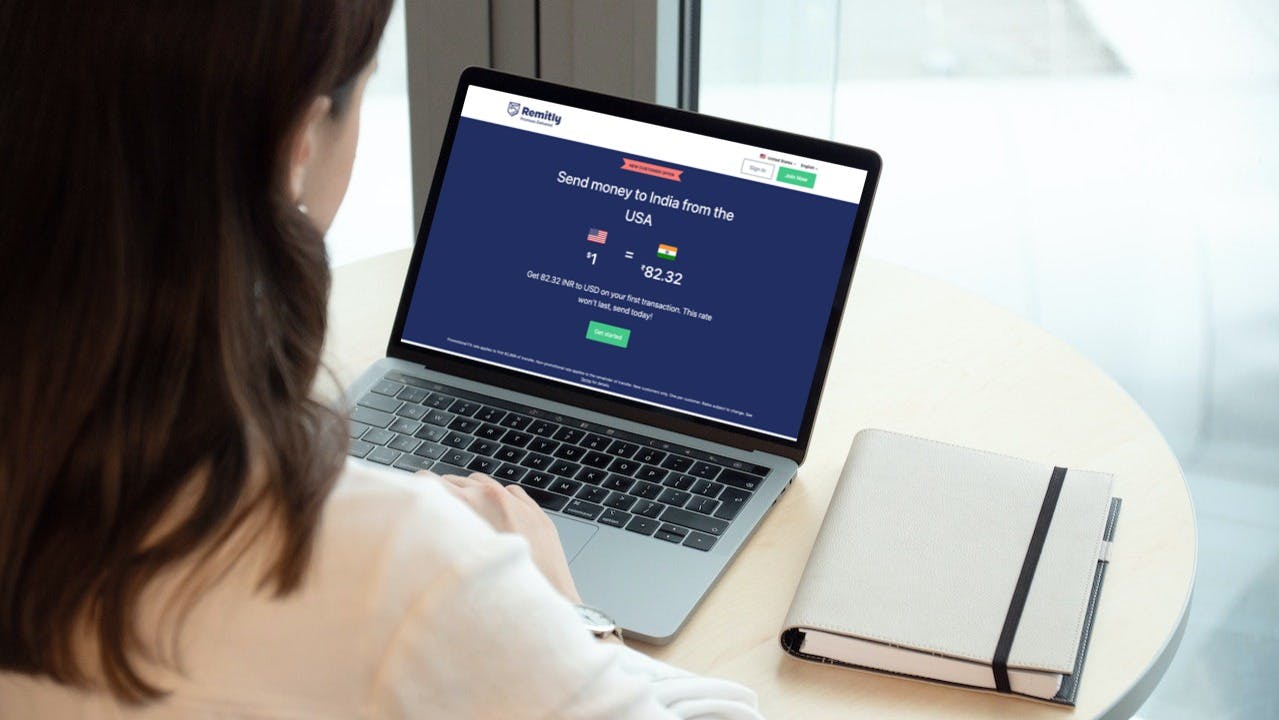

Sending US Dollar to Indian Rupee With Remitly (Best Exchange Rate?)

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreRemitly is one of the best online remittance services to help you safely and affordably send money to India from the United States. With their user-friendly mobile app, you can eliminate the hassle of traditional money transfer methods, SWIFT codes, and hidden exchange rate fees.

Remitly offers Express or Economy transfer service, with Express delivering funds within minutes. Economy service offers a stronger USD to INR exchange rate but takes 3 to 5 business days. You can send up to $10,000 USD to INR per day.

What Monito Likes About Remitly

- Cheapest on 32% of USD to INR comparisons on Monito in 2022;

- Excellent choice for cash pick-ups;

- Numerous destinations are available around the world;

- Special exchange rates for first-time users.

What Monito Dislikes About Remitly

- 35% of fees are hidden in the exchange rate margin;

- A limited number of origin countries can't send to each other.

Compare Remitly's dollar to rupee exchange rate with other services:

Key Facts About Sending From US Dollar to Rupee With Remitly

| 🇮🇳 USD to INR Rates | Cheapest for 32% of USD-INR Monito comparisons in 2022 |

|---|---|

| 🌎 Availability | Over 85 countries |

| ⭐ Customer Reviews | Apple App Store: 4.9/5 stars |

| 📩 Delivery Methods | Bank transfer, cash pick-up, mobile wallet, cash delivery |

| 💵 Transfer Fee | Sending less than $1,000: $3.99 |

| 📈 Exchange Rate Markup | Between 0.7% and 1.6% |

Remitly: USD to INR

- 01. Overview of sending money from the USA to India with Remitly

- 02. Fees for dollar to rupee transfers with Remitly

- 03. Remitly's exchange rate for US dollar to Indian rupee

- 04. Dollar to INR delivery options with Remitly

- 05. How to send money from US dollar to Indian rupee via Remitly

- 06. Compare Remitly with other top remittance services

- 07. FAQ about the dollar to rupee exchange rate with Remitly

What You Need to Know About Sending Money From the United States to India With Remitly

Remitly is an international money transfer service headquartered in Seattle with offices in London, the Philippines, and Nicaragua. It operates transfers in over 47 currencies around the world and offers good rates for USD to INR transfers.

