Nuri Review: Fees, Debit Card, Crypto Functionality, Usability, and Monito's Verdict

Byron Mühlberg

Guide

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Jan Watermann

Reviewer

As a digital nomad, Jan is an expert in cross-border money transfers and internationalization. At Monito, he shares his knowledge by writing content geared primarily towards a German-speaking audience.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreNuri is Insolvent!

As of August 2022, Nuri is no longer available to new customers, as the company has filed for bankruptcy in Germany. Compare top Nuri alternatives in our dedicated guide to the best travel cards:

Nuri is a good online banking app (7.9/10) recommended by Monito, especially for its low-fee pricing for which the platform charges practically no fees for everyday use at home and abroad (10/10). Nuri also earns a high level of satisfaction from customers (7.6/10) on a robust and trustworthy web and mobile platform (8.4/10). However, despite offering an interesting range of services and features including savings functionality and cryptocurrency trading, Nuri offers limited top-up options and no in-app international transfers, leaving room for improvement in its service quality (5.4/10).

What Monito Likes About Nuri

- One of the EU's cheapest neobanks, with zero fees for top-ups, withdrawals, and card spending at home and abroad;

- Comes with a German IBAN;

- Account opening is fast and straightforward.

What Monito Dislikes About Nuri

- No bill splitting functionality;

- Card spend isn't integrated with Apple Pay or Google Pay;

- No joint account, overdraft, or interest on Euro balances'

- Customer service is reachable only by email.

Key Questions About Nuri Answered

- 01. Is Nuri safe?

- 02. How good is Nuri's account and card?

- 03. What are Nuri's fees and costs?

- 04. What are customers saying?

- 05. Are international transfers with Bitcoin or Ethereum worth it?

- 06. How do I open a Nuri account?

- 07. Is Nuri right for you and what are the alternatives?

- 08. Other frequently asked questions about Nuri

Last updated: 29/11/2021

⬆ Top-up | Bank transfer, crypto transfer |

|---|---|

💳 Card | Debit Mastercard |

💶 Payment Fees | 0 |

🏧 Withdrawal Fees | 0 |

💵 Conversion Fees | 0.00%* |

💻 Account Details | IBAN (DE) |

💱 Currency | Euro |

👥 Users | Approx. 80,000 |

🔐 Trustpilot | 3.4/5 |

📝 Reviews | Approx. 1,600 |

Last updated: 29/11/2021

* Mastercard's exchange rate is applied

📍 Headquarters | Berlin (DE) |

|---|---|

📃 Established | 2015 |

🖋 Licensing | Subsidiary of Solarisbank |

👥 Employees | Approx. 200 |

🌍 Available | EU, UK, Switzerland, Iceland, Liechtenstein, Norway |

💬 Languages | English, German |

Last updated: 29/11/2021

Who Is Nuri For?

All residents of the EU, as well as those of the UK, Switzerland, Iceland, Liechtenstein, and Norway are eligible to open a Nuri account. However, new customers don't necessarily need to be EEA nationals, as Nuri also accepts ID documents from over 70 countries.

We are trusted.

Monito's reviews are trusted by 100,000+ readers every month.

We go the extra mile.

We don't merely research. We probe and verify every statement.

We are independent.

Our recommendations are always unbiased and independent.

We are principled.

We only recommend the products and services we'd recommend to our friends and families too.

Nuri — The New Name for Bitwala

Since mid-May 2021, Bitwala has officially rebranded as 'Nuri' to broaden its appeal to new customers. The company is now focusing on a complete banking experience in which cryptocurrencies only form a small part. Instead, the Nuri debit card takes centre stage with its outstanding fees and sustainable investment offer!

How Monito Reviewed Nuri's Services

As with all services reviewed by Monito, Nuri underwent a rigorous evaluation to assess the quality of its service. To begin with, our experts analysed several key criteria, including customer reviews, the percentage cost of various transaction types, top-up options, access to customer service, as well as business and legal metrics such as revenue, appropriate authorisation, and company size. As with all Monito Scores, Nuri's score was peer-reviewed by at least one Monito expert.

Reviews are written independently by Monito's editors and recommendations given are our own. Services you sign up with using our links may earn us a commission. Learn more.

Trust & Credibility

Background check

Licensed as a broker by the BaFin and funds are insured via Solarisbank AG.

Security & reliability

Accounts are fully secured using segregated user accounts and HTTPS and cards are 3-D Secure.

Company size

Around 250 thousand customers and $10 million in annual revenue.

