Comparez les services de transfert d'argent international pour éviter les frais cachés

Plus de 6 millions d'utilisateurs font confiance aux comparaisons de Monito

Les utilisateurs de Monito ont déjà économisé plus de 30 millions d'euros

Nous ne recommandons que des entreprises autorisées et sûres

Pourquoi utiliser un comparateur de transfert d’argent international?

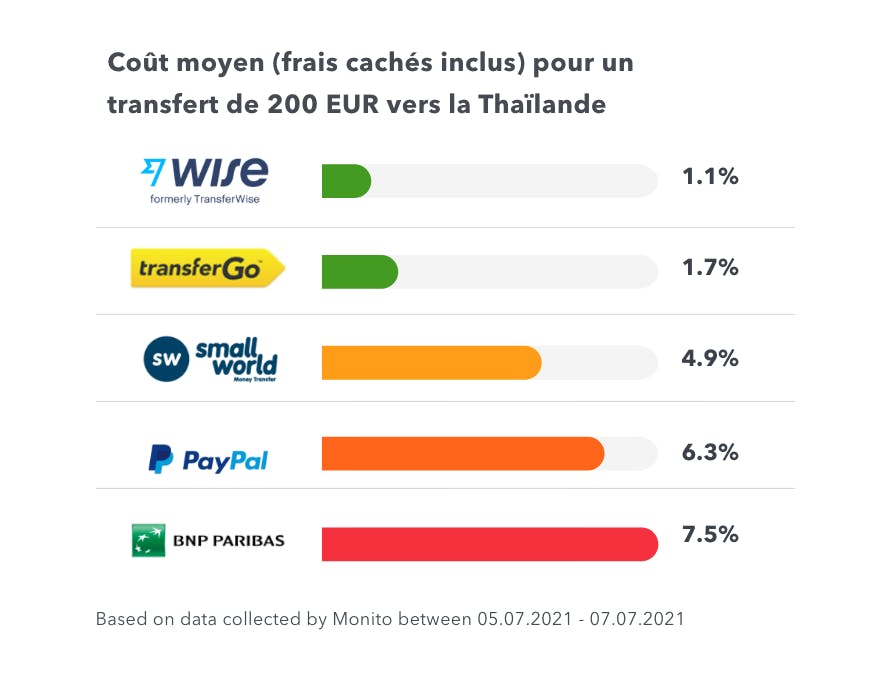

Envoyer de l’argent à l’étranger comporte de nombreux frais, dont certains sont cachés si l’on n’y prête pas attention.

Comparer tous les frais et taux de change en temps réel, pour le montant exact que vous voulez transférer à l’étranger, permet de faire rapidement de grandes économies. Avec le comparateur Monito, vous découvrirez des services très bon marché en quelques clics.

Plus de 10 millions de comparaisons

Plus de 30 millions d'euros de frais de transferts économisés

200 prestataires évalués et comparés

650 guides pour vous aider à éviter les frais cachés

Nous comparons plus de 300 services d'envoi d'argent

Voir tous les servicesCe que les utilisateurs disent de Monito

"Monito m'a donné un résumé complet et fiable pour choisir le meilleur prestataire"

Rana, Norvège, utilisateur de Monito depuis 2018

"Avant, je ne faisais pas confiance à la moitié des sites. Monito m'a beaucoup aidé en rendant le choix d'un opérateur beaucoup plus simple."

Rena, États-Unis, utilisateur de Monito depuis 2020

"Le grand avantage de Monito, c'est que je peux comparer différents opérateurs sur une seule plateforme."

Bilal, Royaume-Uni, utilisateur de Monito depuis 2020

Les experts de Monito passent des heures à rechercher, tester et comparer les services d'envoi d'argent pour vous éviter de le faire.

L'avis des experts Monito est indépendant

Nos articles sont régulièrement mis-à-jour

Nous examinons sans relâche les services

Monito vous guide avec des recommandations claires

Trouvez le meilleur service d'envoi d'argent

Nous vous aidons à trouver le meilleur service de transfert d'argent international vers plus de 154 pays.

Les derniers articles de Monito