Wise vs PayPal: Which Is Better?

9.5

6.0

Other Side-by-Side Comparisons

More about Paypal

Sending From Chime to PayPal

September 23, 2022 - by Byron Mühlberg

PayPal GBP to USD

July 5, 2022 - by Byron Mühlberg

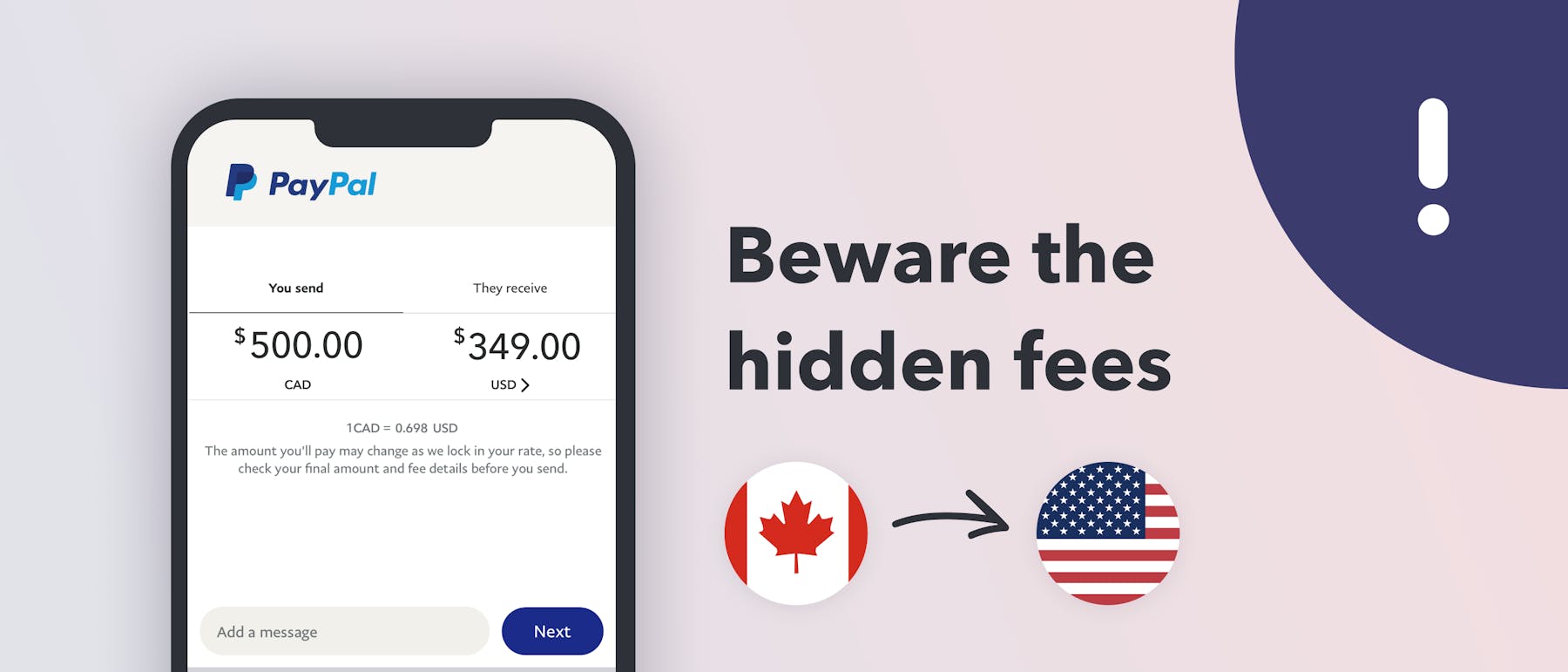

PayPal Canada to US

September 8, 2022 - by Byron Mühlberg

PayPal to Skrill

September 9, 2022 - by Byron Mühlberg

Best PayPal Alternatives

June 9, 2020

PayPal International Fees & How to Avoid Cross-Border Charges

