N26 vs Monzo: Which Is the Best? What are the Pros & Cons of Each?

François Briod

Guide

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreN26 vs Monzo: which one offers the best card for travelling? What about the best way to manage your money digitally? Who offers the most options to add to your account's balance and the lowest fees or best exchange rates to use it at home or around the world? Check out our side-by-side comparison of N26 vs Monzo offering and the pros and cons of each company.

N26 vs. Monzo

Monzo and N26 are two exciting new banks offering well-featured current accounts, debit cards, mobile apps and a range of services designed for people with busy lifestyles. We’ve researched both businesses in detail so we can compare them and share the insight you need. Read on to see how they stack up with each other across multiple areas so you can decide which one might be right for you.

Plans and Fees Winner: N26 🏆

Monzo and N26 compare very well to each other for their basic, free plans. The reason N26 wins in this area is due to their lower fees for withdrawing from an ATM. If you don’t tend to use an ATM, then consider this area a tie.

Overall Banking Service: Tie

Both providers offer a wide range of services under their free plans. You get a fully-featured current account, a Mastercard debit card with no foreign transaction fees, international money transfers through TransferWise, well-reviewed mobile apps and a range of other services. There’s no monthly cost to holding either type of account.

ATM Withdrawals: N26

N26 charges a flat 1.7 percent of the amount you withdraw to take money out of an ATM. Monzo gives you a free limit of £200 every 30 days, but charges you three percent of the amount withdrawn after that, which is likely to be considerably more expensive.

Getting a Debit card: Tie

Neither N26 nor Monzo charges a fee for providing you with a debit card. It can take up to ten working days to get a card from N26, while Monzo say it takes one to two weeks. N26 also offers an express delivery service at a cost of 22 EUR to get you a card in one to three days.

International Money Transfers: Tie

TransferWise provides currency exchange services through an integration with both Monzo and N26. TransferWise is a much-loved way to send money abroad, with superb exchange rates and low, transparent fees. This means you’ll pay a fee of 0.35 percent to 2.85 percent of the amount you’re transferring, depending on the currency.

Using Your Debit Card Abroad: Tie

There’s good news from both providers when it comes to using your card abroad. Neither Monzo or N26 charge any commission for FX services when you pay with your card abroad.

The N26 Card vs. The Monzo Card: Tie

The cards offered by Monzo and N26 come with identical features. Both are Mastercard debit cards and both offer contactless payments, Apple Pay and Google Pay. Mobile apps from each provider allow you to block and unblock your debit card if it goes missing.

N26 vs. Monzo: How Does the Account Compare?

N26 and Monzo claim to be replacements for a traditional bank account. Both providers offer very similar services, so we’re calling this one a tie.

Overall Winner for Account Comparison: Tie

The Account Experience: Tie

Both providers offer a range of features to make banking easier. N26 offers direct debits in EUR or GBP, and while Monzo only allows GBP, they also have a direct debit switching service to make it easier to migrate from your old account. Monzo also allows for joint accounts, whereas N26 does not. N26 is available across both a mobile app and a website, whereas you can only use Monzo through the mobile app, with a website only available for emergencies.

N26 and Monzo also guarantee your funds, up to £85,000 for Monzo and up to €100,000 for N26. If you lose your phone or card, both providers let you block and unblock your card, and get back into the app through contacting customer service.

Local Accounts Available in Specific Currencies: N26

Due to their availability across the EEA, N26 provides local accounts in both euros and pounds. Monzo is currently available in the U.K. and only offers accounts in pounds, although they are in beta in the U.S.

Other Bank Account Features: Tie

Both providers offer savings accounts, although N26 interest on savings is only available in Germany and Austria. Both offer good savings rates, with Monese offering up to 1.63 percent and N26 offering up to 1.48 percent. Monzo provides an overdraft at a cost of 50 pence per day in the UK, while N26 also offers an overdraft to German and Austrian users, charged at 8.9 percent annual interest. Monzo is a member of the “Current Account Switching Service” which makes it easy to move your existing account to them.