Transparent pricing

A full overview of pricing is easily accessible and provides all fees as per the regulator-standard fee schedule.

Is Nuri Safe?

Yes, Nuri is a safe digital banking option that takes security very seriously. As a Nuri user, you'll be fully guaranteed that your account balance is protected up to a total of €100,000 through the Solarisbank deposit insurance scheme.

If you trade cryptocurrencies via Nuri's integrated wallets, you can also expect a high-security standard. This is because the platform relies on multi-signature keys and an integrated two-factor authentication, which means that Nuri crypto wallets adhere to the highest security standards in the industry.

In our opinion, Nuri's customer support is also a feather in its cap which convinced us of its seriousness and credibility. Many customers on Trustpilot also praise the competence and speed of response through the various contact channels. As a customer, you'll be able to contact Nuri's customer support team in any the following ways:

- Nuri Support Centre: The Nuri Support Center is geared toward solving minor issues and questions in the shortest possible time. It includes a built-in chatbot that offers the opportunity to leave a message for an employee, who usually responds fairly quickly via email.

- Facebook: Nuri's Facebook page offers the option to leave messages directly via Facebook Messenger. In our experience, we found that customer service responds in the shortest possible time and is eager to solve problems.

- Email: You can send an email question to support@nuri.com which, in our experience (and that of many users on feedback platforms.), is usually answered quickly. At peak times, however, Nuri says that it can take up to 24 hours to receive an answer.

Service & Quality

Using the mobile app

Smooth and user-friendly with many interesting features, although lacking automatic spending categorization.

Managing the account

Basic account features with a limited number of top-up methods, no international money transfers, joint account, overdraft, or interest.

Making card payments

Contactless and online payments are supported, but Apple Pay, Google Pay, and social payments are not.

Contacting support

FAQ, live chat, and email are available but phone support and 24/7 service currently aren't supported.

Nuri's Product & Service Quality

Nuri was created with the aim of merging blockchain and banking to enable a "New Reality Banking". To this end, Nuri's primary focus is neither on its crypto trading platform nor its debit card per se, but on combining cryptocurrencies (e.g Bitcoin, Ethereum, etc.) and fiat currencies (e.g. the Euro, US dollar, British pound, etc.) into a single, durable solution. In this way, Nuri is positioning itself for a future in which digital currencies are increasingly integrated in our day-to-day lives.

In spite of this, it was important for us when reviewing Nuri to know that its bank accounts and cryptocurrency wallets are separate features, as we don't recommend cryptocurrency trading except for purely speculative purposes. That said, Nuri's cryptocurrency features are quite interesting and could could become more important as time goes by.

Bitcoin, Ethereum, or Euro — What Is the Account Currency?

If you take a look at the Nuri website, things can get quite complicated, and many customers aren't fully aware from the outset which account currencies are offered and which aren't. In fact, the situation is relatively simple and easy to explain:

The Nuri account is a completely normal bank account, functionally on par with checking accounts at other EU banks. This is because Nuri's accounts are covered and administered by Solarisbank, a German bank that's based in Berlin and regulated in the EU alongside a full banking license. This means that the Euro is the only account currency at Nuri by default. Deposits denominated in Euros are guaranteed of up to a value of € 100,000 — a fact that we find particularly favourable about Nuri's digital account.

Alongside the Euro, cryptocurrencies are also available with Nuri — but only as an optional additional feature. In the app, users have the option of exchanging their Euro balance for Ethereum and Bitcoin, allowing an interesting balance between crypto speculation on the one hand, and everyday spending on the other.

