit their website or download the mobile app to sign up. Both have various options for sending money, including mobile transfers. MoneyGram’s transfer fees depend on the amount you’re sending and the transfer option you choose.

From New Zealand to Kenya

Sending money from New Zealand to mobile wallets in Kenya no longer has to be a hassle. Several third-party mobile money transfer platforms facilitate fast and affordable transfers. Here are some of the best platforms.

Wise

Just like from Australia, one of your top options for sending money from New Zealand to Kenya is Wise, whose money transfer platform that lets you make money transfers to over 150 destinations globally, including to Kenya where your recipient can receive the transfer via their mobile money account.

To make a mobile money transfer using Wise, you’ll first have to set up your account by signing up for free using your email address or Facebook account. After setting up the account, you can choose your transfer option and the amount you want to send. Wise shows you all the fees upfront and an estimate of how long it will take for the money to arrive.

Western Union

Western Union is the oldest money transfer platform and one of the most secure means to send money from New Zealand to Kenya. People hear Western Union and think of physical agents and cash pickup, but there are other options now, including mobile money transfer.

You can use Western Union to conveniently send money from New Zealand to mobile wallets in Kenya directly. All you have to do is sign up for an account, choose your preferred transfer option, and the amount you’d like to send.

From Canada to Kenya

You can now send money from Canada straight to mobile wallets thanks to third-party money transfer platforms. The following are two of your best options.

Sendwave

Sendwave is a popular digital remittance service that allows users to send money from Europe and the US to several countries in Africa, Asia, and the Americas. As an app-based company, it manages to keep its transfer fees pretty low.

Sendwave lets you directly send money from Canada to your recipient’s mobile wallet. To create your account, you’ll first sign up, verify your identity, and then link your debit card. You can then choose your money transfer option from the three available options; mobile wallet, cash pickup, and bank account.

Skrill

Skrill is a relatively new but fast and secure platform to make money transfers to more than 40 destinations. The platform is fast gaining popularity, mainly due to its relatively low fees and competitive exchange rates.

To use Skrill for mobile money transfers to Kenya, simply register your account on their app or website. From there, you can securely and conveniently send money from Canada to Kenyan mobile wallets.

See Our Other Money Transfer Guides

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.