Sigue Money Transfers Review: Is it safe? How does it work? What are the rates?

François Briod

Guide

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreSigue Money Transfers is one of the largest money transfer providers in Latin America.

Sigue transfers can be made from a local branch or their mobile app.

Their transfers are very fast, available even within 30 minutes.

It's a good choice if you want a fast transfer to get delivered as cash pick-up.

Our independent review of Sigue Money Transfer

Sigue Money Transfer is one of Latin America's top non-bank providers for cash delivery services. The company allows transferring our funds directly to another person without using banks or credit cards. The company focuses mainly on the US-Mexico money transfer corridor. The global network and millions of customers position Sigue as a major player in the remittance market in Central and South America.

The company helps immigrants living in the United States to send their hard-earned money back home. The service is especially popular in the Hispanic and Mexican communities. No wonder the company is popular with these minorities - many Mexicans living in the United States can’t open a bank account. It is why Sigue service is within reach of many immigrants to bring the remittances to their relatives.

Unfortunately, Sigue is not the most convenient way of transferring money abroad. The service allows sending money in cash from one agent location to another. For some currencies, you can pay with Sigue mobile app, available both in Android and iOS. There is no online transfer service available.

Sigue has tied up with the largest banks and non-banking institutions. Is has the branches throughout Mexico and a vast network of partners, ex. Elektra, Azteca Bank, super Pharmacy, Caja Popular Mexicana, Walmart and many more. Since 2018, customers can also send money to beneficiaries through more than 16,700 OXXO convenience stores, as well as through over 38,000 Sigue payment locations throughout Mexico. The company has in total 90,000 physical locations worldwide.

Speed is definitely a competitive advantage for Sigue. The service is fast - usually the funds are available for the beneficiary to pick in 30 minutes or less (depending on time zone, time of the transfer & agent’s business hours).

But compared to other options available, Sigue is not the cheapest choice for sending money to Latin America. Agent-to-agent transfer costs around 10 USD and their mobile transfer- 2.99 USD. What is more, there are limits on the amount sent - maximum 5000 USD (transfer in cash) and 1000 USD (transfer via Sigue Pay app).

As one of the largest companies providing money transfer services in Latin America, Sigue has a poor-quality website. There is no relevant information about fees, exchange rates or agent locations. We did find their website not transparent - there is no possibility of calculating exchange rates and fees. We also didn’t find any relevant info about agents’ location. It seems that the only way to get any information is to either call their customer service or visit an agent (only if we find it - agent locator on their website doesn’t work).

Fortunately, their customer service is easy-to-reach. Their customer support by live chat or phone is available every day - it’s professional and helpful. We had a pleasure to check it!

The company provides its services in both English and Spanish. It’s worth noting that Sigue is focused on transferring money for personal purposes only. The company doesn't support commercial money transfers.

What Monito Likes About Sigue Money Transfers

- Excellent coverage throughout South America, Central America and the Caribbean

- The extensive network of cash pickup locations in Mexico

- Money is available to beneficiaries almost immediately, even within 30 minutes

- Helpful customer service available 24/7

What Monito Dislikes About Sigue Money Transfers

- No online transfers

- More expensive than many competitors

- Basic website with no ability to make an overseas money transfer or find relevant information

- The maximum amount for one transfer comprises 5000 USD (at agent's location) and 1000 USD (via mobile app)

- There are no exchange rates listed on their website

- Not available for commercial transfers, only for individual customers

Compare Sigue Exchange Rates and Fees

Find alternatives to Sigue Money Transfer

Sigue Money Transfers fees & exchange rate

Sigue fees & exchange rates

Transparency seems to be ignored by Sigue: relevant information is not presented upfront and it’s really hard to say if a transfer is processed free of hidden charges.

The transfer tariff depends on transferred funds and can comprise from 1.9%-3.2% (minimum 2.99 USD). There are no other fees listed for sending money abroad. It means you will need to visit an agent location to understand the fees you will need to pay.