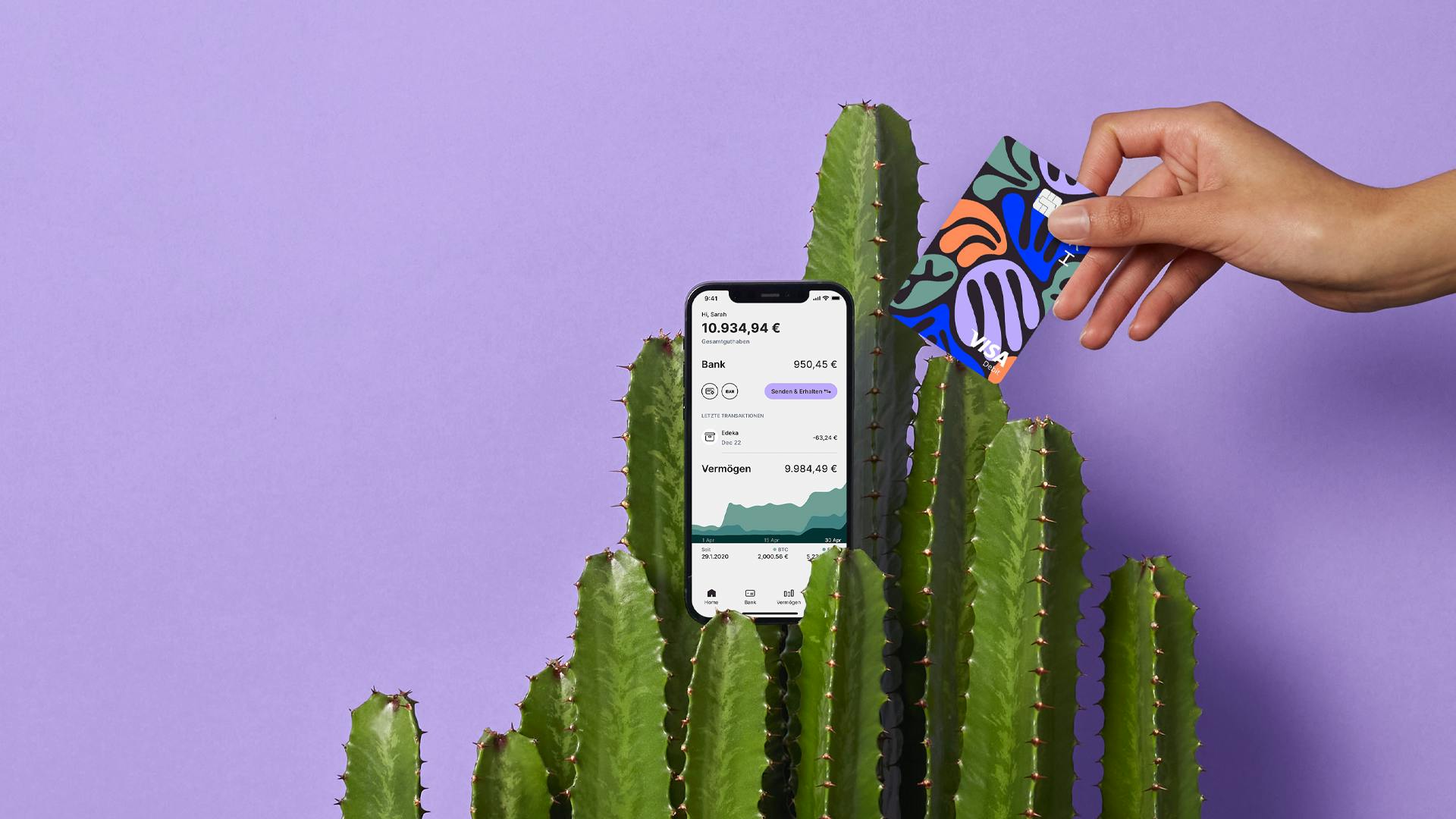

Nuri Mobile App Review

Not only are Nuri users able to manage their bank account via the website, but they can also do so a slick mobile application that's fully equipped with all of Nuri's many perks. What particularly appealed to us about the app is that the bank account is clearly separated from the trading area, making it easy for users to see whether they're accessing Euro or crypto transactions.

The Nuri app offers you the following unique features, among others:

- Direct access to the bank account and the trading offer;

- Account opening in a few minutes from your smartphone;

- Block your debit card and order a new one in seconds;

- Biometric authentication;

- Push messages on all account transactions;

- Includes a cryptocurrency wallet.

Fees & Exchange Rates

Everyday use

No everyday costs such as monthly fees, transfer fees, and local ATM withdrawal fees.

ATM withdrawals

Withdrawals are free at home and incur only a Visa exchange rate margin for foreign currency withdrawals abroad.

Online spending

Online spending comes at no cost, neither in Euros nor in a foreign currency.

International spending

No fees for spending abroad, although Visa's exchange rate applies to foreign currency transactions.

How Pricey Is Nuri?

One aspect of Nuri's bank account that stands out above the rest is that it can be used 100% free of charge in everyday life. This is because Nuri's functions are deliberately limited in order not to have to charge any fees.

We find it particularly appealing that no fees are charged for all payments with your debit Mastercard — regardless of whether you're in the Eurozone or an overseas country. An exchange rate surcharge is also waived for foreign currency transactions, including both card payments and cash withdrawals. Every transaction is based on the Mastercard exchange rate, which corresponds very closely to the prevailing mid-market rate. Withdrawing cash is also possible for free and without any limitation on the number of withdrawals or the value. Compared to Wise's Multi-Currency Account, Revolut, or Monese — which only support cash withdrawals up to around €200 per month free of charge — this is a decisive advantage.

