CurrencyFair Review: Transfer Fees, Safety, Alternatives, and Monito's Verdict

Byron Mühlberg

Guide

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Monika Macur

Reviewer

Monika is an expert in international transfers, fintechs, and neobanks. Leading the life of a digital nomad, she shares her knowledge and experience about living abroad with Monito users.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreCurrencyFair is a good money transfer service (8.4/10) that Monito's experts firmly recommend for bank transfers worldwide. Although it's not the most famous money transfer service, CurrencyFair has a high level of security and brand reputability (9.2/10) and provides a wide range of easy-to-use services and features (7.8/10), as well as well-priced fees and exchange rates (8.2/10). Taken together, all of this leaves CurrencyFair a well-liked service in the eyes of its customers (8.2/10).

What Monito Likes About CurrencyFair

- Excellent exchange rates on Monito's comparison engine.

- Users can choose their desired transfer speed and cost.

- Clean, easy-to-understand web and mobile app interface.

- Outstanding customer satisfaction rankings.

- For businesses, CurrencyFair comes integrated with Xero.

What Monito Dislikes About CurrencyFair

- Only 22 currencies are currently supported;

- Bank payments are the only fund-in methods.

A fast and well-priced money transfer option, we recommend CurrencyFair especially for bank transfers between the British pound, Euro, Swiss franc, Polish zloty, and the Australian dollar, as the service tends to perform very well between these currencies on Monito.

