Can I Receive Money From Nigeria Through M-Pesa? (Answered!)

Lydia Kibet

Guide

Lydia Kibet is a freelance writer with a knack for personal finance, investing, and all things money. She's passionate about explaining complex topics in easy-to-understand language. Her work has appeared on Business Insider, Investopedia, The Motley Fool, GOBankingRates, and Monito. She currently writes about personal finance, insurance, banking, real estate, mortgages, credit cards, loans, and more.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreM-Pesa is one of the most convenient ways to send, receive money, and make payments for goods and services. It’s trusted by millions of Kenyans and beyond due to its safety and ease of use.

With M-Pesa Global, you can now send and receive money globally. But can you receive money from Nigeria through M-Pesa? Yes, but only through a third-party service.

Currently, you cannot send money directly from Nigeria to Kenya via M-Pesa without using a third party. Fortunately, plenty of fast, affordable third-party digital remittance platforms make cross-border transactions effortless.

Compare these options in real-time using Monito’s comparison engine.

Alternatives for Receiving Money From Nigeria Via M-Pesa

Receive Money From Nigeria Through M-Pesa

Different Ways to Receive Money From Nigeria Via M-Pesa

Here are some of the most popular platforms people use to send money to Kenya via M-Pesa.

1. PayPal

Thanks to the M-Pesa-PayPal partnership, you can now send money directly from PayPal to M-Pesa. As one of the world's most popular financial service platforms, PayPal operates in Nigeria and Kenya.

PayPal gives you various money transfer options, including mobile wallets like M-Pesa. You can make money transfers within minutes by simply logging into your PayPal account and choosing your preferred transfer method.

While PayPal is a convenient way to send money, it is relatively expensive, so we'd recommend looking into cheaper digital remittance services.

2. Mukuru

Mukuru is a South Africa-based financial service and one of Africa's leading digital money transfer services. It provides a safe and cost-effective way to send money across Africa.

With Mukuru, you can send money instantly from Nigeria to Kenya using your preferred transfer method. You can send the money via mobile wallets like M-Pesa, bank account, or even cash pickup.

To send money using Mukuru sign up for an account and enter your recipient's details. Mukuru sets money transfer limits based on the information provided. The more info you provide, the higher your limit.

3. Wise

Another popular money transfer platform is Wise. This digital remittance platform facilitates money transfers to more than 175 countries worldwide.

You can use Wise to send money from Nigeria to Kenya. The platform supports money transfers via bank accounts and mobile wallets. This means you can make transfers directly to your recipient's M-Pesa wallet.