In our opinion, all of this makes the Nuri debit card an excellent solution for frequent travellers and cross-border commuters alike. Take a look at the table below to get an idea of the fees that Nuri charges:

Fee | |

Account Opening/Management | 0 |

SEPA Transfers | 0 |

Card Payments (SEPA) | 0 |

Card Payments (non-SEPA) | 0 |

ATM Withdrawal (SEPA) | 0 |

ATM Withdrawal (non-SEPA) | 0 |

Replacement Card | 9.95 |

Last updated: 25/05/2021

However, bear in mind that for account balances of €50,000 or more, Nuri charges negative interest in the amount of the current deposit rate. As of October 2020, this was 0.50%. We therefore recommend that you avoid keeping large sums of cash on your Nuri balance.

Spending & Trading Limits

Anyone who thinks that the Nuri debit card is too good to be true and expects strict limits might be surprised. In fact, the debit card — with its relatively high limits of €3,000 per day and €10,000 per month for cash disposal — is very generous and on a level with other neobanks.

Offline payments are limited to between €3,000 and €5,000 per day and €10,000 per month. There is a limit of €50,000 per seven-day period for the trading offer. What's more, there is also presently no limit for SEPA transfers.

To get a better picture of these limits in action, see the table below:

Type of Limit (EU) | Daily Limit | Monthly Limit |

|---|---|---|

Payments | 5000 | 10000 |

Cash Withdrawal | 3000 | 10000 |

Limit (Per Trade) | 25000 | - |

Limit (Per 7-Day Total) | - | 50000 |

Last updated: 29/11/2021

In our opinion, most account holders should be just fine with the Nuri limits and not encounter any problems in using the debit card for all kinds of everyday expenses. However, it is not suitable for larger expenses, such as buying a car. (Although we didn't expect this from Nuri either!)

Customer Satisfaction

Customer review score

Average rating of 3.6 out of 5 stars on Trustpilot, Google Play, and the App Store.

Number of positive reviews

Around 3,000 four- and five-star reviews on Trustpilot, Google Play, and the App Store.

What Experiences Do Nuri Customers Report?

In general, Nuri has earned good feedback from users across the board, garnering an average rating of 3.6 out of 5 stars on Trustpilot, Google Play, and the App Store at the time of writing.

Aspects of Nuri that users frequently praise include its customer support service, no fees, minimal currency conversion costs and, of course, Nuri's separate-but-accessible crypto trading platform. On the other hand, critiques of Nuri included that the platform withheld funds for AML purposes without adequately disclosing the fact and that the registration process took long.

Are International Transfers With Bitcoin or Ethereum Worth It?

With Nuri, there are no limits to banking with cryptocurrencies, and crypto-based transfers can be flexibly transferred from any wallet to any other wallet around the world in just a few minutes. Nuri charges a flat fee of €1.00 per transaction, regardless of the transfer volume. With this Nuri will certainly make a small profit because the transaction costs are much lower in reality.

Fun fact — a few months ago a high Bitcoin transaction caused a stir. It was worth nearly $1 billion in total. However, the transaction only incurred a fee of $0.48.

Foreign transfers are theoretically almost free and completely independent of the banks. This can be worthwhile for many people who want to transfer assets from one country to another as quickly and cost-effectively as possible. However, as international money transfer experts, we have some significant concerns about international money transfers with cryptocurrencies, and therefore we don't recommend Nuri for this purpose.

As a trusted comparison website for international transfers and neobanks, we can only recommend cryptocurrencies to a very limited group of people: experts in the field and those who acknowledge the speculative nature of the industry. In contrast to traditional fiat currencies, cryptocurrencies. are usually very volatile, meaning their value fluctuates constantly. For example, it has happened before that Bitcoin has fallen 48% in a span of only 24 hours.

If you want to make a secure international transfer and do not already have the corresponding cryptocurrencies, you should not use crypto to make international transfers, in our opinion. Nevertheless, we find it intriguing that Nuri is trying to combine the advantages of cryptocurrencies with the benefits of classic bank accounts.

How To Open a Nuri Bank Account

Opening an account with Nuri is as easy as it is with most other neobanks. Since the company doesn't have any branches, you can open an account entirely online. If you decide to open a Nuri account, you'll need to go through the following steps:

- Download the Nuri app: In principle, you can open a Nuri account without a smartphone; however, we recommend downloading the Nuri app, as the opening process is a lot less complicated.