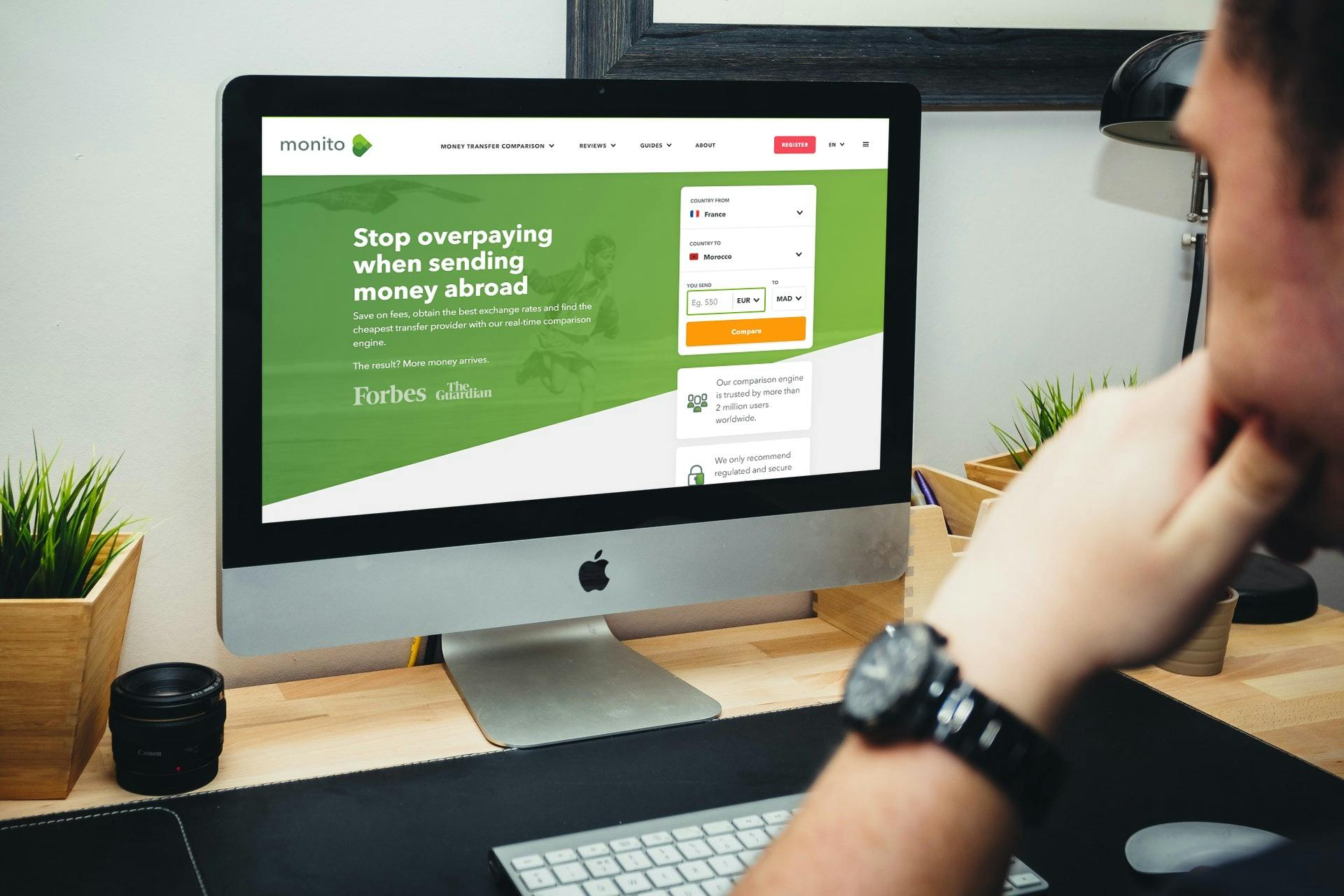

However, if you'd like to transfer money for cash pick-up or make sure you're getting the best deal of all, then we recommend running a search on Monito's real-time comparison engine to find the best deal.

Category | Monito Score | Highlight |

|---|---|---|

9.2/10 | Over 150 thousand customers. | |

7.8/10 | Sending money is fast and easy. | |

8.2/10 | Low fees and exchange rates. | |

8.2/10 | Excellent 4.4 out of 5 stars on Trustpilot. |

Last updated: 25/04/2023

💳 Pay-in | Bank transfer |

|---|---|

🏧 Pay-out | Bank deposit |

⬇ Min. Send | £5.00 |

⬆ Max. Send | 19,500,00 GBP |

💱 Currencies | 22 |

👥 Users | 100000 |

🔐 Trustpilot | 4.4/5 |

📝 Reviews | 6400 |

🌍 Available | US, UK, Eurozone, Canada, Australia, New Zealand, South Africa, and others |

💬 Languages | English, French, German |

Last updated: 25/04/2023

📍 Headquarters | Dublin (IE) |

|---|---|

📃 Established | 2009 |

🌏 Offices | Dublin, London, Singapore, Hong Kong & Newcastle (AU) |

👥 Employees | 156 |

📈 Private/Public | Private |

🏆 Award(s) | 5-Star Rating for International Money Transfers from Canstar, Finnies Awards - Deal of the Year 2022 winner |

✅ Fun Fact | CurrencyFair's founding mission was to provide expats with a cheap, simple way to move money to and from their new home countries. |

Last updated: 25/04/2023

How We Review Money Transfer Providers

With more than 50 providers reviewed and 100 test transfers made over the past ten years, we pride ourselves on providing the best reviews of international money transfer services online. Curious how we make them and why you can trust us? Take a look at our process below:

🔎 See how our scoring methodology works

All international money transfer services we review are put through a comprehensive and rigorous scoring methodology, which involves the testing of the platform's functionalities, assessment of customer reviews, fees, pay-in options, customer service, and business metrics. The methodology is also powered by an analysis of millions of searches on Monito's comparison engine to determine each provider's competitiveness in terms of pricing. When the research is done, each Monito Score is then peer-reviewed by at least one Monito expert. Learn more about our scoring methodology here.

🤝 See why you can trust our recommendations

Reviews are written independently by Monito's editors, and the recommendations given are our own. We might make money from some links on our reviews to bring you premium content without pesky banner ads and paywalls. We promise you that this never impacts the independence of our recommendations. Learn more about our promise and our business model here.

Key Questions About CurrencyFair Answered

Where Is CurrencyFair Available?

| CurrencyFair | Switzerland |

CurrencyFair is available to residents of the EU/EEA, UK, US, Canada, Australia, New Zealand, Hong Kong, South Africa, and all affiliated overseas territories and constituencies. See the official list of supported countries here.

Trust & Credibility

Background check

Security & reliability

CurrencyFair's platforms are fully secured and use top-notch security protocols, including segregated user accounts and HTTPS.

