Find the Best Way to Send Money to Singapore

Top Providers For transfers to Singapore

Based on 8,663 comparisons made by Monito users in the past 3 months.

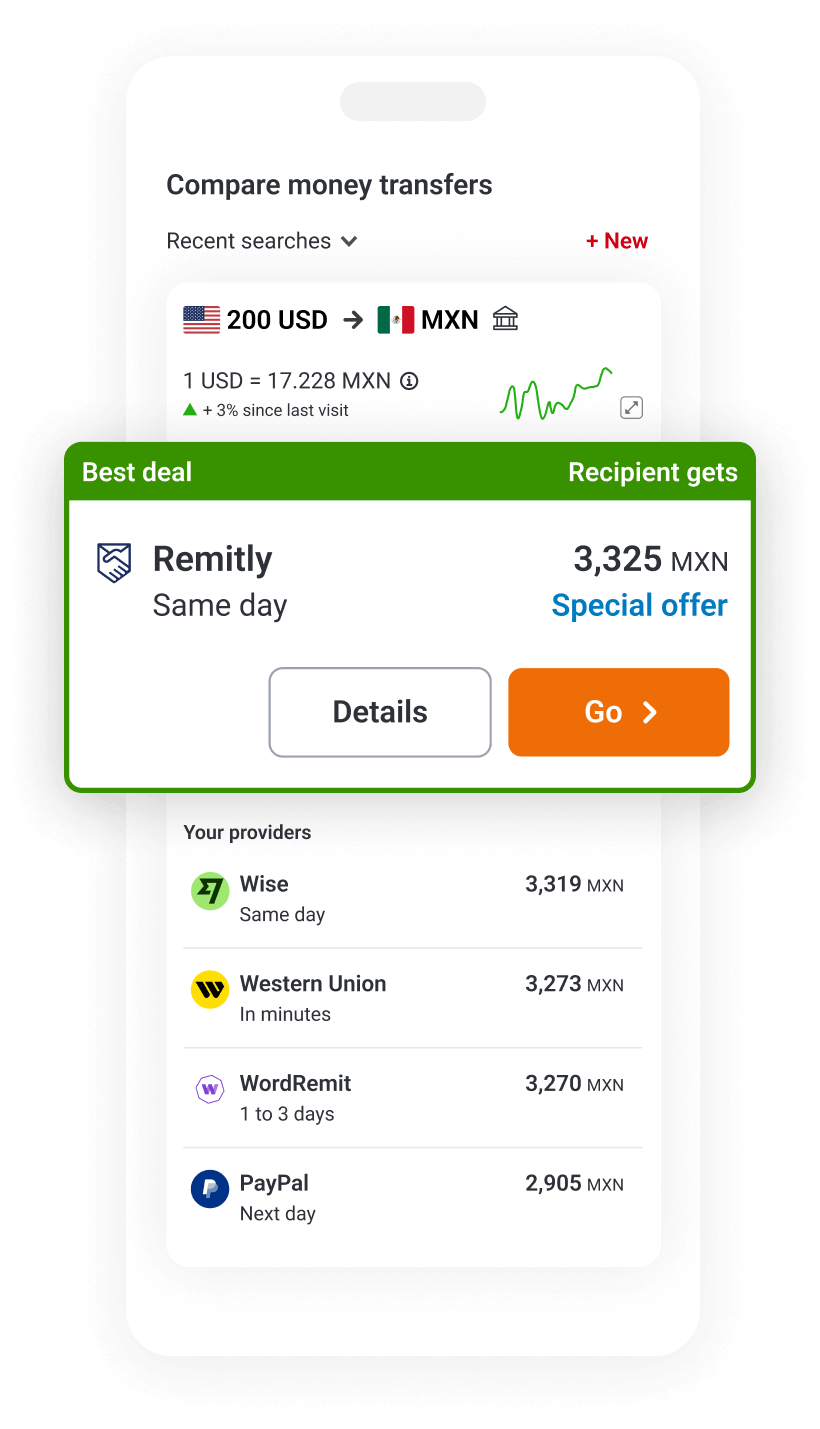

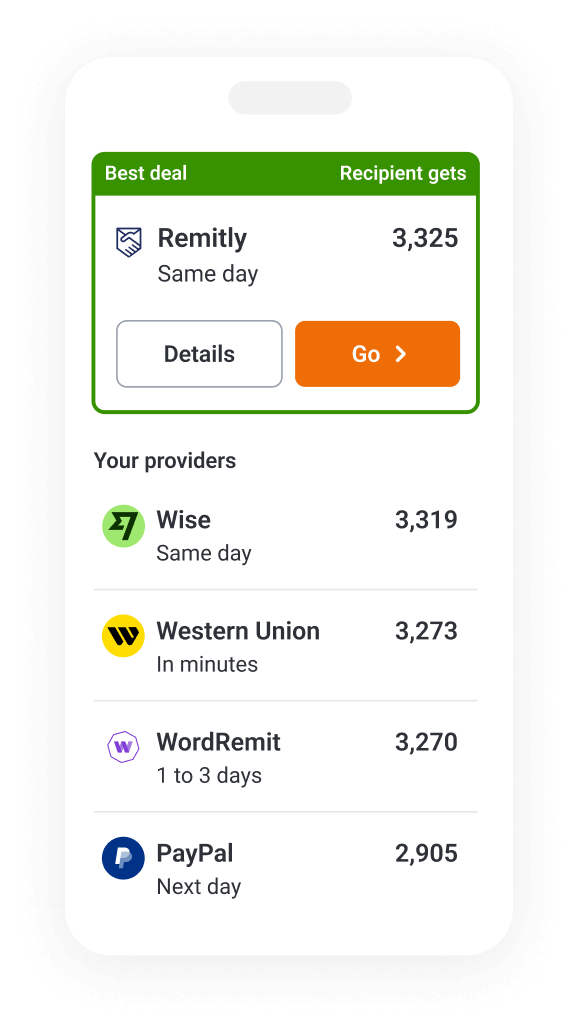

Compare live resultsBest for Transfers to a Bank Account

- 9.5Top providerGo to Wise

Cheapest

in 28% of all comparisons

Top rated

in 86% of all comparisons

Fastest

in 28% of all comparisons

Best of 48 providers. Compare all

Best for Transfers to Cash Pickup

- 9.0Top providerGo to Western Union

Cheapest

in 100% of all comparisons

Top rated

in 100% of all comparisons

Fastest

in 100% of all comparisons

Best of 1 provider. Compare all

Best-Rated Providers to Send Money to Singapore

9.5

9.4

9.4

9.4

9.3

9.3

9.3

9.3

9.2

9.2

9.2

9.1

Sending an Airtime Top-Up to Singapore? 📲

With Monito, you can take advantage of lightning-fast airtime and data top-ups with our trusted partner, Rebtel

Recharge airtime or mobile data online by entering your loved one's number and letting Rebtel take care of the rest!

- Send money from UK to Singapore

- Send money from France to Singapore

- Send money from Germany to Singapore

- Send money from Australia to Singapore

- Send money from Spain to Singapore

- Send money from Canada to Singapore

- Send money from the Netherlands to Singapore

- Send money from Portugal to Singapore

- Send money from Switzerland to Singapore

- Send money from Austria to Singapore

- Send money from Ireland to Singapore

- Send money from Belgium to Singapore

- Send money from Hong Kong to Singapore

- Send money from Malta to Singapore

- Send money from Denmark to Singapore

- Send money from Italy to Singapore

- Send money from Luxembourg to Singapore

- Send money from Finland to Singapore

- Send money from Greece to Singapore

- Send money from Cyprus to Singapore