Find the best ways to send money to Sri Lanka from the USA

Top Providers For transfers from the USA to Sri Lanka

Based on 1,775 comparisons made by Monito users in the past 3 months.

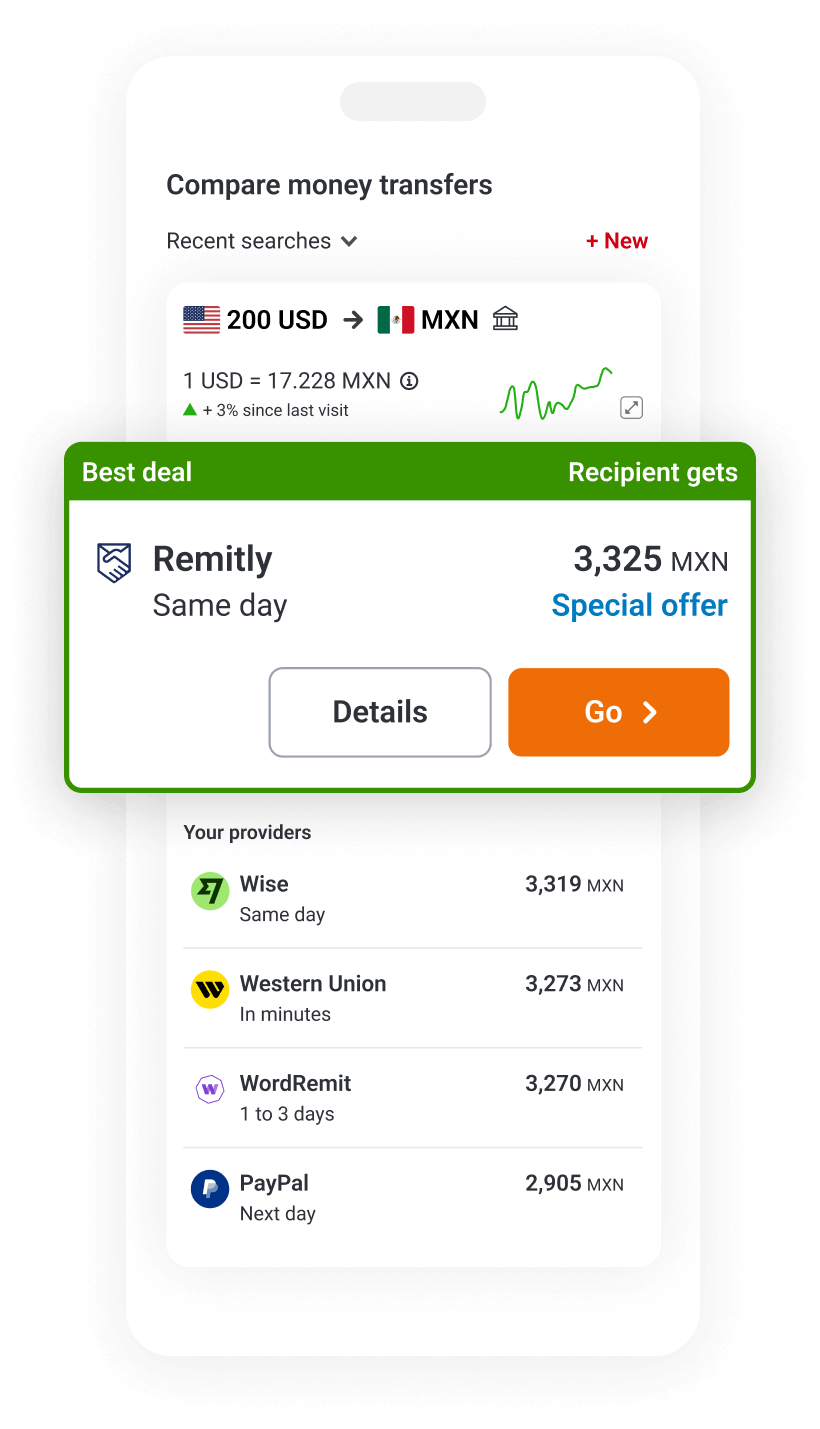

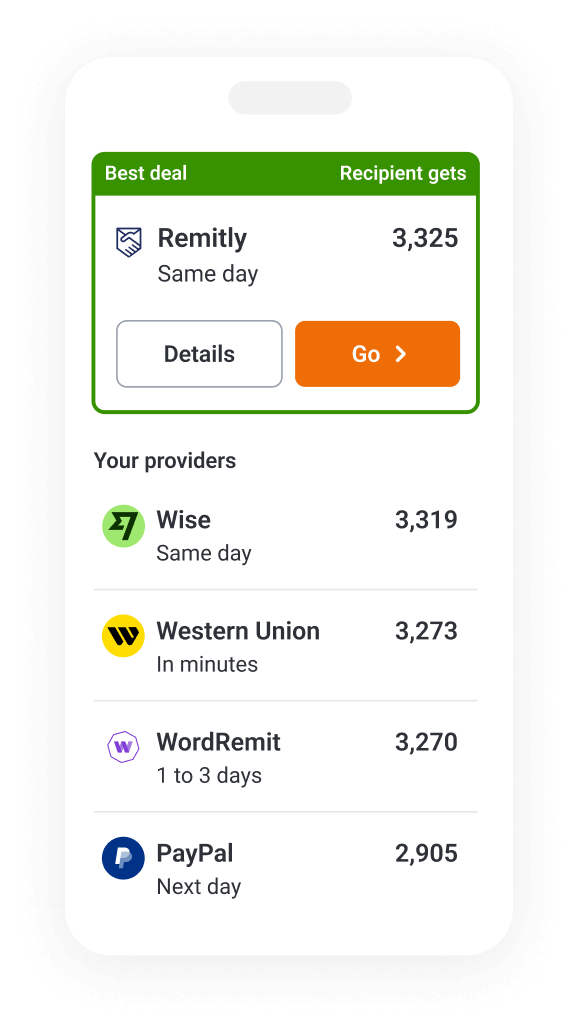

Compare live resultsBest for Transfers to a Bank Account

Best of 7 providers. Compare all

Best for Transfers to Cash Pickup

- 9.3Top providerGo to Remitly

Cheapest

in 91% of all comparisons

Top rated

in 100% of all comparisons

Fastest

in 91% of all comparisons

Best of 2 providers. Compare all

Stay on top of the market

Get our email alerts

We'll send you the exchange rate, best deal, and other helpful tips.