WorldRemit Review: Our Definitive Review of WorldRemit's Money Transfers in 2023

Olivia Willemin

Guide

Writing for Monito, Olivia is here to help users navigate the world of money transfer fees, exchange rates, and tips and tricks that help you make your best decisions.

Jarrod Suda

Reviewer

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreWorldRemit is a good money transfer service (8.1/10) often recommended by Monito. Ranking highly when it comes to all matters related to trust and credibility (8.3/10), WorldRemit is a reputable service that is trusted by four million clients — WorldRemit excels in customer satisfaction (9.2/10), customer support (9.5/10), is deemed easy to use (7.7/10), and receives overwhelmingly positive reviews — but sometimes lags behind when it comes to its fees and exchange rates (7/10) where it is rarely the cheapest nor the most transparent provider available. Still, it remains a competitive provider, especially when it comes to sending money for cash pick-ups. Overall, WorldRemit is a solid contender in the international money transfer world that has much in its favour.

What We Like About WorldRemit

- A large, global network of cash pickup locations;

- Varied options for sending and receiving money;

- Ease of use & customer satisfaction;

- Reliable customer support.

What We Dislike About WorldRemit

- Not always the cheapest provider;

- The majority of fees are buried non-transparently in exchange rates.

💳 Pay-in | Bank Transfer, Debit Card, Credit Card |

|---|---|

🏧 Pay-out | Bank Deposit, Cash Pick-up, Cash Home Delivery, Mobile Wallet |

💶 Min. Transfer | 1 |

💷 Max. Transfer | 9000 |

💱 Currencies | 150 |

👥 Customers | 4 million |

🔐 Trustpilot | 3.9/5 |

📝 Reviews | 70000 |

🌍 Available | 56 countries |

💬 Languages | English, Spanish, French, Dutch, Danish, German |

📍 Headquarters | London (GB) |

|---|---|

📃 Established | 2010 |

🌏 Offices | London (GB), Denver (US), Cebu City (PH), Kraków (PL) |

👥 Employees | 1000 |

📈 Publicly Traded | No |

🏆 Award(s) | EY Entrepreneur Of The Year (2016), The Powerlist (2019) and others |

✅ Fun Fact | WorldRemit's founder Dr. Ismail Ahmed used to work for the UN |

How We Review Money Transfer Providers

With more than 50 providers reviewed and 100 test transfers made over the past ten years, we pride ourselves on providing the best reviews of international money transfer services online. Curious how we make them and why you can trust us? Take a look at our process below:

🔎 See how our scoring methodology works

All international money transfer services we review are put through a comprehensive and rigorous scoring methodology, which involves the testing of the platform's functionalities, assessment of customer reviews, fees, pay-in options, customer service, and business metrics. The methodology is also powered by an analysis of millions of searches on Monito's comparison engine to determine each provider's competitiveness in terms of pricing. When the research is done, each Monito Score is then peer-reviewed by at least one Monito expert. Learn more about our scoring methodology here.

🤝 See why you can trust our recommendations

Reviews are written independently by Monito's editors, and the recommendations given are our own. We might make money from some links on our reviews to bring you premium content without pesky banner ads and paywalls. We promise you that this never impacts the independence of our recommendations. Learn more about our promise and our business model here.

WorldRemit Review

Is WorldRemit Available in Your Country?

| WorldRemit | Switzerland |

Is WorldRemit Safe to Send Money?

WorldRemit is a well-established international money transfer provider that serves over 4 million customers worldwide and has transferred over $10 billion in the last year.

Is WorldRemit Safe to Use?

Yes, WordRemit is safe indeed. We would not hesitate to say that WorldRemit is completely trustworthy and is among the most secure remittance services available. WorldRemit is headquartered in London, United Kingdom, where it is authorized and regulated by the Financial Conduct Authority (FCA) for the provision of payment services.

Is WorldRemit Legit?

Absolutely, the FCA regulations place high standards on WorldRemit to protect consumers against fraud and safeguard their funds in case the company has financial difficulties. It requires the company to hold sufficient amounts of capital to ensure financial stability, and to have internal procedures to manage risk.