Company size

Founded in 2009, CurrencyFair is a fast-growing money transfer company handling around US$300 million in transactions each year for some 150 thousand customers.

Transparent pricing

CurrencyFair is not transparent in its pricing, failing to disclose that a majority (62%) of its fees are hidden in the exchange rate margin.

Can I Trust CurrencyFair?

As a duly authorised financial services provider with around 100 thousand active customers, CurrencyFair is indeed a trustworthy money transfer service.

Not only is CurrencyFair regulated and authorized by the Central Bank of Ireland, but under the European Communities (Payment Services) Regulations 2009, CurrencyFair is required to protect client funds and maintain systems and procedures at the highest standards. This includes the deterrence of financial crime, the maintenance of a minimum level of capital and liquidity, and the appointment of individually approved and vetted key personnel. It is also regulated by the Customs and Excise in Hong Kong and the Monetary Authority Singapore (MAS) in Singapore.

As per regulations, clients’ funds are held in segregated accounts, which are kept completely separate from CurrencyFair’s own business accounts. This means that your money is safe should the company have any financial difficulties.

Is CurrencyFair Safe?

Yes, CurrencyFair is indeed a safe and trustworthy platform for foreign currency solutions. A large and global company, CurrencyFair is headquartered in Dublin, Ireland, and employs around 156 people across its Irish and Australian offices. Employees give the company a 5-star rating on the employer review site Glassdoor and frequently describe CurrencyFair as a desirable place to work.

Hundreds of thousands of clients have used CurrencyFair to exchange over €13.9 billion. They have thousands of 5-star reviews on Trustpilot and very few complaints. The company is financially strong with over €5 million net assets and has raised around €20 million from investors.

