Citibank: Foreign Currency Exchange, International Wire Transfer & ATM Fees explained

François Briod

Guide

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreTravelling or sending money abroad? Discover Citibank's fees for international wire transfers, currency exchange and for using your credit or debit card abroad (incl. ATM fees). You'll learn how to save and how to make smarter decisions so your money goes further.

Citibank international wire transfer - all you need to know

Citibank provides comprehensive international wire transfer services. They let you send money directly from your Citibank account to other bank accounts around the world, where the money can be accessed by the beneficiary. Although they provide a wide range of services, like many other banks their fees are much higher than you can get from a specialist currency exchange provider.

What are Citibank’s international wire fees and exchange rates?

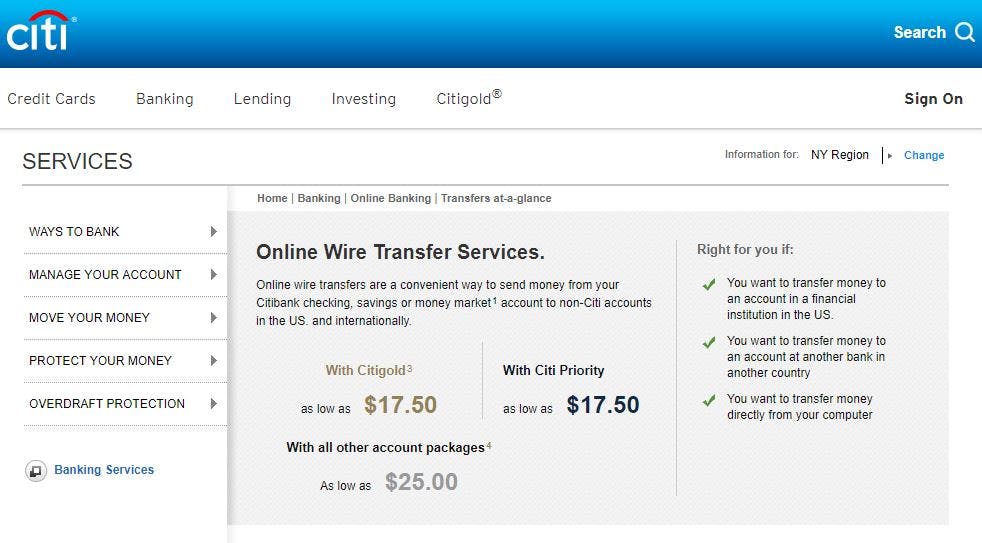

Citibank are very transparent about their international wire transfer fees and limits. They provide clear pricing on how much it will cost you to send money overseas through a Citibank wire transfer. The fee you will be charged depends on the type of Citibank account that you have. If you’re sending money through the online service, fees are as follows:

- Standard Citibank account: International wire transfer fee of $35, incoming transfer fee of $15

- Citigold* account: International wire transfer fee of $25, incoming transfer fee is waived

- Citi Priority account: International wire transfer fee of $25, incoming transfer fee is waived

- Citi Private Bank account: International wire transfer fee is waived, incoming transfer fee is waived

- Citi International Personal Account: International wire transfer fee is $30, incoming transfer fee is waived

- Citigold* International Account: International wire transfer fee is $10, incoming transfer fee is waived

- Citigold* Private Client Account: International wire transfer fee is waived, incoming transfer fee is waived

- Citi Global Executive Account: International wire transfer fee is $30, incoming transfer fee is waived

- Citi Global Executive Preferred Account: International wire transfer fee is waived, incoming transfer fee is waived

*This fee will be waived for Citigold and Citigold International Account Packages that had a combined balance of $500,000 or more for the monthly period that was two (2) calendar months before the date of the transaction.

Citibank says that, “Transfers initiated from a savings or money market account are included in the six preauthorized or automatic transfers permitted each statement period. If the transfer is made in foreign currency, the exchange rate includes a fee for the currency conversion.”

Note that if you need a special Citibank account, other than a regular account, the requirements are quite strict. You will often need to keep a high minimum balance in the account, $500,000 for Citigold, and there may be other requirements as well. This means the majority of Citibank account holders will pay a standard international wire transfer fee of $35.