It also operates and is regulated in the United States (in all 50 states), Australia, and Canada.

WorldRemit's Product & Service Quality

WorldRemit offers a variety of pay-in and pay-out options, making it a convenient and popular option for sending money abroad.

Impressions During Our Tests

Slick and easy to use, WorldRemit made a good impression on us, especially once its rather long registration process was behind us. The money transfer process itself is smooth, and displays the relevant sums front and center throughout, while providing helpful tips at every step.

Although WorldRemit is not always transparent when it comes to the amount of fees it bakes into its transfer rates, it does display the thresholds of its preferential rates clearly. It also is pretty on top of things when it comes to making sure you get the information you need, from email updates on your chosen rates to very granular live updates about its services around the world.

Pay-Out Methods for WorldRemit Money Transfers

Unlike many international money transfer services that offer only bank transfers, WorldRemit gives customers the freedom to choose from several pay-in and pay-out methods. Let's have a look at how they work:

Bank Deposit

If you choose this payout method, your money will be credited to the bank account of your recipient. They will then be able to withdraw the funds as cash, use them to make payments or make a bank transfer.

Cash Pickup

With this payout method, the money you send will be available for pickup in cash at a local agent location of a WorldRemit money transfer partner.

Mobile Money

This allows you to send money to a mobile money account (also known as a mobile wallet), such as Vodafone M-PESA, MTN Mobile Money, Airtel, Globe Cash, Tigo, etc. This way, the money is available to your recipient anywhere and at any time.

Airtime Top-up

You can also choose to top-up your recipient’s mobile airtime, which they can use to make calls or send SMS text messages.

WorldRemit Mobile App Review

WorldRemit is a mobile-first company both for sending and receiving money. The London-based firm reports that over a third of its global transfers and half of its transfers to Africa go to mobile money services, and it has been called “the WhatsApp of money.”

WorldRemit’s apps, available for both iOS and Android, provide an easy and very convenient way to send money with WorldRemit, from anywhere and at any time. With the WorldRemit mobile app, you can check out WorldRemit’s exchange rate and fees, set up and track your money transfers, and manage your recipients.

How Does WorldRemit Work?

Step 01

Check WorldRemit’s Rates

Use Monito's comparison tool to understand WorldRemit’s exchange rates and fees to ensure they are the cheapest international transfer option. You can find the cheapest way to fund your transfer (pay-in) and receive the money (pay-out).

Step 02

Create an Account with WorldRemit

You can easily sign up for WorldRemit online or via the app. You’ll need to provide WorldRemit with your Full Name, Residential Address, Date of Birth, and email address.

Step 03

Verify your Identity (KYC)

Depending on the amount you are transferring and the country you’re sending money from, WorldRemit may ask you to provide additional information, such as a proof of funds (e.g. payslip), and to verify your identity with a government-issued photo ID (limits and documents vary country by country) and provide a proof of address (i.e. scan of a utility bill sent at your name showing your residential address).

Step 04

Initiate a Transfer

Enter how much you're sending, the destination country and currency, and your delivery method of choice. Make sure you understand the total cost difference between the pay-in and pay-out options to send money conveniently but at the best rate.