November 29, 2023 - by Jarrod Suda

Sites Like Wise

January 8, 2024 - by Byron Mühlberg

A Guide to PayPal's International Fees

October 31, 2023 - by Byron Mühlberg

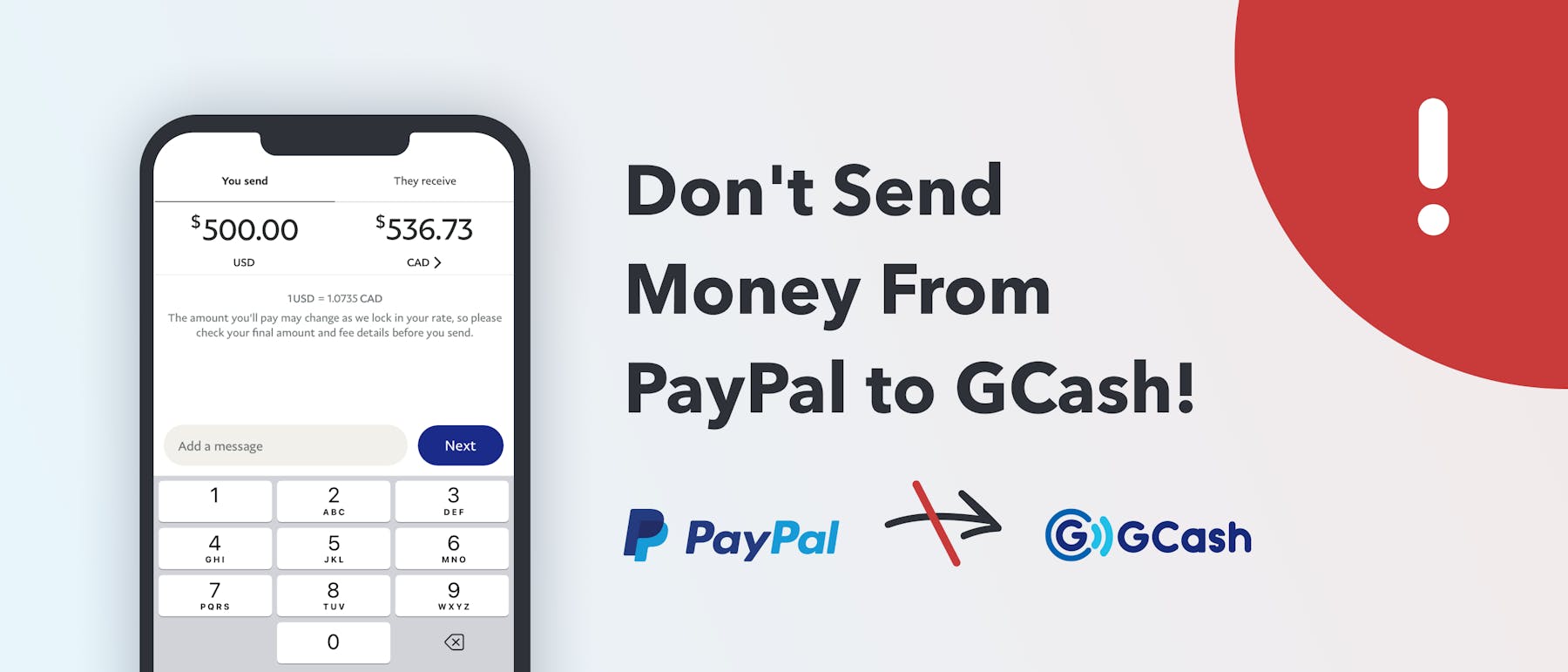

How to Transfer From PayPal to GCash (Plus Cheap Alternatives)

October 11, 2023 - by Jarrod Suda

Wise vs Western Union

October 6, 2023 - by François Briod

How To Use PayPal in Kenya (Complete 2023 Guide)

August 18, 2023 - by Lydia Kibet