Wise vs OFX

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

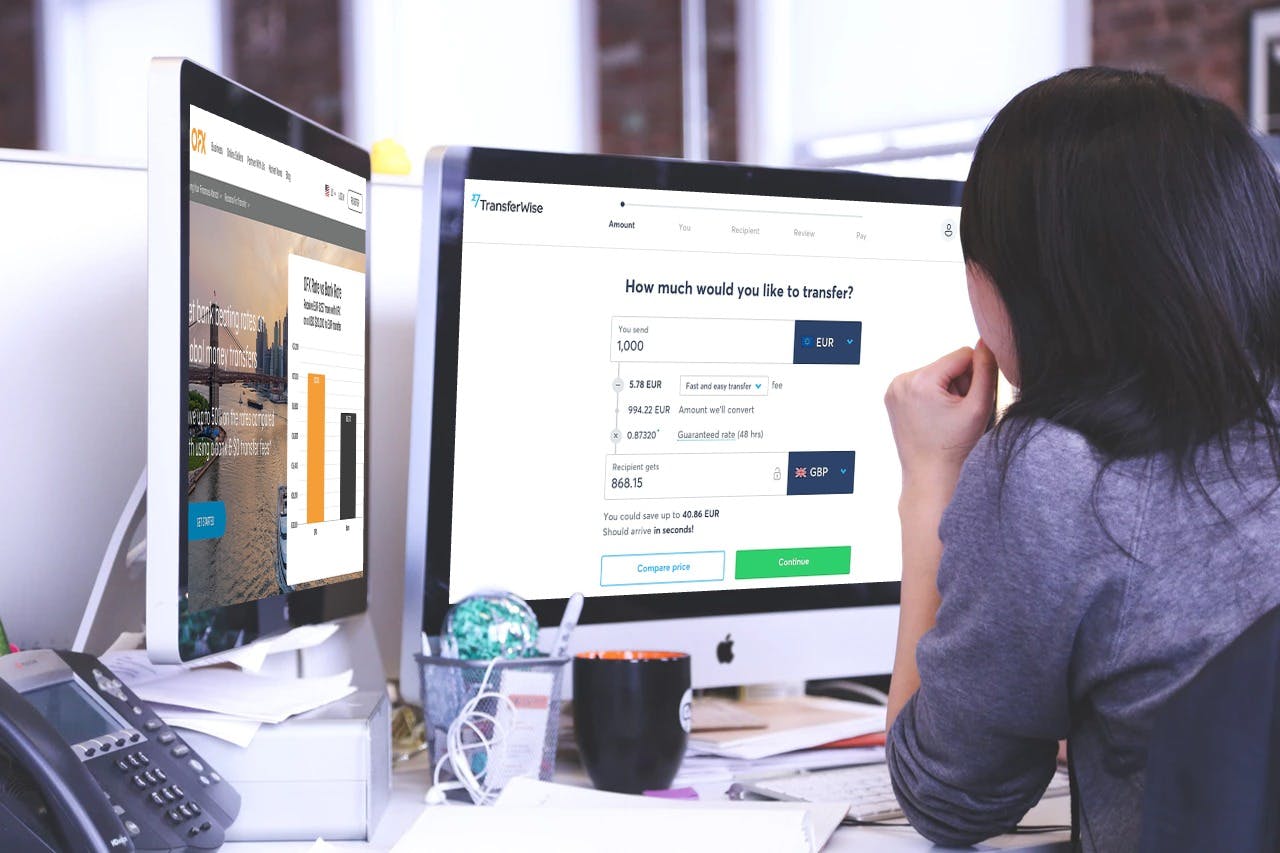

Read moreWise vs OFX. Which one is the solution for you and your money transfer needs? Which option should you choose if you need to send or receive money internationally? Check out our comparison of the pros and cons of each money transfer service.

Our recommendation: Wise is a better deal most of the time

Wise is an online service that specializes in helping you send money between two different currencies. They charge extremely competitive fees, but most notable about Wise is that they do not make a margin on the exchange rate.

OFX is one of the world's major companies that specializes in foreign exchange and international payments. They leverage network effects so they can provide pricing and service ordinarily reserved for institutional customers. Their lower fees and decent exchange rates save customers plenty of money compared to using traditional options like banks.

Both are great choices, but Wise is more affordable because of their zero margin on exchange rates (whereas OFX charges an exchange rate are above the mid-market, or "real," exchange rate.

📢 Important: Wise Is the New Name for TransferWise

Until March 2021, Wise had been formerly called TransferWise. The company decided to change its name to broaden its appeal and encapsulate the full range of service it offers. While the name is different, it's important to note that the service is still the same, and you're still able to use the service as usual with the same set of login details that you used on TransferWise. See more here.

Compare Wise, OFX and 100+ Other International Money Transfer Services

How Wise & OFX Compare on Services, Fees & Exchange Rates

How Wise works:

Transfers are paid from your bank account, debit or credit card. Funds go directly to the recipients bank account. Options vary according to the country combination of where you are sending money from and to. As an example, if you are transferring money from the UK to India you can pay with your debit or credit card, or directly from your bank account., but if you are sending money from Germany to France, you can make a SOFORT transfer. Exchange rates and fees are displayed before you make the transfer. Wise also calculates fees for you and warns you about potential local bank fees (which they can't control).

How OFX works:

OFX If you prefer, you can set up your transaction with an OFX dealer over the phone, or through the OFX mobile app which is available on both Android and iOS. Pay in and payout options vary by sending and receiving country. For example, US customers can fpay direct from their bank account or apply to set up an ACH direct debit.

Fees

Wise charges a percentage of your total transfer amount. This amount is roughly 0.6% to 1% of the transfer fees (it depends on the currency combination). There's no transaction fee if you pay via a traditional bank transfer. Paying via ACH? There's a 0.15% fee, or by debit or credit card there's generally a 0.3% to 2% fee. It's variable; according to Wise's website, "most banks charge an additional fee. These processing fees vary depending on the kind of card you use and where it was issued." Fees are also always very clearly displayed, and if there is a local bank fee that may be added, they alert you to that.

OFX charges no transfer fees for Monito users on all their transactions. This means the entire amount, with no deductions, is converted at the agreed-upon exchange rate

Exchange rates

Wise's exchange rate is set to standard, mid-market rate. They don't add a margin on top of that rate, which is unique compared to their competitors.

OFX has among some of the best exchange rates in the market. Their exchange rates get even better the more you send, with margins as low as 0.4%. After you agree on an exchange rate with OFX, the rate will be locked so that you know in advance exactly what amount your beneficiary shall receive, regardless of how the exchange rate evolves. Sp while they do charge above the mid-market exchange rate, you are not losing a lot of money with their service.

Key takeaways:

- When it comes to flat fees, OFX is free while Wise charges a percentage of the amount. However, when we played around with a number of country combinations, in many instances Wise rates were still better so you usually got a better deal with them.

- In terms ofd exchange rates, Wise is better, but OFX is not that far behond

- Wise is the better option but OFX is a good alternative

"Wise is better for online money transfers, but OFX is also a great option."

Related Provider Reviews

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.