Step 05

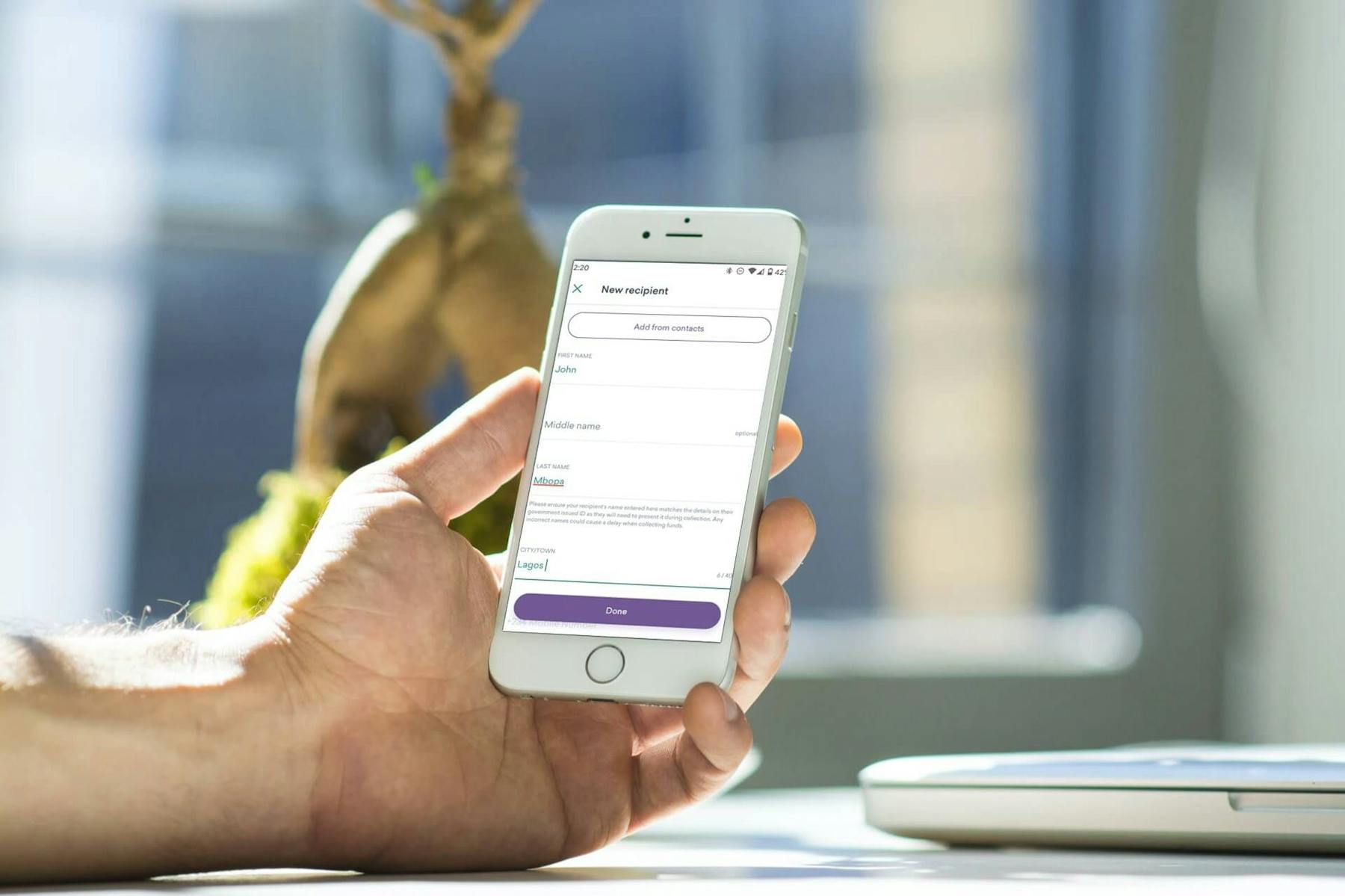

Add a Beneficiary

Enter the recipient’s details including name (matching their ID), address and contact info (mobile phone and email), as well as the reason for your transfer.

Final step

Fund your Transfer and Click Send

Try WorldRemit 🡪Pay for your transfer with the payment method you selected, click “Send,” and voilà the money is on its way! You can follow the status of your transfer on WorldRemit’s website or mobile app and subscribe to SMS or Email notifications.

WorldRemit's Fees & Exchange Rates

WorldRemit is rarely the cheapest option for sending money abroad but is regularly a competitive provider in approximately half of relevant Monito searches.

WorldRemit Transfer Fees

WorldRemit does not show its fees upfront. They also depend on the amount, the payout method and where you are sending the money. For example, the fees for cash pickup are usually higher than for a bank deposit. While WorldRemit’s transfer fees are usually flat, in some cases, fees will vary according to the amount you are sending.

We found that if you wanted to send 1,000 USD, you would have to pay a fixed fee of 2.99 USD. The total bill you’d pay at checkout would be 1002.99 USD.

