What Is a Telegraphic Transfer? Here’s Everything You Need To Know

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreA telegraphic transfer, also known as a ‘telex transfer’ or simply ‘TT’, is a banking term that’s used slightly differently depending on where you’re from. Fortunately, the definitions are fairly straightforward, with only a few minor differences needing to be taken into account when sending money across borders.

In most contexts, a telegraphic transfer is synonymous with a standard international money transfer—the two are simply different ways of saying the same thing. In countries such as Singapore and Hong Kong, a “telegraphic transfer” is the standard term for an international money transfer, while in the UK and Japan, the term is used slightly differently still.

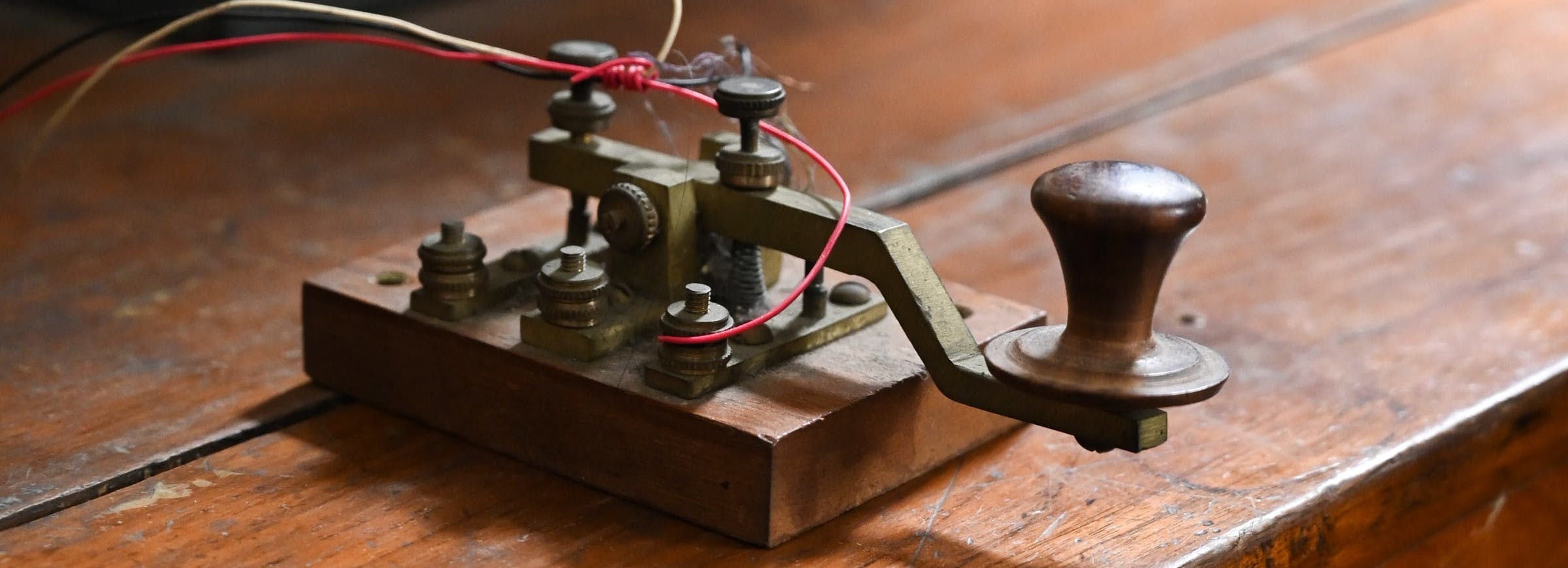

A vestige from a bygone era, the term “telegraphic transfer” once referred to cable telegraphs that were used to facilitate money transfers between banks. However, even once the internet had become the standard way to send cash, the term stuck around, coming to refer to a broad variety of ways of moving money from one bank account to another.