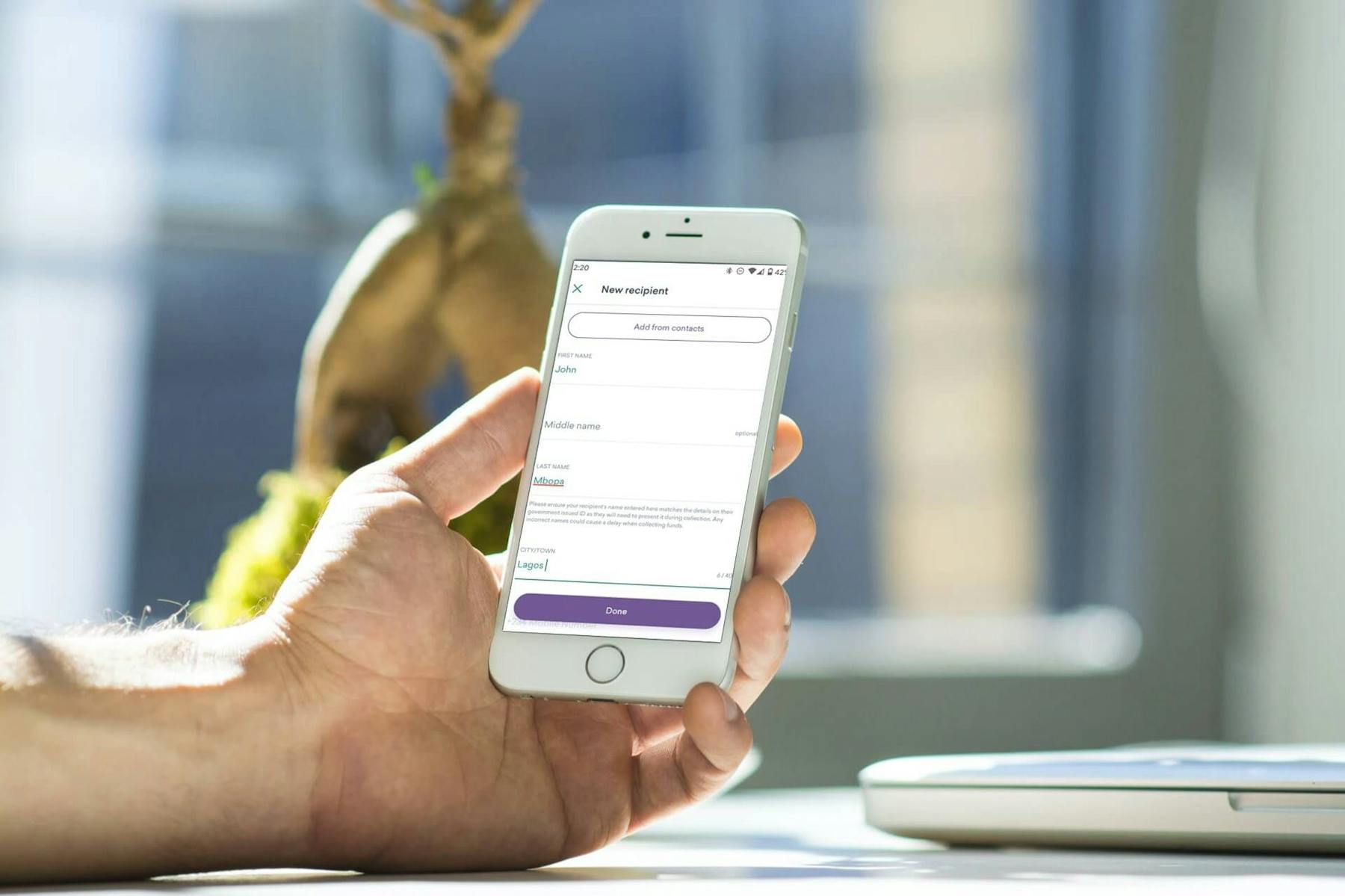

Setting up a Wise account is straightforward. Simply sign up using your email address and provide the necessary details. Note that you must verify your account.

Once your account is set up, you can choose your recipient, preferred transfer method, and the amount you wish to send. Before sending the money, Wise shows you the fees upfront and the estimated time it will take to reach the recipient.

4. Eversend

Eversend is another fintech service you can use to make money transfers across Africa. You can receive money from Nigerial trough M-Pesa with Eversend.

One of the advantages of using Eversend is it’s free, provided both the sender and recipient have an Eversend account. The Eversend app can also be used to pay utility bills, buy airtime and data subscriptions.

To open an Eversend account, simply sign up and provide personal details like your full name, date of birth, phone number, email address, and a form of national identification. You’ll need to link a debit or credit card to your Eversend account so you can make deposits.

Your recipient in Kenya will withdraw the money directly into their local bank account, or M-Pesa.

5. Skrill

Skrill is another fast and secure way to transfer money from Nigeria to Kenya. Skrill is mainly known for competitive exchange rates and relatively low transfer fees.

With Skrill, both the sender and recipient are not charged for the transfer. You can start sending money using Skrill by registering for an account on their official website or downloading the Skrill app.

You can use Skrill to send money from Nigeria to Kenya via bank transfer or M-Pesa. For mobile transfers, the money reaches the recipient almost immediately, which is one of the biggest perks of using Skrill.

6. Western Union

You can go old-school and use legacy platforms like Western Union to send money from Nigeria to Kenya. Western Union is a reputable money transfer service that has been in business for decades.

Initially, you could only send money using Western Union by visiting physical agents with cash, but the platform has now expanded to include digital services. You can now use Western Union to send money to M-Pesa and other mobile wallets.

To get started, you have to register your Western Union account. Next, you'll choose your recipient's country and how you want them to receive the money. You can choose cash pickup, bank transfer, or mobile wallet.

7. MoneyGram

MoneyGram is another extensive legacy platform that you can use to send money from Nigeria to Kenya.

With thousands of service locations and agents globally, MoneyGram facilitates money transfers through cash pickup. Initially, the only options you had for money transfer were cash pickup and bank transfer.

Currently, you can use MoneyGram to send money via mobile wallets as well. This is a lot more convenient, as you can make the transfers on your phone, instead of visiting a MoneyGram agent.

MoneyGram charges you transfer fees based on the amount you’re sending, and you can pay for the transfer and related fees using a debit card, credit card, or bank transfer.

FAQs About Receiving Money From Nigeria Through M-Pesa

Is It Possible To Send Money From Nigeria to Kenya via M-Pesa?

Currently, you cannot send money directly from Nigeria to Kenya via M-Pesa. However, you can use third-party services like PayPal and Wise to facilitate money transfers from Nigeria to Kenya.

How Can I Receive Money From Nigeria to Kenya?

Depending on the sender's transfer method, you can receive money from Nigeria via bank transfer, cash pickup, or mobile money. Digital remittance services facilitate money transfers to M-Pesa directly, which is one of the most convenient ways to send and receive money.

Which App Can I Use To Send Money From Nigeria to Kenya?

Apps like PayPal, Wise, Skrill, Western Union, and Mukuru facilitate transfers from Nigeria to Kenya. You can choose an app based on exchange rates and transfer fees to find the best deal for you.

Transfer fees and exchange rates are constantly changing, so the best app today may not be the best tomorrow. Use Monito's comparison engine to compare different money transfer options in real time.

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.