However, the money that enters the account of your recipient may not be equal to 102.99 USD. This is where exchange rates come in. The exchange rate that is applied on your transfer may not be as strong as the actual mid-market exchange range.

WorldRemit Calculator

WorldRemit exchange rates depend on the payout method you choose. They are locked in advance so that you know exactly how much money will reach your recipient.

You can follow the on-screen prompts on their website to get an estimation of how much it would cost to send a specific amount to your designated country.

WorldRemit's Best Exchange Rates

From June 2021 to June 2022, we found that WorldRemit was by far the best service for transfers from Japan to the Philippines and for transfers from South Africa to Nigeria and the United Kingdom. The service is also a very competitive choice for Malaysian and American users.

For other regions, it's a good idea to compare WorldRemit's rate to the mid-market range, which you can find on Google or XE.com. Also use Monito's comparison engine to compare WorldRemit's rates to other international money transfer services to make sure that you are getting the best deal.

The Exchange Rate Margin Fee

WorldRemit does not openly charge any fees besides the transfer fees. However, it should be noted that WorldRemit does not disclose its exchange rate margin. 69% of the total cost of your transfer is hidden in this margin, aka the difference between the actual mid-market exchange range and the weaker rate that they offer you. WorldRemit keeps the difference.

Additionally, if you are paying by credit card, you should be aware that your card provider might charge you a cash advance fee. It’s best to check this with your card provider directly to avoid any bad surprises. Also, if you are sending an airtime top-up, note that some countries apply taxes that will reduce the amount of airtime received by your recipient. If this is the case, WorldRemit will warn you before you complete your transfer.

Compare fees & exchange rates cheaper than WorldRemit:

Customer Reviews of WorldRemit

WorldRemit is an extremely popular money transfer provider with over 40 thousand positive reviews on sites like Trustpilot.

Positive WorldRemit Review Highlights

- Customers like how fast it is to make a transfer;

- Money is delivered quickly;

- The convenience and ease of use of WorldRemit’s service;

- The fees and exchange rates are better than those of competitors;

- Customers think WorldRemit is trustworthy.

Negative WorldRemit Review Highlights

- Some transfers were delayed.

FAQ About WorldRemit

💸 Is Worldremit the cheapest way to send money abroad?

Worldremit offers a transparent way to send money abroad, but it's not always the cheapest option possible. You can use Monito's live comparison tool to compare all services and find the best option for your international money transfer.

🚨 Is WorldRemit safe and reliable?

WorldRemit is a legitimate and trustworthy money transfer service. It has excellent reviews on Trustpilot with an average rating of 4.5 (out of 5) across almost 40,000 reviews.

All customer funds are held in separate accounts. WorldRemit offers cancellation and refund facilities. All connections to WorldRemit are secured using industry-leading security measures, including 256-bit SSL encryption with a 2048-bit signature.

In the UK, WorldRemit is licensed as an Electronic Money Institution and is authorized and regulated by the FCA (Financial Conduct Authority). In Australia, WorldRemit is registered with AUSTRAC (Australian Transaction Reports and Analysis Centre). In New Zealand, the company is regulated by FSPR (Financial Service Providers Register).

We would not hesitate to say that WorldRemit is among the most secure remittance services available. That’s why the service has a 9.1/10 in Credibility and Security Monito Score.

Is it possible to send money to Nigeria with Worldremit?

Yes, you can send money to Nigeria with Worldremit. There are dozens of excellent digital services for money transfers to Nigeria that you can compare on Monito. By comparing all your options, you can mare sure you get the best naira exchange rate. Choose the most convenient delivery method for you - transfer to a bank account, mobile top-up or to a cash pick-up agency in Kano, Kaduna, or any other city in Nigeria.

💱 How to avoid Worldremit fees?

There is no way to avoid Worldremit fees entirely, but they can be minimized.

- Always compare Worldremit fees and exchange rates with alternatives with Monito's comparison widget for international money transfers.

- Keep in mind that WorldRemit fees depend on the amount, the payout method, and where you are sending the money.

- The exchange rats for cash pickup are usually worse than for a bank deposit. While WorldRemit’s transfer fees are usually generally, but in some cases, fees will vary according to the amount you are sending.

