Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 50+ money transfer providers

- We've made 100+ test transfers

- Our writers have been testing providers since 2013

Sending Money to Other Mobile Wallets?

Below, you'll find all our guides helping you to send money to various mobile wallets between different countries worldwide:

Other Money Transfer Guides

Best Travel Credit Cards in Canada

April 24, 2024 - by Byron Mühlberg

KOHO Financial Review

April 23, 2024 - by Jarrod Suda

Open a Bank Account in Canada

April 23, 2024 - by François Briod

Monito Awards

April 8, 2024 - by François Briod

Best Ways To Send Money Internationally

March 27, 2024 - by François Briod

Sendwave to M-Pesa

March 20, 2024 - by Lydia Kibet

Best Business Accounts in Kenya

February 28, 2024 - by Lydia Kibet

Sending Money to Kenya via M-Pesa

February 15, 2024 - by Byron Mühlberg

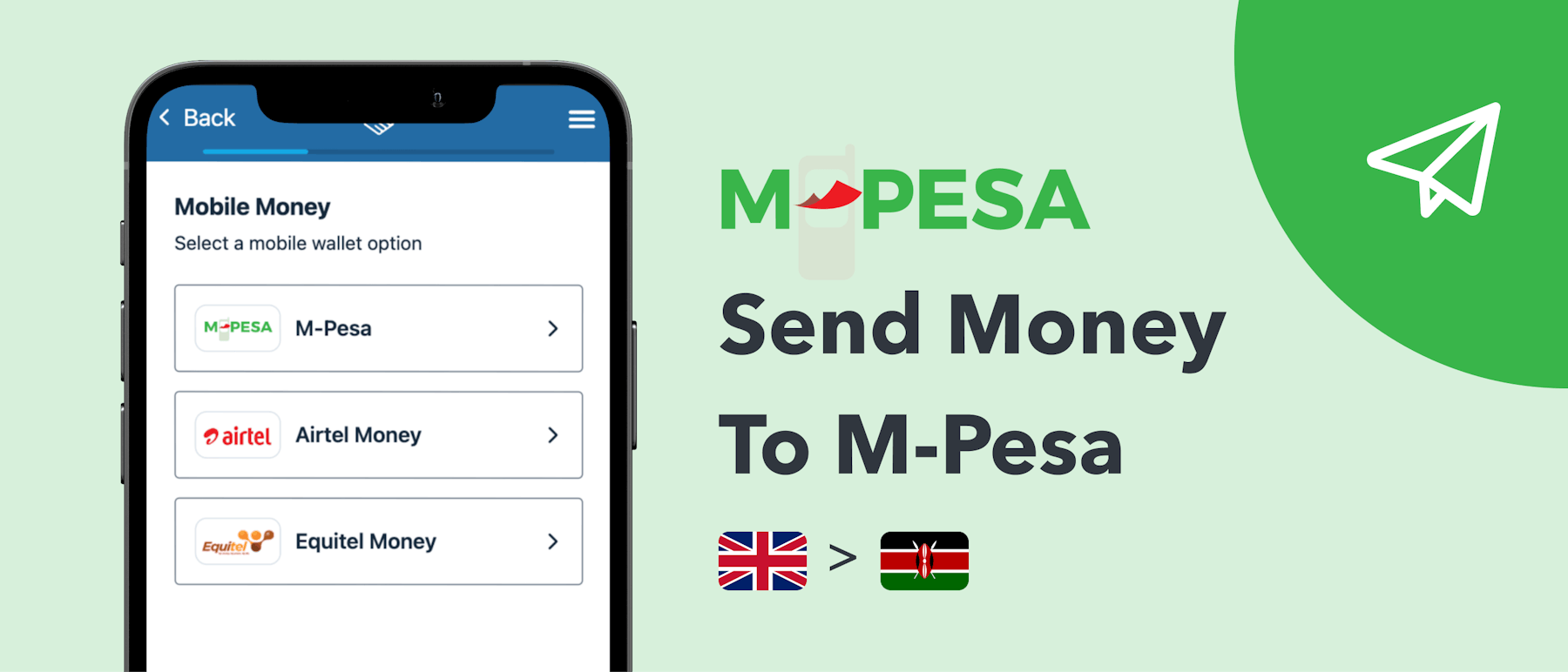

Sending M-Pesa From the UK to Kenya

February 15, 2024 - by Byron Mühlberg

Airtel Money Transfer

February 15, 2024 - by Jarrod Suda

Cheapest Ways To Exchange Money

February 5, 2024 - by Jarrod Suda

Tips For Your First Online Money Transfer

January 31, 2024 - by Byron Mühlberg

How To Send Money Internationally (Use These 5 Services)

January 16, 2024 - by Jarrod Suda

Best Small Business Banks in Canada

January 9, 2024 - by Jarrod Suda

Best Money Transfer Apps in Canada

January 9, 2024 - by Jarrod Suda

Cash App Canada

January 9, 2024 - by Jarrod Suda

Best Money Transfer Apps in Africa

January 9, 2024 - by Jarrod Suda

7 Best Virtual Banks in Canada in 2024

January 8, 2024 - by Jarrod Suda

International Money Transfer Services in Kenya

December 31, 2023 - by Lydia Kibet

Can You Transfer Large Amounts?

December 13, 2023 - by Byron Mühlberg

Interbank Transfer Charges Kenya

December 6, 2023 - by Lydia Kibet

Mastercard Application in Kenya

December 4, 2023 - by Lydia Kibet

Open a Bank Account Online

November 28, 2023 - by Lydia Kibet