The money transfer company allows you to transfer money to bank accounts in major Indian banks, such as ICICI, SBI, Citi Bank, Axis Bank, and more. Most importantly, Remitly is regulated under the following authorities:

- Registered Money Services Business with US Department of Treasury;

- Licensed as a money transmitter in the US;

- Regulated in the UK and Ireland (for the EU);

- Registered with FINTRAC.

Remitly is trusted by more than 3 million customers annually and offers a 100% satisfaction guarantee. All in all, this option ensures fast deposits and on-time delivery for transfers from dollar to INR. You can learn everything you need to know with our in-depth Remitly review.

Fees for Dollar to Rupee Transfers With Remitly

The fixed fee that Remitly will charge you will depend on the amount of your transfer. If you send $1,000 USD or more, then Remitly will waive its fixed fee entirely. If you send under $1,000, then you will be charged $3.99 per transfer.

Remitly also offers two kinds of transfers (Economy or Express). Express transfers send to your recipient in minutes while Economy transfers can take 3 to 5 business days to reach your account in India. In either case, Remitly will waive its fixed transfer fee of $3.99 as long as you send $1,000 or more.

Remitly’s USD to INR Rate

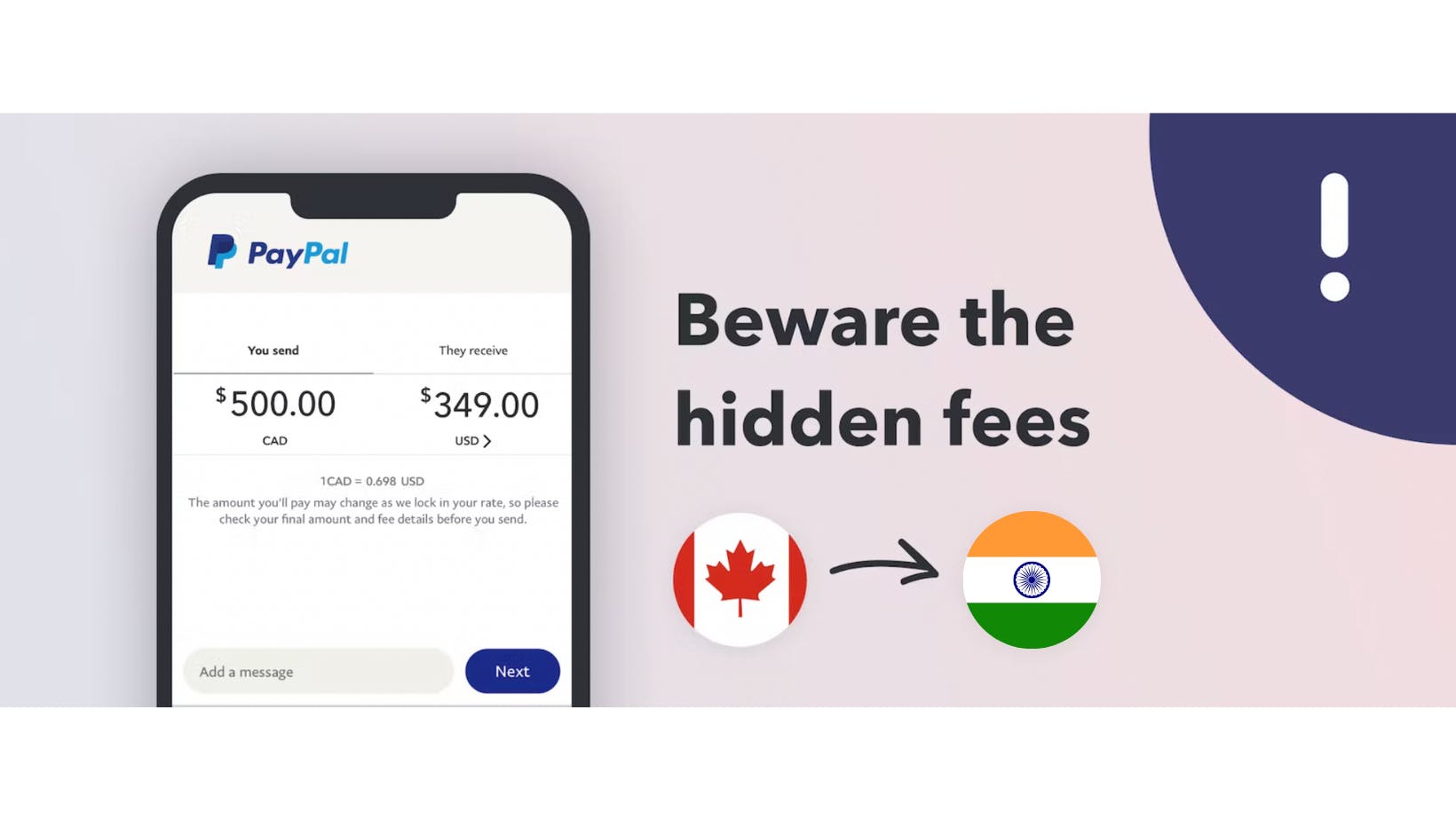

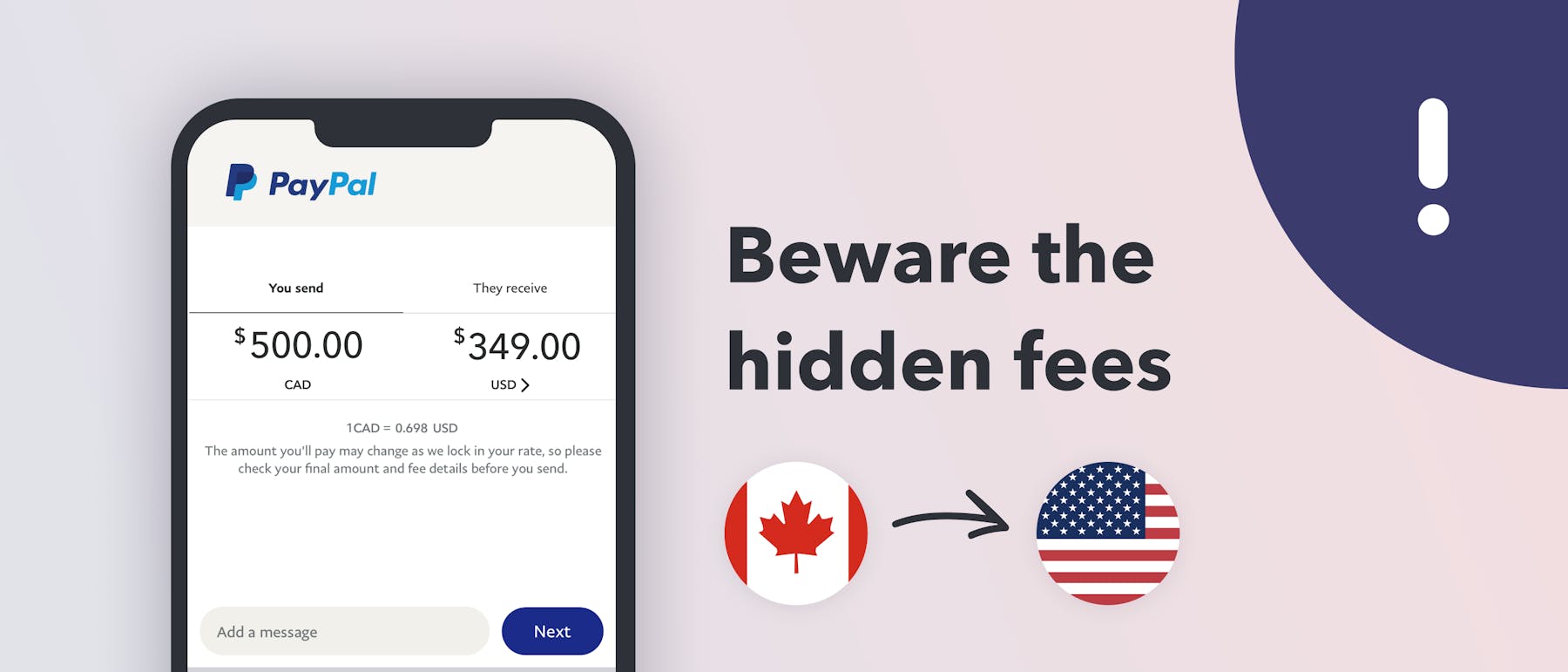

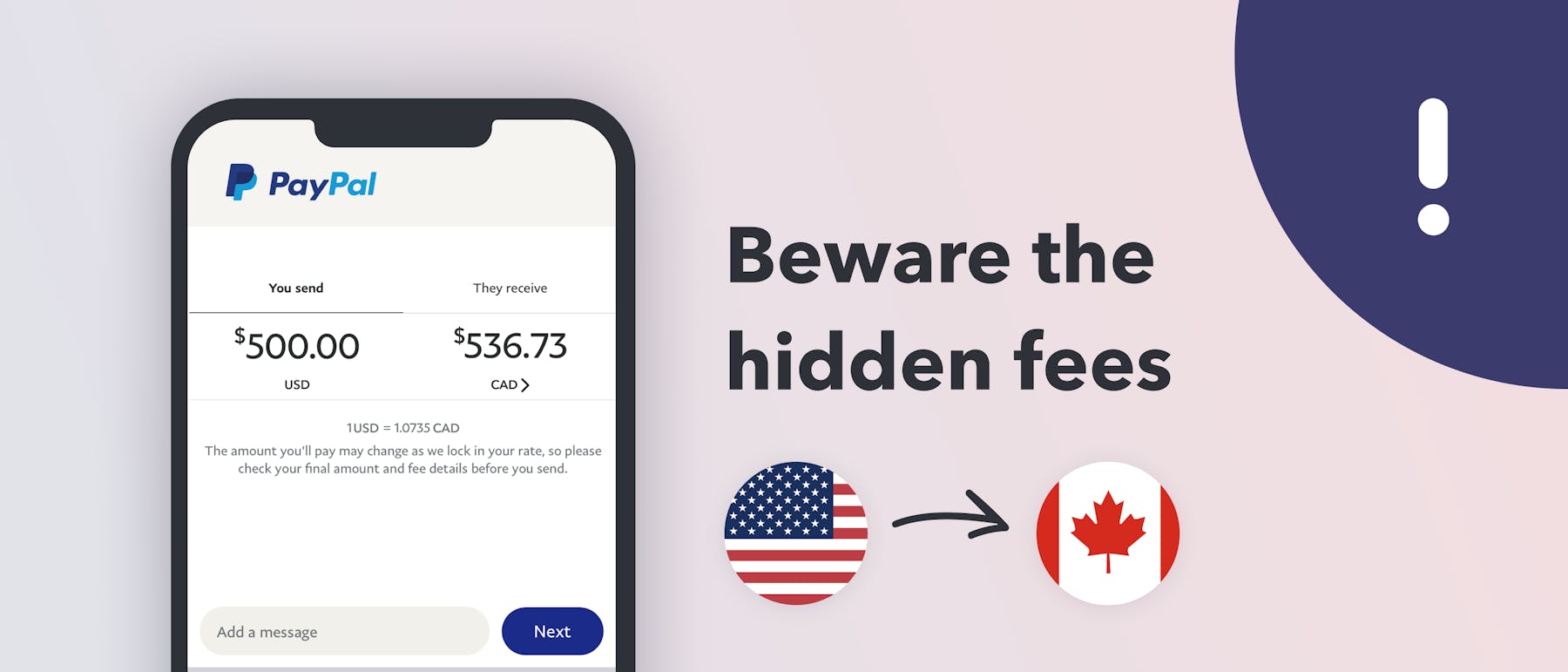

When you send money overseas, your transfer service will use an exchange rate to convert one currency to the other. Big American banks and mobile apps like PayPal apply markups as high as 7%, which can dramatically reduce the amount of money your recipient gets. They profit by pocketing that margin for themselves, known as an exchange rate margin.

Remitly, on the other hand, offers very reasonable dollar-to-INR exchange rates for transfers from the US to India. On Monito's real-time comparison engine, Remitly was the cheapest overall provider for 32% of dollar-to-rupee searches in 2022.

Dollar to Rupee Exchange Rate With Remitly Example

Let's look at an example of the Remitly rate from the United States to India, recorded on February 13th, 2023. Remitly offers strong USD to INR rates for their Economy service. Their Express service will apply a slightly weaker rate.

- USD to INR Real Mid-Market Exchange Rate: ₹82.70

- Remitly Economy Rate: ₹82.10

- Remitly Express Rate: ₹81.42

*Rates recorded on February 13th, 2023 at 12:00 CEST

In this example, Remitly applied a very low exchange rate markup of 0.72% for its Economy rate. This is a very competitive rate. For every 82.70 rupees you send, your recipient will get 82.10. If you got Remitly's Express rate, then you would have experienced a 1.54% markup.