- Avoid credit card charges - your card provider might charge you a cash advance fee.

- Consider sending money with another money transfer operator with lower fees and better exchange rates. Compare your options with Monito to make sure that you're not loosing your precious money on high transfer fees.

💰 How much does WorldRemit charge to send money?

WorldRemit's Transfer fees vary depending on where you're sending money. Transfer fees start from £0.95. Remember that additional WorldRemit fees may be hidden in the markup on the exchange rate. That’s why you can always estimate Worldremit's transfer fees with Monito's live comparison widget to discover if WorldRemit's cost to send money is the lowest possible.

How do I or the beneficiary receive funds from WorldRemit?

You can get to your money in various ways with WorldRemit, depending on how the sender has decided to transfer money to you. Popular methods include depositing money directly into your bank account or arranging for cash pickup at one of the thousands of WorldRemit agent locations around the globe. In some cases you can also choose to have money transferred to your mobile, through an electronic wallet service that allows you to send, receive and store money on your phone. Mobile airtime top-up is also an option if you want to increase the minutes on your mobile plan.

In some countries, the sender can even choose to have money sent directly to your address via a home delivery service, or you can take advantage of the WorldRemit wallet. Note that not all payout options are available in all countries. If you want to arrange a specific payout option, get in contact with the person who is sending the money and let them know how you want to receive funds.

Sourced from WorldRemit, How it works: https://www.worldremit.com/en/how-it-works

How do I cancel a WorldRemit transaction?

If you want to cancel an international money transfer made through WorldRemit, you will need to do so before the transaction has been paid out. You can cancel a transaction by contacting WorldRemit customer service, through their website or over the phone. Note that not every WorldRemit transaction can be cancelled.

Contact numbers for WorldRemit customer service include:

- USA: +1 888 772 7771

- Canada: +1 888 772 7771

- United Kingdom (Individual): +44 20 7148 5800

- France: +33 2 72 24 21 17

- Italy: +39 06 94803110

- Spain: +34 960 473 401

- Australia: +61 2 6145 2161

Sourced from WorldRemit FAQ, Cancellations and refunds: https://www.worldremit.com/en/faq/cancellations-refunds#15801

Is WorldRemit legit?

Yes. WorldRemit operates as an Authorised Electronic Money Institution. In the UK the company is regulated by the Financial Conduct Authority (FCA). The FCA ensures that WorldRemit operates under all relevant rules and obligations. All connections to WorldRemit through their website and mobile app are secured using 256-bit SSL encryption with a 2048-bit signature to protect your identity and financial and personal data.

WorldRemit also has excellent reviews on Trustpilot with an average rating of five stars across almost 30,000 reviews.

- Sourced from WorldRemit, Security and privacy: https://www.worldremit.com/en/faq/security-privacy

- Sourced from the FCA company register: https://register.fca.org.uk/ShPo_FirmDetailsPage?id=0010X00004D8FDGQA3

How long does it take to send money with WorldRemit?

The time it takes for your beneficiary to receive funds after you send them depends on several factors. These include the countries and currencies you’re sending money between, the amount you’re sending, how you pay for the transfer, how the beneficiary wants to receive the money and any additional security checks. WorldRemit transfers will not start until WorldRemit has received a cleared payment from you.

In many cases, money will arrive almost instantly, but it can take up to seven days, depending on the beneficiary's location. Typically, bank transfers, cash pickup, mobile money and airtime top-ups are very quick, while home delivery can take a few days to reach the beneficiary.

Sourced from WorldRemit FAQs, Getting started: https://www.worldremit.com/en/faq/getting-started

How does WorldRemit work?

Sending money with WorldRemit is super easy. First, you need to register a free account on the WorldRemit website. To do that, you will need to provide a range of personal information and identity documents, in order to satisfy WorldRemit’s regulatory obligations. Once your account is verified and activated, you can proceed with your money transfer. With WorldRemit, you can send money via the app or website.

To make a money transfer with WorldRemit, you need to follow the steps below:

- Enter the countries that you want to send money to and from.

- Select the amount that you want to transfer and choose the pay-out method.