Topping Up Your Account: Monzo

N26 offers account top ups via bank transfer and also by cash if you’re in Austria or Germany. Monzo also offers cash and bank transfers for topping up an account but also allows you to use a cheque.

N26 vs. Monzo: Service Coverage and Customer Satisfaction

Customer experience is an important consideration when you’re deciding whether Monzo or N26 could be right for you. It’s a mixed outcome here as Monzo has limited service availability (UK only) while N26 has fewer support channels and a slightly lower satisfaction rating. Given their wider availability, we’re going to give this area to N26.

Overall Winner for Service Coverage and Customer Satisfaction: N26 🏆

Service Availability: N26

N26 wins here for one simple reason—it has much wider availability than Monzo. At the moment, Monzo only provides its app and services to customers in the United Kingdom, although they’re currently in beta in the United States. N26 offers services across the European Economic Area: The EU plus Iceland, Liechtenstein and Norway. N26 doesn’t yet offer services in Croatia, Bulgaria, Cyprus, Malta, Czech Republic, Hungary, Latvia, Lithuania or Romania.

Languages Supported: N26

The breadth of service availability is also reflected in support languages. Monzo only provides customer support in English, while N26 offers English, French, Spanish, German and Italian.

Number of Customers: Tie

N26 does have more customers with 3.5 million, compared to Monzo with 2.7 million, however, given Monzo’s limited availability, we’re saying this one’s a tie.

Customer Satisfaction: Monzo

Monzo scores highly for customer satisfaction, with a score of 8.8 out of ten on Trustpilot. Unfortunately, N26 doesn’t do quite as well, only scoring 7.7 out of ten, one of the lower review scores we’ve seen for these modern banking services. Although many reviewers were happy with N26, some did mention frozen accounts and issues with money.

Customer Support Channels: Monzo

N26 only offers support between 07:00 - 23:00 Berlin Time, via in-app chat and email. Monzo has the edge here as they provide support over the phone from the U.K. and abroad, via email and through an in-app live chat

