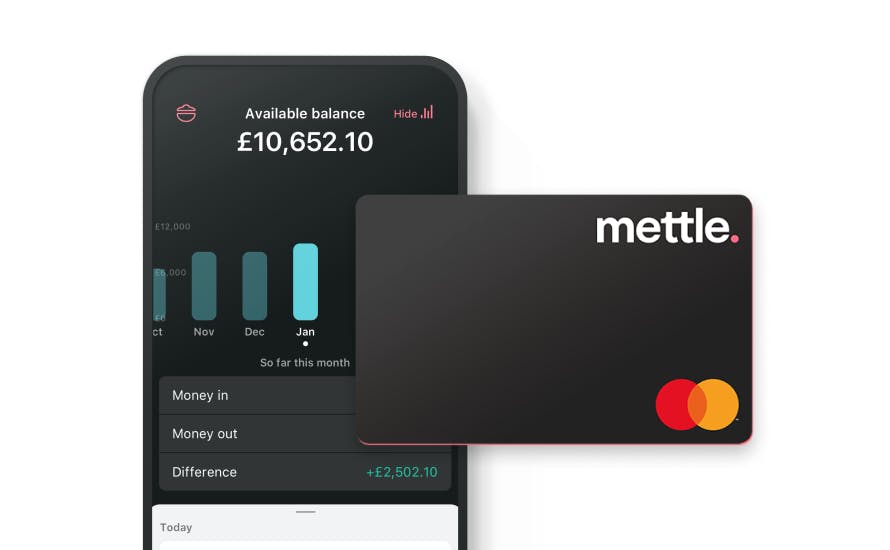

Key Facts About Opening a Mettle Business Bank Account

| 📍 NatWest Headquarters | Edinburgh, Scotland |

|---|---|

| 💸 Monthly Fee | None |

| 📂 Requirements | UK Resident over 18, Photo ID, UK Phone Number, Business Registration from Companies House |

| ✅ Eligible Business Status | UK sole traders, limited companies (Ltd) with at least one director |

| ⭐ Reviews | Apple Store: 4.9 out of 5 | Google Play: 4.8 out of 5 | Trustpilot: 4.6 out of 5 |

| 📵 Ineligible Business Status | Public limited companies (PLC), Unlimited companies (Unltd), Limited liability partnerships (LLP), Charities |

Banking Guides About Business Accounts in the United Kingdom

7 Best Online Business Bank Accounts for UK Small Business

February 27, 2023 - by Jarrod Suda

11 Best International Business Banks

January 9, 2024 - by Jarrod Suda

9 Best Sole Trader Bank Accounts for Self-employed in the UK

January 20, 2023 - by Jarrod Suda

Revolut Business Review: Fees, Exchange Rates, Functionalities, and More

December 29, 2022 - by Rachel Wait

Payoneer Review

November 25, 2022 - by Byron Mühlberg

HSBC Business Bank Account: 2023 Review of Service & Fees

May 8, 2023 - by Jarrod Suda

All You Need to Know About Wise Business (Formerly Transferwise for Business)

December 29, 2022 - by Olivia Willemin

4 Best Multi-Currency Business Accounts

September 22, 2023 - by Byron Mühlberg

How to Set Up a Company in the UK in 2022

May 26, 2023 - by Jarrod Suda

Tide Business Review

December 29, 2022 - by Rachel Wait

Best UK Challenger Banks

January 16, 2024 - by Byron Mühlberg

Best Free Bank Accounts UK

January 9, 2024 - by Byron Mühlberg

Atlantic Money Review

January 23, 2024 - by Byron Mühlberg

UK Bank Account (Even For Non-Residents)

March 15, 2024 - by François Briod

Best Digital Banking App UK

January 16, 2024 - by Jarrod Suda

UK's Best Online Banks

January 8, 2024 - by Byron Mühlberg

Best Place to Buy Dollars in the UK

May 26, 2023 - by Jarrod Suda

Wise vs HSBC

March 1, 2019

HSBC UK: Foreign Currency Exchange, International Money Transfer & ATM Fees explained

December 14, 2022 - by François Briod

Compare Best 7 Business Bank Accounts for UK Startups 2023

September 22, 2023 - by Jarrod Suda

How to Open a Business Bank Account in 2023

February 23, 2023 - by Jarrod Suda

How to Pay a Foreign Contractor

March 27, 2024 - by Byron Mühlberg

Chase UK Review

March 15, 2024 - by Byron Mühlberg