- Languages English

- Country availability United Kingdom

- Services Full bank account

- Monthly fee Very low

- Card delivery time Mid

- Best for Everyday banking

- Bank details UK account no. & sort code

- Supported currencies Pound sterling

- Overdraft Yes

- Annual interest rate Low

- Supports cash deposits Yes

- International transfers Yes

A Comprehensive Guide to Opening a UK Bank Account (Even For Non-Residents Online)

François Briod

Guide

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Byron Mühlberg

Reviewer

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreWith its high standard of living and easy-going way of life, the UK is one of the world's most popular countries for living and working.

Whether you've just arrived in the country or are planning to move there soon (or whether you're there for university, work, or anything else), one of the things you'll need to get in order is a local bank account. This comprehensive guide delves into the nitty-gritty of how to open a bank account in the UK for non-residents in particular. If you're already a UK resident, no problem; you'll find that much of our information still applies to you too.

Fortunately, depending on your needs, the process should be doable, and you'll likely be able to open a bank account online in the UK without much hassle. (And, if you've heard the horror stories about opening a bank account in the UK, don't worry too much!)

Are you in a rush? Here are our recommendations if you're...

- from the EEA with no UK residence: Revolut gives you a UK account number, sort code, SWIFT code, and a debit card to spend in over 30 currencies, including pounds.

- not from the EEA with no UK residence: A Wise Account gives you multi-currency bank details in nine countries, including in the UK.

- in possession of a UK residence: Starling Bank offers a fully-fledged online current account that costs next to nothing every month.

Because it's needed to open most bank accounts, proof of address is usually where newcomers and non-residents in the UK hit a brick wall. It's also challenging if you've landed in the UK to live with relatives, where you won't have any bills or rental contracts in your name.

Can I Open a UK Bank Account as a Non-Resident?

All told, there are three main paths to open a bank account online in the UK, and not all of them are suitable for all types of non-residents. As a result, the best UK bank account will depend heavily on your needs and preferences. These paths are as follows:

- High-street banks: This path requires proof of UK residence and is only open to non-residents who make significant investments or who will soon be relocating to the UK. It's best for those who want extensive banking services and don't mind the fees.

- Online banks: Although the application is significantly more straightforward than at high-street banks, this path still requires proof of UK residence. It's best for those who want low-cost, digital banking services and don't mind slightly less banking coverage.

- Multi-currency accounts: This path provides a UK bank account without proof of address and is ideal for those wanting to open a UK bank account online from abroad.

Without further ado, let's explore each of these paths in detail below:

Can I Open a UK Bank Account as a Non-Resident?

- 01. Path 1: Use a high-street bank (UK residents only)

- 02. Path 2: Use an online bank (UK residents only)

- 03. Path 3: Use a multi-currency account (no UK residence required)

- 04. How to get proof of address in the UK

- 05. How to transfer your money to the UK

- 06. Recapping how to open a UK bank account for non-residents online

- 07. FAQ about non-resident banking in the UK

Key Facts About Banking in the UK

| 🏦 No. of Banks in the UK | 320+ |

|---|---|

| 👨⚖️ Regulatory Body | FCA |

| 🏆 Best Bank for Residents | |

| 💸 Best Money Transfer to the UK | It varies. Compare now. |

| 💻 Best Account for Non-Residents | |

| 💷 Average Running Costs |

|

Path 1: High-Street UK Banks

Håkan Dahlström (CC BY 2.0, modified)

The biggest high-street banks in the UK are HSBC, Lloyds, Barclays, NatWest, and Standard Chartered¹. Other big names include RBS, Nationwide, Santander, and Metro Bank. By "high-street", we mean traditional big banks with physical branches across the country (versus online banks, which don't have any branches).

High-street banks will generally only accept your application if you can provide proof of UK residence in your name. The only exceptions are for wealthy foreign investments (which we won't discuss in this article) and for opening an account before moving to the UK. In the latter case, some banks such as Barclays and Lloyds allow account opening from abroad within three months of moving to the UK. Still, they also require a higher barrier to entry, i.e. upwards of £50,000 in gross annual income or £25,000 saved or invested with the bank².

All deposits in UK high-street accounts are protected up to £85,000 in the case of bankruptcy by the Financial Services Compensation Scheme (FSCS)³, making them safe from a customer perspective.

Types of Bank Accounts in the UK

There are numerous types of accounts in the UK, but here are the two that most people mean when they talk about a "bank account":

- Current account: Called a 'checking account' in the US, this is what most people are looking for basic everyday use, such as paying bills and receiving a salary. They generally come with a debit card and overdraft facilities. Chequebooks are no longer automatically issued to new customers, but you can opt for one if you wish.