Service & Quality

Opening an account

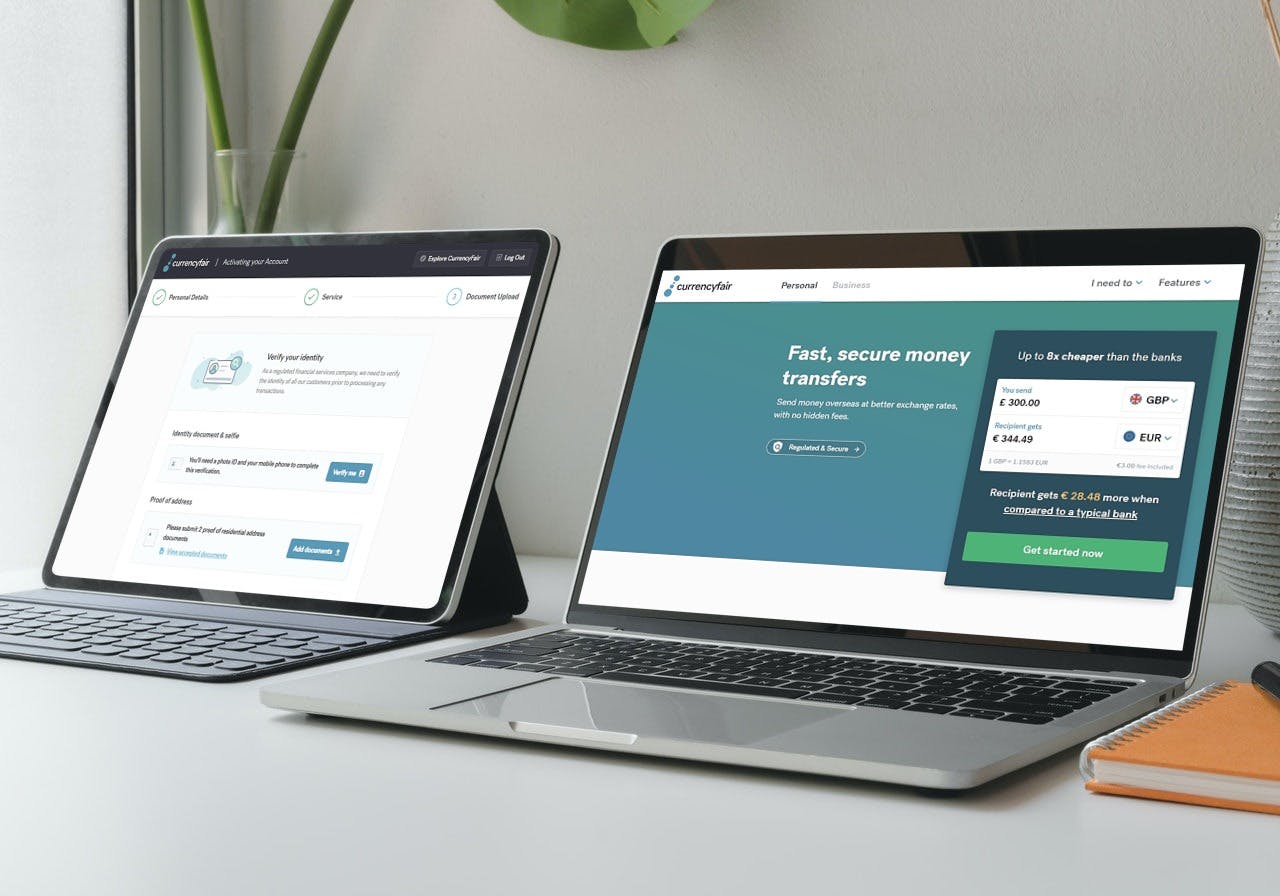

Opening an account with CurrencyFair is easy, thanks to a clean user interface and lack of information overload. However, you'll need to complete a few regulatory steps before sending money.

Making a transfer

Once you've registered for CurrencyFair, you'll find making a new money transfer to be a fast and simple process.

Contacting support

Contacting CurrencyFair's customer support team is very easy, with on-site chatbot functionality and multi-lingual support.

CurrencyFair's Service Quality

Opening and managing an account, contacting customer service, and funding a transfer with CurrencyFair are very convenient, although relatively few pay-in options and receiving currencies are available.

What Is CurrencyFair?

CurrencyFair is an international money transfer service with a unique approach to sending money across borders. CurrencyFair's pricing iscompetitive; they only add around 0.49% to the mid-market currency exchange rate, whereas traditional banks can add markups of between 3% and 6%. This makes their exchange rates extremely competitive, and their flat fee remains low at just €3 or currency equivalent.

CurrencyFair allows you to exchange between 22 different currencies, and you can send money from and to over 150 countries, with recent expansion into Asia and the United States. The company has local accounts for nearly all the supported currencies, meaning transferring your money to them should be free. They employ staff who speak various languages, including English, German, and French.

After you've exchanged your money, you'll have to pay a small flat fee of around €3 in most cases to transfer your money to the bank account of your choice. The money takes approximately one day to transfer into CurrencyFair, then around one to two working days to be received. This can take longer for certain currencies.

You can exchange and transfer your money on the CurrencyFair website or the CurrencyFair mobile app, available on iOS and Android, at any time (except on weekends and bank holidays) and from anywhere. Moreover, CurrencyFair integrates with specific local interbank and bill payment systems, including PayNow in Singapore and BPAY in Australia.

CurrencyFair also allows customers to save, download, and print their currency balances or statements as a CSV or PDF, which can be nifty for users who like to manage their finances closely.

CurrencyFair For Businesses

CurrencyFair also offers business money transfer services. Businesses, for example, can use CurrencyFair for international payroll, global payments and receiving money. Most notable in this regard is CurrencyFair's integration with Xero, a leading accounting software that allows small businesses and SMEs to reconcile payments, manage multicurrency transactions, and group similar transactions together.

Monito's Impressions During Our Test

CurrencyFair's money transfer platform impressed our reviewers with its user-friendliness and speedy loading times. Although the signup process did include several regulatory steps, the process was handled smoothly and had helpful tooltips and colourful illustrations along the way. Sending money was straightforward, guided by clear instructions and a seamless user experience. We especially liked the option to select the transfer time and fees of our choice — something we found useful and set CurrencyFair apart from many of its competitors.