While Remitly usually offers very good rates, the Remitly rate can fluctuate from minute to minute. This is why we recommend you use Monito's live comparison engine to compare the best rates today.

Remitly Fees and Exchange Rates for USD to INR

In the chart below, you will see how Remitly's fees are set up and what kind of services they come with for transfers from US dollars to Indian rupees.

Service | Sending $0 - $999 | Sending $1,000+ | Exchange Rate | Speed | |

|---|---|---|---|---|---|

Express | 3.99 | Free | Around 0.7% | Instant | Try Remitly ❯ |

Economy | 3.99 | Free | Around 1.6% | 3-5 business days | Try Remitly ❯ |

Recorded 13 February 2023

USD to INR rates are estimated

Dollar to INR Money Delivery Options With Remitly

You have three options as a sender from the United States to India. With Remitly, you can transfer your money by bank transfer, credit card, or debit card.

A bank transfer will likely be your best option since card processors like Visa and Mastercard may charge fees for processing debit and credit cards. Keep in mind that bank transfers will take 3 to 5 business days while card payments give you instant transfers.

What You Need to Send USD to INR With Remitly

Your recipient in India will have four ways of receiving money in India. You may send the money to him or her by bank transfer, cash pick-up, UPI (UPI Virtual Payment Address), or cash delivery. Make sure to have the following info at hand:

- Your recipient’s name as it appears on their valid ID;

- Your recipient’s address;

- Your recipient’s phone number.

If you want to send the transfer directly to your recipient’s bank account, you’ll need to have their payment details. Make sure to prepare the following:

- Your recipient’s bank account number;

- The name of the bank.

How To Send Money From the USA to India With Remitly

Step 01

Start your transfer

- Sign in to the Remitly app or their website;

- Select Get Started on the app or Send money on your web browser.

Step 02

Choose your delivery method

1. Select Bank Deposit, Cash Pick Up, or another delivery method;

2. Enter your recipient's bank account number, pick-up location, email, or other required information.

Step 03

Choose how you'd like to pay

1. Choose your desired payment method;

2. Enter your bank account information, your credit or debit card information, or other payment details.

Final step

Confirm the transfer

Try Remitly ❯1. Review the transfer information;

2. Click Send Money when you are ready.

Compare Remitly With Other Top Remittance Services

In summary, we highly recommend Remitly as an international money transfer service from the United States to India. Not only was it the cheapest provider in 2022 for 22% of all global searches on Monito. It was also the cheapest service for over 32% of Monito comparisons for transfers specifically from the USA to India.

In comparison, XE Money Transfer was the cheapest option for over 28% of USD-INR searches on Monito in 2022. Panda Remit took third place with over 18% in 2022.

If you're still not sure if Remitly the cheapest or safest, use our real-time comparison engine below to compare Remitly's dollar to rupee rate with other top remittance companies 👇

Compare Remitly's rate for dollar to rupee:

Frequently Asked Questions About the Dollar to Rupee Exchange Rate With Remitly

Can Remitly send money from the USA to India?

Yes, you can use Remitly to send money from the USA to India. In fact, Remitly is one of the cheapest money transfer providers to send money from USD to INR.

Is Remitly cheaper than Western Union?

Yes. We highly recommend Remitly for sending money from the United States to India. XE Money Transfer and Panda Remit are other excellent choices that rank highly for the best ways to send money from USD to INR.

What is the USD to INR rate of Remitly today?

Check our real-time comparison engine to find the fee and exchange rate of Remitly from the United States to India today.

How much does Remitly charge for a transfer?

Remitly has no fixed fees for transfers above $1,000 from the US to India. If you send less than $1,000, then you will pay a $3.99 fee.

What is the dollar rate in Remitly?

The dollar rate for Remitly transfers changes depending on the time of day and the currency you are exchanging. The USD to INR transfer rate on Remitly is typically marked up by 0.7% to 1.6%.

Can I send $1,000 through Remitly?

Yes, Remitly allows you to send up to $10,000 per day.

What is the Remitly exchange rate?

Remitly's exchange rate changes constantly depending on the time of day and the currency you are exchanging. The USD to INR transfer rate on Remitly is typically marked up by 0.7% to 1.6%.

Where can I exchange US dollars for Indian rupees?

You can exchange US dollars for Indian rupees with Remitly. The service has been the cheapest way to exchange dollars for rupees for 32% of the comparisons done on Monito in 2022 for international money transfers from the USA to India.

XE Money Transfer and Panda Remit are good runner-ups.

Money Transfer Guides on Rates For Sending Money From USD to INR

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.