- Savings account: These accounts traditionally yield a higher interest rate and are meant for what their name implies — saving money. Some savings accounts require you to not touch the funds for a set number of months or years. However, some current accounts also pay interest on balances up to a set amount.

- Basic account: Major high-street banks in the UK are mandated by law to provide basic bank accounts to legal residents and citizens. Basic accounts are fee-free and offer only the most standard deposit and withdrawal operations, including failed payments to prevent overdrafts.

- Joint account: Joint accounts are legally shared between family members. They are generally used for married couples to combine their finances together, or for parents to manage expenses with their children.

- Student account: Banks usually offer accounts with added features and low fees for university students. The fees raise to their standard levels once you graduate or reach a certain age limit.

- Digital mobile account: With both high-street banks and UK online banks, you should be able to access your account balances by desktop or mobile app. User experience and service quality certainly varies from bank to bank, with UK online banks specialising in digital-only accounts.

- International non-resident account: International accounts are ideal for non-UK residents who want access to current accounts and everyday services in the UK. In addition to the resources found in this guide below, learn more with our guide about the 8 best international bank accounts for expats.

- Offshore account: UK banks with an international presence (such as HSBC or Barclays), and banks in your home country with a presence in the UK (like Santander or Citibank), may offer offshore accounts. These accounts have high minimum balance requirements and monthly fees, but they usually come with an account manager and balances held in multiple currencies. Offshore accounts are often used for real estate management, investment management, trusts, or holding deposits.

Documents Needed To Open a UK Bank Account

To open a UK bank account, you generally need the following:

- Proof of identity: Passports, driving licences, and national identity cards are accepted. In general, if you're a foreign national, your best bet is to use your passport — EU ID cards are usually accepted, but if you're from Australia, your home driving licence may not be.

- Proof of UK address: Generally, a recent utility bill, rental contract, or council tax bill will suffice. Mobile phone bills are generally not accepted.

There are no banks that don't need ID to open an account. Banks are required by law to collect this information for Know Your Customer (KYC) and anti-money laundering (AML) reasons⁴.

Which UK High-Street Banks Offer Accounts For Non-Residents?

Below, you'll find the account offerings among major high-street UK banks that we found the most useful for newcomers to the UK. As we saw above, there are also premium accounts and specialised accounts for students and youth too, but we selected the basic current accounts for the sake of illustration:

1. HSBC

HSBC is the UK's largest bank by market value and total assets.

- Account: HSBC Bank Account

- Monthly fee: £0

- Int'l transfer cost: 1.5% - 8% (depending on the currency)

- Int'l card payment cost: 2.75% with limits

- Proof of UK residence required: Yes

2. NatWest

National Westminster Bank, known colloquially as 'NatWest', is a large British bank that's based in Edinburgh, Scotland.

- Account: Select account

- Monthly fee: £0

- Int'l transfer cost: 5% - 10% (depending on the currency)

- Int'l card payment cost: 2.75%

- Proof of UK residence required: Yes

3. Barclays

Barclays is a UK banking giant offering retail, business, and investment banking worldwide.

- Account: Barclays Bank Account

- Monthly fee: £0

- Int'l transfer cost: 4% - 10% (depending on the currency)

- Int'l card payment cost: 2.99%

- Proof of UK residence required: Yes

4. Lloyds

Famous for its black horse logo, Lloyds is a popular banking choice among UK residents, with millions of customers nationwide.

- Account: Classic Account

- Monthly fee: £0

- Int'l transfer cost: 3.5% - 8% (depending on the currency)

- Int'l card payment cost: 2.99%

- Proof of UK residence required: Yes

Opening an Account Before You Move to the UK

If you plan to relocate to the UK soon, you can sometimes still open a British bank account without proof of residence.

At Barclays, for example, you can open a UK bank account online from your home country within 90 days of relocating there. You'll then be required to complete the application process at a Barclays bank branch after you arrive in the country. You'll be eligible to open the following two types of accounts this way: (1) the £0-per-month Barclays Bank Account mentioned earlier, or (2) the Premier Current Account, which has a high barrier to entry (£75,000 gross annual income or £100,000 saved or invested with Barclays) and comes with a lucrative rewards program.

Similarly, Lloyds offers customers the International Current Account in GBP before they move in from abroad. To open an account from your home country, you can apply online, though you must have a £50,000 gross annual income or £25,000 saved or invested with Lloyds (which is a lower barrier to entry than Barclays).