CurrencyFair App Review

CurrencyFair has mobile apps for both iOS and Android devices. The CurrencyFair app allows you to quickly exchange and transfer money from anywhere and at any time (except on weekends and bank holidays). With the CurrencyFair money transfer app, you can set up deposits into your CurrencyFair account, and the app will provide you with the information you need to make your transfer through your online banking platform or at your local bank branch. The CurrencyFair app then allows you to exchange funds in 22 different currencies and transfer them out to the bank account of your choice.

Fees & Exchange Rates

Transfers to a bank account

While CurrencyFair does not offer transfers to cash pickups, mobile wallets, or cards, it offered competitive rates on all (100%) of the bank transfers where it was available.

CurrencyFair's Fees & Exchange Rates

Despite offering reasonably competitive pricing on Monito's comparison engine, CurrencyFair is only sometimes the cheapest money transfer service for bank transfers. The fees you'll pay to send money internationally can be broken down as follows:

CurrencyFair's Transfer Fees

CurrencyFair charges a small fixed fee, usually €3.00, for each transfer out of your CurrencyFair account to a bank account. If you have money in multiple currencies on your CurrencyFair account, you can choose which currency to pay the fees in to get the best deal. They may also charge a commission of between 0.10% and 0.60% of the exchanged amount.

CurrencyFair's Exchange Rates

You exchange immediately at the best available exchange rate. On average, you will pay a reasonably competitive exchange rate margin of around 0.35% below the mid-market exchange rate.

Other Fees

In most instances, CurrencyFair’s accounts are held locally in the country of the currency you are exchanging from or exchanging to. This means there should be no fees to transfer money into or out of your CurrencyFair account using a local bank transfer.

However, if you are sending from or to UAE dirham, Canadian dollar, New Zealand dollar, US dollar, South African rand, or sending to Israeli new shekel (ILS), the transfer in or out of CurrencyFair will be made with an international bank transfer. You will pay additional fees to the banks involved. Depending on the amount, it is generally still worthwhile to use CurrencyFair, since the better exchange rates make up for the additional fees.

Compare CurrencyFair's Fees & Exchange Rates

Customer Satisfaction

Trustpilot reviews

Earning an average of 4.4 out of 5 stars on Trustpilot from 6,475 reviews, CurrencyFair has made a very positive impression on its customers all-round.

CurrencyFair Reviews

CurrencyFair has largely very good customer reviews on Trustpilot. Here’s a summary of what reviewers have to say:

Positive CurrencyFair Reviews

- Exchange rates are excellent, and transfer fees are much lower than with banks;

- Sending money is a quick and easy process;

- Transfers arrive quickly in the recipient’s account;

- The customer service is very helpful and friendly.

Negative CurrencyFair Reviews

- Opening an account requires a certain amount of personal information (as with all other companies, this is due to regulations). However, electronic verification is speeding up this process;

- Some people found the signup process confusing or unclear;

- In a few exceptional cases, transfers were delayed or blocked.

How CurrencyFair Works

Step 01

Check CurrencyFair's Rates

Use Monito's comparison engine to see how CurrencyFair's fees and exchange rates weigh up against the rest and make sure they are indeed the cheapest option for your international money transfer. There, you'll be able to discover both the cheapest ways to fund your transfer and have the money received.

![]()

Step 02

Create a CurrencyFair Account

Sign up with CurrencyFair by providing your email address and mobile phone number. Once you've verified the number with an SMS code, you'll be asked to add your full name, date of birth, email address, and residential address.

![]()

Step 03

Set Up a Transfer

After you've signed up and verified your account, you'll be redirected to the CurrencyFair user dashboard, from where you can enter how much you're sending, the destination country and currency, and delivery method. You may also be required to select the purpose of your money transfer.

![]()

Step 04

Add a Beneficiary

Enter your recipient’s details, including their name (matching the name on their bank account), email address, and bank information. If you’re sending money within the Eurozone, you'll only need your recipient's IBAN, but if you're sending between other countries (even when one is in the Eurozone), you'll need to provide a SWIFT/BIC code and a bank account number.

![]()

Final step

Review and Pay For Your Transfer

Try CurrencyFairIn the final page, you'll be asked to select whether you'd like to fund the transfer via bank deposit or card payment, after which you'll be prompted to make the payment.