Although the online transfer fee is lower than most of the other big U.S. banks, it’s also a much higher fee than you would pay for sending money through a specialist international money transfer provider. It’s always worth comparing providers to see where you can save the most money, as you’ll always pay more if you use your bank.

Citibank does charge a $45 fee if you send an international money transfer when visiting one of their branches or making a transfer over the phone.

Citibank Global Transfer to Citibank Accounts in other countries

If you’re sending money to another Citibank account around the world, you won’t pay an international wire transfer fee as you can use the Citibank Global Transfer service. The fees listed above are for sending funds to non-Citibank accounts.

Citibank Global Transfer lets you send fee-free transfers to Citibank accounts in the following countries: Australia, Bahrain, China, Hong Kong, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Philippines, Poland, Singapore, Taiwan, Thailand, United Arab Emirates, United Kingdom and Vietnam. Note that Citibank’s normal international wire transfer service lets you send to many more countries and currencies around the world.

Here’s what Citibank says about the Citibank Global Transfer service, “If the Citibank Global Transfer is made in foreign currency, the exchange rate includes a commission for the currency conversion. Citibank Global Transfers initiated from a savings or money market account are included in the six preauthorized or automatic transfers permitted each statement period. Transfer limits are subject to change based upon the security measures we use to protect your accounts. First time transfers are subject to lower limits.”

Citibank exchange rates for international wire transfers

Citibank does not provide the specific exchange rates they use when exchanging dollars into other currencies for their wire transfers. One thing they do provide on the Citibank Australia website is their currency exchange rates if you’re buying or selling money to go abroad. Although these are unlikely to be the exact same rates you get for an international money transfer, they do give us an indication.

Let’s use an example of sending $500 to Canada:

- The base, mid market exchange rate for sending U.S. dollars to Canada is 1 U.S. dollar to 1.333 Canadian dollars

- This means that with the base rate, assuming no fees, the beneficiary would receive $666.48 Canadian dollars for $500 U.S.

- Citibank offers a foreign currency exchange rate of 1 U.S. dollar to 1.319 Canadian dollars.

- This means the beneficiary would get $659.50 Canadian, around one percent less

- Add in a $35 wire transfer fee, and you could be paying up to eight percent of your transfer in fixed fees and exchange rate margins

Remember that these rates are just indicative.

Comparing specialist currency providers might mean you only get charged between 0.5 percent and 1.5 percent in combined fees, so your money would go much further.

This is why it is generally not recommended to wire money internationally with Citibank if you’re looking for the cheapest way to send money abroad, but to compare all providers with Monito and find cheaper alternatives.

Find out more with our complete guide on how banks and money transfer operators make money with hidden fees.

International wire transfer limits

For some accounts, Citibank does limit the amount you can send through an international money transfer. For standard accounts and Citi Private Bank accounts the limit is $50,000 a day. The Citi International Personal Account and Citi Global Executive Account have limits of $250,000. Other Citi bank accounts do not have transfer limits.

How long does a Citibank international wire take to arrive at the recipient bank?

If the international wire is sent by 5:15 PM EST Citibank will start processing it that day, After that time, they’ll start processing on the next business day. Citibank doesn’t list international transfer times, but generally it can take anything between one and three business days for the beneficiary to get access to the money you’ve sent.

If you’re in a hurry, try finding the fastest way to send money abroad by comparing all international money transfer services with Monito.

How to make a Citibank international wire transfer?

Citibank prefers you to make international wire transfers online, through their banking portal. This has several benefits:

- It’s quite fast to setup an international wire transfer, provided you have the right information

- You can save and reuse previous wire transfer instructions

- You can view all of your previous transfers

Here’s the process you’ll need to go through:

- Log into your banking service through Citibank's portal

- Select Payments & Transfers > Any External Account > Set up a Wire Transfer

- Enter additional information as requested

- Tell Citibank that this is a foreign transfer

- Select the Source Account for the transfer

- Enter how much you want to send and the currency

- Enter further information about the beneficiary:

- To save this information for future wire transfers, select option Save as Model, otherwise select Continue

- Verify wire transfer details and select Submit if you agree to the terms and authorize the wire transfer

What is Citibank’s SWIFT Code?