Learn more with our guide about the 8 best international bank accounts for expats.

Hire a Third Party to Sort Out the Paperwork

If you want a high-street bank account but merely thinking about all the options makes you lose your marbles, we recommend visiting Sable International, which has relationships with several traditional banks, including Lloyds, Barclays, HSBC, and Metro Bank.

Sable facilitates an introduction to the banks, enabling you to open a UK bank account without the usual proof of residency documents, such as a utility bill. It offers several options:

- Bank account: If you want to open a UK bank account, you can get one without proof of address. You have to provide a valid passport, proof of permission to live and work in the UK, a residential address to receive post (this can be a friend or relative you're staying with, you don't need a utility bill), and be able to attend an appointment in London with one of their banking affiliates.

- Relocation: If you'd like a UK bank account plus various bells and whistles, this option assists with setting up a UK bank account and obtaining a National Insurance (NI) number and offers one free international money transfer, a pay-as-you-go UK SIM card, and a guidebook covering life in the UK.

- Tier 5 Visa: If you want all of the above (including a bank account) and help to apply for a Tier 5 Youth Mobility Scheme visa, then this option allows people between the ages of 18 and 30 to live and work in the UK for up to two years. However, it's only available to citizens of certain countries (including Australia, New Zealand, and Canada).

Path 2: Online Banks

UK online banks (sometimes called "challenger banks" or "neobanks") can be either registered banks or non-bank fintechs. They're characterised by not operating out of branches, with all banking services handled online instead. These banks generally offer a more limited range of services than the high-street banks we explored above, but at a fraction of the price and over a user-friendly web or mobile app interface.

If you want to open a UK bank account without proof of UK address, then the only online banks that may accept your application will be Monese and Revolut (although these will still require proof of residency in the EU/EEA or another country). On the other hand, Monzo and Starling Bank will require proof of address in the UK. Note that even if you don't submit proof of address, you might still need to supply a UK address to deliver your debit card.

Take a look at the UK's top three challenger banks according to our rankings, though we've summarised these rankings below too:

Starling Bank: Best UK Online Bank

Starling Bank is a fully-authorised bank in the UK that's well known for its fee-free current account.

Because this account is entirely free and gives you access to an impressively complete range of financial services (including the Starling bank card, overdraft facilities, loans, joint accounts, youth cards, pensions, a euro account, interest rates, etc.), we think Starling offers the best free bank account in the UK — one we think makes an excellent replacement for a bank account at a high-street bank.

- Account name: Personal Account

- Monthly fee: £0

- Int'l transfer cost: 0.5% - 3% (depending on the currency)

- Int'l card payment cost: 0%

- Proof of UK residence required: Yes

- More info: See our full Starling Bank review.

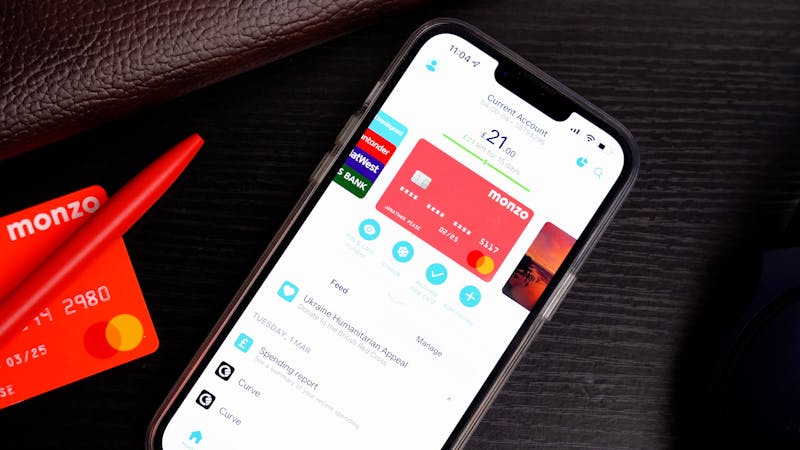

Monzo: Best Bank for Savers

Monzo is a regulated UK bank and probably the country's most famous mobile-only bank account.

An excellent choice if you're looking to avoid fees, Monzo (like Starling) charges no fees for day-to-day card use in the UK and abroad. Moreover, because it offers one of the most advanced and comprehensive savings systems we've seen from any challenger bank (allowing lots of flexibility over your time horizon and savings goals), we think Monzo is especially well-suited for managing and growing wealth, regardless of your individual goals.