- Create an account: Sign in to the app with a new account. During the course of registration, you must provide information about your place of residence, nationality and tax residence. You'll need to confirm your e-mail address and your telephone number in this step to continue with the registration.

- Verify your identity: Nuri uses ID-Now for online verification. While being verified, you must have your identification document ready. This step usually takes less than five minutes to complete.

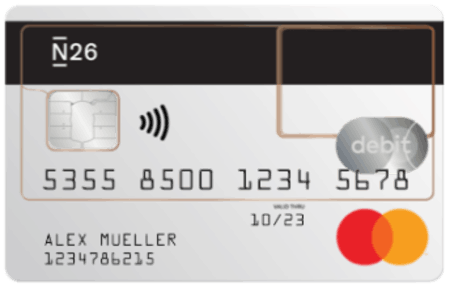

- Receive your debit Mastercard: Finally, you need to order and wait for the Nuri card linked to your new account. Under the menu items Settings and Card settings, you will find the option Order card. The delivery of the card takes a maximum of two weeks.

Is Nuri Worthwhile as a Neo Bank and What Are the Alternatives?

All in all, we at Monito are quite excited about the fee structure of the Nuri bank account. It is superior to most other neobanks and can save a lot of money for people who lead an international lifestyle. We therefore also recommend the account to those who otherwise have nothing to do with cryptocurrencies.

However, since the banking offering is relatively new, we cannot guarantee that Nuri will be able to maintain the low fees. It is still noteworthy that a comparatively small fintech startup can offer better banking conditions than larger, better-established competitors such as Revolut and Wise.

We therefore generally recommend Nuri and are excited to see what the crypto bank has to offer in the future. Here's how Nuri fares against N26, Revolut, and Wise:

|  |  |  | |

Top-up Method(s) | SEPA transfer, crypto | SEPA transfer, debit/credit card | Cash¹, SEPA transfer | SEPA transfer, debit/credit card |

Bank Account(s) | DE | US, GB | DE | BE, GB, US, AU, NZ, CA, HU, RO, SG, TR |

Available Platforms | Mobile, website | Mobile | Mobile, website | Mobile, website |

Account Opening | 0 | 0 | 0 | 0 |

Card Type | Mastercard | Mastercard | Mastercard, Maestro | Mastercard |

Card Issuance | 0 | 6 | 0 | 6 |

Withdrawal (Intl) | 0 | €0.00² | 0.017 | €0.00² |

Transfer (Intl) | N/A | €0.00³ | 0.35% - 2.00%⁴ | 0.35% - 2.00% |

Card Payment (Intl) | 0 | €0.00⁵ | 0 | 0 |

Withdrawal (EEA) | 0 | 0 | 0 | 0 |

| Try Nuri | Try Revolut | Try N26 | Try Wise |

Last updated: 25/05/2021

¹ Germany, Austria and Italy only

² Up to €200.00 per month, then 2.00%

³ Up to 5 withdrawals or €200 per month, then 2.00%

⁴ N26 uses Wise's platform for international money transfers

⁵ Up to €1,000.00 per month, then 0.50%

Frequently Asked Questions About Nuri

Is Nuri a Bitcoin credit card? 💳

No, not quite. Nuri currently offers two services: on the one hand, the customer has a bank account available, which comes with the specific services. On the other hand, Nuri serves as a trading platform for Bitcoin and Ethereum. However, you can only pay with a debit card in fiat currencies. All bills are in euros.

What makes Nuri so interesting? 😎

As a Nuri customer, you not only benefit from a flexible and completely free debit card, you also have the option of doing all banking (fiat and crypto) in one place. What's more, the app also offers a good overview and makes the topic of cryptocurrencies accessible to the general public.

Are N26, Revolut and Wise still worth it? 💶

Yes, absolutely! In our opinion, it never hurts to have several accounts with different neobanks. In principle, it is always possible that individual providers change their fee structures at short notice, leaving their products more expensive. We would generally recommend all Nuri users also to have accounts with other digital banks to still operate cheaper banking in the event of a fee increase.

Do you have to be familiar with cryptocurrencies at Nuri? 💻

In principle, prior knowledge of cryptocurrencies is not required when using a Nuri bank account. After all, the account runs on Euros and otherwise also offers the functions that every bank account holder should be familiar with. However, caution applies to the trading offer! Anyone who is not familiar with cryptocurrencies risks a total loss of the capital invested.