FAQ About CurrencyFair

✅ Can I trust CurrencyFair?

Yes. CurrencyFair is a duly authorised financial services provider with around 100 thousand active customers, that's regulated and authorized by the Central Bank of Ireland. What's more, under the European Communities (Payment Services) Regulations 2009, CurrencyFair is required to protect client funds and maintain systems and procedures at the highest standards. This includes the deterrence of financial crime, the maintenance of a minimum level of capital and liquidity, and the appointment of individually approved and vetted key personnel.

⏱ How long does CurrencyFair take to transfer?

For bank deposits, CurrencyFair transfers take around one to two working days to arrive at their destination. It processes same-day transfers for most major currencies. You can check its processing and transfer time here.

🤝 Is CurrencyFair reliable?

Yes, CurrencyFair is reliable and trustworthy for international money transfers A large and global company, CurrencyFair is headquartered in Dublin, Ireland, and employs around 156 people across its Irish and Australian offices. Employees give the company a 5-star rating on the employer review site Glassdoor and frequently describe CurrencyFair as a desirable place to work.

👨⚖️ Is CurrencyFair legitimate?

Yes, CurrencyFair is a duly authorised financial services provider with around 150 thousand active customers and regulated and authorized by the Central Bank of Ireland, making it a fully legitimate and credible money transfer service.

💻 How does CurrencyFair work?

To use CurrencyFair, you'll need to create an account or log in to an existing one, through which you'll be able to access the user dashboard and make international money transfers to 22 currencies around the globe. To set up a transfer, you'll need to click 'Send Money' in the dashboard and then enter how much you're sending, the destination country and currency, and the delivery method. From there, you'll have to add a beneficiary and pay for your transfer. Take a look at Monito's step-by-step guide for how CurrencyFair works here.

✔ Is CurrencyFair good?

Yes, CurrencyFair is a good money transfer service that the experts at Monito firmly recommend for bank transfers worldwide. Despite having relatively few customers compared to many of its major competitors, CurrencyFair has a high level of security and brand reputability and provides a wide range of easy-to-use services and features, as well as well-priced fees and exchange rates available, making it an all-round good money transfer service indeed.

⛔ How do I delete my CurrencyFair account?

There is no explicit was to delete your CurrencyFair account in-app or on the user dashboard. In order to de-register yourself and close your CurrencyFair account, you'll need to contact CurrencyFair's customer support team, who will help get the job done for you.

📅 How old is CurrencyFair?

Founded in 2009, CurrencyFair turned 14 years old in 2023.

🔐 Is CurrencyFair safe?

Yes, CurrencyFair is indeed a safe and trustworthy platform for foreign currency solutions. A large and global company, CurrencyFair is headquartered in Dublin, Ireland, and employs around 252 people across its Irish and Australian offices. Employees give the company a 5-star rating on the employer review site Glassdoor and frequently describe CurrencyFair as a desirable place to work. Hundreds of thousands of clients have used CurrencyFair to exchange over €13.9 billion. They have thousands of 5-star reviews on Trustpilot and very few complaints. The company is financially strong with over €5 million net assets and has raised around €20 million from investors.

🏦 Is CurrencyFair a bank?

No, CurrencyFair is not a bank but an international money transfer operator that is registered and authorised to handle currency exchange services.

📱 What is a CurrencyFair account?

A CurrencyFair account is a free-to-register user dashboard and online money transfer platform that allows you to send money via bank deposit to 22 currencies worldwide.

⚖ Is CurrencyFair better than Wise?

CurrencyFair and Wise are both very good money transfer service that you can depend on to offer top-notch currency exchange solutions. However, when it comes to fees and exchange rates, Wise is by far the more competitive service according to millions of annual searches run on Monito's real-time comparison engine. Take a look at Monito's full side-by-side review to learn more.

🧾 Who owns CurrencyFair?

CurrencyFair is a for-profit private money transfer company founded by Brett Meyers, David Christian, Jonathan Potter, and Sean Barrett in 2009. Currently, CurrencyFair isn't owned directly by any single company or individual but by a collective of shareholders.

Learn More About CurrencyFair's Alternatives