- Account name: Monzo

- Monthly fees:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£5.00 | |

£15.00 |

- Int'l transfer cost: 0.2% - 2.5%

- Int'l card payment cost: 0%

- Proof of UK residence required: Yes

- More info: See our full Monzo review.

Suits Me: Best For New Arrivals

Suits Me is a reliable banking alternative for new arrivals in the UK.

It offers an easy and fast account opening process without requiring credit checks or proof of address. Additionally, Suits Me gives you a prepaid debit Mastercard, online banking services, and the ability to receive payments from employers and other sources (e.g. Faster Payments, BACS, and CHAPS, although not international SWIFT transfers).

- Account names: Essential, Premium, Premium Plus

- Monthly fees:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£4.97 | |

£9.97 |

- Int'l transfer cost: Not available

- Int'l card payment cost: £1.00 + 2%

- Proof of UK residence required: No

- More info: Go to the website.

Path 3: Multi-Currency Accounts

Online multi-currency accounts aren't full banks in the UK but rather fintech companies (known formally as Electronic Money Institutions or EMIs) that often compete to offer the cheapest ways to transfer money globally. However, in addition to money transfers and currency exchange, multi-currency wallets normally come complete with a debit card, multi-currency account balances, and even foreign bank details.

Below, we go over three of the most prominent multi-currency fintechs: Revolut, Wise, and Monese.

Revolut: Best UK Account for EEA Residents

Probably the UK's most famous fintech, there's a good chance you've heard of Revolut.

Using its innovative personal finance platform, you'll not only have access to a broad range of financial services unique among free online accounts, but you'll also be able to take advantage of these services at a comparatively low price. However, because it's not yet a bank in the UK, we think Revolut is best used as a powerful spending tool next to a main bank account, as opposed to in place of it (even if that bank account is in your home country).

Sadly, although Revolut is also available in the US, Australia, Singapore, Switzerland, and Japan, its British pound account details are only available to EU/EEA and UK customers who get both an EU IBAN account (in Lithuania) and a British current account number, sort code, and SWIFT code.

- Account names: Standard, Plus, Premium, Metal

- Monthly fee:

Account Name | Fee /Month |

|---|---|

£0.00 | |

£3.99 | |

£7.99 | |

£14.99 | |

£55.00 |

- Int'l transfer cost: 0.5% - 1.5%

- Int'l card payment cost: 0%

- Proof of UK residence required: Not necessarily

- More info: See our full Revolut review or visit the website.

Wise: Best UK Account for Non-EEA Residents

The Wise Account is the best way to open a UK bank account from abroad (especially if you're not from the EU/EEA and don't have access to Revolut).

Wise will work for you no matter whether you want to hold money in pounds, spend money on holidays abroad, shop online, or receive earnings from the UK. Fortunately, after opening your account online, you'll only be required to verify your identity; you won't need to show proof of residence in the UK to sign up and obtain the VISA debit card (although you will need to show proof of residence in the EU/EEA, US, Singapore, Japan, Australia, or New Zealand).

Here's what Wise has to say about opening an account without proof of residence in the UK⁵:

"You can then choose to either supply proof of address from a standard list of documents, or to send in a selfie, in which you're holding your proof of ID. This can be a great alternative if you're still waiting to move to the UK or haven't yet got bills and other paperwork registered in your name."

Wise's Top Features

Your Wise Pound account will be held by Barclays Bank and come with the following details unique to you:

- A sort code;

- An account number;

- A British IBAN (starting with "GB").

This means you'll be able to spend and be paid just like a local in the UK and convert your GBP balance into your home currency without the exorbitant bank fees. Here's an overview of the other features you'll get:

- Local bank details, not just in the UK, but also in the US, EU, Australia, New Zealand, Singapore, Romania, Canada, and Hungary.

- Hold, exchange, and top-up up to 56 currencies.

- A multi-currency VISA debit card that's handy for paying in foreign currencies without hidden fees.

- Access to Wise's powerful international money transfer service right from your account balance.

An Example of How Wise is Useful

To get a sense of how helpful Wise can be for expats and non-residents in the UK, let's say that you've just moved from Paris to London and need an active online account to receive and spend pound sterling. With a Wise, you'll be able to...

- send euros from your bank to your Wise euro account,

- convert all or part of your euro balance into sterling at a low fee of around €6.94 to add £1,000,

- pay with your Wise debit card, make or receive SEPA and SWIFT payments, and set up direct debits.

You'll also have UK bank details to share with an employer. Note that this account does not offer overdraft facilities, and you also won't earn interest on any in-credit balances.

