Best Apps Like Paysend You Should Know About in 2024

Byron Mühlberg

Guide

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

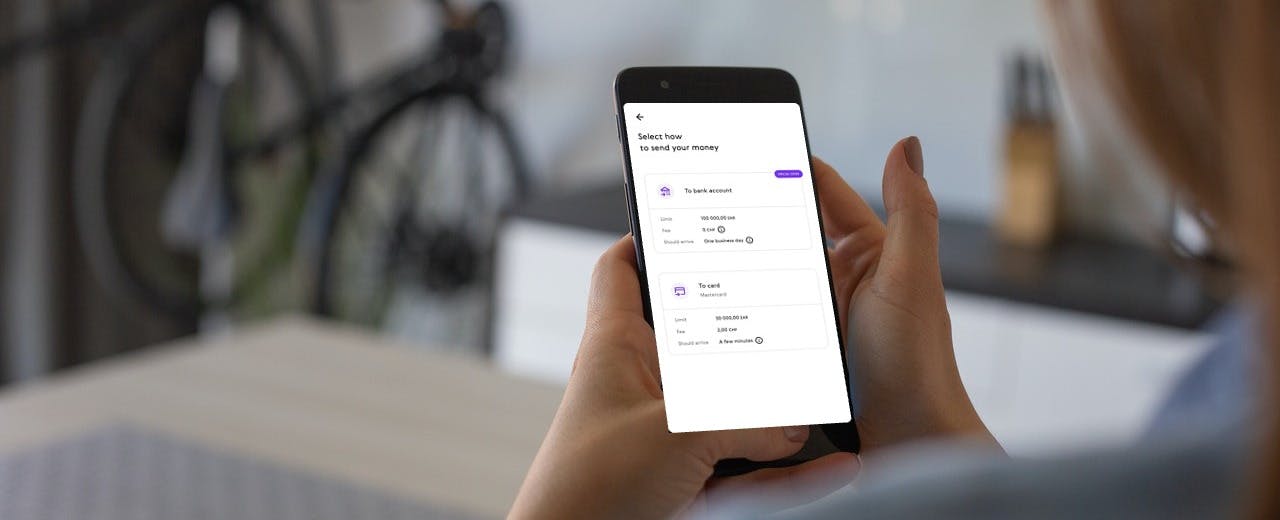

Read moreWhether you like it for its card payments or for its clean, uncluttered app, Paysend is an excellent way to send money overseas!

However, Paysend isn't always the best choice for everybody. Whether it doesn't support money transfers to your desired destination or whether you think you could find better fees and exchange rates elsewhere, there are other options to compare! Find the cheapest and fastest Paysend alternative using Monito's live comparison engine below 👇

Compare the best apps like Paysend in real time:

As we'll see in this guide, we've rated Remitly as the best site like Paysend. To find out more about Remitly and its excellent money transfer platform, be sure to give Monito's Remitly video review a watch:

Remitly: Best Overall

Remitly is a US-based digital remittance app that's very often the fastest and cheapest money transfer app on Monito. Like Paysend, Remitly offers various pay-in options and supports currency transfers to over 85 countries worldwide. Unlike Paysend, however, Remitly has the added bonus of also supporting cash pick-up transfers!

Similarities to Paysend: You can send money to foreign bank accounts for very low fees.

Differences to Paysend: It supports cash pick-up and mobile wallet deposits in addition to bank deposits.

Cost: Approx. 0.5% - 2%

Coverage: Available in Europe, North America, Singapore, and Australia and supports transfers to around 47 currencies.

Speed: Remitly 'Economy' bank transfers take three to five business days, while 'Express' card transfers arrive within minutes.

Transfer limits: Exact limits vary depending on currency and country, but generally, the minimum transfer is USD 1, and the maximum transfer is USD 20,000, or currency equivalent.

More info: See our full Remitly review or visit the website.

WorldRemit

Just like Paysend, WorldRemit is a UK-based online remittance provider. It offers the best way to transfer money internationally to diverse regions, including Africa, the Middle East, and Latin America, and like Remitly (but unlike Paysend), WorldRemit lets you send money to mobile wallets, bank accounts, and cash pick-up locations all across the globe — all at excellent exchange rates!

Similarities to Paysend: You can send money to bank accounts in dozens of currencies.

Differences to Paysend: Supports cash and mobile money payouts.

Cost: Approx. 1% - 2.5%

Coverage: Available in 56 countries and transfers to as many as 150 foreign currencies.

Speed: Depending on the pay-in methods, payout methods, and countries involved, WorldRemit transfers take anywhere between a few seconds and a few working days to arrive.

Transfer limits: USD 1 - USD 9,000 in the US and GBP 1 - GBP 50,000 in the UK.

More info: See our full WorldRemit review or visit the website.

