Eurochange UK Review: Are the exchange rates good? How does it work? Is it safe?

François Briod

Guide

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreIs Eurochange the best option for sending money abroad? Compare your options to make sure you get the best exchange rate and lowest fees for your transfer.

What Monito Likes About eurochange

- Wide availability across the U.K.

- A range of online, local, foreign transfer and travel card services

- You can get better exchange rates by sending more money

- Eurochange UK services are safe, secure and regulated

- High customer satisfaction and good reviews

What Monito Dislikes About eurochange

- Exchange rates can be more expensive than the base exchange rate or exchange rates from other providers

- Local bureau de change rates can be more expensive still and you can get quotes on these rates when you visit a eurochange UK location

- Fixed fee for international wire transfers of under £2,000 can be expensive for sending smaller amounts

Compare Cheaper Travel Card Alternatives to Eurochange Today

Read our in-depth guide for the best travel cards in the UK that will reduce or eliminate foreign transaction fees, ATM fees, and expensive currency conversion fees.

Our independent review of Eurochange UK

Eurochange UK is a currency exchange provider located in Britain that provides a variety of travel money, currency transfer, travel cards and international payment services. They have over 180 branches across the country and they offer travel money in more than 70 currencies. You can make transfers to almost 200 countries and they have over 40 years of experience in foreign currency exchange. They provide financial services to both individuals and businesses. We'll cover each of their services below.

Eurochange UK online ordering and collection

Eurochange lets you order and pay for your travel money through their website and have the money delivered to your local eurochange branch through their “Click & Collect” service. You can pay for the currency when you order and receive that day’s exchange rate, or reserve your money and get the branch rate when you visit a branch and pay for your order.

You can order a maximum of £2,500 in travel money online. When you reserve foreign currency you can choose a collection date up to four days in the future, and if you pay online, your currency could be available for immediate collection from a eurochange branch.

Eurochange UK online ordering and home delivery

You can order and pay for your travel money online and have your foreign currency delivered to your home address or your local Post Office branch. If you order before 4 PM you will receive your money the next working day before 1 PM. If you order £600 or more of currency, delivery is free and for orders under £600, the delivery fee is £4.99. You can also choose an alternative delivery date up to seven days in advance.

When you pay online for home delivery, you can make a payment via bank transfer or with a debit card.

Eurochange UK telephone ordering

If you need help, you can contact eurochange UK by phone for advice or to get them to place an order. You can call them on 0333 240 1687 during the following times: Mon-Fri: 8 AM to 6.30 PM, Sat: 8 AM to 6 PM, Sun: 10 AM to 5 PM.

Eurochange UK foreign currency purchase at a local bureau de change

Eurochange UK has more than 180 bureaux de change and you can order, pay for and receive your foreign currency when you visit a branch. The exchange rates in branch will be less competitive than the rates you can get online. Most currencies will be available for immediate exchange.

When you pay in branch you can make a payment via cash, debit card or credit card.

Eurochange UK quick money transfer to foreign bank accounts

Eurochange lets you send between £300 and £5,000 to an overseas bank account without setting up an account. You can exchange money into more than 40 currencies and more than 110 countries. You can send a maximum of £5,000 with the quick transfer service and you can pay online or by visiting a eurochange branch. Transfers to the United States or Eurozone countries will typically be received within one working day, all other destinations are typically received between two to five working days after you pay for the transfer.

Eurochange UK international payments

If you need to send significant amounts overseas, eurochange offers an international payment account. You can make payments to almost 200 countries with a £2,500 limit if paying by debit card and much higher limits if you pay by bank transfer. Transfers to the United States or Eurozone countries will typically be received within one working day, all other destinations are typically received between three to five working days after you pay for the transfer.

Eurochange UK travel money card

Eurochange offers a prepaid foreign currency card called the “Multi-Currency Cash Passport.” The card can be preloaded with up to ten foreign currencies and can be topped up whenever you need it. You will need to fill out an application and load your card. The following currencies are available: Euros, U.S. dollars, Australian dollars, Canadian dollars, Turkish lira, UAE dirhams, U.K pounds, New Zealand dollars, South African rands and Swiss Francs.

Original exchange rate buy back guarantee

Eurochange offers to buy your foreign currency back at the original exchange rate if you pay a small fee. You can return up to 20 percent of what you purchased up to 20 days later for a fee of £2. You can return up to 230 percent of what you purchased up to 30 days later for a fee of £4.