Monese: Another Option for EEA Residents

Monese is a mobile-only challenger bank that offers fully-fledged checking accounts to more than two million customers in the UK and across much of Europe.

Because Monese doesn't require you to prove your residence to meet the minimum creditworthiness standards to open an account in the UK, we think Monese is especially well-suited for new arrivals to the UK from the EEA. Although we don't find Monese quite as feature-rich as Revolut, we do think it has an advantage over Wise if you plan to split your life between the UK and a country in Europe.

Although you only get a Euro IBAN (starting with 'BE') if you're an EU/EEA resident, you will be able to use this to receive British pounds too. It's currently illegal to discriminate based on the origin of an IBAN in the UK and EU.

Here's an overview of Monese's offering:

- Account name: Starter, Classic, Premium

- Monthly fee:

- Int'l transfer cost: 0.5% - 1.5%

- Int'l card payment cost: 0% (0.4% - 0.8% for cash withdrawals)

- Proof of UK residence required: Not necessarily

- More info: See our full Monese review.

How To Get Proof of Address in the UK

Super Straho on Unsplash

Regardless of which bank account you choose, if you're planning to move to the UK for a more extended period, getting your proof of address in order will be a necessary step in the long run.

Following modern anti-money laundering (AML) regulations, banks and other financial institutions are required to ask for appropriate evidence of identity whenever certain financial transactions occur. Checking that identity and proof of address match minimizes the chance that the account is opened under a false identity⁶.

What Document Count as Proof of Identity?

Banks and other financial institutions will require proof of identity in the form of a valid, government-issued passport, original birth certificate, EU/EEA member state ID card, current UK or EU/EEA driving licence, registration card for self-employed individuals, Resident Permit issued by the Home office to EEA nationals, National Identity card, or a Firearms certificate.

Provisional driving licenses and biometric residence permit (BRP) cards are often not accepted as proof of ID by UK banks.

What Document Count as Proof of Address?

In addition to a proof of identity, you'll also be required to provide one (even two) original documents to prove that you live where you claim to live (i.e. your residential address) in the UK. The following documents are practically always accepted:

- Utility bills, such as for electricity, gas, satellite, TV, or landline that are at most three months old. (Note that a mobile phone bill will not be accepted).

- A local authority council tax bill for the current council tax year.

- A valid UK driving licence.

- Bank or building society statement or passbook less than three months old (bank statements won't be accepted if they're from Monzo).

- Mortgage statement (issued for the last full year).

- Solicitors letter within the last three months confirming the property purchase (or the land registry confirmation of address).

- A council or housing association rent card or tenancy agreement for the current year.

- HMRC self-assessment letters or tax demand dated within the current financial year.

- Electoral Register entry.

- NHS medical card or letter of confirmation from GP's practise of registration for surgery.

Credit card statements or provisional driving licenses will not be accepted as proof of address. According to the Financial Conduct Authority (FCA), if you're unable to provide the documents listed above, you can request to see if the bank will accept any of the following documents:

- A letter from a care home manager or warden of sheltered accommodation or a refuge.

- A letter from the warden of a homeless shelter.

- A letter from a probation officer or a hostel manager.

- A letter from a prison governor.

- If you are a traveller, a letter from the local authority that verifies your address.

- If you are an international student, a passport or European Economic Area National Identity Card and letter of acceptance or introduction from a body on the Department for Education list.

- If you're an asylum seeker, an application registration card.

What If My Application to Open a UK Bank Account is Refused?

There are 9 major high-street banks in the UK that are required to offer basic bank accounts to legal residents and citizens in the UK. These banks are: Barclays UK, the Co-operative Bank, HSBC UK, Lloyds Banking Group (including Halifax and Bank of Scotland brands), Nationwide Building Society, NatWest Group (including Royal Bank of Scotland and Ulster Bank brands), Santander UK, TSB, and Virgin Money.

However, banks in the UK can still refuse to open bank accounts if you fail to provide proper documentation, such as a proof of ID or proof of UK address. Know Your Customer (KYC) laws require banks to obtain identity information about their customers to help prevent money laundering and terrorist financing.

Banks are not required to give their reasons for refusing an account. However, you can issue a complaint to the Financial Ombudsman Service if you think you have faced discrimination. Typically, it takes 8 to 12 weeks to address such disputes. In the event that you are dissatisfied with the Ombudsman's final decision, you may consider pursuing legal action, though you will generally be responsible for covering your own legal expenses.