Wise

Probably the best way of all for sending international bank transfers, Wise has become a very popular transfer app in recent years, famous for its easy-to-use and low-cost platform for international money transfers. In fact, Wise frequently ranks as the cheapest way to transfer abroad on Monito. Like Paysend, it supports bank transfers to dozens of foreign currencies worldwide, but even more so than Paysend, it's among the best money transfer services of all on Monito (compare WorldRemit's 8.2/10 to Wise's 9.5/10 on our Monito Score ranking) and its mobile app is ranked the best money transfer app.

Similarities to WorldRemit: You can send money online to a foreign bank account.

Differences to WorldRemit: It's usually significantly cheaper.

Cost: Approx. 0.25% - 1%

Coverage: Available in the EEA, UK, US, Singapore, Japan, Australia, and New Zealand and supports transfers to around 57 foreign currencies across the globe.

Speed: 52% of transfers arrive within 20 seconds, 71% within an hour, and 90% within a 24-hour period.¹

Transfer limits: Precise limits vary depending on currency and country, but generally, the minimum transfer is just one US dollar, and the maximum transfer is USD million or currency equivalent.

More info: See our full Wise review or visit the website.

¹ Q2 2022 Mission Update: Speed

How to Find the Best Apps Like Paysend

It's worth stressing that there are many alternatives to Paysend, and no single one will necessarily be better than Paysend or every person in every instance. Overall, however, the money transfer apps outlined above will, on average, be cheaper than Paysend and give additional benefits.

Suppose you're changing from Paysend to another provider. In that case, there are a few other rules to keep in mind to ensure that you save every extra dollar when sending money internationally for everyday use. These include:

- Open bank accounts that don't charge additional fees for international money transfers. Look at our list of the best banks for international travel to find out more.

- Avoid using a credit or debit card to fund your money transfer. If you do, then Paysend is by far the best option.

- Make sure you choose a safe and fully-licensed money transfer service. All services on Monito adhere to the highest security standards and are among the safest ways to send money internationally.

- Avoid using big banks and PayPal, which are practically never the cheapest way to send (or receive) money overseas.

- Where possible, send money to a bank account or a mobile wallet rather than to a cash pick-up location.

- If you're looking for the cheapest way to exchange money with cash, avoid doing so at bureaux de change or airports.

- Where possible, send one large transfer instead of multiple smaller ones. Larger transfers almost always incur lower percentage fees than smaller transfers. Learn more about making sizeable international money transfers here and about how much you can send internationally here.

- Choose a longer transfer speed if it reduces your fees.

Sending to a Debit or Credit Card?

If you like Paysend for its card deposit feature, then Wise, WorldRemit, and Remitly won't meet your expectations, as none of them supports this unique feature. (If you're sending money from a debit or credit card, however, Wise, WorldRemit, and Remitly will be good alternatives!)

MoneyGram is the only natural alternative if you want to send money to a debit card. With MoneyGram's Debit Card Deposit scheme, you'll be able to transfer money to Visa debit cards in several foreign countries worldwide. Find out more information in our guide here.

If you make transfers with your credit or debit card, be sure to check out our other how-to guides on the subject:

- How to send money to a debit card abroad

- How to transfer money from one card to another

- How to make a credit card transfer to a bank account

However you send your money, it's important to remember that it's impossible to send money internationally for free and that every currency exchange comes with a cost. However, not all money transfer services are created equal, and some charge you considerably lower fees than others. Monito has reviewed and compared hundreds of money transfer services to simplify your research. Compare them in real time using our award-winning comparison engine below:

Find the best app like Paysend:

FAQ About Apps Like Paysend

🏪 Is there an alternative to Paysend?

Yes, there are many alternatives to Paysend! Remitly, Paysend's direct competitor, is the most similar site to Paysend, and both companies are usually among the cheapest ways to send money internationally!

🏦 Is Paysend better than a bank wire transfer?

Yes, Paysend is almost always cheaper than a bank wire transfer. When in doubt, double-check Monito's real-time comparison engine to make sure you're getting the best deal for your money transfer!

🏤 What are other companies like Paysend?

Other companies like Paysend include WorldRemit, Remitly, and Wise, which will normally save you money compared to sending with your bank.

💰 Why is Paysend so expensive?

Paysend isn't expensive, especially if you make an online bank transfer or a transfer for cash pick-up. However, it's not always the cheapest service out there. This is because its fees and exchange rates are slightly higher than those of savvier, online-only competitors with lower costs, such as Remitly.

💸 Is Paysend worth it?

Paysend is worth it when compared to a bank wire transfer overseas. You'll typically save money by picking Paysend over your bank to handle these transfers. Other similar providers, such as Remitly, are also a good deal for most money transfers where they're available.

See Monito's Guides For Sending Money Internationally

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.