Different Place, Different Meaning

Telegraphic transfers have a variety of interrelated, yet subtly different definitions depending on where they are used:

In the United Kingdom, for example, a telegraphic transfer refers to a domestic money transfer made using the country’s Clearing House Automated Payment System (CHAPS), a payment system that allows for the real-time transfer of GBP-based funds from one UK account to another. However, telegraphic transfers can also be used in the UK to refer to international money transfers using the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network.

In both Singapore and Hong Kong, on the other hand, telegraphic transfers are used only to refer to international money transfers made through the SWIFT network, and not to domestic transfers.

Outside of the three countries mentioned above, money transfers that are made both abroad and within a country are more commonly referred to as “electronic funds transfers” (EFTs), “wire transfers”, or simply “bank transfers”, rather than telegraphic transfers.

However, it's worth noting that it may still be possible to encounter the term being used across many other countries, especially those in South Asia and Oceania such as Malaysia, India, and Australia.

Finally, in Japan, the term has taken on a new meaning entirely. Japanese banks use the term “telegraphic transfer” to refer to the practice of quoting exchange rates for different currencies against the JPY. These exchange rates, which are used for retail purposes, are typically updated on a very regular basis and are used by banks to pocket a small margin, as the amount quoted is actually slightly different from the actual exchange rate.

Take a look at the table below to get a better picture of how telegraphic transfers are defined in the different countries the term is used:

A Telegraphic Transfer Is...

Telegraphic Transfers: Avoid the High Fees

There are two kinds of fees that you’ll be hit with when making a telegraphic transfer using a traditional bank:

- Fees and commissions: Standard charges that vary significantly from bank to bank and country to country. They are typically either a fixed or variable amount charged on each transfer.

- Exchange rate margin: The difference between the exchange rate quoted by the bank (the “telegraphic transfer” in Japan) and the real exchange rate.

The amount you’ll pay in these fees, expressed as a percentage of the total amount, will vary significantly depending on your bank, how much you send, as well as the destination of the money. (The general rule of thumb here is that the larger the amount you send the smaller the percentage of fees you’ll pay will be—even though the absolute value of the fees will continue to increase).

In Singapore, for example, sending a relatively small amount of money abroad (e.g. 500 SGD) to the United States will be hit by total fees ranging from anywhere between 5 and 10% of the total amount, depending on the bank you choose.

Minimizing these fees can be as simple as comparing your options on money transfer providers. Many of the most competitive providers in the industry are, in fact, not banks at all. Rather, they are innovative money transfer providers such as TransferWise and CurrencyFair, for example, which specialize in sending money abroad at low fees, thereby competing with banks for the same market.

Take a look at how the fees on the above transfer would vary depending on which provider you choose (as of 17/08/2020 at 15:30PM +01:00 GMT):

500 SGD to the United States

You May Still Be Wondering...

How fast are telegraphic transfers? 💸

Because they make use of the SWIFT network, telegraphic transfers can take anywhere between a few hours to five working days to arrive in the recipient's account.

Are telegraphic transfers safe? 🔒

Yes. Payment orders for telegraphic transfers use SWIFT, a secure and standardized network. What's more, the providers themselves are also regulated and authorized by relevant authorities. Provided you go with a registered bank or money transfer provider, your telegraphic transfer will be safe indeed!

How do I send a telegraphic transfer? 💳

Using a bank, you will typically need to select an option in your internet banking to initiate an international transfer. From there, you will be prompted to provide the recipient's SWIFT/BIC code, account number or IBAN, and/or other details where necessary. Using a money transfer provider, on the other hand, you will typically have to open an account before adding the details of your beneficiary.

Monito Glossary

When it comes to moving money, don't let yourself be bogged down by all the jargon. Explore the Monito Glossary to get up to speed with everything you need to know about money transfers!

Low-Cost Options for Telegraphic Transfers

Explore Your Best Options

Photo by Sandra Tan on Unsplash

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.