How To Send Money to a UK Bank Account

Thomas Lefebvre on Unsplash

Once you've opened a bank account in the UK, you'll need to consider how to move your funds across, a process that can be exceptionally costly if you're depositing money from a currency other than pounds. To deposit money into your new pound sterling account from your home currency before you move, you'll need to go to your online banking and choose between one of two options:

- Sending a wire transfer through your bank directly;

- Sending a bank transfer via a money transfer specialist.

We don't recommend using your bank to transfer money internationally, as the fees can be exorbitant, and the waiting times can be lengthy. This is mainly because banks wire funds over the SWIFT network, which adds many timely and expensive steps to the money transfer process.

Instead, if the amount you'd like to send to the UK is in the order of several hundred or thousand Pounds or equivalent, then we recommend you use a money transfer specialist service (Wise is one among many.) To compare which services are cheapest for your transfer amount and your home country to the UK, run a search on Monito's real-time comparison engine here.

On the other hand, if you're moving large amounts of money from your home currency to your new bank account in the UK (i.e. anything upwards of £30,000 or equivalent), services such as Wise may not be your cheapest bet. Instead, we recommend exploring your options among the foreign exchange brokers that support transfers from your country to the UK. These services specialise in negotiating favourable exchange rates on your behalf. They are the most cost-effective option for transferring large sums of money (such as life savings or liquid investments) across borders.

To find out which service will offer you the best deal in real-time, run a search on our comparison engine below:

Find the best deal when sending money to the United Kingdom:

Recap: What Are the Best Online Bank Accounts in the UK?

To conclude, let's recap the main recommendations we explored in this non-resident banking guide:

- Revolut: Best GBP non-resident account for EU/EEA residents.

- Wise: Best GBP non-resident account for non-EU/EEA residents.

- Starling Bank: Best low-cost online bank for UK residents.

- Monzo: Best online savings account for UK residents.

- HSBC: Best traditional banking experience for UK residents.

- Monito: Best way to compare money transfers to the UK.

See our guide on the best online-only banks in the UK for more.

FAQ About Opening a Bank Account Online in the UK For Non-Residents

🏦 Can I open a UK bank account without proof of address?

Few solutions offer a bank account in the UK when you don't have proof of address in the UK. With Monzo or Monese, you can open a UK bank account with just a few clicks, although you'll need to show proof of residence. Generally, we consider the Wise Account the best UK bank account for non-residents. See all the details about opening a bank account in the UK without proof of address in our in-depth guide.

🇬🇧 What is the best UK bank account for non-residents?

Expats moving to the UK might find it difficult to open a traditional bank account. To open a bank account, you need proof of address, which might be hard to get if you are a non-resident. The good news is that companies like Monzo or Monese offer a UK bank account without proof of address. You can have a UK bank account with just a few clicks. You will find more info about UK bank accounts for non-residents in our blog post.

💶 Is it possible to have a Euro bank account?

Yes, it is possible to have a Euro bank account in the UK, and some UK banks offer bank accounts in Euros. However, the fees for such accounts are quite high. For low-fee (or even free) solutions, take a look at our guide to the best Euro bank accounts in the UK.

📁 What documents are required to open a UK bank account?

To open a bank account in the UK, you'll generally need two things:

- Proof of your identity: E.g. Passport, drivers license, or national identity card. In general, if you are a foreign national, your best bet is to use your passport.

- Proof of the address in the UK: E.g. a recent utility bill, rental contract, council tax bill. Mobile phone bills are generally not accepted.

If you don't have proof of address, then we recommend opening a Wise Account to take care of your finances until you sort one out.

🏡 How do I get proof of residence in the UK?

UK banks ask customers to prove who they are and where they live in the UK before they open a bank account. Proof of address ensures that a bank account is not opened under a false identity. Each bank accepts different documents, but in general, you will be asked to show two official documents, for example:

- Utility bills

- Local authority council tax bill for the current council tax year

- Current UK driving license

- Bank, Building Society or Credit Union statement

- Mortgage statement

- A council or housing association rent card or tenancy agreement for the current year

- Solicitors letter within the last three months confirming the property purchase (or the land registry confirmation of address)

- HMRC self-assessment letters

- Electoral Register entry

- NHS Medical card

💼 Can a foreigner open a bank account in the UK?

Foreigners can open a traditional bank account in the UK as long as they have proof of the address, which sometimes it's hard to get. The good news is that there are companies like Monzo or Monese which offer UK bank accounts even without proof of the address. All the information about opening a bank account in the UK you will find in our blog post.

🛂 How can a non-resident open a UK bank account?