*This money provider brands itself as “eurochange” with a lowercase "e." We’ve used this styling in our paragraphs, but we’ve used Eurochange in our headings to make this article easier to scan and read.

eurochange fees & exchange rate

Eurochange UK does charge fees for some specific services. In most cases, they make their money on the difference between the “base,” interbank* exchange rate and the exchange rate that they charge to you.

*The interbank rate is also known as the mid-market or standard exchange rate, which is the midpoint between the buying and the selling prices of the two currencies.

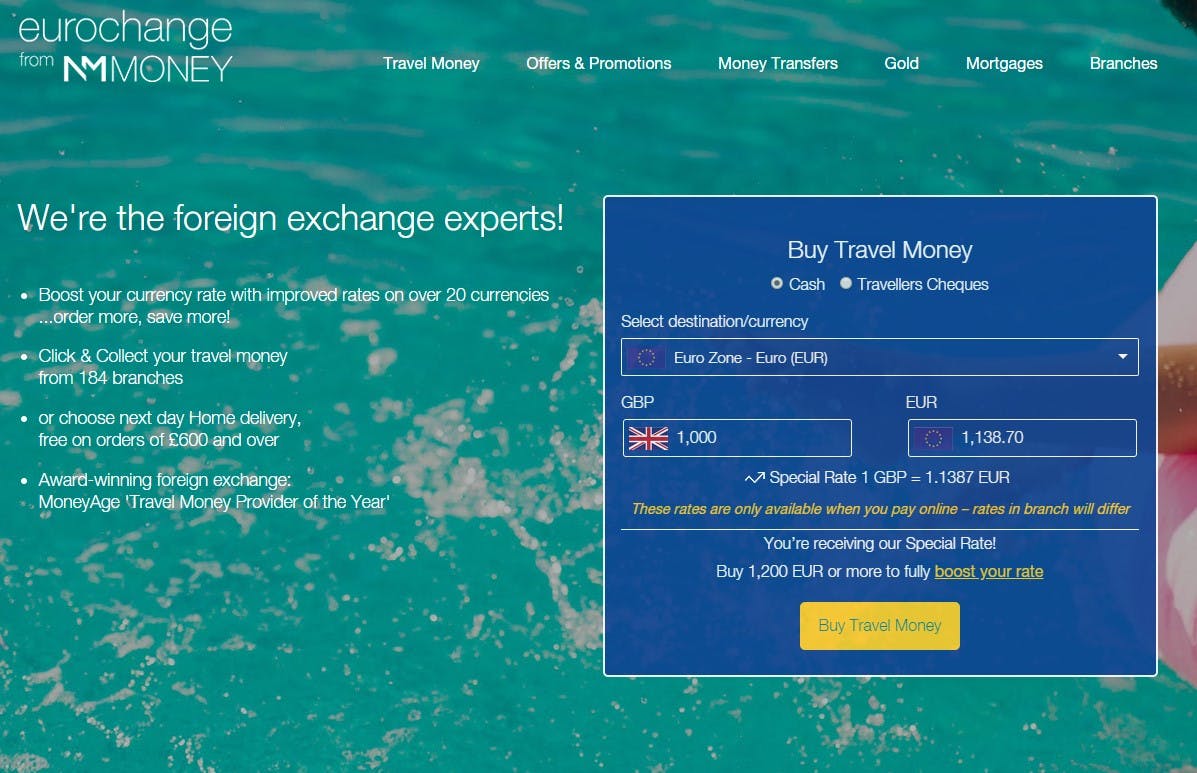

Eurochange UK exchange rates for online travel money

Eurochange makes most of their money on the difference between the exchange rate they offer to customers and the base exchange rate. For example, the base rate to convert U.K pounds into euros is 1.163 euros per pound. Eurochange UK offers an exchange rate of 1.131 euros per pound, a difference of 2.8 percent. That means if you’re exchanging 1,000 pounds into euros, you’ll pay an exchange rate fee of around £28. Note that eurochange does offer better exchange rates if you’re converting larger amounts.