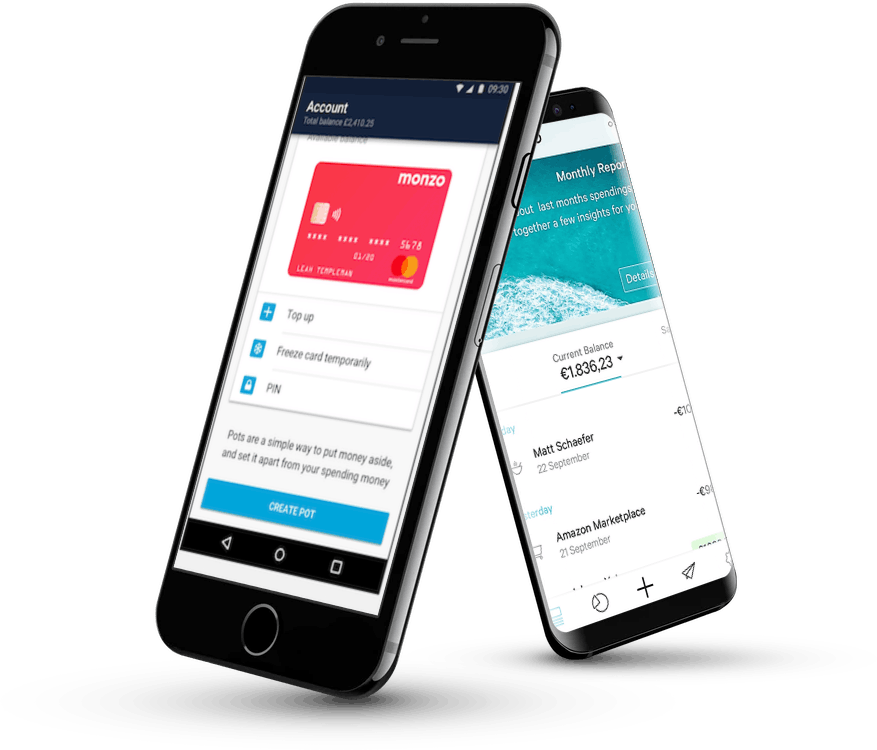

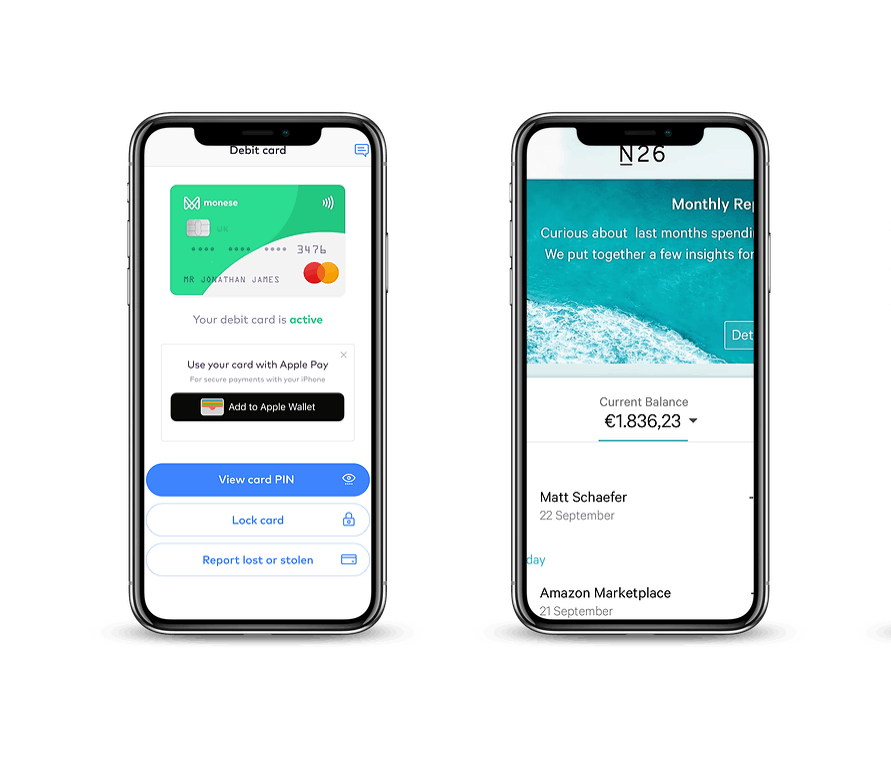

N26 App vs. Monzo: App Features and Reviews

Both Monzo and N26 apps offer very similar features—you get instant notifications, access to your bank account services, budgeting, categorization and more. Both allow you to set cash aside in savings “pots” and summarize all your important financial information in one place.

The similarity between the apps also translates into how customers review them, with both scoring highly on Android and Apple devices, although N26 has many more reviews. Google Play customers with Android phones scored N26 at 4.3 out of five and Monzo at 4.4 out of five. Apple Store customers with iOS phones scored N26 at 4.8 out of five and Monzo at 4.7 out of five.

The apps are well-designed, attractive and easy-to-use, so this is a tie.

Overall winner for app features and reviews: Tie

N26 vs. Monzo: The Verdict

Our detailed comparison should have made one thing clear—these providers are closely matched across most of the areas that matter. The two areas we believe could influence your opinion is service availability, as Monzo is currently only available in the UK, whereas N26 has much wider availability. The other thing that swings this towards N26 is the higher percentage fee that Monzo charges to use an ATM. Apart from that, we think they’re both excellent options, and that either choice could work for you.

Overall Winner for Overall Verdict: N26 (but just barely) 🏆

N26 just barely gets in ahead of Monzo. However, depending on your needs (like having a joint account), Monzo could also be a great choice, specially in the UK where some N26's services are not lived yet (overdraft, cash top-up, interest on savings).

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.