A non-resident cannot open a bank account in the UK in a strict sense, as proof of address is always required by British banks for new customers. However, to open an account ahead of a move to the UK, you can opt to open a British pound foreign currency account at your local bank in your home country, or, you can open a savvy only multi-currency account in pounds (and dozens of other currencies) via Wise that gives you a full set of official UK banking details, including an IBAN, account number, and sort code.

🏛 What are the different types of bank accounts in the UK?

There are numerous types of accounts in the UK, but here are the two that most people mean when they talk about a "bank account":

- Current account: Called a 'checking account' in the US, this is what most people are looking for basic everyday use, such as paying bills and receiving a salary. They generally come with a debit card and overdraft. Chequebooks are no longer automatically issued to new customers, but you may be able to opt for one if you wish.

- Savings account: These accounts have traditionally yielded a higher interest rate and are meant for what their name implies — saving money. However, a number of current accounts also pay interest on balances up to a set amount.

There are also basic accounts (which are generally on offer for people with a poor credit history), as well as premium current accounts (which cost a monthly fee and come loaded with features), as well as current accounts aimed at youth and students.

🇪🇸 Can I open a Spanish bank account from the UK?

Yes, in some cases, it's possible to open a Spanish bank account from the UK, although you'll need to prove a legitimate interest in Spain and obtain a certificate of non-residency (and the associated NIE number) in order to do so. Take a look at our guide to opening a non-resident bank account in Spain to learn more.

📋 How do I open a bank account without a UK ID?

If you don't yet have a UK ID and are planning to move to the country, you can opt to open a British pound foreign currency account at your local bank in your home country, or, alternatively, you can open a savvy only multi-currency account in pounds (and dozens of other currencies) via Wise that gives you a full set of official UK banking details, including an IBAN, account number, and sort code.

💻 Can I open a UK bank account online?

Yes, it's possible to open a bank account online at most UK banks, although many high-street banks will require you to come in for an appointment too. To get an overview of which banks are completely online in the UK, take a look at Monito's guide to the best UK challenger banks.

Compare Top Online Banks in the UK

Filter your results

Languages

See allCountry availability

1See allServices

Monthly fee

Card delivery time

Best for

Bank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Overall Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

Filter your results

Languages

See allCountry availability

1See allServices

Monthly fee

Card delivery time

Best for

Bank details

See allSupported currencies

See allOverdraft

Annual interest rate

Supports cash deposits

International transfers

- Starling Bank Monito Score 9.1

- Monzo Monito Score 9.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Full bank account

- Full bank account

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Everyday banking +1

- Everyday banking

- Saving money

- Bank details UK account no. & sort code

- UK account no. & sort code

- Supported currencies Pound sterling +2

- Pound sterling

- US dollar

- Euro

- Overdraft Yes

- Annual interest rate High

- High

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Wise Multi-Currency Account Monito Score 8.9Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +21

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Polish

- Dutch

- Slovenian

- Polish

- Romanian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +37

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- New Zealand

- Malaysia

- Services Multi-currency account

- Multi-currency account

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN +11

- Euro IBAN

- Hungarian account no.

- US account & routing no.

- UK account no. & sort code

- Australian account & BSB no.

- New Zealand account no.

- Canadian account

- transit

- institution no.

- Romanian account no.

- Singaporean account no. & bank code

- Turkish IBAN

- Supported currencies US dollar +50

- US dollar

- Euro

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Pound sterling

- Croatian kuna

- forint

- Japanese yen

- Malaysian ringgit

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Romanian leu

- Swedish krona

- Singapore dollar

- Turkish lira

- United Arab Emirates dirham

- Chilean peso

- lari

- Moroccan dirham

- Pakistani rupee

- Tanzanian shilling

- Uruguayan peso

- ZMK

- Argentine peso

- Botswana pula

- Chinese yuan

- Egyptian pound

- Ghanaian cedi

- Indian rupee

- Kenyan shilling

- Mexican peso

- Ukrainian hryvnia

- Vietnamese Dong

- Costa Rican colon

- Israeli new shekel

- South Korean won

- Malaysian ringgit

- Thai baht

- Ugandan shilling

- CFA franc

- Bangladeshi taka

- Sri Lankan rupee

- Nigerian naira

- Philippine peso

- Russian ruble

- rand

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Revolut Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +20