Here are some other examples:

Exchanging 500 U.K. pounds into U.S. dollars

- Base exchange rate, 500 GBP converts to 648 USD

- Eurochange UK online exchange rate, 500 GBP converts to 633 USD

- The eurochange UK exchange rate is 2.3 percent more expensive, or around 12 GBP in exchange rate fees

Exchanging 500 U.K. pounds into South African rand

- Base exchange rate, 500 GBP converts to 9,569 ZAR

- Eurochange UK exchange rate, 500 GBP converts to 9,198 ZAR

- The eurochange UK exchange rate is 3.9 percent more expensive, or around 19 GBP in exchange rate fees

Exchanging 500 U.K. pounds into Australian dollars

- Base exchange rate, 500 GBP converts to 944 AUD

- Erochange UK exchange rate, 500 GBP converts to 912 AUD

- The eurochange UK exchange rate is 3.4 percent more expensive, or around 17 GBP in exchange rate fees

If you’re purchasing currency online or you want to transfer money to an overseas account, you can get much better deals by comparing specialist currency exchange providers. Several money exchange services have overall fees of one percent or lower, even when taking into account differences in exchange rates.

All of the eurochange UK exchange rates quoted in this section are based on their online rates for converting money for home delivery or store pickup. Local bureau de change rates may vary and are likely to be more expensive than what we quote here. All rates correct as of mid-October 2019.

Eurochange quick money transfer fees

There is no fee to send money to an overseas bank account using quick transfer if you’re sending £2,000 or more. If you’re sending less than £2,000, there’s a £5 fee.

Eurochange international payments fees

There is no fee to send money to an overseas bank account using international payments if you’re sending £2,000 or more. If you’re sending less than £2,000, there’s a £5 fee.

Eurochange UK travel money card fees

Here are the fees for eurochange’s travel money card.

- You will need to pay a foreign transaction fee of 5.75 percent if you try to spend money on a currency that’s not on the card, in which case the card will transfer money from an existing preloaded currency on the card

- Top-up fee for loads and reloads into GBP: Two percent of the amount

- Paying for goods and services in currency on the card: No fee, although merchants may charge a fee

- Using a cash machine: £1.50, amounts in other currencies vary

- Withdrawing cash over the counter in a bank: £4, amounts in other currencies vary

- Shortfall fee: £10, amounts in other currencies vary

- Transferring money from one currency to another: 5.75 percent

- Inactivity fee for not using the card for 12 months: £2 per month

Eurochange UK travel money card limits

Eurochange UK does have limits for its prepaid money card.

- The minimum amount you can load onto the card is £50

- The maximum amount you can have on your card is £5,000 and you can’t load more than £30,000 in a 12-month period

- The maximum amount you can withdraw in 24 hours is £500 at a cash machine

- The maximum amount you can spend at merchants in 24 hours is £3,000

- There is a cash over-the-counter limit for withdrawing money at a bank or bureau de change of £150

About fees levied by banks

Certain fees may be levied by banks when you are transferring money to another account. These fees are outside the control of eurochange UK. Circumstances where banks may charge additional fees include:

- Wire transfers into or out of sender or beneficiary accounts

- Transfers that are sent via SWIFT or certain other banking protocols

- Beneficiary banks charging a fee to receive a transfer

- Intermediary banks charging fees to process money in transit

These fees could mean that the beneficiary receives less money than stated by eurochange UK due to circumstances beyond eurochange UK’s control. If you want to understand what these extra fees are likely to be, please contact your bank and the beneficiary's bank.

Eurochange UK exchange rates for international money transfers

Here are the rates eurochange charges for sending money to foreign bank accounts.

Sending 1,000 U.K. pounds to a euro account

- Base exchange rate, 1,000 GBP converts to 1,162 EUR

- Eurochange UK exchange rate, 1,000 GBP converts to 1,130 EUR

- The eurochange UK exchange rate is 2.8 percent more expensive, or around 28 GBP in exchange rate fees

Sending 1,000 U.K. pounds to a Canadian dollar account

- Base exchange rate, 1,000 GBP converts to 1,696 CAD

- eurochange UK exchange rate, 1,000 GBP converts to 1,645 CAD

- The eurochange UK exchange rate is 3 percent more expensive, or around 30 GBP in exchange rate fees

Sending 1,000 U.K. pounds to a New Zealand dollar account

- Base exchange rate, 1,000 GBP converts to 2,024 NZD

- eurochange UK exchange rate, 1,000 GBP converts to 1,969 NZD

- The eurochange UK exchange rate is 2.7 percent more expensive, or around 27 GBP in exchange rate fees

Note that you may need to pay a eurochange UK international money transfer fee to send money to a foreign account.

All of the eurochange UK exchange rates quoted in this section are based on their online rates for sending money to an overseas bank account. All rates correct as of early October 2019.

Comparing eurochange UK rates to other providers

You can easily compare many money transfer services directly using our comparison tool. There are several new services that it’s worth comparing directly to eurochange UK.

