International Money Transfers Explained

![]()

Live Comparison

Find cheapest way to send money abroad

![]()

Service Reviews

In-depth reviews of money transfer services.

![]()

Exchange Rates

Follow exchange rates over time

![]()

Bank Wire Costs

Learn about bank charges for sending abroad.

![]()

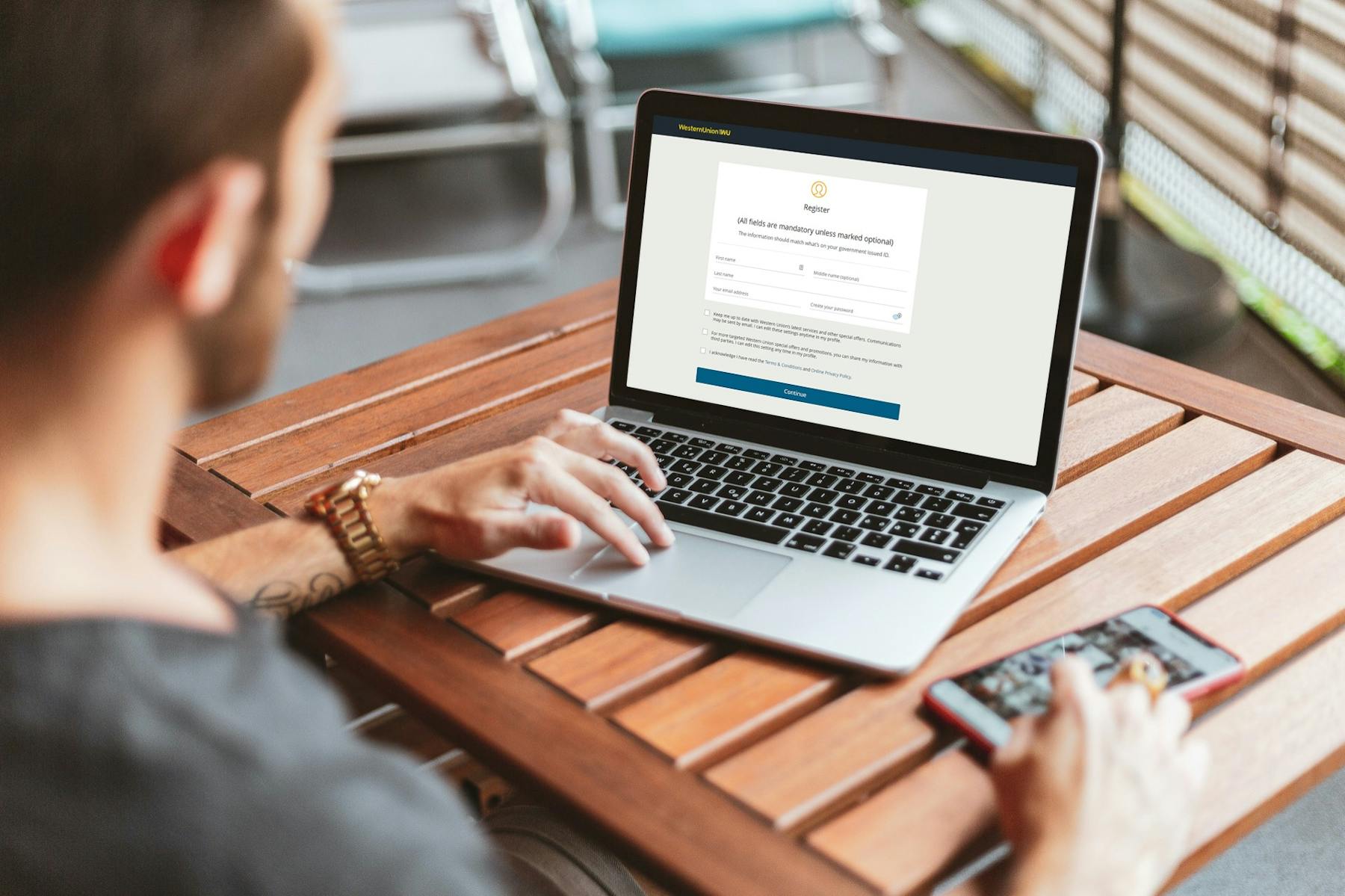

Digital Transfers

Learn about low-cost money transfer alternatives.

![]()

Receiving Money

Learn about receiving money from overseas.

Bank Wire Transfer Fees

April 14, 2023 - by Byron Mühlberg

Wells Fargo Wire Transfers

October 10, 2022 - by Byron Mühlberg

Bank of America International Wires

March 28, 2024 - by Byron Mühlberg

Citibank International Wires

November 22, 2022 - by Jarrod Suda

HSBC International Transfers

December 14, 2022 - by Olivia Willemin

Barclays International Transfers

July 20, 2022 - by Byron Mühlberg

Santander Overseas Transfers

July 20, 2022 - by Olivia Willemin

BMO International Transfers

December 22, 2022 - by Byron Mühlberg

TD International Transfers

November 17, 2022 - by Byron Mühlberg

RBC International Wires

September 23, 2022 - by Byron Mühlberg

Sending to BDO From the US

November 22, 2022 - by Byron Mühlberg

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 50+ money transfer providers

- We've made 100+ test transfers

- Our writers have been testing providers since 2013

Best-Rated Money Transfer Platforms

See Side by Side Comparisons 9.5

9.4

9.3

9.2

9.2

9.0

Learn More About International Money Transfers

Sending Money To India With Remitly

February 14, 2023 - by Byron Mühlberg

How To Receive International Payments in India

February 14, 2023 - by Jarrod Suda

Monito Awards

April 8, 2024 - by François Briod

Best Ways To Send Money Internationally

March 27, 2024 - by François Briod

Internation Money Transfer Apps Ethiopia

March 1, 2024 - by Lydia Kibet

International Money Transfer Services Uganda

February 28, 2024 - by Lydia Kibet

Cheapest Ways To Exchange Money

February 5, 2024 - by Jarrod Suda

Tips For Your First Online Money Transfer

January 31, 2024 - by Byron Mühlberg

How To Send Money Internationally (Use These 5 Services)

January 16, 2024 - by Jarrod Suda

Can You Transfer Large Amounts?

December 13, 2023 - by Byron Mühlberg

International Money Transfer

December 1, 2023 - by Lydia Kibet

Receive Money from Western Union

November 28, 2023 - by Lydia Kibet

Does Venmo Work With GCash?

November 8, 2023 - by Byron Mühlberg

How Much Are Western Union's Fees?

October 12, 2023 - by Jarrod Suda

Best Money Transfer Services

October 11, 2023 - by François Briod

4 Best Multi-Currency Business Accounts

September 22, 2023 - by Byron Mühlberg

The Best Place to Buy Euros in the UK in 2023

June 20, 2023 - by Jarrod Suda

The Best Way to Buy Euros in the USA in 2023

June 20, 2023 - by Jarrod Suda

Best Place to Buy Dollars in the UK

May 26, 2023 - by Jarrod Suda