If someone needs to send you money from abroad, they’ll need a SWIFT Code for Citibank. That code for the U.S. is CITIUS33. Citibank accounts in other countries may have different IBAN or SWIFT numbers, check with your local branch.

Which Citibank details should someone use when sending me money from abroad?

If you're a Citibank customer in the U.S. and you need to receive a transfer from abroad, the relevant details are as follows:

- Name of bank: Citibank, N.A.

- Citigroup SWIFT code: CITIUS33

- Citibank Routing Transit Number: 0210000890 for all international transfers, plus the ABA number of the branch where you opened your Citibank account

- Bank address: 399 Park Avenue New York, NY 10043, USA

What is Citibank’s IBAN?

Citibank in the U.S. does not have an IBAN, as the United States does not participate in the International Bank Account Number system. Citibank accounts in other countries may have different IBAN or SWIFT numbers, check with your local branch.

What Monito Likes About Citibank

- If you’re a Citibank customer, you can easily send money internationally from online banking

- Secure transfer with a bank you already trust with your money

- Lower transfer fees than other banks if you’re sending online

- No transfer fees at all if you’re sending money to a Citibank account in another country

What Monito Dislikes About Citibank

- Expensive international money transfers

- Hidden fees in the currency exchange rate margin

- No visibility on the exchange rate applied to your transfer beforehand

- You can only send money to a bank account

- Can take several business days to reach the beneficiary

Alternatives to Citibank

Find the cheapest way to send money abroad

Citibank currency exchange service

Citibank’s currency exchange services are limited to Citibank account holders. You can buy and sell foreign currency at a Citibank branch, and if you’re exchanging less than $1,000 US dollars worth, you will pay a $5 fee. Alternatively, you can choose to have money sent directly to you through Citibank’s World Wallet Foreign Currency Exchange Services.

Here are the details for World Wallet:

- The service delivers foreign currency to your home, office or nearest Citibank branch

- You can access World Wallet by calling 1-800-756-7050 or visiting a Citibank branch

- World Wallet will convert between U.S. dollars and 50 other currencies

- You will get your money on the next business day

- Any fees are deducted from your Citibank account, you can’t pay in cash

- Citibank will buy unused currency back when you return

- There is a $5 service fee for most account holders if you are exchanging less than $1,000

- Delivery is free to a Citibank branch

- Delivery to home or office will cost $10 (standard overnight), $15 (priority overnight), $20 (Saturday overnight)

Unfortunately, the rates that Citibank exchanges currency at will be worse than you can get from many international, specialist foreign currency providers. You can find better deals, and pay less, by comparing travel money services in the US here.

Using your Citibank credit card abroad

In general, the foreign fees applied for using your Citibank credit card abroad will depend on your credit card. You can compare the options on Citibank’s website or learn about innovative multi-currency cards here.

In common with many other banks, Citibank charges a three percent foreign transaction fee with most of their credit cards. This means an additional three percent will be added to your charges, in addition to what will likely be a poorer exchange rate than you could get elsewhere. It’s important to note that Citibank does provide several credit cards that do not have any foreign transaction fees.

What are the fees for using Citibank credit or debit cards at an ATM abroad?

It’s difficult to find the specific fees that Citibank charges for ATM withdrawals outside the U.S. The best information we have is that Citibank will charge a $2.50 foreign transaction fee plus a three percent charge on the total amount of money you’re withdrawing.

What you need to know when withdrawing money/paying abroad?

The ATM or Point of Sale device will often ask you if you want to use your card’s currency (USD if you’re banking with Citibank) or the local currency (let’s say Euros if you’re in Paris).

💡 Tip

You always want to pay in the local currency! If you pay in your home currency (USD), you’re getting a dynamic currency conversion (DCC) which is often a very bad rate (we’ve seen 5-18% currency exchange margin).

What are the fees for paying in foreign currencies online or at a shop with Citibank credit or debit cards?

Paying with most Citibank debit or credit cards abroad will incur a three percent foreign transaction fee.