Modern, mobile-only banks

There are several new, mobile-only banks that are becoming more widely available throughout the U.K. and Europe. Providers like N26, Monese, Revolut, Monzo or Bunq provide a wide variety of financial services to the modern consumer. All of these modern banks provide international travel cards and international money transfer services, and it’s worth comparing them to eurochange UK.

For example, N26 provides international money transfers through TransferWise, a very popular and trusted currency exchange provider. If you compare sending 500 GBP to Mexico, the recipient would get 12,312 MXN with N26 / TransferWise compared to 11,776 with eurochange UK, a difference of around 4.4 percent or £22.

Specialist currency providers for other destinations

You may also be able to get a better deal for money transfers when you’re sending money to certain countries. For example, if you’re sending 500 GBP to Switzerland, the beneficiary would get around 636 CHF with Transferwise compared to 616 CHF with eurochange UK, a difference of around 3.2 percent or £16.

How easy is it to send money with eurochange

Eurochange UK is easy to use, with a full range of currency exchange services, including convenient local and online currency exchange and money transfer services, combined with an international travel card.

Credibility security

Eurochange has over 40 years of experience in foreign currency exchange and they handle over 2.5 million customer transactions a year. Here’s what they say about security:

“Your payment card details are encrypted using industry-standard SSL technology to ensure they are kept completely safe and secure. As part of our policy to protect against fraudulent use of debit cards we conduct security checks on all orders received. These checks can take various forms and may involve contacting you by telephone before we process your order. We also work with various credit and fraud prevention companies and we may share your details with them for the sole purpose of detecting and preventing fraudulent transactions. If, for any reason, there is a problem with your order we are not be obliged to release this to you. We will contact you and process a refund.”

They also state, “Our business is regulated by two individual authorities – the Financial Conduct Authority (FCA) and Her Majesty's Revenue & Customs (HMRC), each having rules and regulations for different departments of our business. At each of our eurochange branches, through our corporate relationships and through our website we work hard to ensure that all of our team are fully compliant with the policies and procedures that have been put in place to ensure that your business and our business are protected. HMRC governs our bureau de change business including our eurochange branch network and the eurochange online travel money website. Each of our locations is registered as a Money Service Business (registered number: 12117902). For our International payments business we are authorised by the FCA under the Payment Service Regulations 2017 (register reference: 534703) for the provision of payment services.”

Customer Satisfaction

Euromoney scored very highly for customer satisfaction on Trustpilot, achieving a score of 4.7 out of 5 across more than 11,000 reviews. Ninety-three percent of reviews said that they were “excellent” or “great” compared to four percent of reviews that said they were “poor” or “bad.”

Positive

Most of the reviews praised the speed of service with eurochange and praised their excellent customer support. People were particularly pleased with the home delivery service. Here’s a typical review, “Great company! Usually, always get my currency from here. I generally always use the pay online click and collect feature for the best rate but used the home delivery service this time. I was very pleased with the service, came promptly on the day I selected, easy to track. Lovely little note included, many thanks!”

Negative

There were a few complaints about eurochange, mentioning spam marketing and poor exchange rates. Here’s a review, “Reserved my exchange got to shop and was offered lower exchange rate will not use them again had to go back out to the store and purchase online and then pick up for the exchange rate online.”

Other services from Eurochange UK

In addition to foreign currency exchange, eurochange also provides a couple of other services:

- They buy gold at over 30 branches and sell gold in all their branches

- They provide fee-free mortgage advice through their sister company, NM Money

How eurochange UK works

To collect an order you’ve paid for online

You will need the card you used to place the order and a proof of identity which could be:

- Passport

- U.K. or E.U. photo card driving licence

- National I.D. card

To collect an order you’ve reserved online

You will need to pay for your money when you visit a local store. You will need an email order confirmation and form of identity which could be:

- Passport

- U.K. or E.U. photo card driving licence

- National I.D. card

To send money to a bank account

- Log into your profile

- Choose who and where you’re sending money to

- How much you’d like to send and how they’ll receive it

- Pay for the transfer

- Your money transfer is on its way

Here are the beneficiary details you’ll need:

- Your recipient’s first name and last name as displayed on their officially-issued ID.

- Your recipient’s address and phone number.

- A selected method for how your recipient will receive the money transfer. If you choose to deposit money directly into your recipient’s account, you’ll need their bank account and routing number (this might be called an IBAN or SWIFT number).