Maximum allowed amount for one cash transfer comprises 5000 USD (transfer at an agent's location) and 1000 USD (transfer via Sigue Pay mobile app).

Sigue doesn’t provide information about exchange rates on their website.

How easy is it to send money with Sigue Money Transfers

Assessing the ease of use of Sigue services is difficult. The company provides cash and mobile transfers, but online transfers are unfortunately not on offer.

We did find their website not transparent - there is no possibility of calculating exchange rates and fees. We also didn’t find any relevant info about agents’ locations. It seems that the only way to get any information is to either call their customer service or visit an agent. Reviewing their website we had a feeling the company wants to hide information from the client, instead of making the transfer process easy and transparent.

Credibility security

Sigue is a trustworthy and secure money transfer provider. In the USA Sigue is authorized money provider which operates in 50 states and jurisdictions. Globally it is licensed by regulatory authorities in the UK, France, Spain and Hong Kong. The company is compliant with fraud prevention. It is registered as a Money Services Business (MSB) and complies with the regulations of the Consumer Financial Protection Bureau (CFPB).

The company has been present in the money transfer market since 1996. Since then Sigue has become one of the top players in the Latin America remittance market. Sigue’s headquarter is located in Sylmar, California. The company has regional offices in the UK, France, Italy, Spain, Ivory Coast, Hong Kong, China, and India. Their operational centers are located in Mexico, India and Romania.

Authorized by the Nationwide Multi-State Licensing System and Registry (NMLS)

Firm Reference ID: #915912

Customer Satisfaction

We couldn't find information online for Sigue customer satisfaction. We were unable to find any direct reviews of Sigue Money Transfer service (ex. on Trustpilot). There are only a few opinions on their Facebook profile, and their number is not sufficient to treat them as representative ones.

Customer support

Sigue customer service can be reached by phone, chat or email. Most of the email queries are handled promptly (within maximum 24h). There is also a live chat customer support available (in English & Spanish).

These are Sigue customer support telephone numbers:

- From United States of America: 1800 – 385 - 3316

- For International area: 1866-465-2001

- For Digital Services / Sigue Pay app: 1-877-754-9777

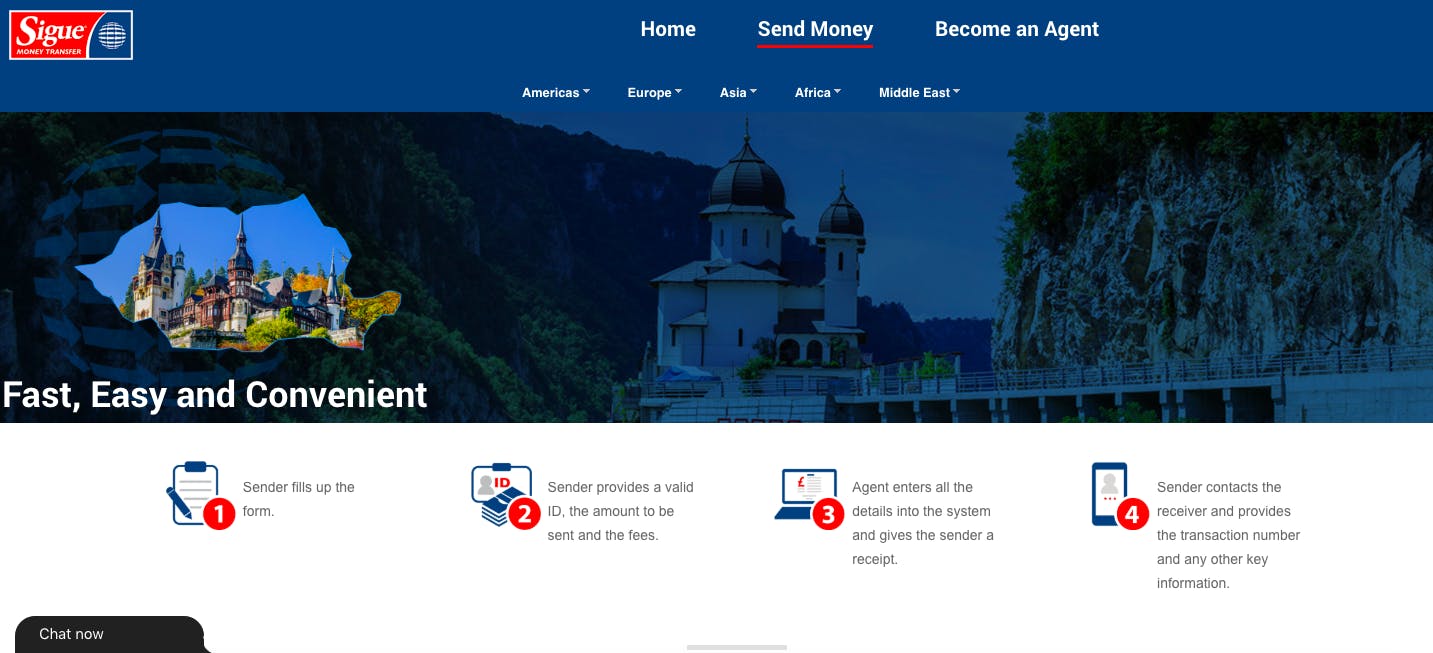

How to send money with Sigue Money Transfer

There are two methods of sending money with Sigue Money Transfer - cash transfer at an agent’s location or mobile transfer via Sigue Pay app.

How to send a cash transfer at an agent’s location

- Find Sigue agent location in which you are going to transfer your money.

- Fill up the form, present your ID & provide all necessary information of the transfer beneficiary (name, address and telephone number as shown on their ID).

- Indicate the amount and select a local payout location.

- Pay for your transfer.

- After entering all the details into the system, an agent gives you a receipt with a unique transaction code.

- Your beneficiary will be asked for ID and unique transaction code. This code can be found on your receipt in the beneficiary information section.

How to send money via Sigue Pay mobile app

- Download an app and sign up for Sigue Pay in just a few moments.

- Provide all the necessary information about your US debit card. Credit cards are not accepted.

- Set up a transfer; enter how much you're sending and where and how you’d like the money to be received (cash pick-up or bank deposit).

- Provide your recipient’s details & approve it.

- Pay for your transfer.

- Money on its way to your recipient. In the meantime, you can track your transfer through the app.

Sigue mobile app

Sigue Money Transfer offers a mobile app both for iOS and Android devices. The app is available only in the United States and in Latin America, both in English and Spanish languages.

Sigue Pay app allows you to quickly open an account, exchange and transfer money, and track your money transfers from anywhere and at any time.

The Sigue’s app users can send money to 21 countries, mainly those situated in South America: Mexico, Argentina, Costa Rica, Jamaica, Peru, Guatemala, Bolivia, Dominican Republic, Nicaragua, Philippines, Honduras, Chile, Ecuador, Panama, Uruguay, El Salvador, Columbia, Haiti, Paraguay, Brazil & India. Sigue promises that more countries will be added to the distribution network in the coming months.

The app is rated 3.6 / 5 in the Google Play Store and 3.6 / 5 in the Apple App Store.

The story behind Sigue Money Transfer

Guillermo "Bill" de la Viña established Sigue Money Transfer company in 1996. As a son of Mexican immigrants in the USA, he understands the needs of Mexicans and Mexican-American immigrants.

He wanted to create a service which according to him “takes into account the needs of the working class.” He realized that making a bank transfer to South America can be relatively expensive, and it takes at least a couple of days to process the transaction. That’s why he decided to concentrate on cash transfers which support millions of low-income families in Mexico.

The company has achieved a dominant position in the US to Mexico corridor in less than a decade. Within 20 years the company has grown from a regional player to a global brand, present in over 100 countries worldwide.