- English

- German

- French

- Portuguese

- Spanish

- Dutch

- Slovenian

- Polish

- Romanian

- Italian

- Chinese

- Czech

- Norwegian

- Swedish

- Danish

- Hungarian

- Bulgarian

- Greek

- Croatian

- Latvian

- Lithuanian

- Country availability Austria +35

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Australia

- Singapore

- Switzerland

- Japan

- United Kingdom

- United States

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Mid

- Mid

- Best for Spending online +1

- Spending online

- Spending while abroad

- Bank details UK account no. & sort code +1

- UK account no. & sort code

- Euro IBAN

- Supported currencies United Arab Emirates dirham +26

- United Arab Emirates dirham

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Euro

- Pound sterling

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Russian ruble

- Qatari riyal

- Romanian leu

- Saudi riyal

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- US dollar

- rand

- Overdraft Yes

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Conotoxia Multi-Currency Card Monito Score 8.6Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages Polish +1

- Polish

- English

- Country availability Austria +28

- Austria

- Belgium

- Bulgaria

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- United States

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +19

- Euro

- US dollar

- Pound sterling

- Swiss franc

- Australian dollar

- Canadian dollar

- Czech koruna

- Danish krone

- denar

- Japanese yen

- Mexican peso

- Norwegian krone

- New Zealand dollar

- Russian ruble

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- rand

- Polish zloty

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits No

- International transfers Yes

- Trust & Credibility

- Monese Monito Score 8.0Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +11

- English

- French

- German

- Spanish

- Portuguese

- Italian

- Czech

- Estonian

- Lithuanian

- Polish

- Romanian

- Turkish

- Country availability Austria +30

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Lithuania

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Services All-in-one finance app

- All-in-one finance app

- Monthly fee Very low

- Very low

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details UK account no. & sort code +2

- UK account no. & sort code

- Euro IBAN

- Romanian account no.

- Supported currencies Euro +2

- Euro

- Pound sterling

- Romanian leu

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Zen Monito Score 7.1Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English +7

- English

- Polish

- German

- Spanish

- French

- Greek

- Italian

- Ukrainian

- Country availability Austria +29

- Austria

- Belgium

- Bulgaria

- Cyprus

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Gibraltar

- Services Multi-currency account +1

- Multi-currency account

- Travel card

- Monthly fee Low

- Low

- Card delivery time Fast

- Fast

- Best for Spending while abroad

- Spending while abroad

- Bank details Euro IBAN

- Euro IBAN

- Supported currencies Euro +29

- Euro

- US dollar

- Pound sterling

- Polish zloty

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Chinese yuan

- Croatian kuna

- Czech koruna

- Danish krone

- Hong Kong dollar

- forint

- Israeli new shekel

- Japanese yen

- Kenyan shilling

- Mexican peso

- New Zealand dollar

- Norwegian krone

- Qatari riyal

- Romanian leu

- Saudi riyal

- Singapore dollar

- rand

- Swedish krona

- Swiss franc

- Thai baht

- Turkish lira

- Ugandan shilling

- United Arab Emirates dirham

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

- Pockit Monito Score 6.7Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Languages English

- English

- Country availability United Kingdom

- United Kingdom

- Services Travel card

- Travel card

- Monthly fee Moderate

- Moderate

- Card delivery time Fast

- Fast

- Best for Easy registration

- Easy registration

- Bank details No account details (balance only)

- No account details (balance only)

- Supported currencies Pound sterling

- Pound sterling

- Overdraft No

- Annual interest rate Very low

- Very low

- Supports cash deposits Yes

- International transfers Yes

- Trust & Credibility

Non-Resident Bank Accounts in the UK vs Other Countries

Many countries allow non-residents to open a bank account within their legal jurisdictions, but exactly what kind of requirements non-residents face can differ drastically from country to country and even bank to bank. See the list below to get a better idea of this:

Country | Which non-residents can open an account? |

|---|---|

Parties with close ties, expats, immigrants, investors, students | |

Any interested party | |

Parties with close ties | |

Parties with close ties, investors, students | |

Parties with close ties, Investors | |

Investors only | |

Parties with close ties, investors, students | |

Parties with close ties, investors, expats, students | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Any interested party | |

Parties with close ties, investors | |

Investors only | |

Investors only | |

Parties with close ties, investors, expats | |

Parties with close ties, investors, expats | |

Any interested party |

Last updated: 18/2/2022

Country | Which non-residents can open an account? |

|---|---|

None | |

Parties with close ties, investors | |

Parties with close ties, investors | |

Any interested party | |

None |

Last updated: 18/2/2022

Country | Which non-residents can open an account? |

|---|---|

Any interested party | |

Any interested party | |

Parties with close ties, investors |

Last updated: 18/2/2022

Country | Which non-residents can open an account? |

|---|---|

Any interested party | |

Parties with close ties, investors |

Last updated: 18/2/2022

Other Banking Guides in the UK

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.