- Enter recipient details (depending on the transfer method).

- Click/tap on the “Send” button.

- You will get a breakdown of all transfer costs. If you’re satisfied with all the costs (fees and exchange rates), you can proceed and pay for your transfer. If you’re not satisfied, you can compare other money transfer options on Monito to find a cheaper one.

- You can pay for your transfer by a credit card, debit card, or bank transfer.

- Once your transfer is paid for, you will receive a text message and e-mail confirmation.

How much can you send through WorldRemit?

The amount you’re able to send with WorldRemit depends on the countries you’re sending to and from, as well as the payment method used to fund the transfer. For example, in the UK, the maximum WorldRemit transfer is 30,000 GBP; in Australia - 50,000 AUD, in the US - 20,000 USD.

Can you get your money back from WorldRemit?

Yes, you can get a refund from WorldRemit as long as your transaction is not paid out. After a transaction is completed, WorldRemit might not be able to refund it. If you want to cancel your transaction, contact WorldRemit customer service asap. A refund usually takes up to 7 working days.

Where can I pick up money from WorldRemit?

WorldRemit pick-up options depend on where you and the transfer recipient are based.

You have several options when it comes to picking up your transfer: funds can be sent directly to a recipient’s bank account, to Mobile Money accounts, or as an airtime top-up.

What’s more, WorldRemit has an extensive banking network in almost all countries around the globe. The recipient can receive the transfer as cash from WorldRemit’s 30,000+ agent locations worldwide.

Is WorldRemit Safe?

Yes, WordRemit is safe indeed, and we'd not hesitate to say that WorldRemit is completely trustworthy and is among the most secure remittance services available. Headquartered in London, United Kingdom, WorldRemit is authorized and regulated by the Financial Conduct Authority (FCA) for the provision of payment services, which imposes strict regulations on WorldRemit to protect consumers against fraud and safeguard their funds in case the company has financial difficulties.

See How Remitly Compares Overall With Alternatives

WorldRemit Availability

For American and Canadian transfers, check out a few countries that you can send money to with WorldRemit and explore the fees involved. We also highlight available transfer options, transfer time, and WorldRemit alternatives.

Nigeria | South Korea | Mexico | Brazil | Russia | UK | Canada | Belgium | |

Is WorldRemit Available? | Yes | No | Yes | Yes | No | Yes | Yes | Yes |

How much does a transfer of 500 USD get me in my destination currency? | 185,894 NGN | / | 11,140 MXN | 2,603 BRL | / | 392.80 GBP | 665.22 | 436.83 |

How long does a WorldRemit transaction take to get to its destination? | Minutes | / | Minutes | Next Day | / | Next Day | 2 Days | Next Day |

What is a good alternative to WorldRemit? | Monito does not offer another alternative at this time. | |||||||

How can the WorldRemit transfer be received? | Cash or Bank Account | / | Cash or Bank Account | Cash or Bank Account | / | Cash or Bank Account | Cash or Bank Account | Cash or Bank Account |

Are there any special considerations to keep in mind with WorldRemit? | No | / |

Last updated: 23/05/2021

UK | Philippines | Pakistan | Russia | Nigeria | Mexico | United Arab Emirates | Japan | |

Is WorldRemit Available? | Yes | Yes | Yes | No | Yes | Yes | No | No |

How much does a transfer of 500 CAD get me in my destination currency? | 290.89 GBP | 18,246 PHP | 60,702 PKR | / | 137,061 NGN | 8,046 MXN | / | / |

How long does a WorldRemit transaction take to get to its destination? | Next Day | Minutes | 2 Days | / | Minutes | Minutes | / | / |

What is a good alternative to WorldRemit? | / | |||||||

How can the WorldRemit transfer be received? | Cash or Bank Account | Cash or Bank Account | Cash or Bank Account | / | Cash or Bank Account | Cash or Bank Account | / | / |

Are there any special considerations to keep in mind with WorldRemit? | No | No | No | / | No | No | / | / |

Last updated: 23/05/2021

Read More About WorldRemit and its Alternatives

Recharging a Loved One's Airtime Instead?

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.