What You Need to Know When Making Paypal Transactions In Different Currencies

- PayPal can be used in different ways: as a mobile wallet, it can store different credit cards as well as keep a balance. You can use either your cards or your PayPal balance to send money to other individual users, or to make online payments.

- When making payments that do not require conversion – either because you have a balance or a credit card in the currency – PayPal won’t charge you a fee, though your card issuer still might if the payment is processed abroad.

- When making payments in another currency, however, things get more complicated. If you use your balance, PayPal will handle the conversion, charging you a conversion fee of 4%. If you use a credit card, PayPal can either handle the conversion for the same 4% fee, or it can directly charge the amount to your card, letting the issuer handle the conversion.

- Since your card issuer very likely charges less than 4% when spending money in another currency, it is always a bad idea to let PayPal handle the conversion if you can.

- Making multi-currency transactions via PayPal also comes with fees, though those are less transparent: they consist of a mark-up on the mid-market exchange rate, exchange rate fees, and destination delivery fees. PayPal needs to show their fees, but often finding these details on the page can be like looking for a needle in a haystack!

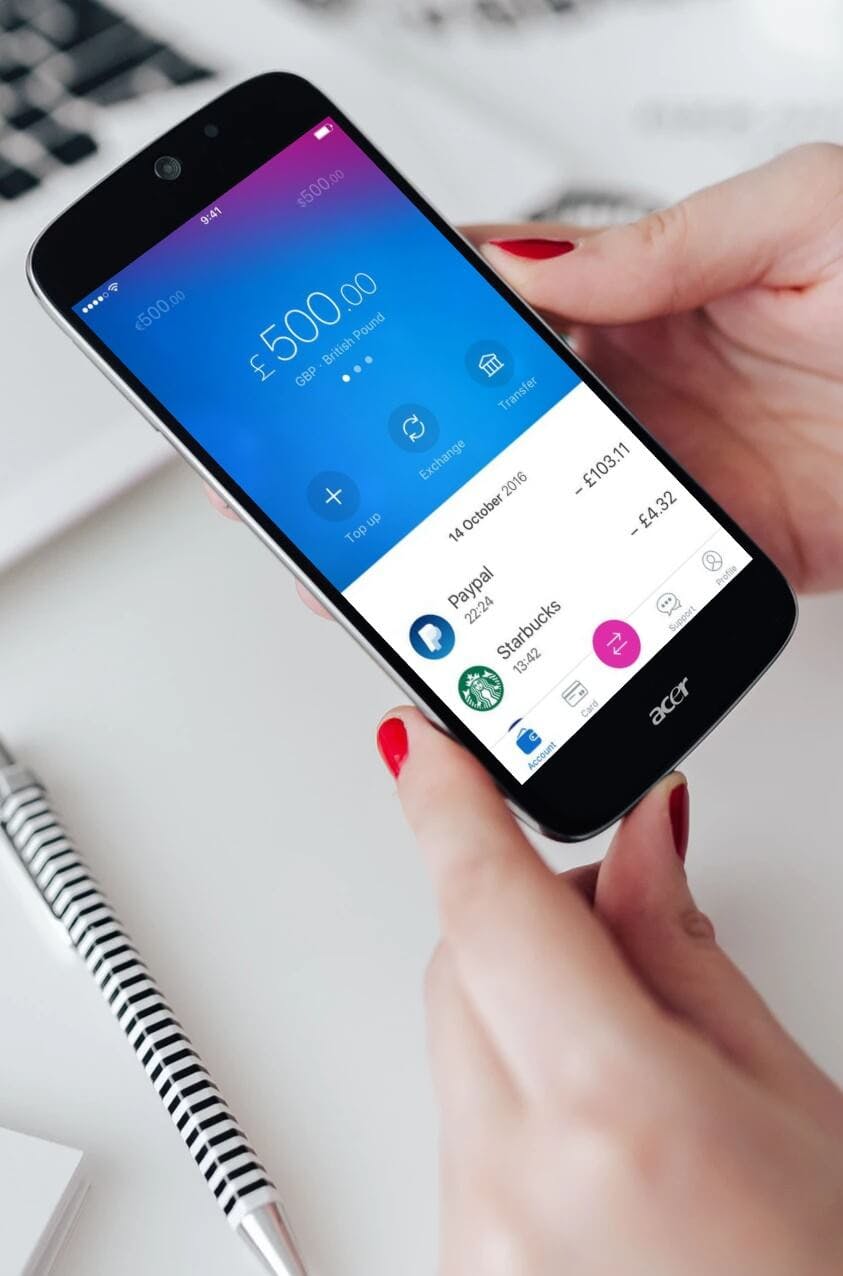

Consider Using a Multi-Currency Card as an Alternative to PayPal What is a multi-currency card?

A multi-currency card – sometimes also known as a travel money card – is usually a prepaid debit card provided by internet-only banks that can be used in multiple currencies around the world without facing extra hidden fees. You charge them up through your account and are free to use them just as you would any debit card, whether online or in person. Sometimes, though rarely, a multi-currency card can be a credit card.

When dealing with foreign currency, a multi-currency card is always your best option.

Are they safe? Multi-currency cards acquired through reputable online banks are safe.